Bitcoin breaks $30,000

Bitcoin finished the year in style last week, as the first cryptocurrency closed the last month of December with a stunning gain of close to 50%.

In terms of annual gains, Bitcoin opened 2021 over four hundred percent higher than the cryptocurrencies January 2020 open price, of $7,165.

BTC performed an early week pullback from the $28,000 level, following news that cryptocurrency exchanges Coinbase and OKcoin were going to delist Ripple. However, the move was short-lived as BTC went on to surpass the $30,000 resistance level.

BTC/USD Monthly Chart

Source: Tradingview

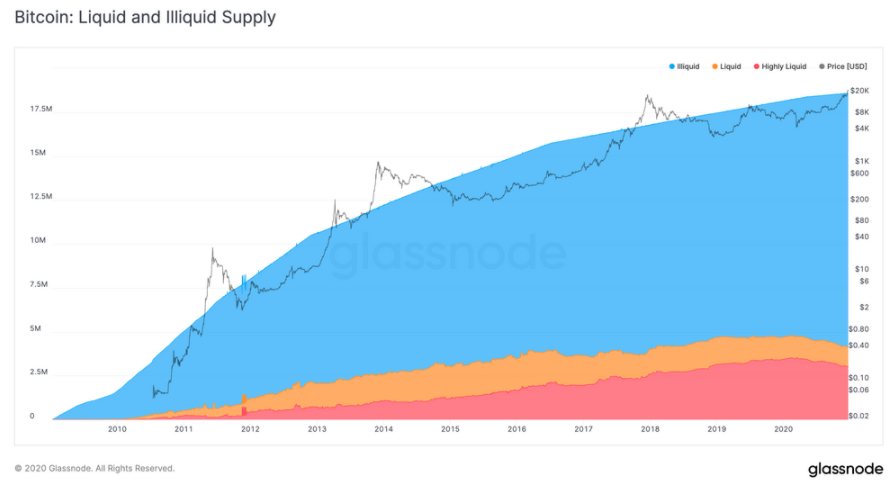

Crypto traders and institutions quickly scooped up the early week pullback towards the $25,800 support level last week, as the ongoing BTC supply shortage moved into overdrive.

News that President Trump had signed the new $900 billion COVID-19 stimulus package also helped to boost crypto market sentiment.

The US dollar index slumped to its weakest level since April 2018 last week, which further exacerbated the bullish sentiment towards Bitcoin.

Grayscale Investments also entered back into the business of buying Bitcoin last week, following a short-lived two-day pause. Speculation that Grayscale Investment Trust were preparing to start selling some of their BTC holding proved to be wrong.

BTC Supply & Liquidity

Source: Glassnode

On-chain data recorded notable whale activity last week as BTC Token Age Consumed recorded it’s third largest spike of 2020, flagging a massive incoming move.

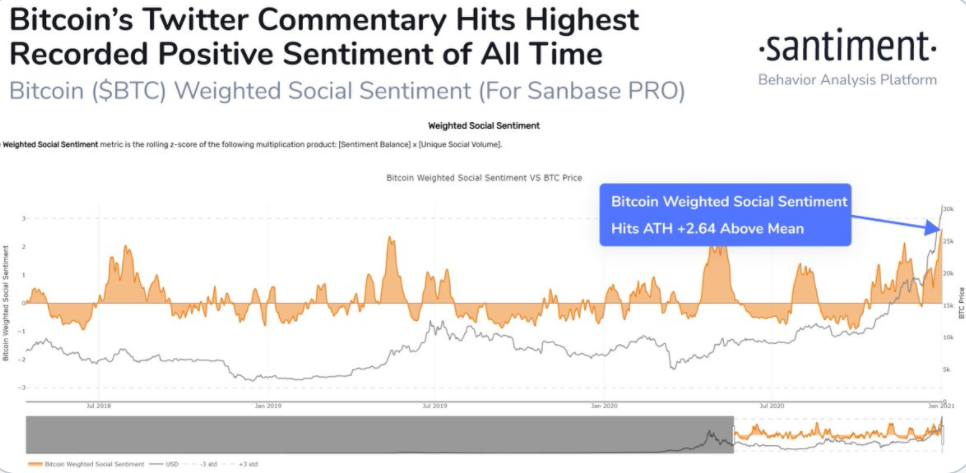

Data from crypto behavioral platform Santiment also showed that weighted social sentiment towards Bitcoin on Twitter reached a new all-time high.

The Crypto Fear and Greed Index also showed that sentiment towards BTC was reaching unsustainable levels, as the index hit a new all-time record high.

Source: Santiment

The crypto total market capitalization rallied to a new all-time high last week, largely driven by the ongoing bull runs in Bitcoin and Ethereum.

Bitcoin’s market dominance also traded towards 15-month highs last week, and surged towards the 73.50% benchmark level.

Ripple continued to dominate the news as 2020 came to close. Binance US became the latest exchange to delist XRP.

Ethereum and Polkadot stole the show in the altcoin space last week. Ethereum broke above the $1,000 level, which Polkadot reached its highest trading level since its exchange listing in August this year.

During my upcoming webinar I will be looking at Double-bottom patterns, and I will also be charting Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and EOS (EOS).

The Week Ahead

In the first full week of 2021 Bitcoin is expected to step on the gas even more, and surpass the volatility that was observed over the not so quiet Christmas Holiday season.

U.S. political twists and turns are likely to be a major focus for broader financial markets and indeed the crypto this week, as the Georgia run-off on January 5th has very real political implications for America.

Following the U.S. election, Bitcoin has obviously reacted positively to the prospect of a Biden Presidency. Should we see a democrat victory and control of the Senate then I expect BTC could crack $35,000.

The reason is likely to be the U.S. dollar. The ongoing bear market in the greenback is likely to become more protracted as the prospect of more government spending and ultra-loose fiscal policy from the Democrats should exacerbate the downtrend in the DXY, and play right into the hands of BTC.

Protests outside the White House, and a speech from President Trump also have the ability to upset the apple cart this week. These are very real risk events that the crypto market is currently not pricing in.

Perhaps the biggest moves in financial markets tend to happen when events are not priced in. This is exactly what we saw with COVID-19 in March. So any unexpected shocks can cause trades to quickly get unwound or status quo trades can also go into overdrive.

One thing is for sure, it will certainly not be a quiet start to 2020 for Bitcoin. Remember, January is an historically volatile month for BTC. Just look at a chart from January 2018.

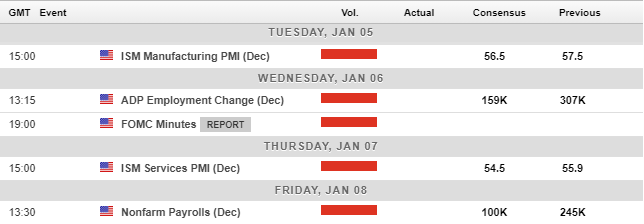

The economic calendar is also heavy U.S. centric this week, with the FOMC Meeting Minutes, ISM Manufacturing report, and the December Non-farm payrolls job report all being released.

Source: Forexlive

The technicals surrounding Bitcoin (BTC) in the near-term look fairly overstretched, and we have seen a sizable pullback this morning, following the epic bull run above $34,000.

As I said last week “bets on the options market for BTC reaching $34,000 in January look pretty good right now”. Well, that proved to be eerily correct.

A cup and handle pattern is still projecting a potential move towards the $36,000 level. Past $36,000 fibonacci analysis highlights $42,000 and $50,000 as possible upside targets.

Should we see BTC hit $36,000 to $37,000 area reach and then we start retrace quickly, then I would anticipate a greater pullback than we saw today. We also have to factor in the possibility that BTC may have put in an interim top already, around the $34,800 area.

Future areas where dip-buyers may look to buy in are found at the $30,000 and $24,300 levels. I would imagine if we saw a substantial retrace this month, then $20,000 would be a great spot to look for longs.

Technical indicators still show that BTC is overbought, and bearish MACD price divergence is extending back towards the $28,000 area has been reversed, although we do have more divergence around the $20,000 level also.

Source: Tradingview

Ethereum (ETH) cracked the $1,000 benchmark level and could well be on its way to a new all-time high. Currently, I see few reasons why this will not be the case.

An extremely large bullish pattern will form if Ethereum reaches the $1,400 level, which suggests that in the longer term ETH/USD could trade well above the $2,000 area in the medium to long-term.

In terms of where to enter on a pullback I still see the case for a pullback towards the $680.00 region this year to form the final right-hand of an inverted head and shoulders pattern.

Various time frames show negative MACD price divergence extending down to the mentioned bearish target, so I would not be surprised to see this play out.

This is an extreme scenario at the moment, and it really depends what happens around the former all-time high, around the $1,400 area.

It must be said that a breakout in the total market cap chart, and a major drop in BTC market dominance also bodes well for Ethereum in the near-term.

However, when Bitcoin’s market dominance starts to pick-up again, it could certainly slow down the pace of gains for ETH. But now does not seem to be the time to look for weakness. Waiting for $1,400 or a fundamental catalyst to cause a pullback would be more prudent.

ETH/USD Daily Chart

Source: Tradingview