New Year, New Highs.

Bitcoin has given everyone a present this New Year. As it marches to new highs, it creates more fuel for a subsequent alt season.

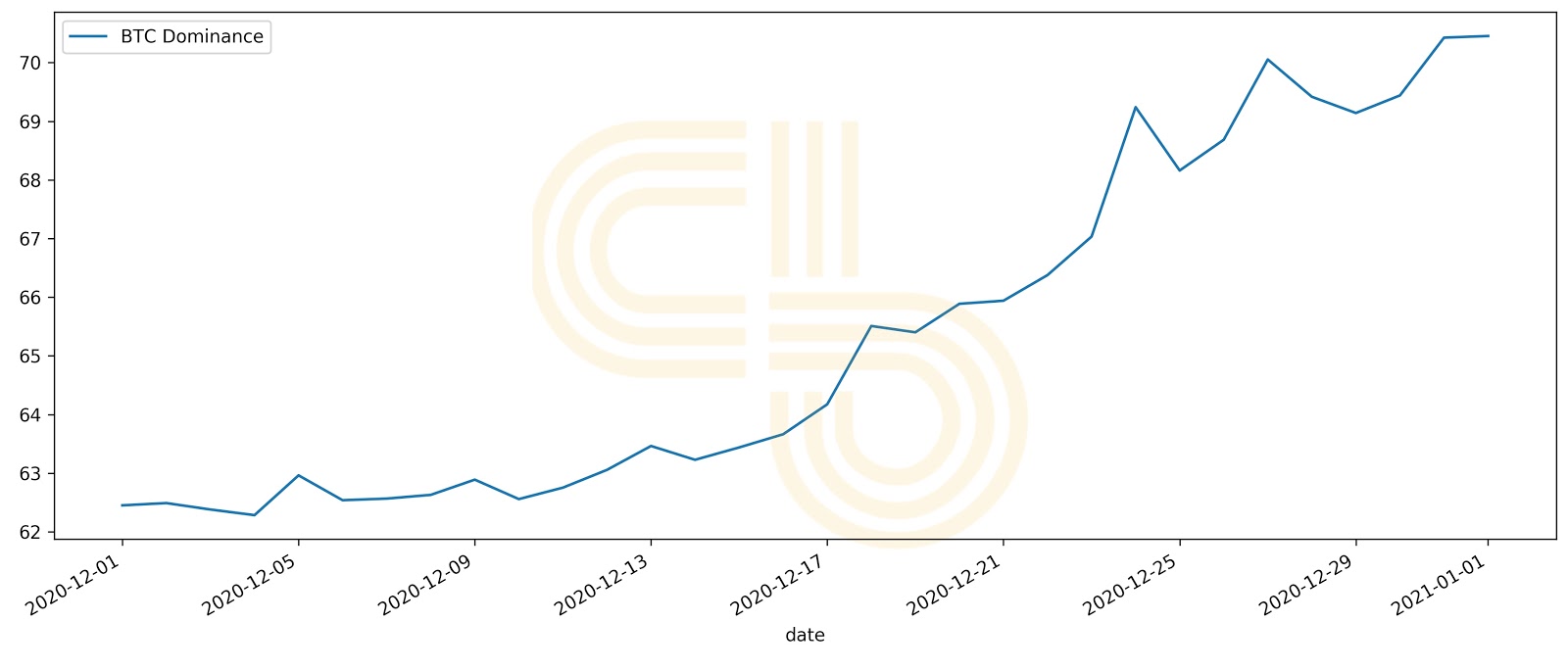

Bitcoin dominance remains at high levels, though it has been flat for the last several days. Consequently, altcoins have taken a short rest, but BTC volatility will likely remain high in the short term. Hence, liquidity will continue flowing into bitcoin.

It’s clear that BTC has entered a growth phase, just as it did in 2017, which means that altcoins will perform modestly until the price of Bitcoin peaks. The altcoin rally still hasn’t begun, considering that ETH is slightly above $700 while its previous all-time high was at over $1,400.

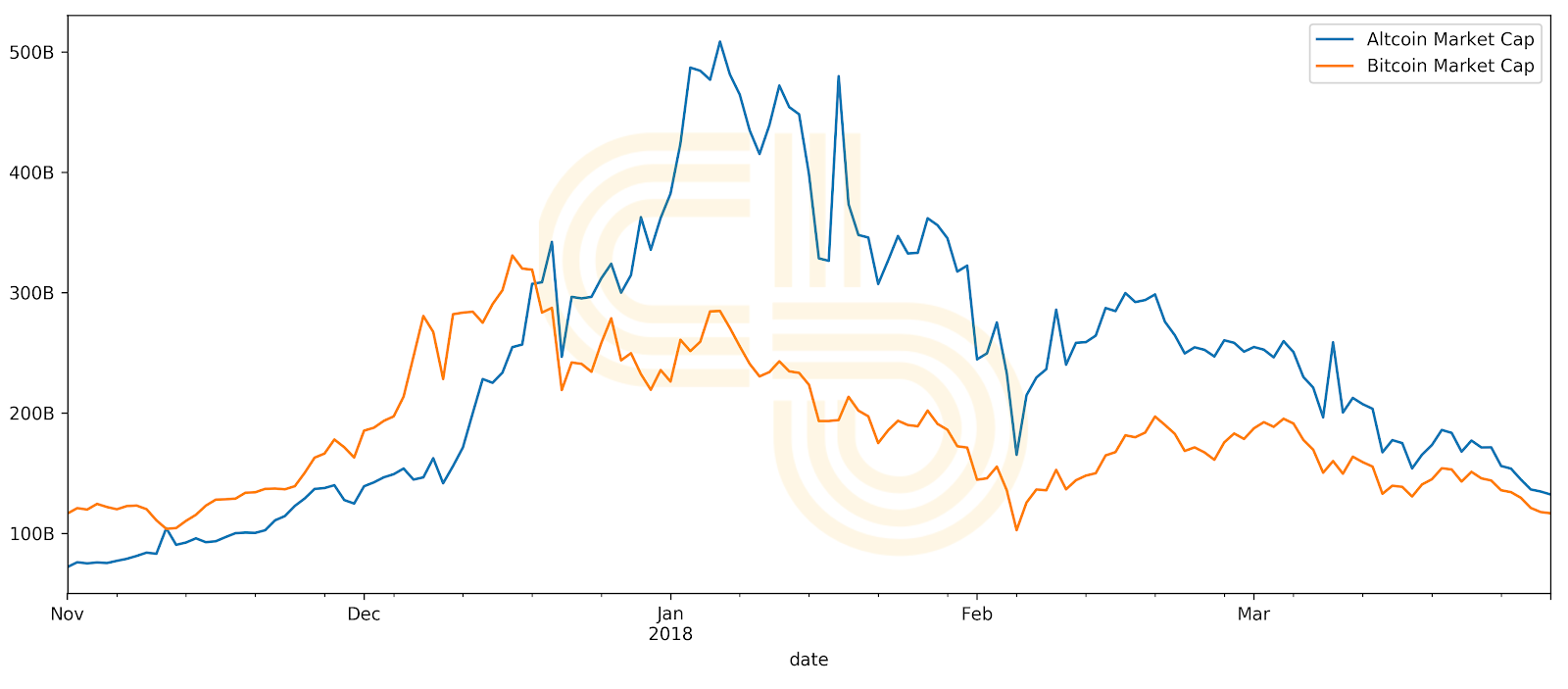

Once bitcoin reaches its top, investors will likely rush to altcoins. This happened during the last macro bull run. Notably, the growth of the altcoin market cap significantly exceeded the BTC market cap during 2017’s altcoin boom.

If history repeats, we are far from the next real alt season despite BTC lifting alts’ valuations. The important signal for the alt season will be the next time bitcoin prices peak.

According to our lead Bitcoin analyst,Nathan Batchelor, BTC is still bullish on the macro level, but there may be short-term pullback due to regulatory actions in the United States, such as the recent FinCEN KYC proposal for crypto wallets. Bitcoin’s current target is $36,000.

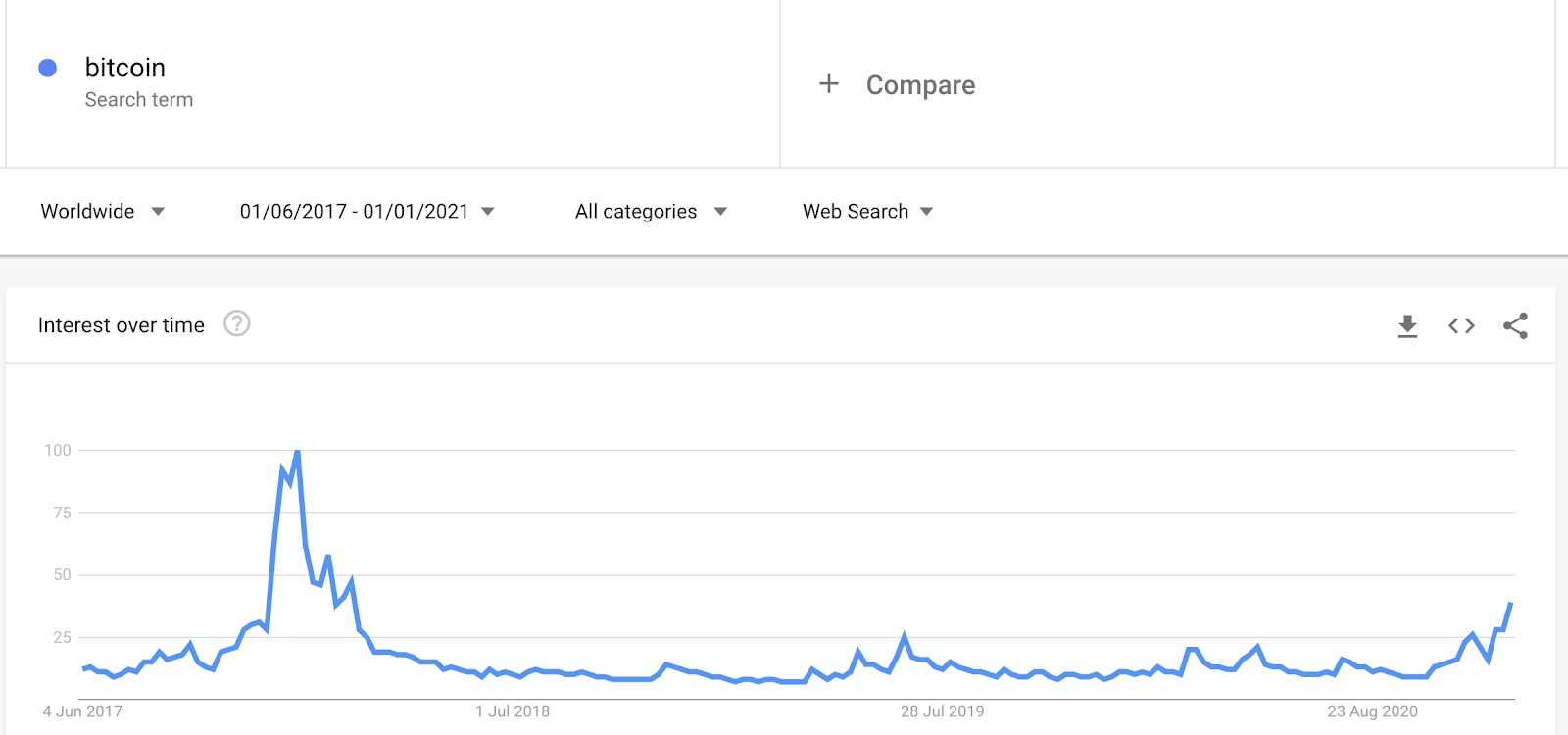

BTC still hasn’t attracted significant retail investment. Google Trends show that search volume for the term “bitcoin” is still far from what the market experienced during 2017 excitement.

However, there are positive signs on the horizon. VanEck recently made another attempt to launch a Bitcoin ETF, which could open up bitcoin for many more retail investors. If the US Securities and Exchange Commission approves VanEck’s ETF product, other institutions will rush to introduce their own ETFs. That would produce even greater upside for BTC.

Still, at some point, bitcoin’s bull run will end. This will be the time for alts to shine. So, our recommendation is that investors sit tight and wait for the next alt season.

SIMETRI Portfolio Beats Alts (Again)

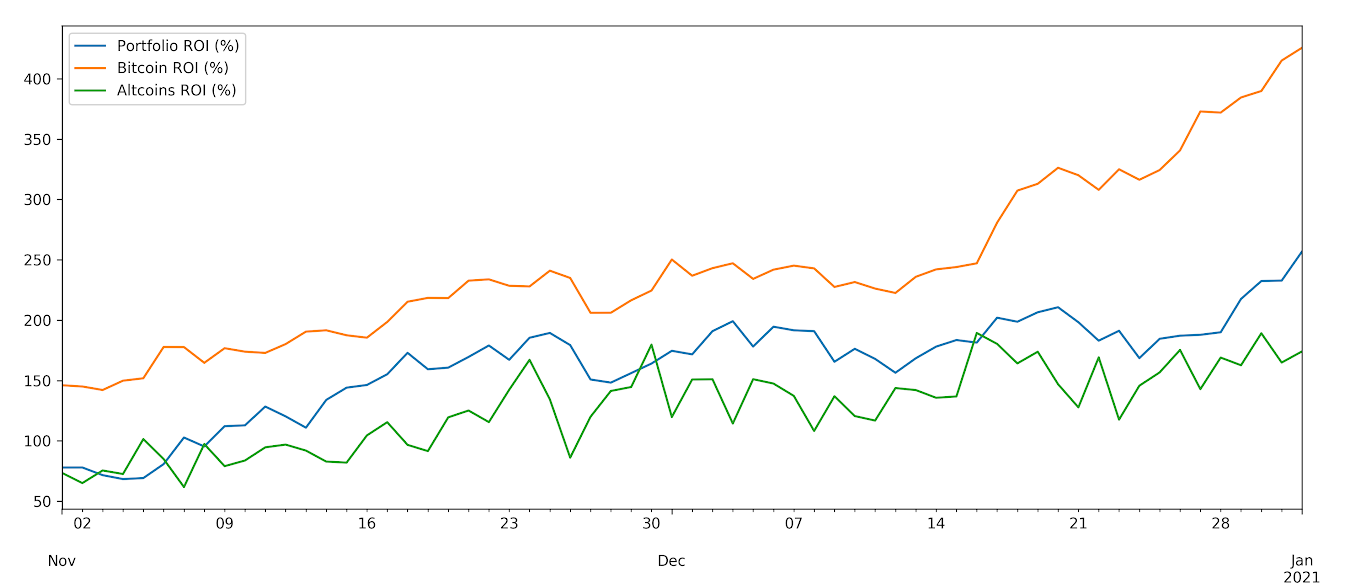

The SIMETRI portfolio continues to prove its resilience and is following Bitcoin’s uptrend, even as the rest of the altcoin space stagnates.

The ROI of our picks went from 539% to 712%, the highest return that our selection has produced since we launched our digest. Our strategy proves that picking fundamentally sound projects is more effective than picking random projects in hopes that a big market wave will lift all boats (otherwise known as the “spray and pray” approach).

Considering SIMETRI Portfolio’s performance, it is safe to assume that our Picks will capture more growth than the rest of the market once alt season hits.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.