Crypto Market Roundup: Why the Market Collapsed and How to Reposition Yourself for Crypto Success Today

We are living in truly unprecedented times. The Coronavirus has continued on its exponentially destructive path. The pandemic is forcing country after country to shut down with no signs of capitulation.

The backdrop of a global pandemic along with a breakdown of OPEC has led investors fleeing risk-on assets into cash. Safe haven assets like gold are also experiencing price drops while crypto has certainly shown no immunity.

In just two short weeks, the S&P 500 dropped 23%, crude oil prices fell 52%, and even gold prices took a 10% dip. The freefall in equity markets triggered circuit breakers multiple times.

The overall crypto market capitalization fell 42% in a single day, the second-largest drop in history, with Bitcoin (BTC) leading the sell off.

Why Did Crypto Prices Collapse

COVID-19 caused one of the most aggressive sell-offs in U.S. history, triggering a global flight to safety from risky assets. The crypto markets also experienced a historically unprecedented series of cascading events. Let’s quickly recap what happened last Thursday.

- On Mar. 11, President Trump announced a 30-day travel ban on 26 European nations.

- On Mar. 12, Wall street officially fell into a bear market with the S&P 500 dropping more than 20%, ending an 11-year bull market—the worst drop since Black Monday in 1987.

- Early morning on Mar. 12: Bitcoin drops 25% from $8,000 to $6,000.

- Later in the day on Mar. 12: Bitcoin drops another 40% down to $3,600.

Examining Bitcoin’s Price Drop

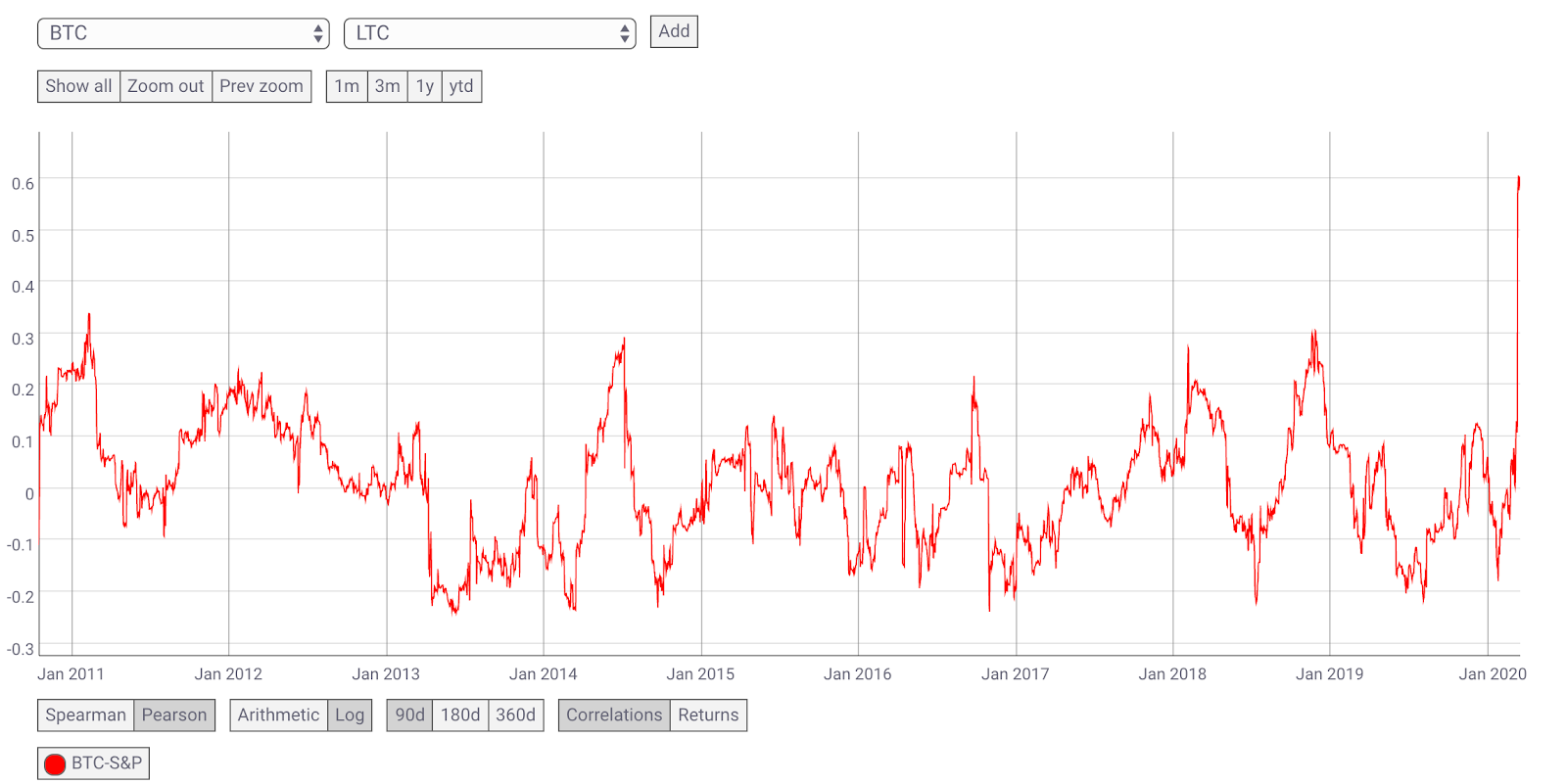

Bitcoin’s first price drop from $8,000 to $6,000 can largely be attributed to a general sell-off in all risk-on markets. We have observed a remarkable spike, from -8% to +59%, in the correlation between Bitcoin and the S&P 500 over the past 60 days.

We went from slight negative correlation to a substantial positive correlation.

Crypto naysayers were quick to Twitter to discount Bitcoin’s narrative of becoming a digital safe-haven asset, gold 2.0. However, we are seeing a similar pattern with gold prices, signifying that during times of extremely high volatility and uncertainty, in the short term, neither gold nor Bitcoin will be able to provide immediate shelter.

Amongst the sellers were retail folks who recently bought into Bitcoin over the past 12 months, miners who have set stop prices on their BTC, crypto hedge funds who have taken out crypto back loans and forced to deleverage, and most significantly, lending and borrowing platforms who have liquidated the collateral held from their borrowers.

What happened on the next drop was an interesting account of two significant market failures in the broader crypto market as well as the emerging niche DeFi space.

Broader Crypto Market Failure

Bitcoin’s first precipitous drop of 25% had caused a tsunami of selling and collateral liquidations. This selling frenzy then led to further price drops and subsequent collateral liquidations for margin traders on derivative exchanges like BitMEX and Deribit.

When these positions are liquidated someone needs to be on the other side of the trade to buy the liquidated collateral at market prices. However there was so much collateral liquidated within such a short amount of time that there weren’t enough buyers to support the rate at which BTC was being liquidated.

To compound this liquidity crunch was the fact that Bitcoin and Ethereum networks were so jammed transactions that both blockchains were clogged to a halt. Even if some traders were willing to catch a falling knife and buy up all the liquidated Bitcoins at a significant discount, they were not able to send their funds to the exchanges in time.

This lack of liquidity compounded with a clogged network caused the next major drop in the price of Bitcoin.

Ultimately, the price of one Bitcoin fell to just below $4,000 before BitMEX abruptly went offline for “maintenance” due to “hardware issues.” Once BitMEX resumed operations, Bitcoin’s price rebounded immediately and stabilized around $5,500 for the remainder of the day.

Once again, crypto pundits took to Twitter to propose conspiracy theories suggesting there were, in fact, no hardware issues and that BitMEX took their exchange offline to stop the freefall. BitMEX quickly responded and denied such allegations. Regardless of how and why BitMEX went down, the fact remains, had they not gone offline, the price of one Bitcoin could have indeed approached $0.

The ultimate cause of a market failure of this magnitude cannot simply be placed on just any one exchange. Traditional equities markets have circuit breaker rules in place that temporarily halt trading when there dramatic price drops in the market. This allows time for traders to regroup and rethink their positions. In fact, we saw these circuit breakers get triggered on the same day on US stock exchanges and they presumably helped save the stock markets from complete freefall.

However at the moment most crypto exchanges do not have circuit breaker functionality in place.

DeFi Market Failure

Concurrently on the same day, the DeFi space also saw a series of market failures unfold. On the DeFi end, leading the fall was Ethereum, the base currency underpinning the entire DeFi market and the leading DeFi protocol, Maker.

DeFi users use Maker to collateralize their Ethereum in order to borrow USD-pegged stablecoins known as Dai. During the first part of the crypto crash on Mar. 12, the price of Ethereum dropped dramatically from $190 to $130. As a result, many with collateralized Ethereum positions were liquidated.

The liquidated Ethereum from Dai borrowers are supposed to be put up for auction by the Maker system and offered to the highest bidder. This ensures every Dai minted on the Maker system is backed by a commensurate dollar value worth of Ethereum.

However, the congestion in the Ethereum network caused the Maker system to believe that there were no bidders. Much of the failure was due to a design flaw in Maker’s liquidation system that did not dynamically adjust gas prices to ensure orders were properly submitted.

One savvy user figured out that if they increased the gas price they would be the only recognized bidder in the auction. This user was ultimated awarded $8M of Ethereum for $0 Dai. All other parties took a major loss and their collateral liquidated well below market price.

This was the black swan event that all DeFi investors hoped would never actually happen. The sequence of events that occured last week is a humble reminder of the nascent and volatile nature of the DeFi market, as well as that of the broader crypto markets in general.

What’s Happening Behind the Scenes in OTC?

Whenever markets get crazy I like to check in with my friend Justin Chow and get further insight on what the big whales and institutions are doing. Justin Chow is the Global Head of Relationship Management at Cumberland, the largest trading desk in the world.

Here’s what he told me:

“The flow on our desk has been relatively neutral. Despite the violent market sell-off, it’s encouraging to see longer-term investors coming in to buy the dip, many of whom have been in the space for a while. The sellers appear to be levered market participants who are unwinding long positions.”

Usually, whales tend to trade with shops like Cumberland because trades of that magnitude move the markets too much. Essentially what this tells me is that both retail and institutional players in the space were equally caught in the crossfire and had to deleverage their positions and contributed to the sell off.

But this also tells me that for every seller there was almost an equal amount of buyers. So then where did all the money from the market go? Stablecoins?

Crypto Briefing reported that over $600M worth of the stablecoin USDT has been minted in the past week and now has a market capitalization of $5B, further solidifying Tether’s place as the #1 dollar back crypto on the market. This is a good sign as it means this money is still sitting on the sidelines looking to move back into the crypto when the time (and price) is right.

Quantitative Easing and Bitcoin as Gold 2.0

In response to the panic in the U.S. economy and American financial markets, this Sunday, the Federal Reserve announced plans to cut interest rates to near 0% along with a $700B quantitative easing plan. In other words, the government plans to print $700B out of thin air.

Usually Fed stimulus plans are met with upward market movements. And, immediately following the announcement, this was momentarily the case. However, by the next day, the S&P 500 plummeted 10% and triggered more circuit breakers. This tells us that the general market is no longer optimistic about the Fed’s ability to effectively stimulate the economy by simply printing more money.

Injecting a fresh $700B of new money into the economy will likely do nothing more than lower the purchasing power of the dollar and make the average American holding USD poorer relative to the world. So why do it?

Quantitative easing is intended as more of a psychological signal that the central bank will take extraordinary measures to help stimulate the economy.

But if interest rates are at 0% then the Fed is out of ammo right? Wrong, the Fed can print money indefinitely as it sees fit. And interests can go into negative territory just like they are with several European nations.

This only makes the case for a cryptocurrency like Bitcoin, which has a programmatically fixed supply, with a set inflation schedule which approaches zero, that much more interesting.

But isn’t Bitcoin Correlated with the Stock Market?

The chart provided above does in fact illustrate a trend that Bitcoin correlation with the stock market is increasing.

My initial assumption was that this is only a short term trend because there is currently a panic-driven flight to cash all-around. Bitcoin will likely decouple as the investor base around the asset matures. This will further be driven by financial institutions who will include crypto in their investment mandates and the public who will see their purchasing power eroded by quantitative easing.

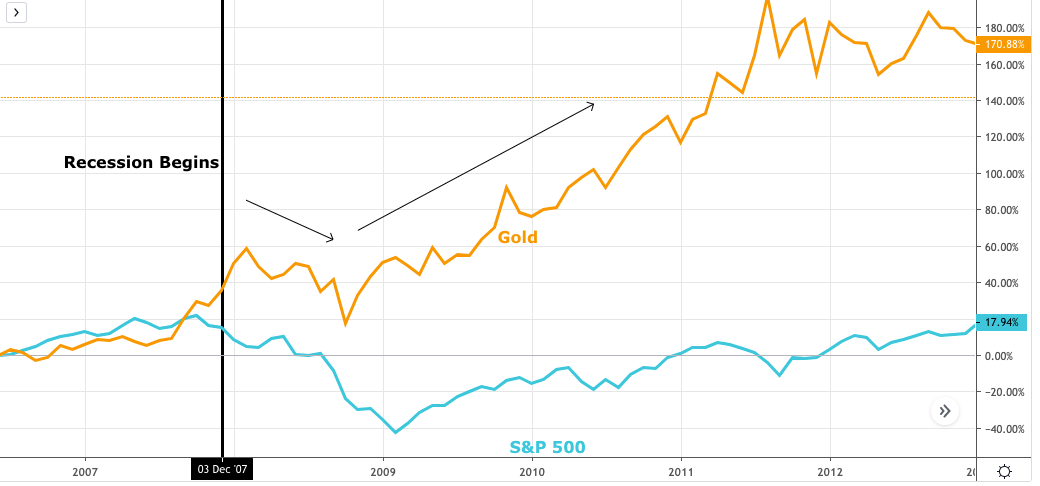

So, I went back to the last recession that started on December 2007 to test this assumption and see how gold fared throughout the global financial crisis.

After a quick initial uptick gold also began trending down and followed the S&P 500 until Oct. 2008, when it decoupled and began it’s recovery to its previous high. It only took gold six months to recover, and it continued to outgrow the S&P 500, which did not fully recover for another five years.

How We Plan to Play the Crypto Markets

Let’s go with what we know. Dominating global investor and consumer sentiment right now is the overhang of coronavirus. We see that headlines and news about coronavirus is driving the stock markets. And, in turn, the stock markets seem to be driving the crypto markets.

This will likely be the case for the next few months until the markets become desensitized to bad news. That would usually be a sign we are at the bottom. On a personal level, this is when online deliveries, social distancing, and complete lockdown start feeling like the new “normal.”

If we believe that the worst is yet to come, then we can assume that we will expect more bad news and more downward movement in the stock markets and crypto.

But here is the silver lining. At some point we will reach the bottom. What goes up must come down. And, if the fundamentals don’t change, what goes down must come up. Such is the nature of the business cycle. And judging by the last recession the bottom could be 40-60% of pre-recession prices.

Lets throw in an additional premium for the added volatility and ultra speculative nature of crypto and let’s say the potential bottom could potentially be -70% from Bitcoin’s pre-recession price of roughly $9,000 right before the drop (only two weeks ago). So let’s assume that BTC at ~$2,500 is still within the realm of possibilities. It is my personal opinion that this price is also very likely the bottom.

However the Bitcoin halving is coming up in May and Bitcoin will be even more scarce than it has ever been. And we are seeing a slow, but consistent stream of new institutional investors trickle into the space each month.

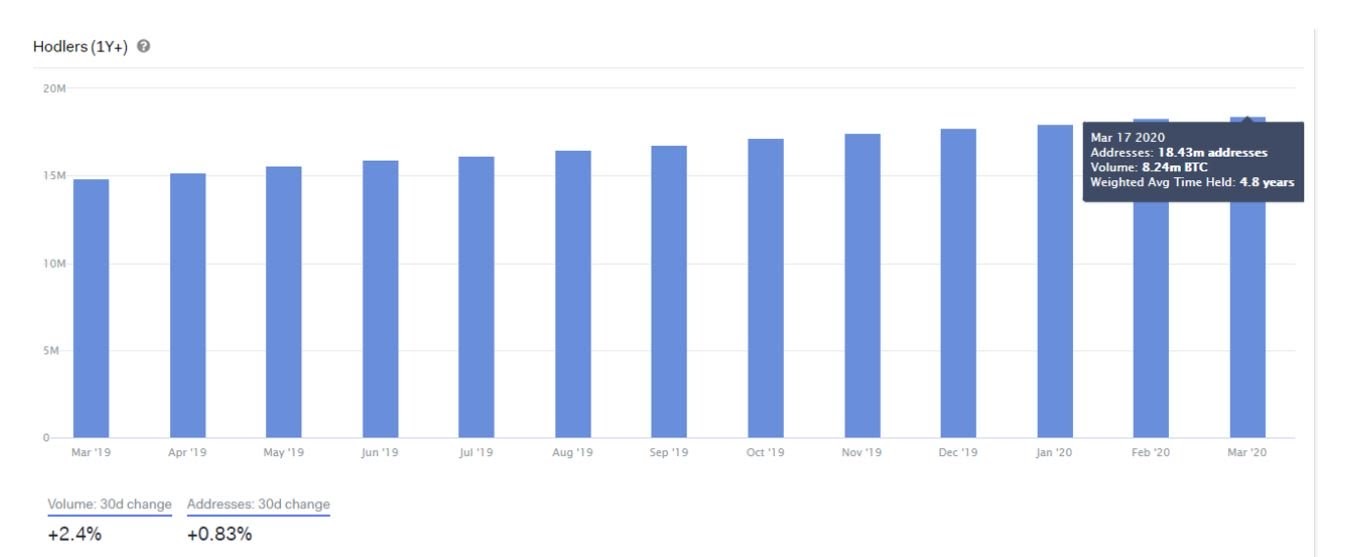

Further, Into the Block analysis suggests that young (1-12 month old) Bitcoin was sold off, but the number of new entrants soared, as determined by the number of new UTXOs. The analytics firm also found that the number of long-term Bitcon holders reached all-time highs again.

Courtesy Into The Block, BTC Hodlers

I believe that Bitcoin will rise back to $10,000+ levels within the next 6 months. The Fed, and other central banks around the world will continue to boost their economies by printing and pumping trillions of dollars into their economies over the next few years. This should only further the case for Bitcoin. Although skeptics continue to mock the prediction, Bitcon going to $50,000 or $100,00 is still fully within the realm of possibilities over the next 2-3 years.

So my point is in the overall scheme of things, buying in at $6,000, $5,000, $4,000, or $2,500 really doesn’t make a big difference. What’s more important is consistent and disciplined buying.

What you could do is start dollar cost averaging in and buy a set amount each week so your average cost will even out over time, dampening the effects of volatility. You could also buy a set amount now, and buy the same amount each time Bitcoin’s price drops by $500.

The world will soon seek shelter in a non-inflationary (or, in Bitcoin’s case, “disinflationary”) currency that cannot be controlled, censored, or diluted by any central government. You don’t want to miss the boat because you called the wrong bottom.