May 11 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) rallied above the $10,000 level last week, and ahead of the cryptocurrencies’ highly anticipated halving event.

The BTC/USD pair moved above the $10,000 resistance level for the first-time since February 24th this year, after bulls eventually broke through the April monthly trading.

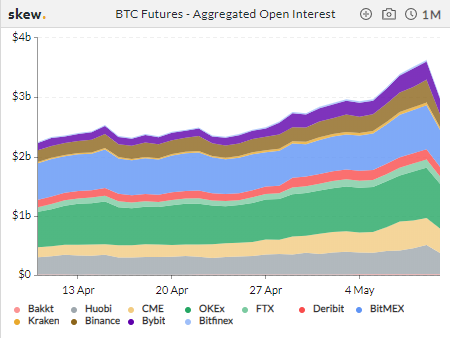

Bitcoin Futures Open Interest

Source: Skew.com

The breakout above the $9,400 level encouraged technical buying. Reports that legendary investor, Paul Tudor Jones, publicly praised Bitcoin as a store of value also helped the rally to $10,000.

The rally also appeared to be supported by institutional money, as Open Interest on the Bitcoin CME futures exchange spiked to a ten-month high.

Data also showed that Bitcoin’s node count had fallen to its lowest level in three years, despite the price surge towards the $10,000 level.

After repeated struggles to gain traction above the $10,000 level, the BTC/USD pair eventually pulled back towards the $9,500 technical area.

Over the weekend a huge move lower in Bitcoin took place, that was attributed to crypto whales exiting their long positions.

BTC/USD M15 Chart

Source: Tradingview.com

Transaction data showed that a substantial amount of money piled into stablecoins as BTC plunged by over 15 percent in a frantic 10-minute trading period.

Bitcoin’s social dominance spiked to its highest level since the March 12th flash crash this week. Brief outages were also reported on some of the most popular cryptocurrency exchanges as the crypto flash crash took place.

Whale Alert showed that a large amount of sell orders triggered the massive decline in Bitcoin, which in-turn wiped-off around $40 billion in market capitalization of the entire cryptocurrency market.

The total market capitalization of the cryptocurrency market eventually recovered towards the $235 billion level, after finding support just below the $220.00 level.

Crypto Total Market Cap

Source: Tradingview.com

The broader crypto market followed Bitcoin lower during the weekend’s flash crash, with Ethereum (ETH), Stellar Lumen (XLM), and EOS (EOS) and a basket of other top coins suffering heavy losses.

Stellar Lumen (XLM/USD)

Source: Tradingview.com

0x was the star performer inside the top-50 cryptos last week. ZRX/USD staged a huge rally, and posted gains over over 150 percent at one point before pulling back alongside the broader market.

Retail trading data showed that traders remained heavy net long BTC going into the halving event. While The Crypto Fear and Index showed that traders had moved into a period of ‘Greed’ for the first-time since the crypto flash crash.

The crypto market also brushed aside one of the worst monthly jobs reports ever. As the United States unemployment rate spiked above 16 percent.

The Week Ahead

Looking at the week ahead, the weekend’s pullback in Bitcoin and the halving event are setting the crypto market for another big week of trading action.

The technicals are certainly more bearish for Bitcoin after the recent crash. However, the halving event is still very much in focus, and some traders and investors may see the latest pullback as a buying opportunity.

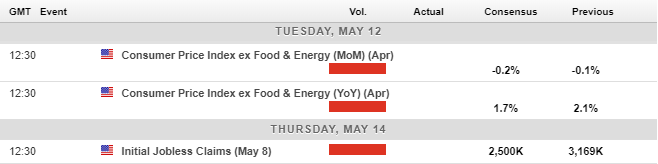

Looking at the U.S. economic calendar, traders will be focused on inflation and jobs data this week. Economists are expecting CPI inflation to fall into negative territory this week as the effects of the coronavirus continue to damage the American economy.

Economic Calendar

Source: Forexlive.com

The latest decline in Bitcoin (BTC) has created a huge price gap on the CME futures chart, which extends towards the $10,000 level. This is something to watch if bulls gain traction above the $9,300 resistance level this week.

From a technical perspective, a break below the $8,500 level could spark heavy technical selling, with the $7,700, $7,000 and $6,500 levels the likely bearish targets.

BTC/USD DAILY Chart

Source: Tradingview.com

Ethereum (ETH) is looking increasingly interesting after being swiftly rejected below the $200.00 level last week. Continued losses below the $190.00 level could see the ETH/USD coming under additional downside pressure over the near-term.

Downside targets this week extend towards the $155.00 to $150.00 area, however, sellers still have to move price under the $175.00 level in order to shift the current medium-term outlook to bearish.

ETH/USD DAILY Chart

Source: Tradingview.com