May 4 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

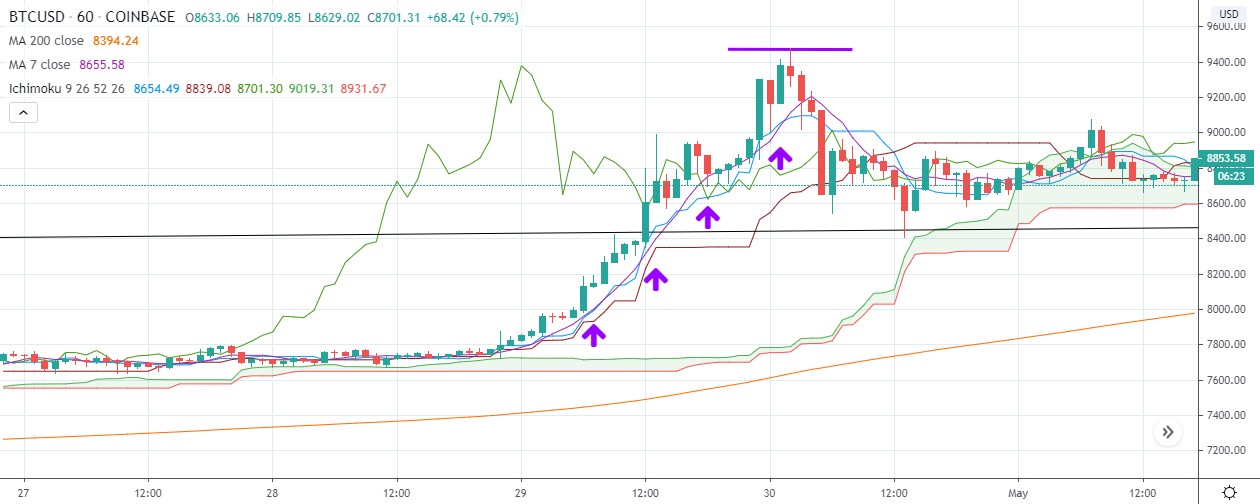

Bitcoin (BTC) rallied towards the $9,480 level last week as traders and investors turned increasingly bullish towards the cryptocurrency ahead of the upcoming halving event.

The BTC/USD pair staged its largest one-day advance since October 2019 following a breakout above the $8,000 level. The breakout above the $8,000 level completely reversed the losses from the March 12th crypto market crash.

BTC/USD ONE-HOUR Chart

Source: Tradingview.com

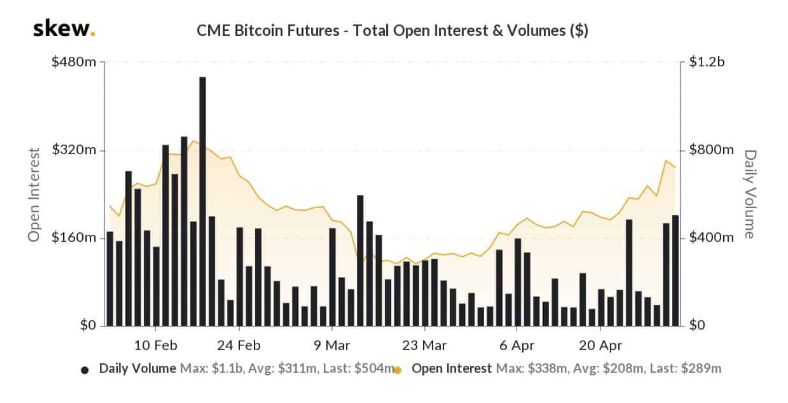

Bitcoin trading volumes on the Bakkt and CME futures trading exchange experienced a strong increase during the April 29th rally.

Although, the move higher in the crypto market last week appeared to be driven by organic demand, as data showed that cryptocurrency spot trading volumes largely drove the rally.

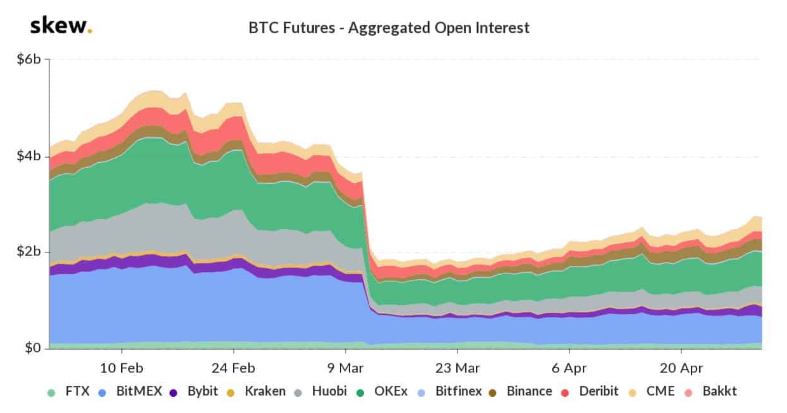

Open interest for Bitcoin futures remained under the levels seen during the March 12th flash crash, and well-below the current yearly high for open interest.

BTC CME Futures Open Interest and Volumes

Source: Skew.com

A significant amount of whale activity was also present after Bitcoin peaked just below the $9,500 level.

Whale Alert shows that a large amount of sell orders have been triggered since Bitcoin peaked earlier today. Whale Alert also shows that over $160 million USDT tokens were minted during yesterday’s huge rally.

The total market capitalization of the cryptocurrency market rallied towards the $264 billion level, marking its highest trading level since February 25th.

The broader crypto market followed Bitcoin higher, with top altcoins such as Ethereum (ETH), Ripple (XRP), and Bitcoin Cash (BCH) staging significant rallies. Outside of the top-50, THETA (THETA), DigiByte (DGB), and Band Protocol (BAND) posted massive weekly gains.

Band Protocol (BAND/USD)

Source: Tradingview.com

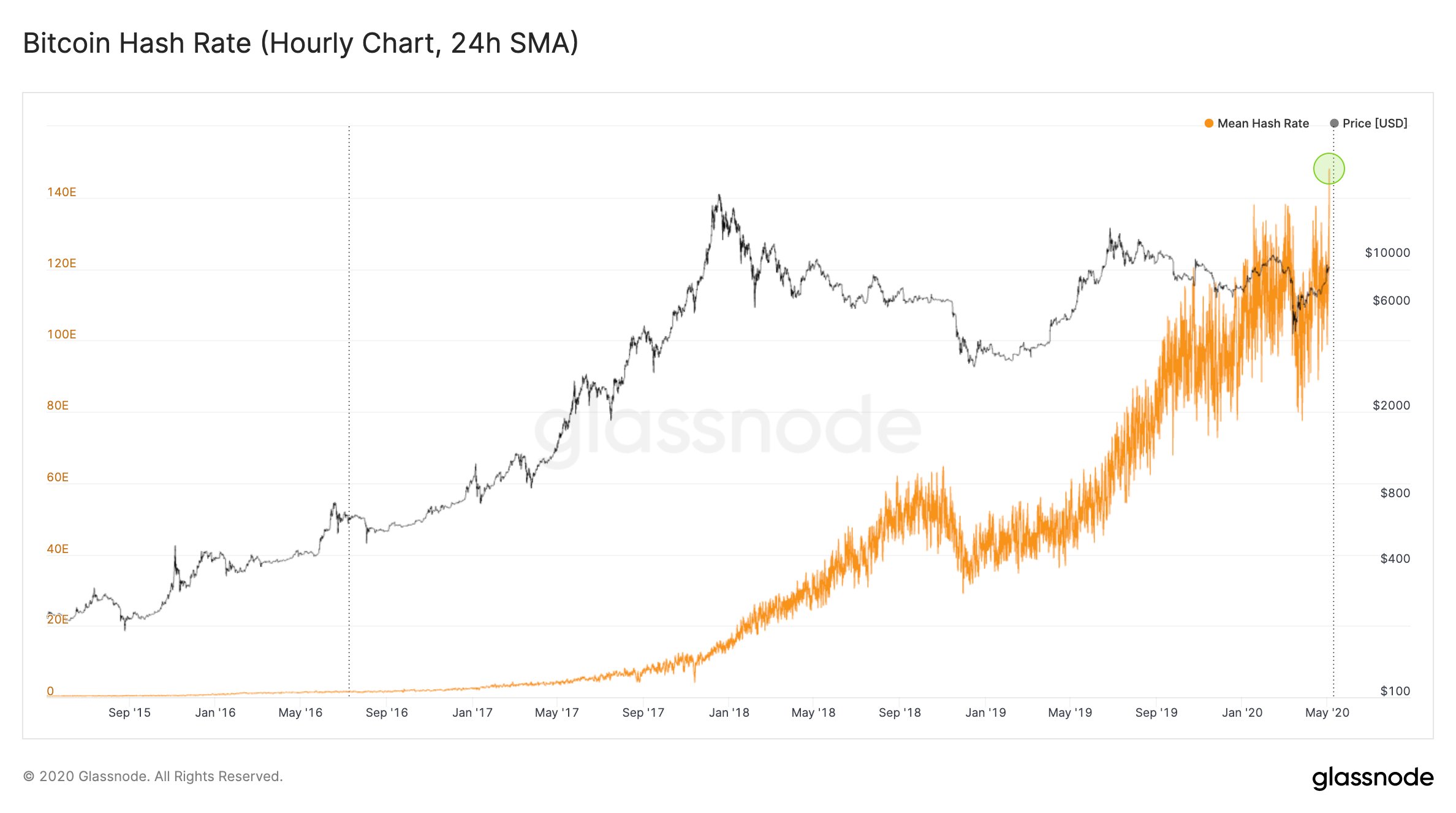

Bitcoin’s hash rate also surged to a new all-time high last week, ahead of the upcoming halving event, which is scheduled for May 12th-13th.

Bitcoin also became the best performing asset of 2020 so far, as BTC overtook gold, following last week’s advance.

The Crypto Fear and Index recovered sharply higher last week as the market advanced, with the index rising to levels not seen since February 24th.

Bitcoin’s Hash Rate

Source: glassnode Twitter

Risk-off trading sentiment in traditional financial markets started to fall towards the end of last week. The S&P 500 started to pull lower, while Amazon’s share value slumped by around 7 percent into the weekly price close.

The Week Ahead

Looking at the week ahead, risk-off trading sentiment has come back into the fray. Tensions between the United States and China are starting to simmer again.

This may cause problems for the cryptocurrency market if global stock markets start to fall sharply and Bitcoin follows the S&P 500 and other indices lower.

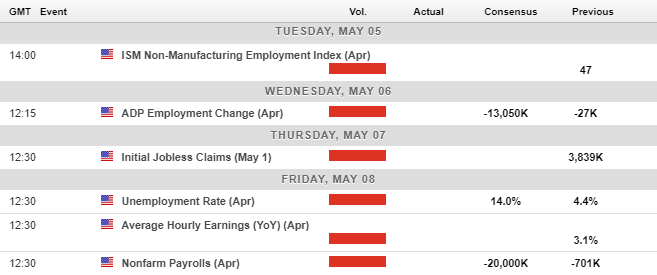

The United States monthly job report, commonly known as the non-farm payrolls job report, headlines the economic calendar this week. Most economists are forecasting an historically weak monthly jobs figure and sharp increase in the U.S. unemployment rate.

Economic Calendar

Source: Forexlive.com

Bitcoin (BTC) is at risk of moving lower this week if bulls fail to anchor price above the $9,100 level. Bearish MACD and RSI price divergence is currently present on the lower time frames, and warns of a coming price drop towards the $8,100 level.

A double-top is also present on the lower time frames, failure to negate the double-top could result in a drop towards the $8,100 level, and possibly the $7,800 technical area.

Traders are also watching a major long-term trendline around the $8,550 that bears have so far been unable to breach.

BTC/USD DAILY Chart

Source: Tradingview.com

Ripple (XRP) is at risk of turning lower if bulls fail to overcome the $0.2300 technical area. XRP/USD is also one of the few coins that has failed to turn technically bullish and break above its 200-day moving average during the recent rally.

A breakout below the $0.2000 level could see XRP/USD tumbling towards the $0.1850 and possibly even the $0.1600 technical support area.

XRP/USD DAILY Chart

Source: Tradingview.com