April 27 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) rallied towards the $7,800 level last week after bulls finally broke through the $7,460 resistance level, following numerous failed upside attempts.

Growing optimism from institutional investors and retail traders towards the upcoming Bitcoin halving event appeared to be the main catalyst behind the move higher.

It is also noteworthy that the rally took place after a short-lived dip towards the $6,750 level in early week trading after the price of WTI oil crashed into negative territory.

BTC/USD Weekly Chart

Source: Tradingview.com

Bitcoin futures trading volumes on the CME exchange also increased to their highest levels since mid-February last week as BTC/USD broke through the $7,460 level.

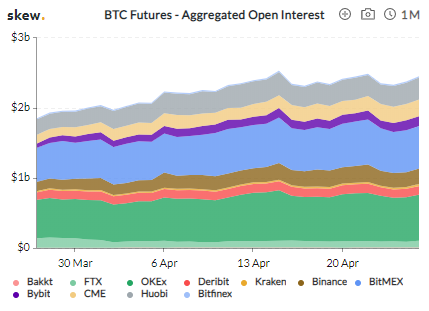

BTC Futures Aggregated Open Interest

Source: Skew.com

Data also showed that aggregated open interest on the major cryptocurrency futures exchanges has been steadily rising ahead of the halving event.

The broader cryptocurrency market also moved higher in lockstep with Bitcoin, as the total market capitalization finally broke through the $200.00 billion resistance level.

Stellar Lumen (XRM) was a major beneficiary of the rally last week and traded higher by over 35 percent at one stage. Minor profit taking eventually kicked-in, with the XLM/USD closing the week above the $0.06000 level, marking a gain of over 25 percent higher on a weekly basis.

Kyber Network (KNC) was another star performer in the altcoin space last week, with the KNC/USD pair trading over 70 percent higher on a weekly basis. Tezos and Theta also made notably strong moves last week.

The Crypto Fear and Greed Index recovered to its highest level in over six-weeks as the strong recovery in Bitcoin and the broader crypto market helped encourage the notion that market participants are once again turning bullish towards cryptos.

Bitcoin Active Entities

Source: Glassnode Twitter

Google searches for “Bitcoin halving” continued to explode as Bitcoin stayed well-bid above the $7,000 level. On-chain data metrics also painted a bullish picture for the number one cryptocurrency ahead of the halving.

Risk sentiment gradually recovered after the historic crash in oil prices last week. Gold also made a notable run to the upside, and challenged towards the yellow-metals multi-year trading trading high around the $1,750 level

The Week Ahead

Looking at the week ahead it should be a big week for Bitcoin with the breakout now in place and the halving event less-than three weeks away. If Bitcoin rallies above the $8,000 level it would mean that the entire March 12th flash crash will have been reversed.

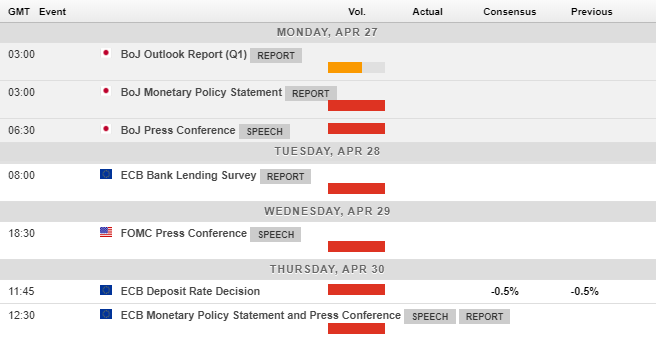

Central bank action is set to dominate the economic calendar this week. Watch out for potential changes in policy from the Bank of Japan and European Central Bank. More QE from either central bank will likely be bullish for cryptos.

Economic Calendar

Source: Forexlive.com

Bitcoin (BTC) closed the week above the $7,460 level, and also made a new monthly high in late Sunday trading. The number one cryptocurrency even try to close the CME futures gap around the $8,800 level.

A brief drop below the $7,460 level this week may be a gift from a crypto gods and provide a chance for traders seeking to enter the recent recovery from a more attractive price.

BTC/USD DAILY Chart

Source: Tradingview.com

Ethereum (ETH) is also on our radar this week. This is one coin that may have strong upside potential if bulls finally take out the $200.00 level. ETH/USD could start to rally towards the $240.00 level if the outlined scenario occurs.

A bullish breakout has taken place on the daily time frame, these type of trendline breakouts have a high probability of work if the breakout area remains well-defended by buyers.

ETH/USD DAILY Chart

Source: Tradingview.com