April 20 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Last week the cryptocurrency market performed its strongest weekly price close in over five-weeks as Bitcoin and a number of altcoins received renewed dip-buying interest, following a short-lived early week sell-off.

Bitcoin reversed sharply from just above the $6,450 level, and eventually peaked just above the $7,300 resistance level. BTC/USD finished the week with a gain of over three percent after trading down by nearly 6.5 percent during midweek trading.

ZEC/USD Weekly Chart

Source: Tradingview.com

Ethereum posted strong gains last week as data showed that institutional money is increasingly moving into the second-largest cryptocurrency. Chainlink, Tezos, and ZCash were also other notable outperformers in the altcoin space.

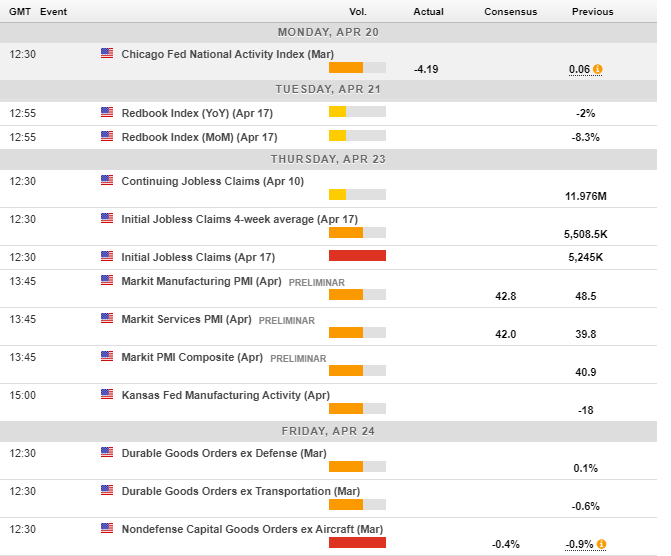

Despite negative consumer spending and weekly jobs data U.S equity markets continued to press higher, as the notion of QE infinity from the Federal Reserve continued to underpin the bid-tone in U.S. stocks.

BTC Vs SPX/GOLD

Source: Tradingview.com

Gold rallied to its highest trading level since November 2012 last week, although the yellow-metal eventually closed the week marginally below the $1,700 level after finding strong resistance from just below the $1,750 level.

Stimulus checks started to be sent out to eligible U.S. citizens last week. Data suggests that some U.S. citizens may actually have bought cryptocurrencies with their $1,200 coronavirus stimulus checks.

Two Democrat Congressmen called for more emergency aid for U.S. citizens. Some analysts argued that the cryptocurrency market may have rallied on this news of yet more economic stimulus measures from the United States.

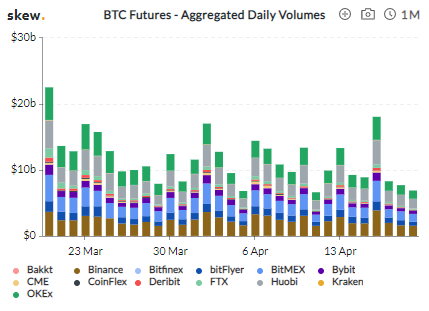

Open interest for Bitcoin started to increase last week, as institutional money came back into the cryptocurrency market. Aggregated futures volumes for Bitcoin saw a strong pick-up in mid-week trading, however, the spike in volume was short-lived.

Market buzz surrounding the upcoming Bitcoin halving event increased last week. Google Trends for the words ‘Buy Bitcoin’ and ‘Bitcoin Halving’ surged to new all-time record highs.

The Week Ahead

Looking at the week ahead Bitcoin and the broader cryptocurrency market the balance of power is finally poised as traders await a decisive range breakout.

The major themes I am paying attention to this week are Bitcoin’s ability to hold the $7,000 support level and make a new monthly high. We also need to see some follow through in the altcoins space after last week’s strong rally.

As buzz continues to circulate about the upcoming Bitcoin halving event I am paying close attention to dip-buying demand on pullbacks, this should help identify if BTC/USD can sustain the recent bid-tone, and if institutional money is really ‘back in the game’ again.

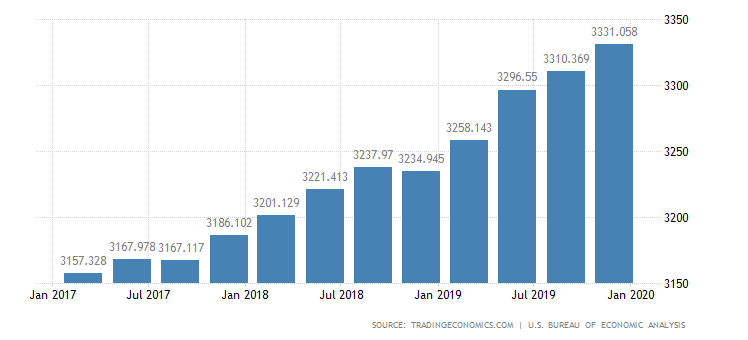

This week it is also worth paying some attention to the events on the U.S economic calendar, as the impact of the coronavirus is now showing up in the macro data.

It will be interesting to see if and indeed how long traditional markets continue to ignore it. This may be imperative for continued upside in Bitcoin and the entire cryptocurrency market.

Economic Calendar

Source: ForexLive.com

In the short-term, we may have to see demand around the $7,000 support level tested before Bitcoin, and possibly the broader crypto market, can start to head higher again.

Bitcoin (BTC) has been struggling to move past its current monthly high, around the $6,465 level. The risk from current levels is a slump back towards the $6,600 area if weakness occurs below the $6,850 support level takes place this week.

Looking at the upside, a breakout above the $7,465 level exposes a potential breakout towards the $7,700 and possibly the $8,100 level. Breaking above the $8,100 level really would be a statement of intent from BTC bulls, given that the March 12th plunge would then have entirely reversed.

BTC/USD Weekly Chart

Source: Tradingview.com

Ethereum (ETH) is one to watch after last week’s strong recovery from the $148.00 level. ETH/USD is currently struggling to move above its 200-day moving average. Gains above the 200-day MA this week could see the cryptocurrency rallying towards the $200.00 level, and possibly the $225.00 level.

To the downside, a loss of the $175.00 support level could provoke a slump towards the $165.00 to $160.00 area. Dip-buyers may be lurking around these areas.