April 13 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) started the new trading week in positive fashion as the pioneer cryptocurrency definitively broke through the $7,000 resistance level, and subsequently rallied to its highest trading level since March 12th.

The rally was eventually capped by the BTC/USD pair’s 50-day moving average, around the $7,475 level. Repeated failure to surpass this key technical bench led to frustration amongst traders, and eventually prompted a sell-off back under the $7,000 level.

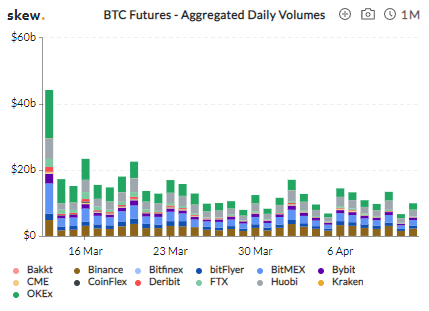

Data showed that aggregated Bitcoin futures daily volumes spiked on April 6th, as the BTC/USD pair surged above the $7,000 level. Futures volumes eventually fell to a four-week low as traders scaled back positions ahead of the Easter Holiday.

The broader cryptocurrency market also moved higher alongside BTC, as the total market capitalization broke above the $200.00 billion level.

Crypto Total Market Cap

Source: Tradingview.com

Ethereum (ETH) tested its 200-day moving average for the first-time since March 10th. A series of upside failures below the 200-day MA eventually caused the ETH/USD pair to turn lower, although the second-largest cryptocurrency finished the week higher by around 11 percent.

Chainlink (LINK) was the star performer amongst the top-altcoins last week, with the LINK/USD pair trading over 50 percent higher on a weekly basis. Tezos (XTZ) also finished the week higher by around 20 percent. Both Chainklink and Tezos are notorious for making moves uncorrelated with Bitcoin.

The Crypto Fear and Index recovered to its highest level since March 9th last week. As the early-week recovery in Bitcoin and the broader crypto market helped improve sentiment towards cryptos.

An increase in risk-on trading sentiment also boosted U.S. equity markets, and sent the S&P 500 index higher by around 8.5 percent on a weekly basis. Traders largely chose to look past a dovish speech from FED Chair Jerome Powell and focus on the notion that coronavirus cases in Europe may be peaking.

The Week Ahead

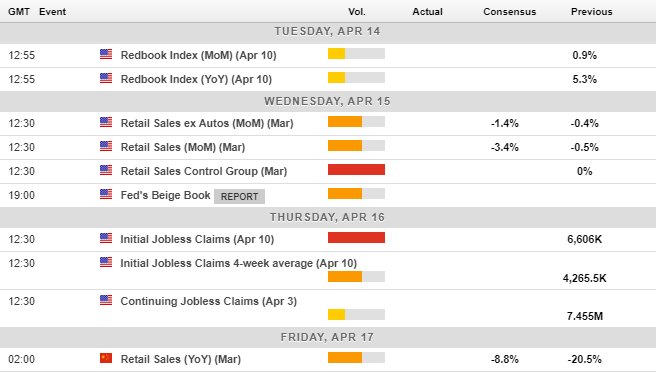

Looking at the week ahead volatility and trading volumes may see a pick-up as traders return from the long Easter Bank Holiday. The economic calendar also has a number of key consumer spending data releases that traders and investors will be focused on.

United States and Chinese retail spending is expected to have contracted sharply in March. Headline numbers significantly lower than analysts expectation could cause current risk-on trading sentiment to dissipate.

Economic Calendar

Source: Investing.com

Bitcoin (BTC) closed the week below the $7,000 level, as BTC/USD abruptly reversed from the $7,200 level in late Sunday trading. The number one cryptocurrency remains at risk of further declines this week while price trades below the former key swing-low, around the $6,750 level.

Key support below the $6,750 level is found at the $6,550 level and the April 1st swing-low, around the $6,150. Once below the $6,150 level the current monthly low, at $5,850, may quickly come into focus.

Bitcoin’s 200-week moving average is another big technical level to be mindful of if weakness occurs below the $6,000 level. The BTC/USD pair’s 200-week MA is currently located around the $5,600 level.

To the upside, gains above the $7,200 level may provoke a test of the BTC/USD pair’s 50-day moving average, which is currently dropping, and located around the $7,170 level. Once above the $7,170 level, the $7,475 and $7,700 levels are the key resistance areas to watch, prior to the $8,000 level.

BTC/USD DAILY Chart

Source: Tradingview.com

EOS (EOS) is also on our radar this week. This is one coin that may have strong upside potential if bulls can defend the bottom of a rising broadening wedge pattern, around the $2.35 level. EOS/USD could start to rally towards the $3.50 level if the outlined scenario occurs.

Broadening wedge patterns usually imply strong-two trading action inside the wedge pattern before a strong directional breakout takes place.

EOS/USD DAILY Chart

Source: Tradingview.com