March 30 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I’d like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

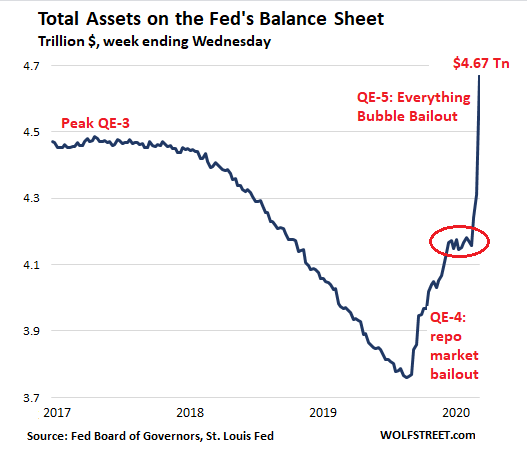

The cryptocurrency market headed higher in early week trading after the Federal Reserve announced a massive open-ended bond buying program, commonly known as QE.

Bitcoin quickly rallied above the $6,000 level on the announcement, and eventually reached a weekly peak of $6,881, according to the cryptocurrency exchange Coinbase. The broader cryptocurrency market also received a boost on the news, with the total market capitalization rallying towards the $187.00 billion level.

The announcement from the Federal Reserve was seen as being bullish for Bitcoin due to the fact that Bitcoin only has a limited supply, while Quantitative Easing effectively floods the market with U.S Dollars, and causes it to lose its purchasing power.

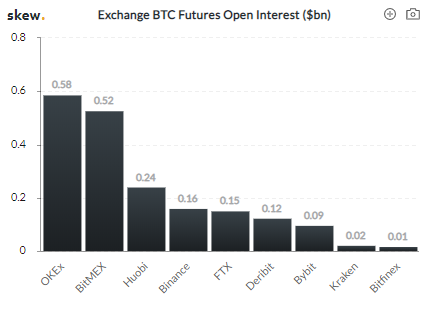

Bitcoin’s move higher after the QE announcement was seen to be driven by the spot market and margin retail traders. Data from the leading future exchanges showed that open interest in the futures market and overall trading volumes towards Bitcoin continued to decline.

Bitcoin Futures Open Interest

Source: Skew Data

Institutions were said to be unsure as to the direction of the crypto market, and remained in cash positions due to the recent market volatility recently seen across a broad spectrum of asset classes.

Bitcoin started to fade lower over the weekend, and fell back under the $6,000 level. Repeated failure to surpass the $7,000 level, and a break below the $6,500 level encouraged technical selling.

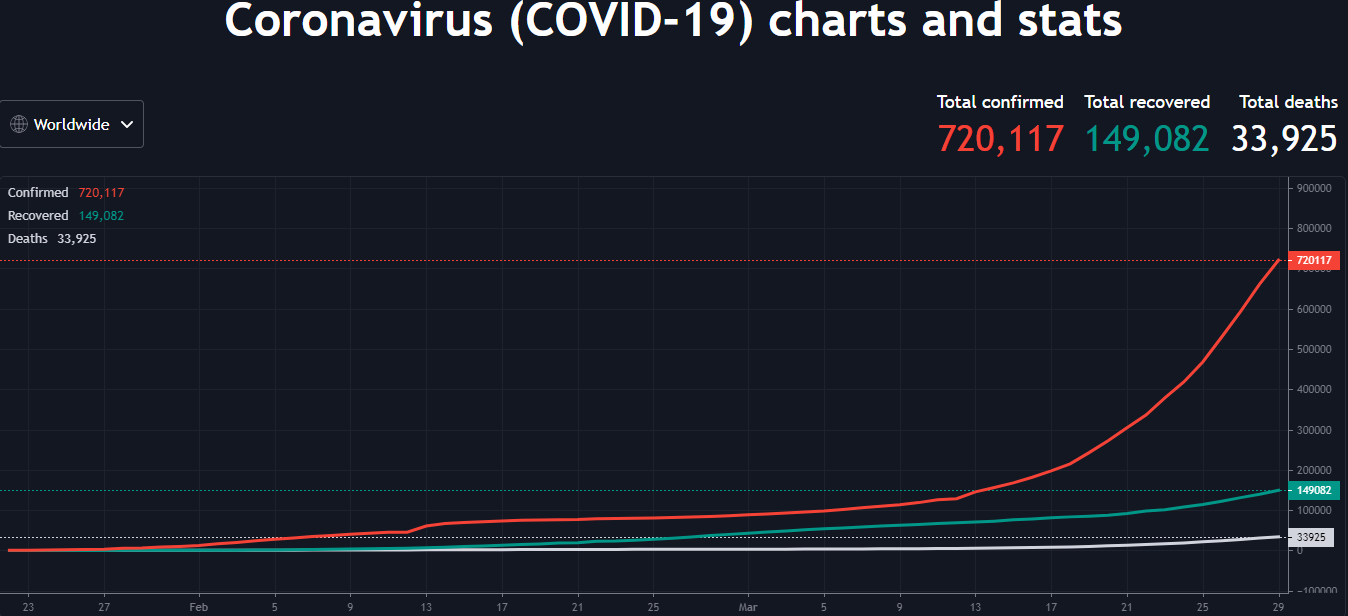

Coronavirus Stats

Source: Tradingview.com

Ripple also offered two-way action last week. XRP staged a 10 percent rally and started to fade after an initial spike towards the $0.018 level. The third-largest cryptocurrency also donated $200,000 to combat Covid-19, as the number of infections and deaths from the virus increased.

MakerDAO also staged a noteworthy rally last week after the Maker Foundation announced that it has successfully transferred the control of MKR tokens to the Maker governance community. MKR/USD rallied by over 40 percent from its weekly opening price before falling back towards the $300.00 level.

The Week Ahead

Looking at the week ahead I will be closely monitoring crypto trading volume, institutional participation in the futures market, and a potential breakout in Bitcoin if the $5,850 to $7,000 price range is broken.

Once again it is worth paying some attention to the U.S economic calendar this week. The March non-farm payrolls jobs figure will be the main event. Anticipation of a large negative number is currently very high. Traders will also be looking at the ISM manufacturing report, and weekly jobless claims.

Economic Calendar

Source: Forexlive.com

As the monthly price close approaches, traders will be paying attention to the Dec 2019 trading low, around the $6,430 level. If Bitcoin closes below the Dec 2019 low, it may encourage technical selling, and vice-versa.

Bitcoin (BTC) has started to struggle moving past the $7,000 level, and medium-term bulls could soon exit positions if this remains the case. A breakout from a rising wedge pattern and double-top pattern formation are also weighing on BTC/USD in the short-term.

It is also noteworthy that Bitcoin’s 200-week moving average is around the $5,600 level. A move under this key technical metric could cause a strong sell-off towards the $5,000 area.

MakerDAO (MKR) is starting to look more bearish, despite last week’s rally. Bulls need to move price above the $370.00 level to invalidate a bearish head and shoulders pattern.

A break above the $370.00 level could trigger a rally towards the $590.00 level, while a break below the $300.00 could trigger losses towards the $240.00 area, at a minimum.