HEGIC DIGITAL ASSET REPORT

Hegic – Time to Change the DeFi Options Game, Research

- Quick Facts

- Funding Information

- External Links

- Summary

- Key Takeaways

- Fundamental Factors

- Introduction

- Market Opportunity

- Underlying Technology

- Ecosystem Development

- Token Economics

- Hegic’s Team

- Roadmap

- Token Performance

- Conclusion

- How to Buy and Stake HEGIC

- Buying HEGIC

- Staking Hegic to Earn Rewards

TABLE OF CONTENTS

- Quick Facts

- Funding Information

- External Links

- Summary

- Key Takeaways

- Fundamental Factors

- Introduction

- Market Opportunity

- Underlying Technology

- Ecosystem Development

- Token Economics

- Hegic’s Team

- Roadmap

- Token Performance

- Conclusion

- How to Buy and Stake HEGIC

- Buying HEGIC

- Staking Hegic to Earn Rewards

Investment Grade

Quick Facts

Funding Information

External links

Summary

Over the last two years, the volume for crypto options has increased from nearly zero to almost $6B. However, DeFi platforms for options trading have lagged behind due to problems with liquidity.

Launched just over a month ago, Hegic was able to solve this problem.

Key Takeaways

- The project currently has over $66M staked on its smart contracts, making Hegic the number one platform for decentralized options trading.

- Hegic’s cumulative options trading volume is growing. Currently, it is already over $82M.

- Hegic token holders receive 1% of the size of each option for staking the token, which generates a solid APY.

Fundamental Factors

Introduction

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum. The platform launched a month ago and is already generating a lot of good buzz in the DeFi space.

Hegic offers good liquidity, something that its predecessors have failed to achieve. With Hegic, traders were finally able to utilize all the benefits of decentralized options trading, with deep liquidity for ETH and WBTC (Wrapped Bitcoin) PUTs and CALLs.

Since the launch, Hegic has attracted over $66M in TVL and has generated substantial trading volumes.

Volumes on centralized platforms for crypto options have increased ten times over the past two years. The growth will likely continue for both centralized and decentralized platforms.

Being a leader in DeFi options trading, Hegic has the potential to evolve from an early stage product to an established DeFi platform.

The direct beneficiaries of this evolution will be the holders of HEGIC (Hegic’s native token). They will receive 1% of the size of each option for staking the token.

Stakers realize that if Hegic achieves similar volumes to its centralized competitor Deribit, it will become a money-making machine.

Given the current traction in the market, little competition, and growing volumes, Hegic has all it needs to become a Uniswap for options in the DeFi space.

Market Opportunity

Options are financial instruments that are derivatives based on the value of underlying securities (such as stocks).

In traditional finance, the options market is a multi-trillion-dollar industry. Professional traders often use them for various hedging purposes. For example, using options, traders might want to hedge against a declining stock market to limit downside losses.

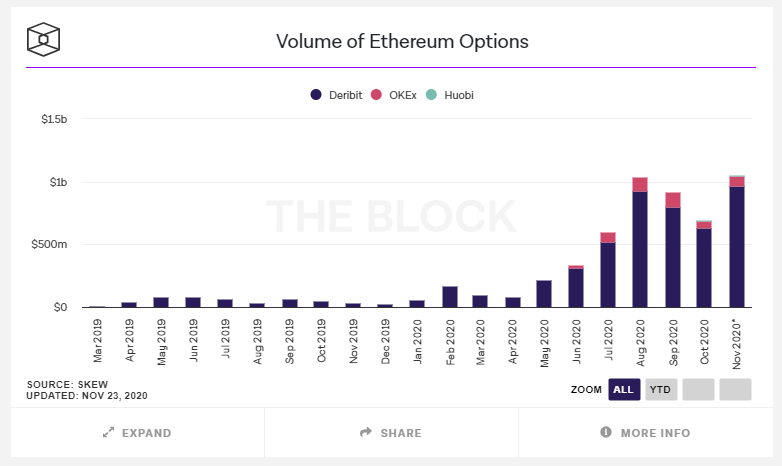

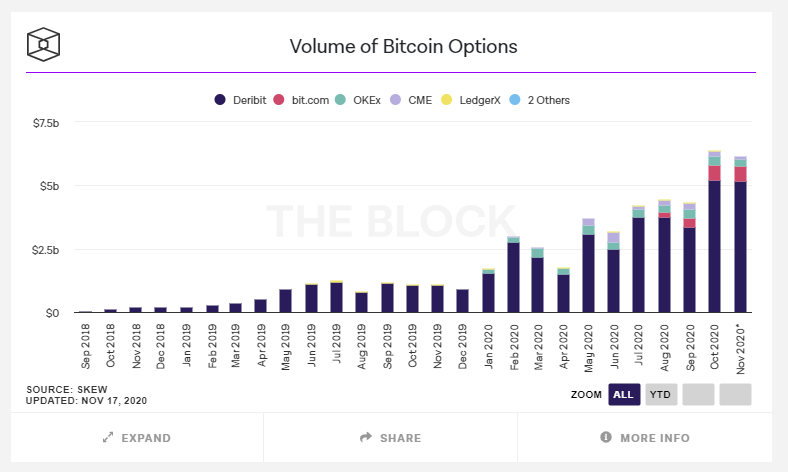

In the crypto space, options are also quickly gaining popularity. According to Skew.com, since 2018, the options trading volume on centralized platforms has been growing significantly.

Over the last two years, the volume has increased from nearly zero to almost $6B.

This indicates the growing potential for crypto options and opens up opportunities for DeFi players.

In the current market, there are two types of competitors for Hegic: centralized and decentralized.

Centralized competitors have already had a two-year head start. During this period, they attracted a significant number of traders and volumes to their platforms.

Currently, the largest centralized player in the space is Deribit. It accounts for more than 80% of all of the volumes on centralized platforms. Other centralized players, such as CME, OKex, and Huobi, generate much smaller monthly volumes.

However, while the centralized players have been ahead of the decentralized players, it looks like the trend towards decentralization will only intensify. And, in the long run, centralized players will be left behind.

This year has already been the year of DeFi. The total value locked on DeFi smart contracts just recently reached its all-time high of $14.4B.

Volumes on Uniswap, an innovative platform for trading without the traditional order book, surpassed volumes on Coinbase, the largest western exchange in the world.

Traders (including the options traders) will likely continue to migrate from centralized to decentralized platforms since they offer many benefits. They don’t hold custody of funds or require any registrations, AML or KYC. Investors are solely interacting with smart contracts and no other intermediary.

These benefits are especially important since regulators in the U.S. and China scrutinize and target centralized cryptocurrency exchanges.

Here are some examples of recent news:

- Bitcoin Plummets as CFTC and FBI File Charges Against BitMEX.

- OKEx Founder Under Police Custody, All Withdrawals Suspended Indefinitely.

- Data shows increased Huobi exchange outflows as firm denies executive arrest rumors.

In light of the above events, Deribit has also announced that it is imposing KYC requirements before the end of 2020, meaning that all U.S. options traders would have to leave the platform as the United States is one of the restricted countries.

The news is extremely bullish for Hegic since U.S. traders will likely start exploring decentralized alternatives. And Hegic, with its deep liquidity, could become an excellent alternative to Deribit.

When it comes to decentralized competition, some players have started earlier than Hegic, but have not achieved comparable results.

Currently, one of the oldest decentralized platforms for options trading is Opyn. It offers a variety of options trading possibilities. However, it lacks the necessary liquidity for traders. Since the launch, Opyn has struggled with liquidity and currently has a TVL of just $3.0M.

Several other decentralized platforms are looking to enter the market. However, none of these platforms are taking Hegic’s “liquidity first” approach.

Therefore, at least in the near-to-medium future, it looks like Hegic will dominate the DeFi options market. This will likely help the project gain the necessary network effects and competitive advantage to successfully deal with the growing competition.

From the market opportunity perspective, Hegic is currently the leader in the decentralized options market. And the platform has all it needs to succeed. Therefore, it receives a grade of 8.7 for the market opportunity section.

Underlying Technology

Like all the DeFi dApps on the market, Hegic is a set of smart contracts on the Ethereum blockchain. These smart contracts support the system and help it operate correctly.

There are three types of stakeholders in the Hegic ecosystem: options traders, liquidity providers, and HEGIC token holders.

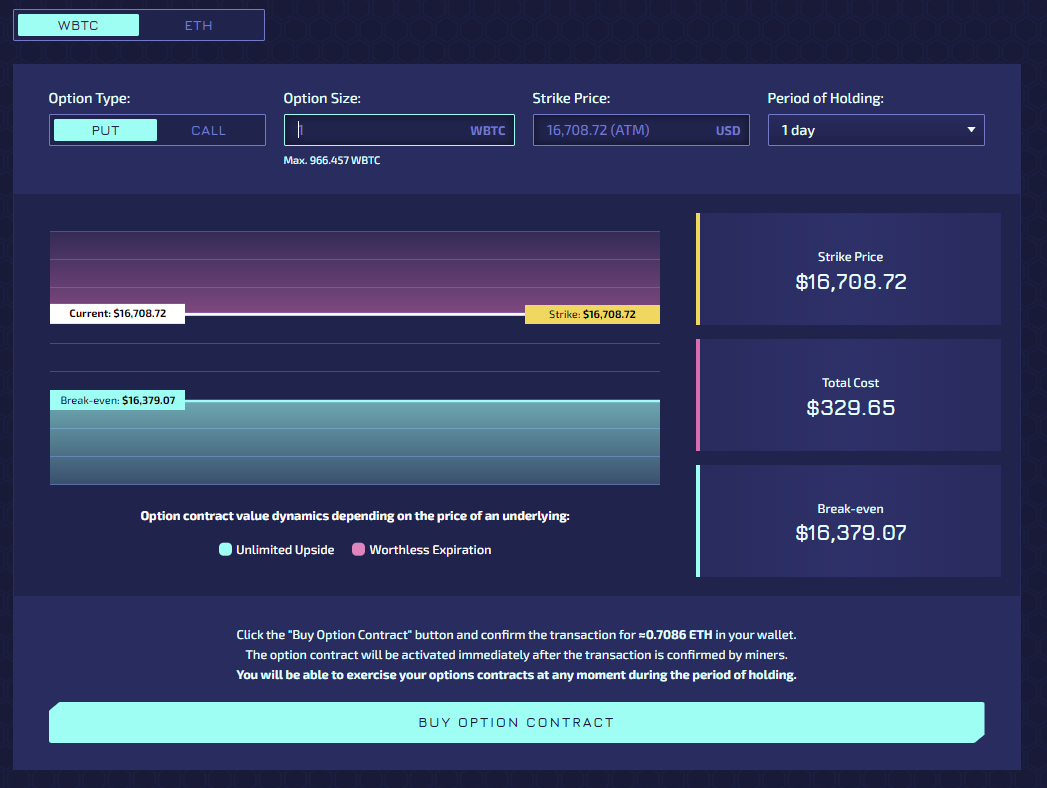

For options traders, Hegic has a relatively simple interface. Traders may choose between WBTC and ETH PUTs and CALLs.

Traders can set the Option Size, Strike Price, and the Period they want to hold that option.

On one side, options give the holder a right to buy or to sell an asset at a specific price. On the other side, options impose an obligation on the writer to buy or to sell an asset during a particular period.

The difference between Hegic and other option trading platforms is that there is no standard order book, where there is a need for an option seller.

Usually, options trading platforms operate in a regular order book fashion, with buyers on one side and sellers on the other side.

Hegic took a fundamentally different approach here. Instead of trying to match buyers and sellers, the project utilized an experimental bi-directional pool model, where liquidity providers became options sellers by staking their ETH and WBTC.

It helped to achieve the deepest liquidity for option buyers.

In the Hegic ecosystem, liquidity providers (LP) benefit from the fact that the risk from selling options transferred from one particular person to the whole group of LPs. They also receive the returns on selling options and the premiums paid by the option buyers.

Hegic Interface | Source: https://www.hegic.co/

In theory, these returns should be higher over the long term. Most of the options, in the long run, usually expire.

However, in the short term, the returns can be negative, especially in times of high volatility.

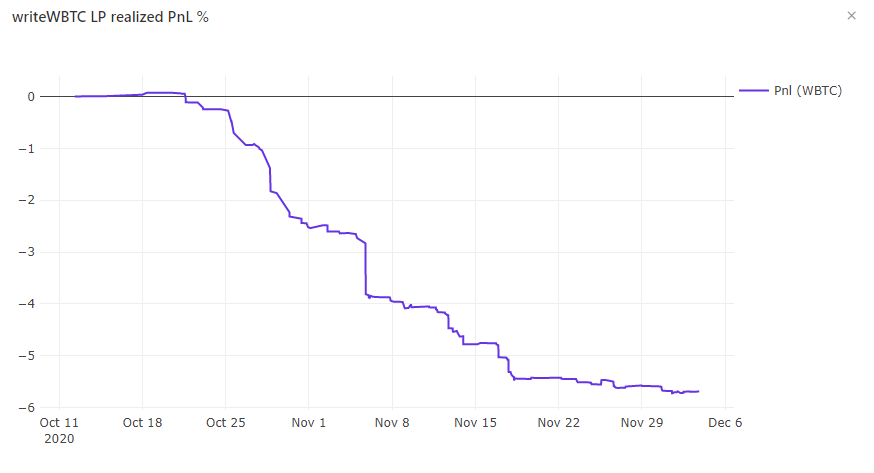

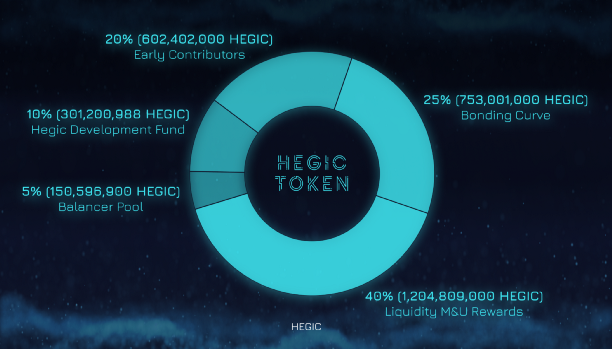

As shown in the graph, LPs on WBTC and ETH liquidity pools currently have negative returns of -5.52% for WBTC stakers and -1.6% for ETH stakers.

However, LPs also receive HEGIC tokens, so losses that they take on providing liquidity are not that substantial compared to the HEGIC rewards.

Nevertheless, this is something to keep in mind if you want to become one of the platform’s LPs.

Besides traders on the Hegic platform, there are also HEGIC token holders. Token holders that stake their Hegic receive 1% of the size of each option. In other words, 1% of all the trading volume goes to HEGIC stakers.

It creates a very healthy token economy, where users have incentives to stake their tokens instead of speculating on them.

From a security standpoint, although the platform went through several audits, it remains in beta and could be vulnerable to different attacks. DeFi remains a highly risky environment. The recent hacks show that security audits do not help.

So, users should remember that this is a highly experimental project, and there are many instances where they can lose all of their money.

In fact, due to the bug in the Hegic smart contract earlier this year, $28,000 worth of user funds were locked forever.

Although the team reimbursed lost funds, there is no guarantee that there are no other undiscovered bugs or smart contract vulnerabilities.

Overall, from a technology perspective, Hegic presents a very elegant and innovative idea. However, from a security standpoint, the project remains risky. Therefore we give Hegic a grade of 7.5 for this section.

Hegic LPs returns | Source: https://explore.duneanalytics.com/dashboard/hegic-v2

Ecosystem Development

Hegic launched just a month ago, but its ecosystem has been developing quickly.

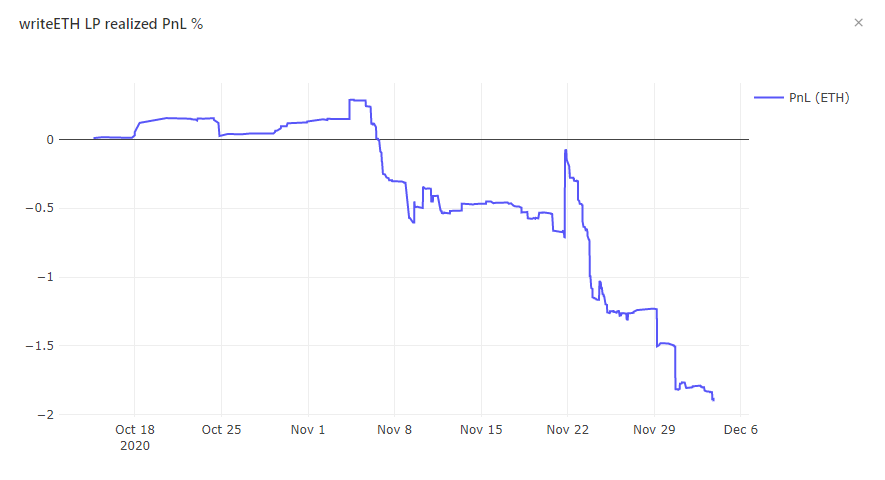

The project currently has over $66M staked on its smart contracts, making Hegic the number one platform for decentralized options trading.

Cumulative WBTC and ETH options volume is around $82M. The volumes are quite good, given that Hegic is only a month old. As more people learn about the platform, usage and trading volumes should increase further.

Hegic Total Value Locked (USD) | Source: https://defipulse.com/hegic

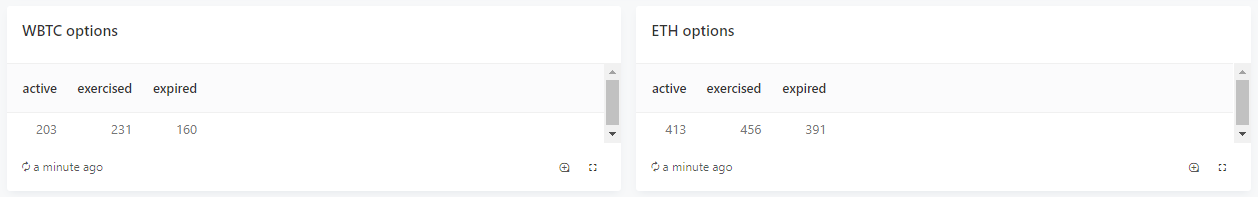

There are currently over 800 users since the launch. Over 1,850 total options comprise current volumes. For traders, ETH options are more popular than WBTC options.

Looking at the numbers, Hegic has had excellent traction since the start, and its strong fundamentals were noticed by some of the key figures in the DeFi space.

The insurance protocol, Nexus Mutual, recently added the support of Hegic to its platform. So, in the case of Hegic’s WBTC or ETH liquidity pools hack, users that have purchased insurance on Nexus Mutual will be able to cover their losses.

The current cost of NXM insurance for Hegic is just around 2.0% percent per year, meaning that NXM token holders are quite confident in the security of these contracts. So, for LPs that need extra protection, Nexus Mutual provides a good option.

Going forward, Hegic plans to do more integrations along with building new features for the product.

For example, @jmonteer23 is already working on implementing a secondary market for Hegic Options. It will improve options liquidity and make the platform even more appealing to traders.

Overall, in just a month, Hegic has achieved more than many projects cannot achieve in years of operation. The project has a very appealing ecosystem with good growth potential. Therefore, it receives a grade of 7.6 for the ecosystem section.

Token Economics

The project has a very robust token economics, where token holders can directly benefit from the platform’s success.

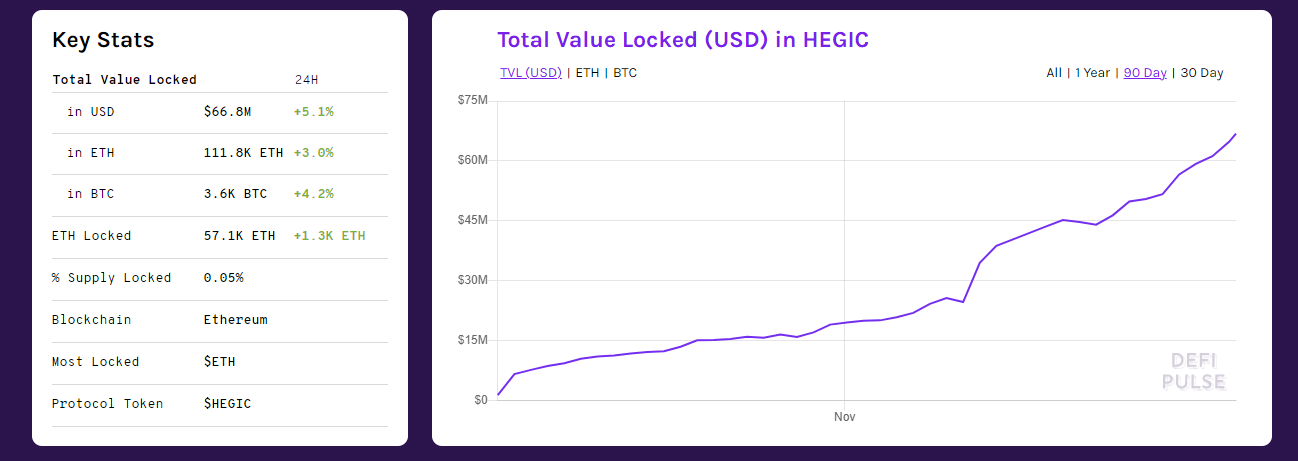

The project has a total fixed supply of 3,012,009,888 HEGIC tokens. According to the team, the current circulating supply is around 130M HEGIC. In two to three years, all of the tokens will be unlocked, meaning inflation will be relatively high over this period.

At current prices ($0.27 per HEGIC), the fully diluted market valuation is $824M.

On the supply side, the tokens will be unlocked for the team, early contributors, and liquidity providers.

However, what’s important to remember is that HEGIC token holders have a really good incentive to stake and will unlikely sell HEGIC on the market if the platform continues to develop on the same path.

As we mentioned in our special report, this project is probably one of the few where fully diluted market valuation does not significantly impact the token’s value.

Users that stake Hegic tokens receive 1% of each option’s size in ETH and WBTC.

Tokens can be staked in lots; each lot contains 888,000 HEGIC. In total, there will be a maximum of 3,000 lots. These staking lots represent 88.5% of the total supply.

Hegic Token Distribution | Source: medium.com

If you cannot afford to buy one staking lot, there is a possibility to stake Hegic with third-party providers here and here. The instructions on how to do that will be at the end of this report.

If we see Hegic achieving similar trading volumes to Deribit, most of the tokens will likely be staked due to the platform’s fees.

In October, Deribit processed $5.2B in trading volumes. If Hegic achieves similar results, it will generate $52,000,000 (1% of $5.2B) to 3,000 staking lot holders per month, or $17,333 per lot, or $207,996 per year. Such returns will make the staking lots precious assets.

Current token holders already realize this potential and are staking their tokens in the staking lots.

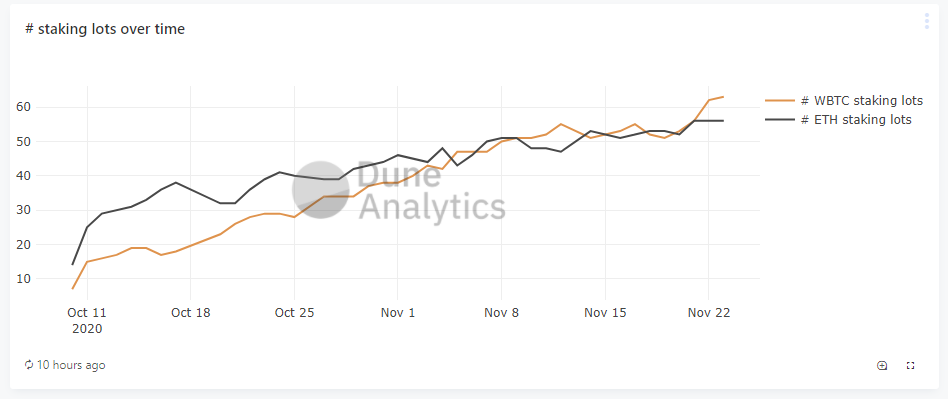

Since the launch of the platform, the number of staking lots has been rapidly growing. There are currently around 119 staking lots, representing 105,672,000 locked HEGIC tokens, or 80% of the total supply.

Staking lots already earn significant returns for its holders in ETH and WBTC.

Since the protocol launch, these 119 staking lot owners earned $822K (or around $6,900 per lot). Annualized, that’s a yield of roughly 23%, all factors held constant.

Going forward, assuming that the trading volumes on the platform will continue to increase, HEGIC could become a valuable asset that not only appreciates in price, but produces great monthly returns to its token holders.

Due to these factors, Hegic receives a grade of 9.0 for its token economics.

Hegic staking lots | Source: https://explore.duneanalytics.com/dashboard/hegic-v2

Hegic’s Team

What is known is that the protocol was developed by an anonymous DeFi builder that goes by the name of Molly Wintermute. It remains unknown whether the project was built by just one or several people.

Hegic is one of the few projects in the space that has been developed by an anonymous founder and has received so much good feedback from the crypto community.

Usually, anonymous founders have a hard time attracting capital and trust from the community, but as we explained in the report, Hegic is a different story.

Nevertheless, having anonymous founders presents benefits as well as drawbacks.

One drawback is that users of the protocol can never be sure that there are no back doors in the code, and their money will not just disappear. These concerns are valid for any kind of project, but when you see who the founders are, at least you can rely on their credibility.

One benefit involves legal concerns. Hegic’s team can do whatever it wants with their platform and not be afraid that the SEC or any other legal entity will shut them down.

There is also a clear interest in Hegic from many outside developers. Several independent developers are already building products for Hegic. Some projects are looking to integrate with it.

Nevertheless currently we can’t give Hegic a high grade for the team section, due to the above risks. Wintermute holds the admin keys, and the project remains centralized.

Due to this, Hegic receives a grade of 6.7 for the team section.

Roadmap

Hegic has provided a very detailed roadmap to what it plans to achieve in the next several months.

In November, we should expect more integrations. Besides this, two independent developers will be building additional features for the protocol.

As was already mentioned, @jmonteer23 will be building functionality for the Hegic options secondary market.

Another developer, @8baller, will build the Autonomous Hegician application using Fetch.ai autonomous agents. To date, over $2M worth of options has expired in the money (since in Hegic options have to be exercised manually), representing a loss for the holders of those options. This application should solve this problem for options traders.

In December, the project is planning to launch several other essential features, such as community trading functionality so that users can engage in copy trading. This could help grow volume.

The project will also be launching auto hedging strategies for LPs, which should protect their funds from downside risk.

Additionally, Hegic plans to integrate Chainlink Implied Volatility feed, which should help provide better prices for options traders.

Overall, the project has a very healthy and robust roadmap for the next several months. Therefore, it receives a grade of 7.5 for the roadmap section.

Hegic roadmap | Source: https://medium.com/hegic/hegic-2020-roadmap-f32b098e547d

Token Performance

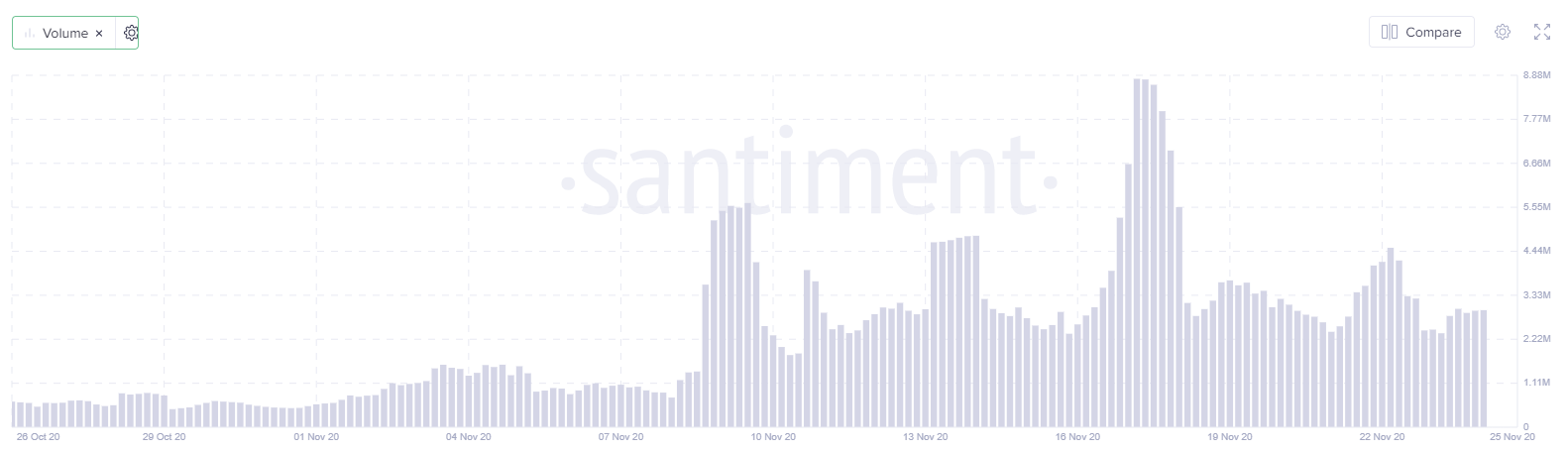

Since trading started, Hegic has shown positive token dynamics and the token price has been growing. This growth could be attributed to the overall positive traction on the market and an increasing number of staking lots.

Many of the Hegic token holders prefer to stake their tokens instead of storing them on their wallets. As mentioned, staking lots brings a solid APY.

Launched a month ago, Hegic is already generating a lot of good buzz in the DeFi space.

Along with the price, the transaction volume has also been increasing, indicating that the project is generating a lot of interest in the crypto community.

Transaction volume | Source: https://santiment.net/

Overall, HEGIC token has very positive prospects for growth. It has not yet been listed on any established centralized exchange, and users will likely continue to stake it.

So, it has all it needs to continue to appreciate in value. Therefore, the project receives a grade of 8.0 for the token performance section.

Hegic Price Chart | Source: https://coinmarketcap.com/currencies/hegic/

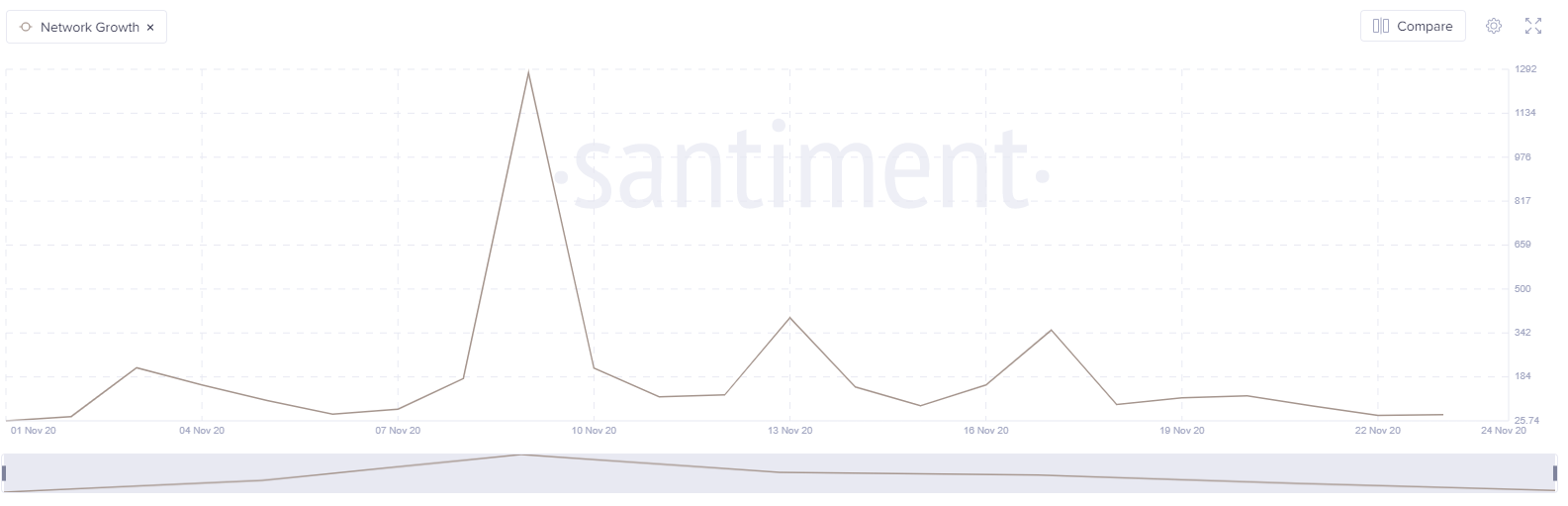

Network growth is also showing positive dynamics. The number of new accounts created each day ranges from 80 to 300.

Network growth | Source: https://santiment.net/

Conclusion

In traditional finance, options are a big market. In crypto, this market is growing at a swift pace. We expect trading volumes for crypto options will continue to grow in the next 5 years for centralized and decentralized platforms.

However, with time, traders will likely prefer decentralized platforms since they don’t require any KYC or hold custody of your funds.

Hegic has a perfect opportunity here. It has a good product that is already used by many traders in the space. As more traders join the crypto ecosystem, they will likely be choosing Hegic for options trading.

It also has nearly perfect token economics, since token holders will be highly incentivized to stake their tokens and take them out of circulation.

These factors should help the project grow as we are entering the next bull cycle. Therefore, Hegic receives an overall grade of B+.

Disclosure: The author of this report owns BTC, ETH, and HEGIC. One or more members of Crypto Briefing’s management team owns HEGIC. The company (Decentral media. Inc) owns HEGIC.

How to Buy and Stake HEGIC

Buying HEGIC

Step 1. You can buy HEGIC from a decentralized exchange or from a bonding curve

Usually, the prices on decentralized exchanges are lower than on the bonding curve. But if you want to buy a large amount of tokens, for example, 100 ETH worth of HEGIC, then it is going to be cheaper to buy it from the bonding curve.

If you are going to be buying HEGIC from a decentralized exchange, proceed with Step 2.

If you are going to be buying HEGIC from the bonding curve, proceed with Step 6.

Step 2. You can buy HEGIC from a decentralized exchange

HEGIC can be purchased from several cryptocurrency exchanges. The full list is available here.

One of the options is to use Uniswap exchange. It currently offers the best liquidity for HEGIC tokens.

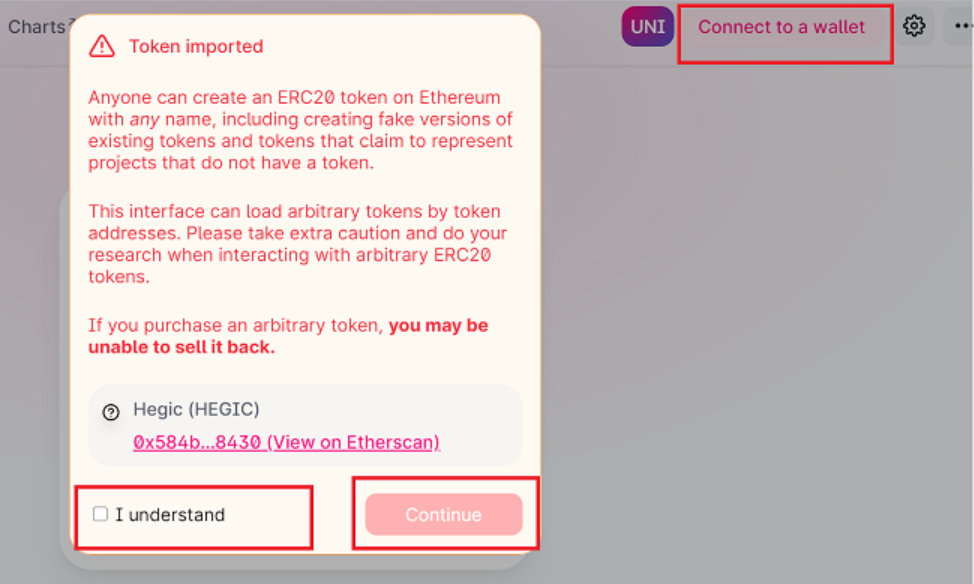

Go to https://app.uniswap.org/#/swap?inputCurrency=0x584bc13c7d411c00c01a62e8019472de68768430

Step 3. Connect to your MetaMask Wallet

Check the “I understand” box and then the “Continue” button.

Connect your MetaMask wallet by pressing the top right corner “Connect to a wallet” button.

If you don’t own a MetaMask wallet, you can go to https://metamask.io/download.html and download the MetaMask extension for your Google Chrome browser. You can find instructions on how to install and use MetaMask here.

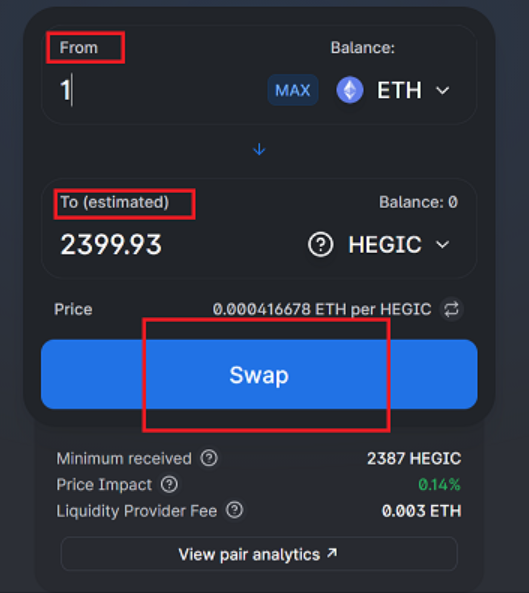

Step 4. Choose how much ETH you want to trade for HEGIC

Make sure you send some ETH from your exchange to the MetaMask wallet. Swap your ETH for HEGIC tokens. Wait until the transaction goes through.

Step 5. Store your HEGIC on one of the supported wallets for increased security.

To store HEGIC, you can use Ledger or Trezor for improved security.

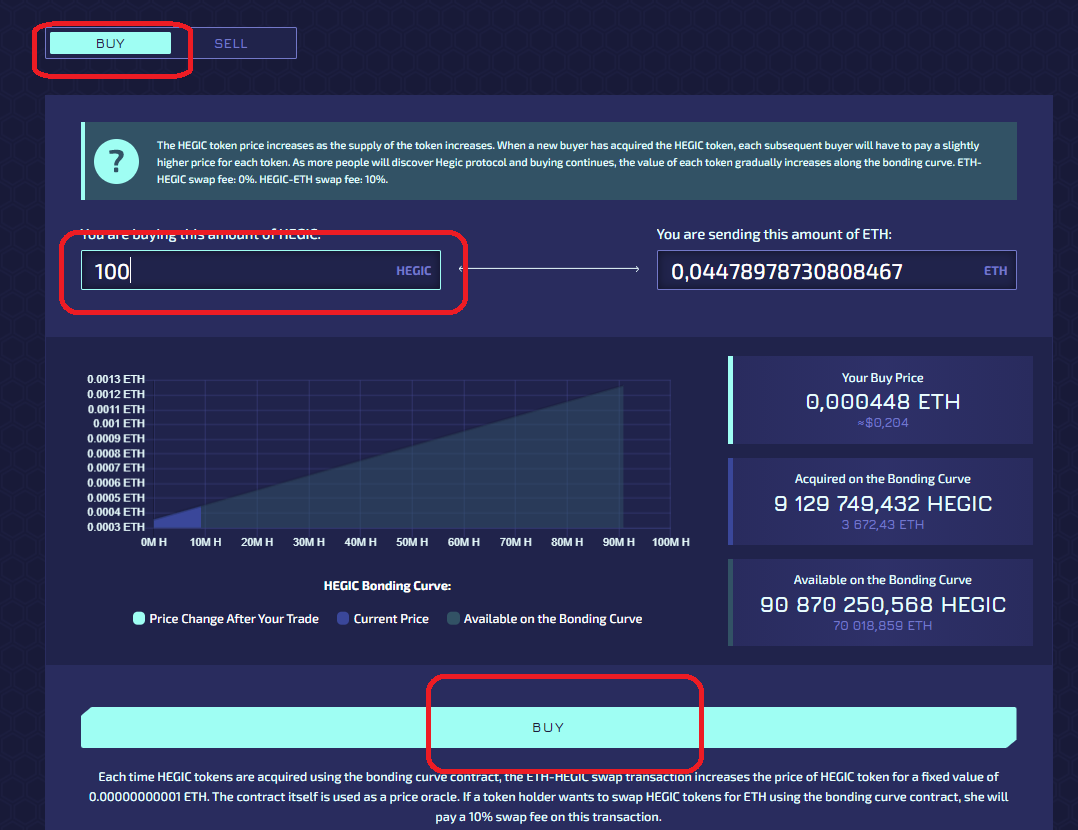

Step 6. Buying HEGIC from the bonding curve

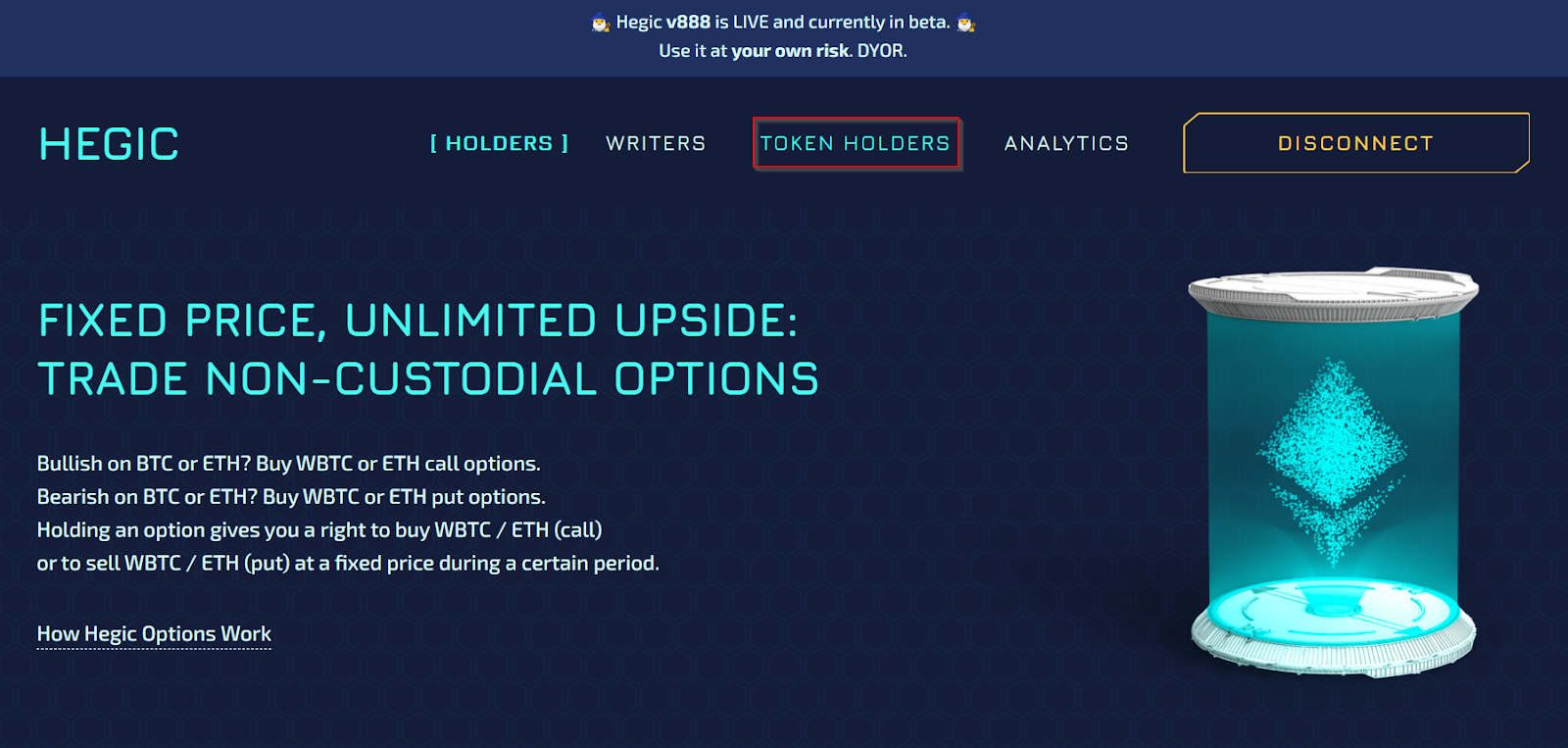

To buy HEGIC go to the Hegic website https://www.hegic.co/ and connect your Metamask Wallet.

If you don’t have a Metamask Wallet, check the instructions on how to install it in Step 3.

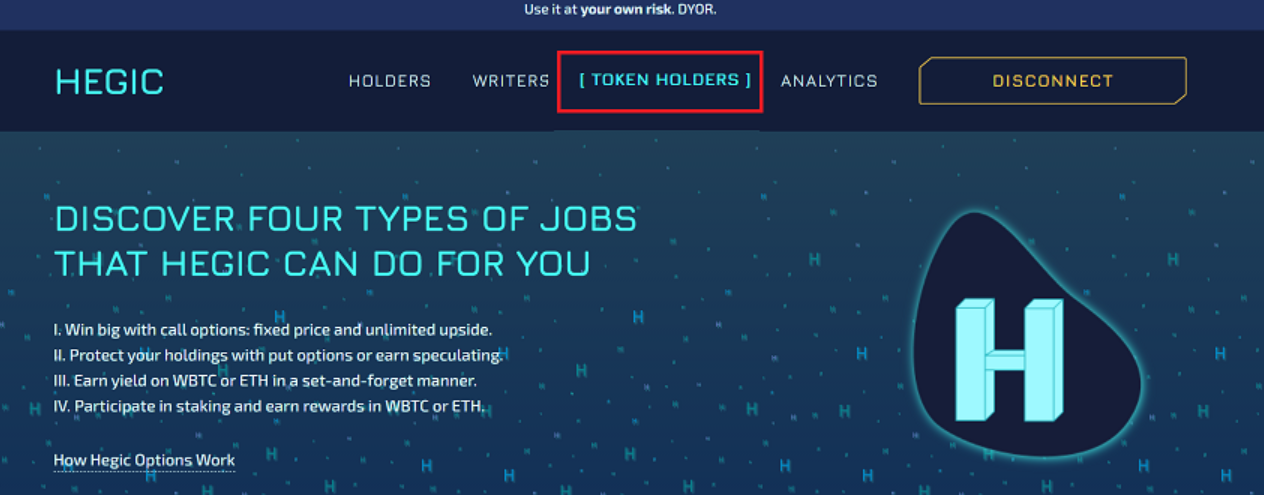

Click on the “Token Holders” section in the navigation bar.

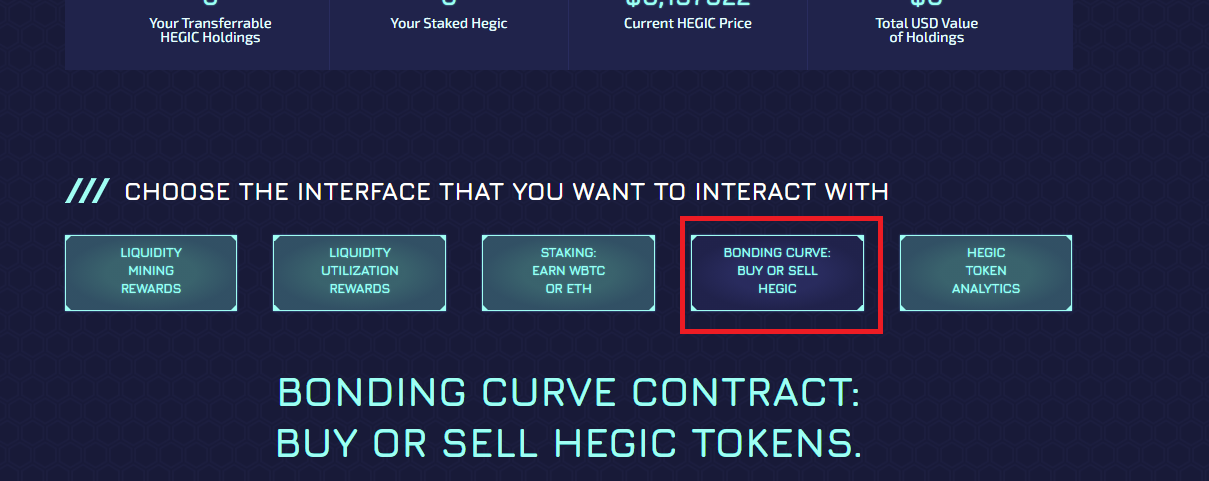

Scroll down and press “Bonding Curve Buy or Sell Hegic.”

Choose the amount of HEGIC you want to buy, and press “BUY.”

Staking Hegic to Earn Rewards

Step 7. If you don’t want to store your HEGIC off-chain and instead want to earn staking lot rewards, you can use one of the third-party providers for staking your tokens.

If you own less than 888,000 HEGIC, third-party providers https://www.hegicstaking.co/ and https://zlot.finance/ offer you the opportunity to stake your tokens and earn rewards.

https://www.hegicstaking.co/ – allows you to earn fees in ETH and WBTC (Step 8).

https://zlot.finance/ – allows you to earn fees in HEGIC tokens, it is using WBTC and ETH earned to buy more HEGIC (Step 10).

Use them at your own risk, since their smart contacts are not audited. You can lose all of your funds.

If you own a whole staking lot, or 888,000 HEGIC, go to Step 9.

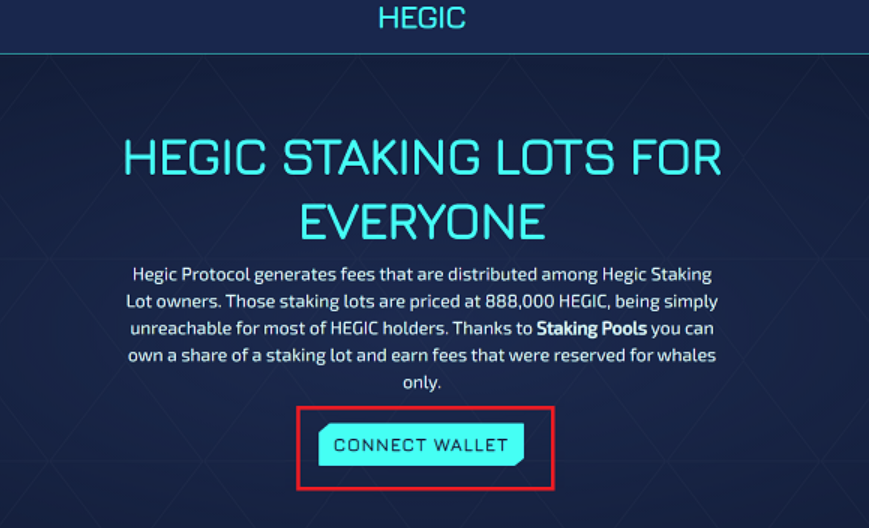

Step 8. Staking Hegic with https://www.hegicstaking.co

https://www.hegicstaking.co/ currently offers lower withdrawal and performance fees and allows you to earn fees in ETH and WBTC.

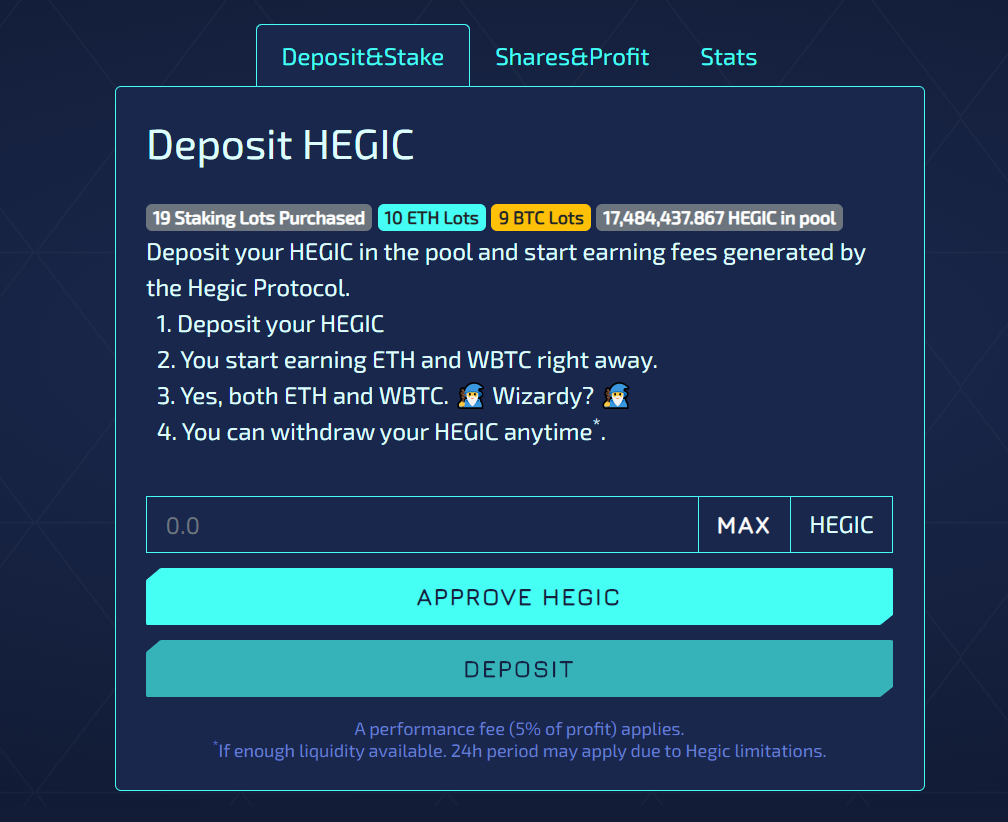

Go to https://www.hegicstaking.co/ and connect your Metamask Wallet

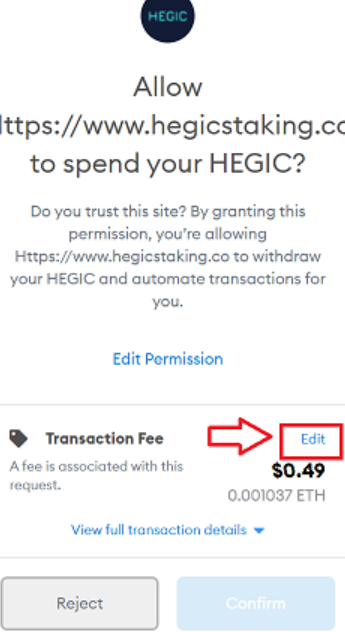

After you connect your wallet, enter the amount of HEGIC you want to stake. Then press “APPROVE HEGIC.” Wait until the transaction goes through, and then press “DEPOSIT.”

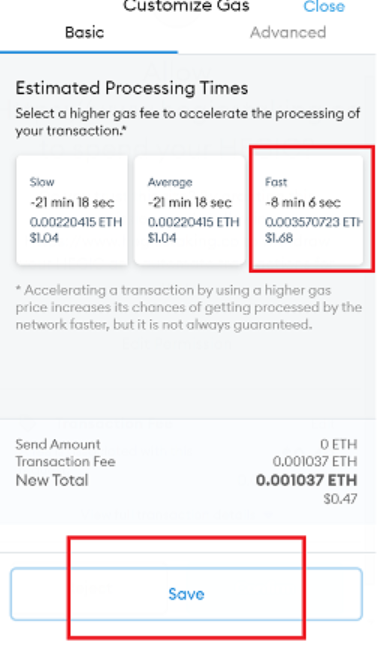

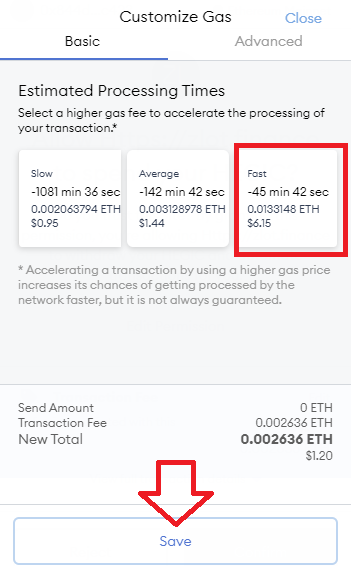

Also, in your Metamask, make sure you use the highest available gas fees so your transaction is not stuck on the network

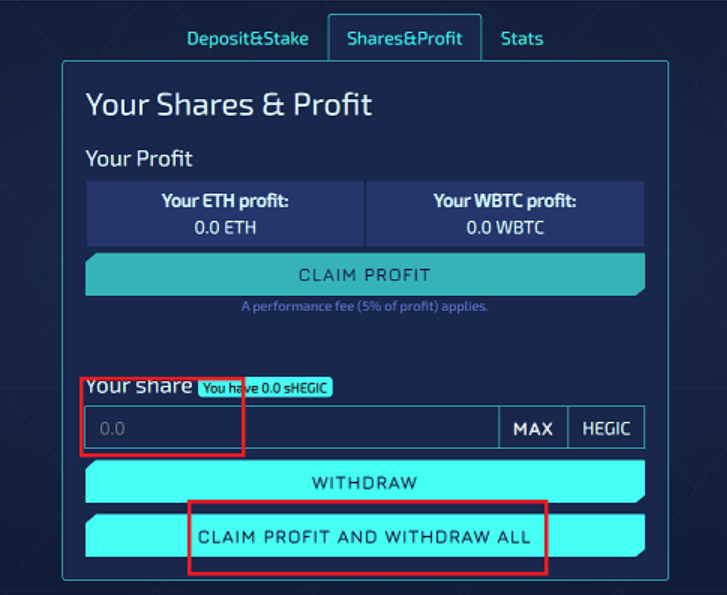

Step 9. If you want to unstake your HEGIC go to the “Shares&Profit” tab

Enter the amount you want to withdraw and press “CLAIM FOR PROFIT AND WITHDRAW ALL.” Make sure you also use the highest option for gas fees.

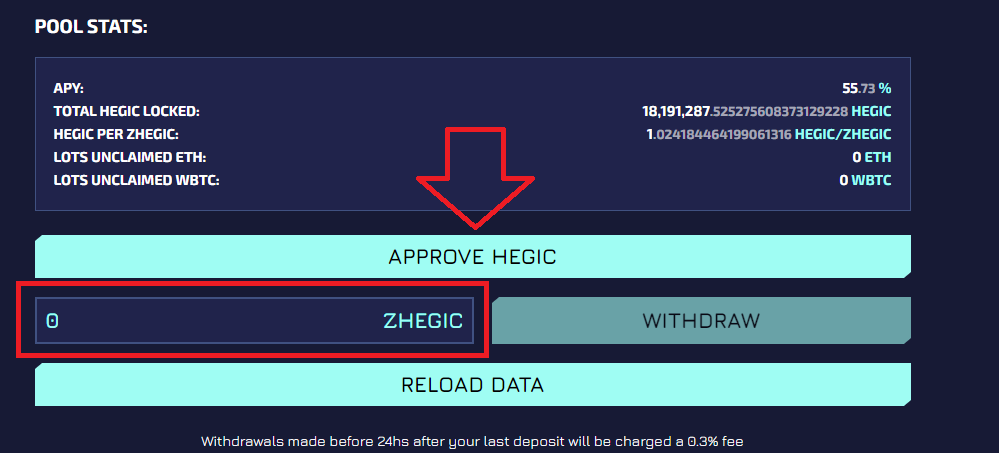

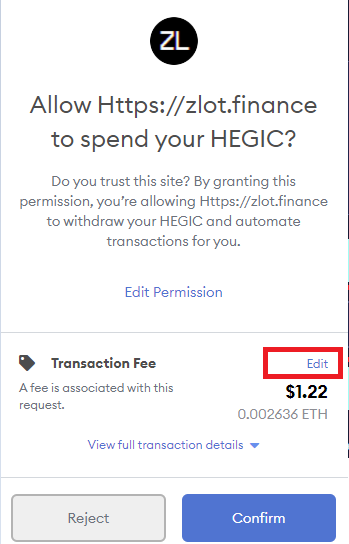

Step 10. Staking Hegic with https://zlot.finance/

https://zlot.finance/ allows you to earn fees in HEGIC tokens. If you want to increase your position in HEGIC, you might want to stake with Zlot.Finance.

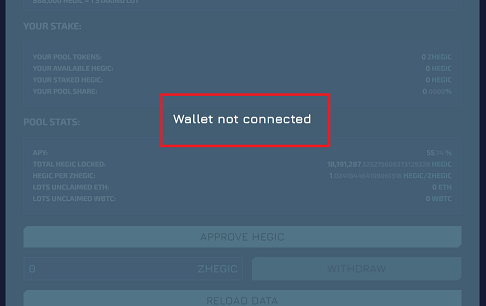

Go to the website and connect your wallet.

Choose how many tokens you want to stake, and press “APPROVE HEGIC.”

Also, in your Metamask, make sure you use the highest available gas fees, so your transaction is not stuck on the network.

If you want to unstake your HEGIC, just press the “WITHDRAW” button.

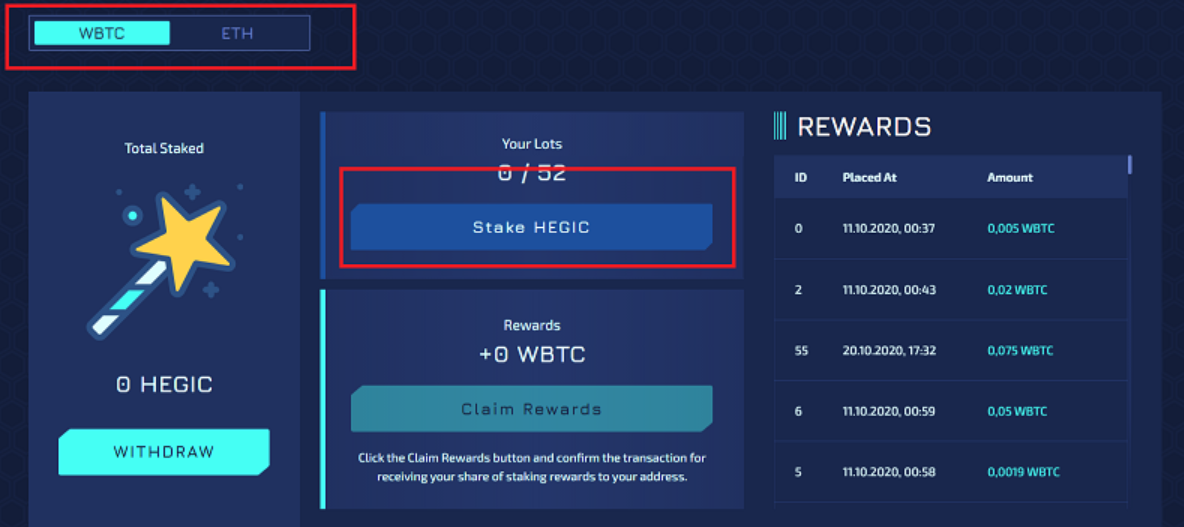

Step 11. If you own 888,000, the best option is to stake it directly with the Hegic platform

Go to https://www.hegic.co/ and connect your wallet and get to the “Token Holders” tab.

Then go to “Staking Earn WBTC or ETH.”

Choose if you want to receive the rewards in Bitcoin (WBTC) or Ethereum (ETH), and press “Stake HEGIC.”

Step 12. Further questions

For further support and additional questions, go to Hegic’s Telegram https://t.me/HegicOptions.