GRIN DIGITAL ASSET REPORT

GRIN DIGITAL ASSET REPORT:

GRIN Review And Investment Grade

TABLE OF CONTENTS

Investment Grade

Quick Facts

Funding Information

External links

Fundamental Factors

Introduction

Grin is a privacy focused cryptocurrency that became a darling of the blockchain community during the tough bear market. One of the two main implementations of the MimbleWimble protocol, it rekindled the maximalists ideals of the Bitcoin faithful: no ICO, no premine, volunteer-driven development.

The solid technological foundation coupled with the support of prominent crypto funds, ensured that Grin received a lot of awareness during the hype-starved months of the second half of 2018. The mainnet was launched to much fanfare in 2019, but the excitement far outpaced real progress. Despite noble goals and hard work, the project could not leapfrog the common network development obstacles. Infrastructure development, user acquisition, and merchant integration would potentially take years.

As the broader community realized Grin was not going to conquer the world overnight the project quickly lost much of its initial luster. Initial mining whales divested en masse – pushing the price lower, while the volunteer developers started to struggle to find funding.

The hype is gone and many of the speculators have left the coin for “Greener” (pun intended) pastures. The project survived the initial storm and now deserves, but still lacks catalysts to help realize its fundamental prospects. The technology remains top in its class, the core community remains as resilient and dedicated as ever, but infrastructure and community development remain too slow to deliver meaningful near term changes.

It was not realistic to expect Grin to become the Bitcoin with privacy overnight, and the mounting risks make that future ever so distant.

Market Opportunity

Summary

- A multi-trillion dollar addressable market

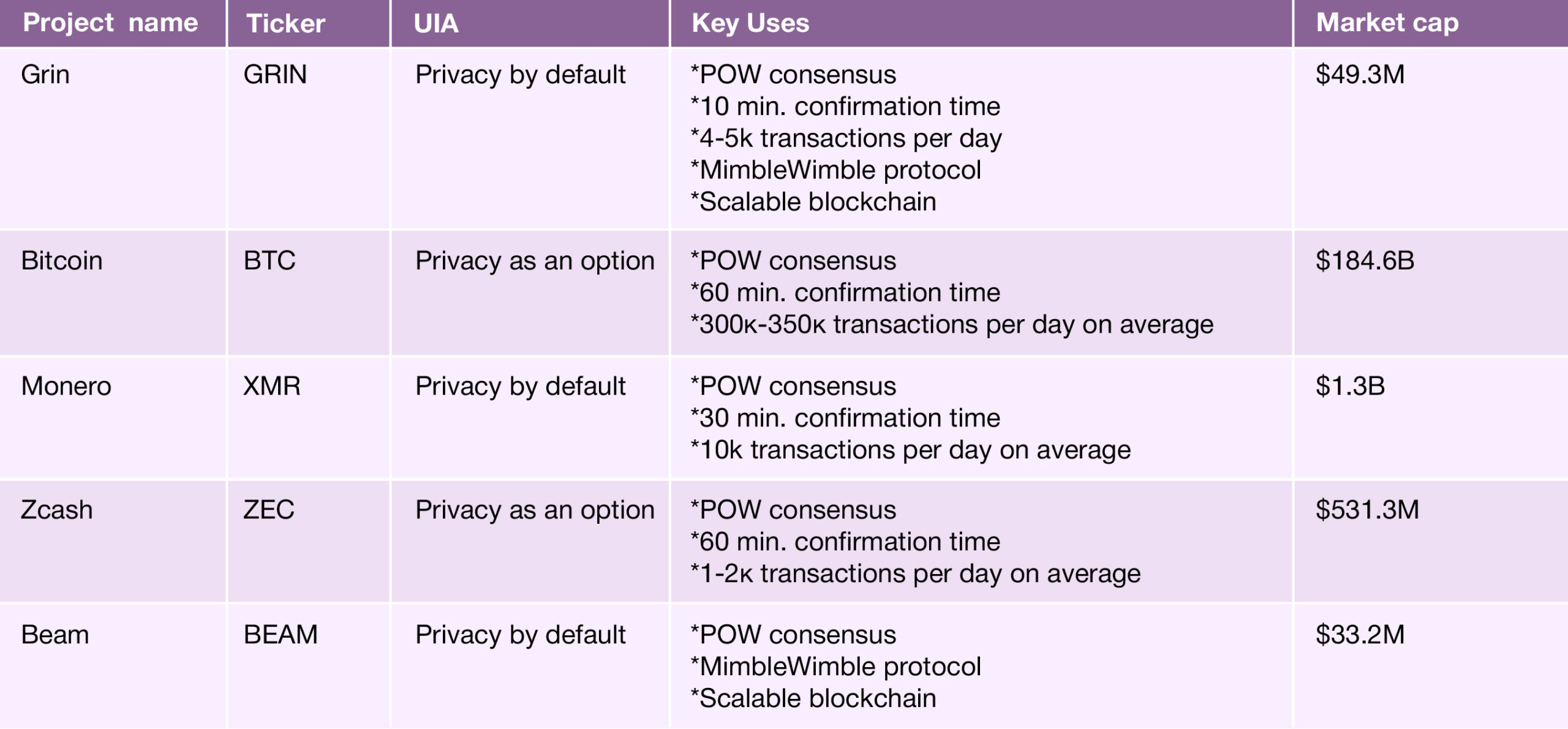

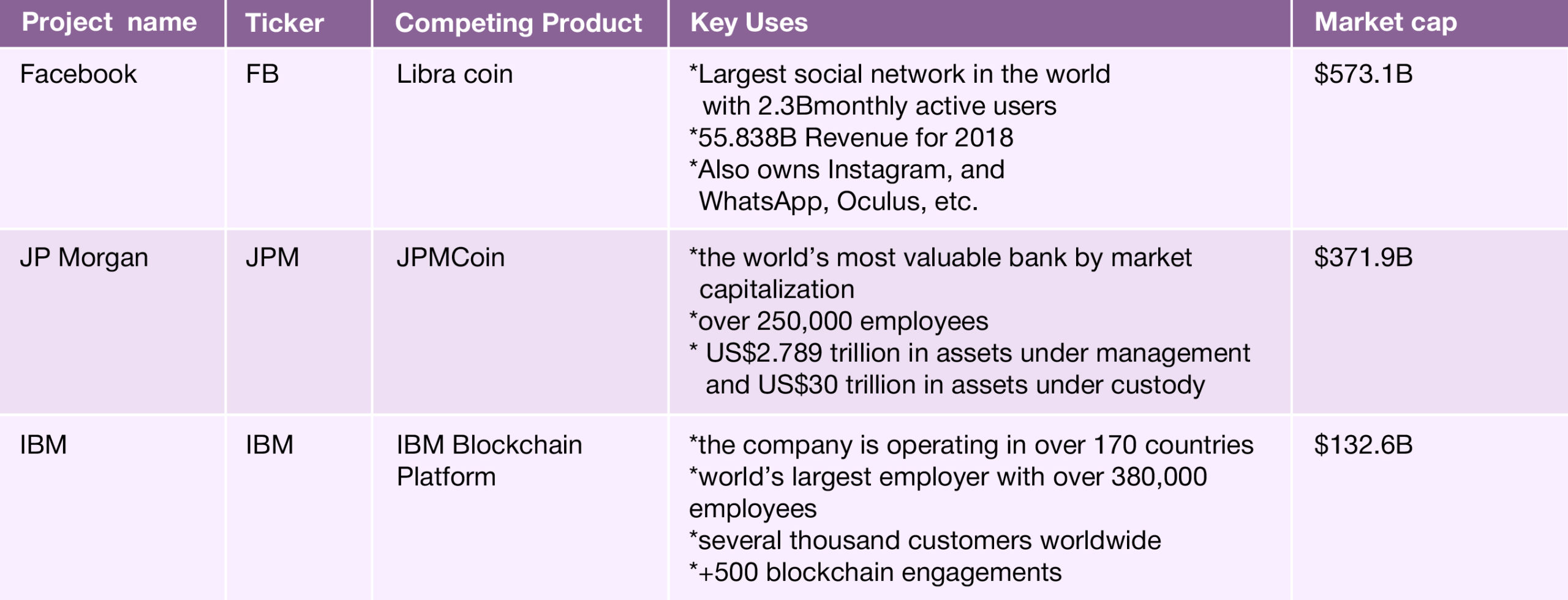

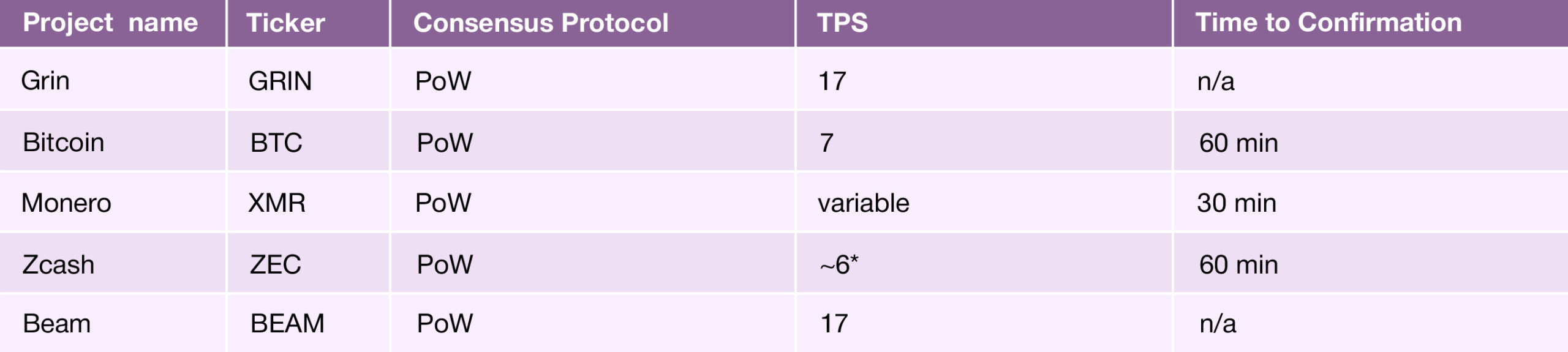

- A lot of rival projects from the blockchain (Monero, Zcash, Beam) and incumbent (JP Morgan, Facebook, IBM) players

- Competing projects are still friendly, not a winner-take-all market yet

Grin is a privacy focused coin, which places it in the same sector as Monero, Zcash and the like. By protecting, sender, receiver, and transaction data information, the project aims to become digital cash in the true sense of the term. This is a $36.8T market.

Just like its privacy brethren, Grin has a chance to impact the $52T shadow economy as well as the traditional payments and remittance markets ($689B).

These are exciting numbers, but given the state of the blockchain industry as a whole, for now, they remain long-term targets.

In addition, Grin will have to compete for user attention with more established privacy and payment projects such as Monero, Zcash, and Bitcoin itself.

This will not be easy. Monero, for example, offers many of the same intrinsic qualities, privacy by default, decentralization, community funding, but has a much bigger community and a head start on merchant integration.

The more centrally governed projects, like Zcash or even the MimbleWimble alternate Beam, are able to drive development and adoption at a quicker pace in the short term.

Furthermore, as Bitcoin attains more and more privacy features, it becomes a looming threat to the entire privacy space. With its dominant network effects, it could make many of the smaller alts irrelevant.

In the absence of a strong catalyst, this leaves Grin at a major disadvantage. The mitigating factor is that most privacy projects don’t appear to be going after one another (Monero vs Zcash is a separate story) and look to be on friendly terms, if not outright cooperating. The Beam team has even donated funds to support Grin development. The Grin team appears to be friendly with its counterparts from Monero, and the space as a whole looks to be collectively growing the pie instead of trying to divvy it up just yet.

The traditional players are also starting to appear on the horizon, with the big players on the payment scene being JP Morgan, Facebook, and IBM. However, for now, this serves more as a validation of the space than a direct threat. Facebook and IBM either through partnership or M&A have cooperatively engaged with crypto startups, while the activity of all three promises to bring more users to industry, which is sorely needed.

Of course, blue chip players have established network efforts and vastly more resources, but Grin’s decentralized nature and privacy by default features give it a specific differentiating angle. In the long-term, this may enable the project to take advantage of the growth in the users generated by the traditional players.

Overall, it is clear that there is a market for Grin’s product. However, its infant state leaves it vulnerable against more established competition. Grin has a window to establish itself as an industry-relevant project, while crypto projects are playing nice. At the moment, it is not in a position to capitalize on the opportunity, but the market remains there for the taking.

Underlying Technology

Summary

- Privacy-by-default utilizing the MimbleWimble protocol

- Dual PoW, currently ASIC resistant, but transitioning to ASIC-friendly

- Problematic UX/UI elevates entry barrier

- Dandelion combats spy node vulnerability but compromised by a small user base

As a privacy coin Grin’s core USP is its anonymity and security. It offers private-by-default transactions that don’t overblow the size of the blockchain. Minimal information gets stored by the network, while the PoW algorithms help maintain the security and validity of operations. However, while the technology offers plenty of theoretical benefits, poor UX/UI and a lacking infrastructure are preventing the community from experiencing the full benefits of the project and limits its potential.

Privacy is enabled using the MimbleWimble protocol, which relies on Elliptic Curve Cryptography to structure transactions based on the verification of zero sums and possession of private keys. This approach verifies inputs and outputs of the transaction without revealing any amounts while also obfuscating the transaction trail.

In addition, the project utilizes rangeproofs to prevent users from spending what they don’t have, and cut-through to reduce the amount of information required to be stored on the blockchain.

None of these instruments are unique to the project, what makes Grin special is its elegant combination of these tools in a way that balances privacy and scalability.

The concept is very promising, but is difficult to realize in a user-friendly way. For instance, in order to make transactions more lightweight, MimbleWimble does not utilize addresses. This forces senders and receivers to communicate off-chain in order to create a transaction. This could be done by sending a transaction file using a messaging service or via a running HTTP wallet listener.

This complicates the core use-case for the cryptocurrency and raises the entry barrier for an average end user.

Furthermore, it exposes a potential vulnerability of the network. In theory, a spy node could record all inputs and outputs before a block is mined. This would enable the perpetrator to build and analyze transaction graphs of the network and possibly discover sender IP, compromising privacy.

To mitigate this issue Grin uses Dandelion. It is a broadcasting delay mechanism by which transactions are first sent through a series of randomly selected peers and then diffused to the entire network. The bigger the peer pool the more difficult it is to link inputs to transactions. Given the currently small user base and a high entry barrier due to UX complexities, Grin’s privacy features could be suspect.

The UX/UI issues are not insurmountable and are currently being addressed. Wallet development and integration have been progressing, and solutions like Grinbox offer signs of improvement.

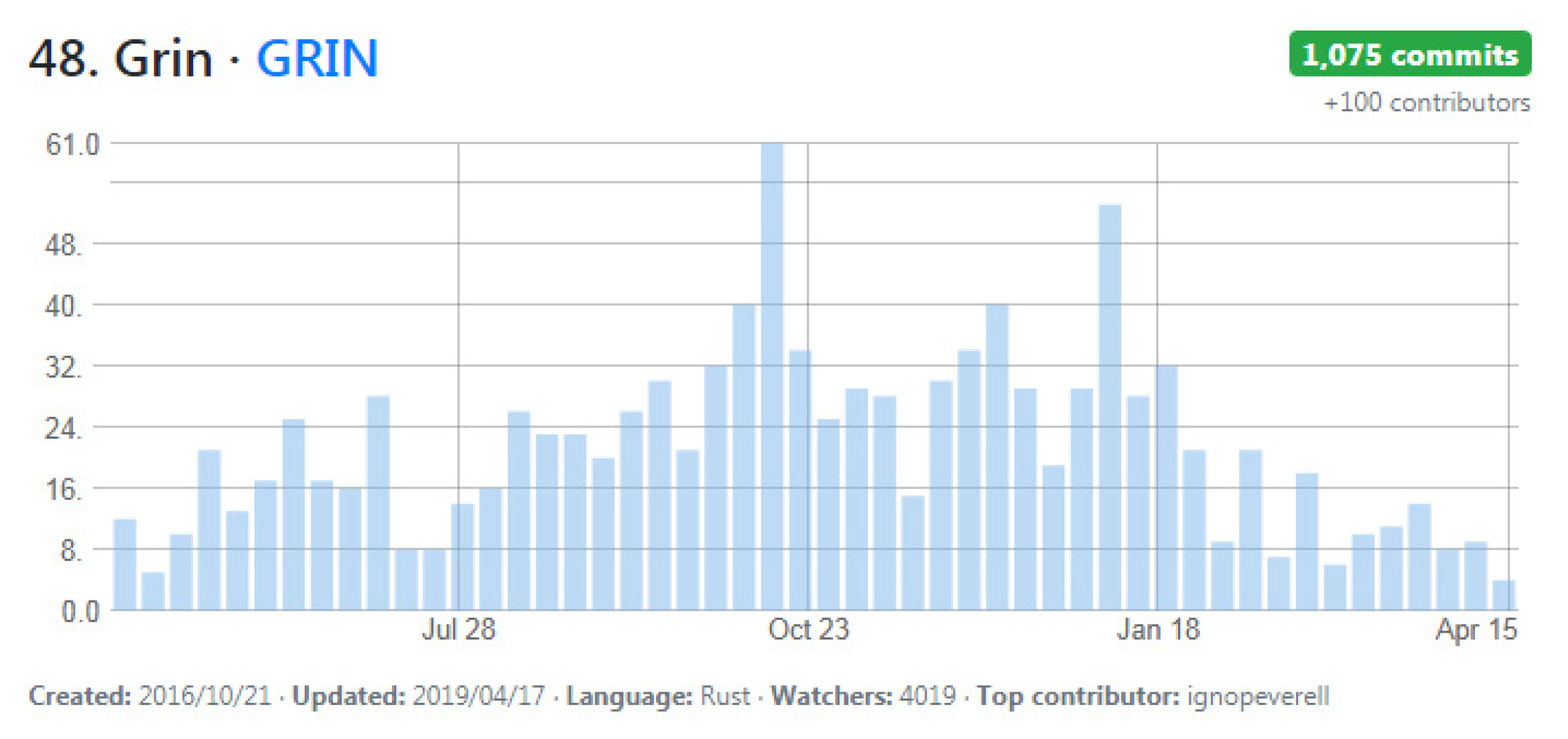

The project has an active GitHub. It launched the network in January of 2019 and has already pushed a major update, Grin v. 2.0.0, which includes improvements for the bulletproof rewind scheme, Node and Wallet APIs and more.

It also helps that Grin is currently ASIC resistant, due to its Cuckaroo29 PoW algorithm. It has been shown that ASIC resistant network offers more decentralization incentive and attract retail users. However, many acknowledge that in the long run ASIC dominance is inevitable.

Grin has chosen to gradually migrate over to an ASIC friendly Cuckatoo32 over the next two years. This will enable the network to enjoy the bootstrapping benefits of the ASIC resistant algorithm while the network is still fragile and then gravitate towards industrial scale mining once it is ready.

Still, this will put the onus on ecosystem development in the short term. In about a year the network will have 50% ASIC penetration and if the ecosystem does not rapidly mature by that time we could start to see a significant drop off in active addresses, similar to how it happened when ASICs were introduced to the Zcash network.

Ultimately, Grin technology is solid but its infrastructure is still raw. The core technology and its continued development show thought and care. However, without significant UX/UI improvements, the project will continue to lack appeal to all but the hardcore enthusiasts, which will impact core USPs and ecosystem growth as a whole. With the mainnet now live, Grin needs to evolve from an R&D project into a commercially viable network.

Ecosystem Development

Summary

- Support from blockchain maximalists

- Underdeveloped infrastructure and few exchange listings

- Unstructured governance and volunteer driven development

- Inconsistent funding, and lack of marketing and awareness efforts

Grin’s nascent ecosystem is its greatest weakness, but also the biggest source of potential catalysts for growth. For the longest time, it has been buoyed by hype and unrealistic expectations. Its community was made up of overly eager investors and speculators looking to catch the last lottery ticket of 2017-2018 alt boom. As the expectations have died down the ecosystem has been exposed for lacking both in quantity and quality of connections due to a basic lack of vital infrastructure and the alpha of operational processes. Still, these issues are not unfixable and if components and tools continue to hit the market Grin will start to gain awareness for its utility. This should give the project a solid chance for growth and adoption.

Grin started as an R&D exercise back 2016, when an anonymous developer posted a file in the IRC channel #bitcoin-wizards describing MimbleWimble (reference to Harry Potter) as a private and scalable upgrade for Bitcoin. Several cryptography researchers took notice of the proposal and collaborated to launch Grin mid-2017.

In many ways, the backstory shaped the development path of the project.

Striving to replicate Bitcoin’s path to adoption, Grin wanted to entice hardcore enthusiasts and long-view miners. However, the launch attracted many VC investors, and nearly $100M was invested into special-purpose investment vehicles to mine Grin. This made Grin’s genesis block one of the most expensive in history and ballooned expectations.

Unlike Bitcoin, Grin did not have years to quietly develop in the shadows, it quickly drew the attention of speculators. Lacking powerful influencers and whales Grin has not been able to match ecosystem growth with the hype.

There simply was not enough time to build up infrastructure and awareness and achieve meaningful on-chain activity.

As the hype died down, Grin became talked of less stalling awareness growth and motivating divestment.

As selling pressure increased the bottom fell out. For PoW projects, price drops can be devastating in the short term, as they affect both security and the ability of the project to attract new miners due to low profitability. Grin has seen considerable mining pool centralization with top 2 pools controlling over 60% of the hashing power. With the ASIC friendly algorithm expected to take up more weight with time, centralization could become a big concern for the network.

The situation has been further exacerbated by the irregular funding and lack of structured governance. Grin chose to avoid ICOs and premines leaving developers fully at the mercy of the community. At times, fundraises were slow, which has undermined project development and community growth.

The disappointment was expressed by the Grin’s anonymous Ignotus Peverell in the community post:

“After just over 2 weeks of grin being live, I’m disappointed by the way the industry around Grin is shaping up. Of course it’s early, but I’d rather not this be an indication of future direction. Grin was started with as fair of a launch as possible for what’s under our control. We did this for good reason: we believe in Grin’s mission. I think I made pretty clear that to continue forward, the project would still need help. And yet yeastplume’s campaign 824 is still very far from being even 10% funded.”

Source: twitter.com

On top of that, Grin’s ecosystem has no centralized governance body and no onchain governance procedure for making decisions. Instead, the project has a Technical Council which manages the Grin General and holds bi-weekly meetings which are open to anyone. This hamstrings the project when it comes to task prioritization and organization of awareness efforts: “the entire active community ends up participating in every discussion, in a synchronous fashion that often does not end up being productive.”

Current community driven projects like Monero or Decred have proven it possible to organize marketing and awareness activities despite a decentralized ecosystem structure. However, some form of formalized governance protocol is imperative. Grin’s community is currently working on something in place, but this remains a work in progress with no milestone dates available.

Source: twitter.com

Still, despite the drawbacks Grin has received a lot of support, especially from the blockchain maximalist community. According to the Grin’s income log, the project raised around ~$1.46M since October 2018. Its list of backers is full of well known industry players and includes Binance Labs, Sparkpool, F2pool, Poloniex, Gate.io, CoinGecko, Qtum, and more. In addition, one of the biggest one-time donations, in the amount of $300,000 was traced back to block 93709, mined in November of 2010. This gives at least anecdotal evidence of support of a deep-pocketed old-school crypto community, which may eventually help Grin with long-term growth.

Lack of infrastructure limits the positive effect that community supporter can have on the ecosystem. Right now Grin is not even listed on most major exchanges. Assuming technical components such as wallet integration start to arrive on a consistent basis, we could see community support starting to have more impact on the network. If and when governance procedures become more organized the ecosystem will be able to do more than evolve the technology. The blueprint for this has been testrun by a number of projects, but it is up to Grin’s community to execute a given vision. Until that time, the ecosystem will remain Grin’s Achille’s heel and the biggest threat to its future.

Grin Corporate Supporters | Source: grin-tech.org

Token Economics

Summary

- Over 100% inflation adds supply side pressure

- Speculation driven by price action fuels selling

- Little organic demand because of a lack of primary use-case implementations

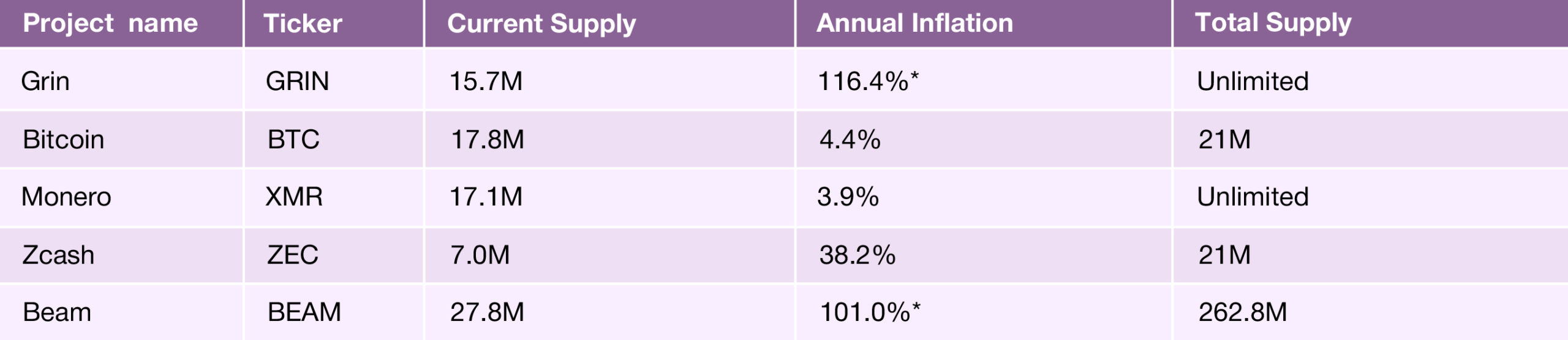

Grin’s token economy has so far been defined by speculation and high inflation. Grin had, what it called, a “fair launch” with no ICO, pre-mine or founders reward. This was meant to maximize the number of miners around the world who could have the opportunity to mine the coin. However, the current inflation eclipses triple digits, and with no immediate commercial demand, this creates enormous downward pressure on the token and reduces mining incentives.

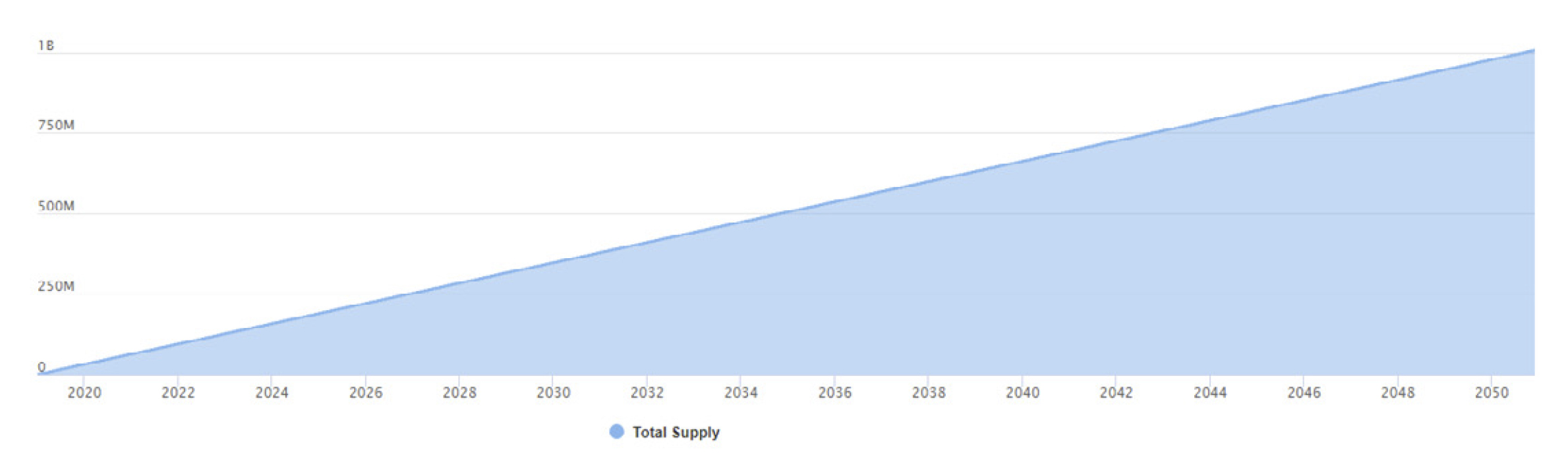

Grin Supply Curve | Source: grin-tech.org

The miners’ block reward is equal to 1 GRIN every second, with on average 1 block per minute, forever. This gives an emission of about 86,400 coins per day (~$271,296) and 2.5M coins per month (~$7.85M).

Current transaction fees range from 0.001-0.008 GRIN ($0.003-$0.025) in 99.9% of cases. However, it is dynamic and based on how many UTXOs are spent versus created.

Grin’s competitors exhibited similar supply properties during their early days. However, Grin is trying to breakthrough at a time when a market is more discerning and looks less favorably on low adoption, high inflation altcoins.

The coin’s unlimited supply may be a useful feature down the road, when macroeconomic issues come to the forefront: “Grin is focused on privacy, scalability and fairness. If groups or individuals «get rich quick,» they will have power to influence the entire grin economy more than others. Grin is not for creating technocrats, but for providing private digital cash to as many people as possible. Hoarding is a huge centralization pressure, and grin emission policy hopes to mitigate this.”

At the moment though scarcity is king, and Grin’s lack of a supply cap may serve as a deterrent for many investors.

Grin’s primary utility is a payment and transfer of value instrument. Yet, with speculators and inflation dominating the price narrative it is difficult for retail users and investors to get excited about the coin.

This creates negative sentiment around the project and hinders awareness efforts. Grin will need a serious adoption push in order to catalyze healthy supply-demand dynamics.

Core Team

Summary

- The direction of development is directed by the Grin Technical Council

- 2-3 full-time employees, mostly volunteer based core group

- The team is very technical and lacks marketing and other support competencies

Grin has a small core team that is focused entirely on development. With only 2-3 full-time employees, the team is heavily dependant on volunteer efforts. It is impressive to see how far the project has come given the minimal human and financial resources, but it is difficult to see who will drive the adoption efforts for the project. While community supporters and investors may take it upon themselves to push the project forward, the one sided nature of the core group’s composition elevates the risk of stagnation.

The core body of the ecosystem is the Grin Technical Council, which makes strategic decisions on the development of the project, and is also responsible for managing all the donations. The funds are kept in a 3/5 multisig wallet, meaning that no spending can occur without at least 3 council members actively signing the transaction.

The team has revealed that the project is reevaluating its governance structure, and might soon introduce different “sub-teams” to work in organized groups around specific areas of knowledge fields. Still, Grin’s biggest issues stem from a lack of non-technical resources.

The present team appears competent enough to continue technological development of the project. However, if the team continues to ignore business development, Grin will remain an R&D experiment.

Ignotus Peverell (GitHub ignopeverell)

Anonymous founder of Grin. Started Grin GitHub repository back in 2016, and has been one of the biggest contributors to the project. The founder has temporarily left the project for «personal reasons.»

Antioch Peverell (GitHub antiochp)

Anonymous core developer, who has been contributing to Grin since 2017.

Daniel Lehnberg (GitHub lehnberg)

Core developer. Previously also worked for over 11 years at Poker Stars as a product manager. Currently also a Co-Founder at vault713, a development team that builds tools and solutions to make it easy to send, store, and swap Grin.

Michael Cordner (GitHub yeastplume)

Core developer. Currently also works as an independent consultant at Revcore Technologies Ltd. Previously held several leadership positions as a software engineer.

Gary YU (GitHub garyyu)

Core developer. Gary has over 20 years of experience in software development. Prior to Grin, he has worked in Alcatel-Lucent (NOKIA) for many years.

Alexey Miroshkin (GitHub hashmap)

Core developer. Alexey started his software engineering career in 1997. Worked in IBM laboratory in Moscow as development manager and CTO. Worked in several fintech startups in Russia, Canada, Germany, and the US. Started working on Grin in his spare time in early 2018, co-organized the first Grin conference Grincon0 and the Grin Berlin meetup. Currently also participates in Binance Fellowship Program.

Quentin Le Sceller (GitHub quentinlesceller)

Core developer. Quentin also works as a software engineer at blockchain startup BlockCypher and holds a Master of Applied Sciences in Information from Concordia University.

John Tromp (GitHub tromp)

Core developer. Dutch computer scientist and also the original creator of Cuckoo Cycle proof of work algorithm. Started working on Grin since 2018.

Jasper van der Maarel (GitHub jaspervdm)

Grin council member based in the Netherlands. The author of the first atomic swaps between Grin testnet and the Bitcoin and Ethereum testnets. He is also the co-founder of vault713 and the creator of GrinScan, blockchain explorer. He has a Master’s degree in physics from the University of Utrecht and is currently finishing his Ph.D.

Roadmap Progress

Summary

- Transparent decision making and regular communication through bi-weekly meetings

- Lack of a structured long-term roadmap

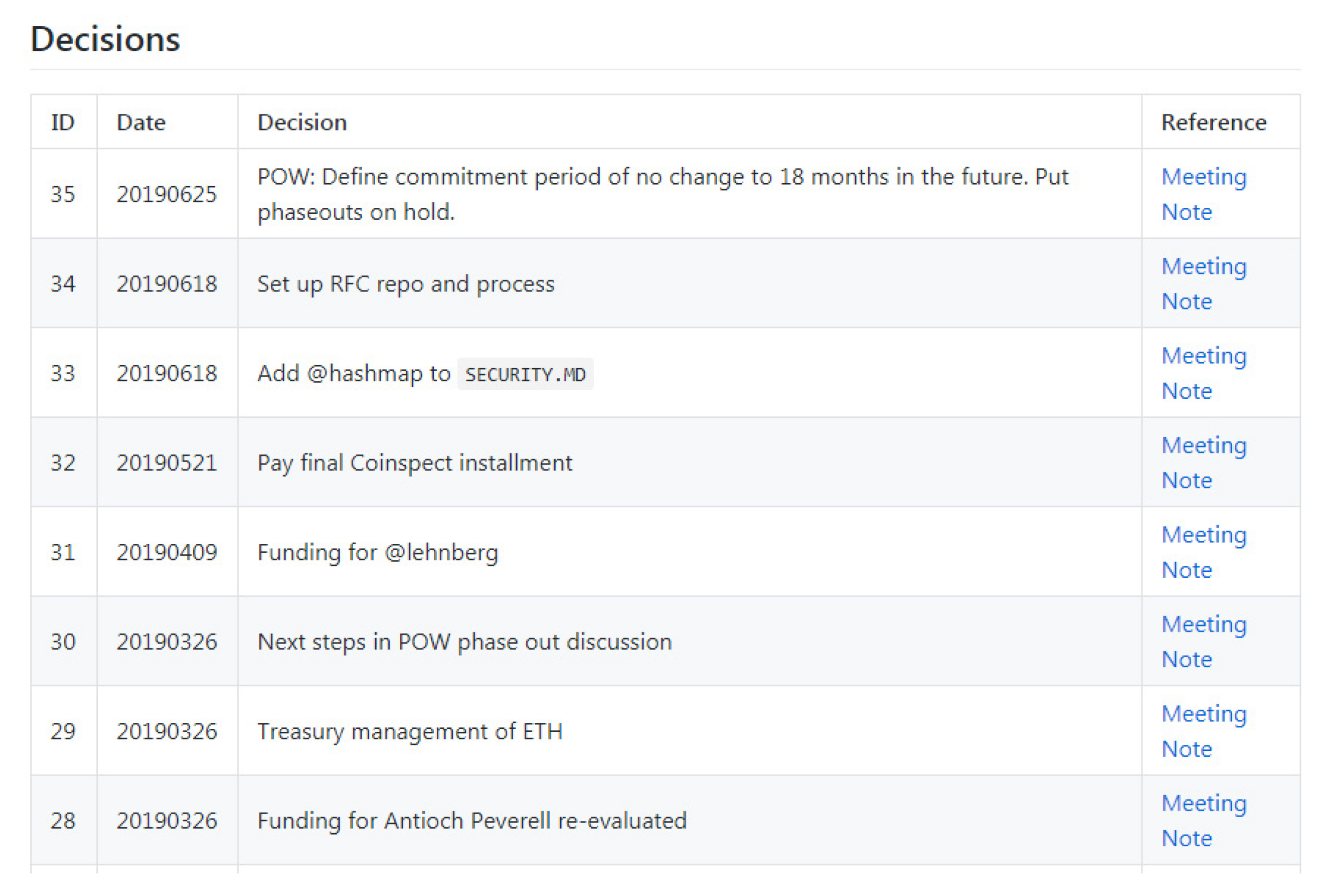

Similarly to Bitcoin, Grin does not have a long term roadmap. Instead, the team is doing bi-weekly governance meetings, where discusses all the ongoing developments and the proposals for future changes to the protocol.

The team is very transparent in their decision making. Every meeting has its own Agenda and Notes. There is also a decision log which tracks all the decisions made by the Grin project.

Currently, the team is planning next minor release Grin v2.1.0 and the next patch Grin v2.0.1. However, it is still unknown what will be included in them, since the planning process has just started.

Also, there is an ongoing discussion on the changes to the governance, to make it more structured and formal. The team wants to convert “Council” into “Core Team” and define its responsibilities and processes.

Besides that, the team wants to introduce formal RFC (Request For Comment) process. It should help “to outline a standardized way of making proposals and allow the community to discuss and evaluate whether something is worth doing.”

The absence of a long-term roadmap is concerning, as is the lack of adoption milestones. Still, it appears the project is ready to undertake operational improvements, which may make the team better prepared to facilitate commercially oriented activities.

Grin Decision Log | Source: github.com

Token Performance

Summary

- Lack of listings on liquid exchanges

- Has recently underperformed Beam

Grin has been rescued by the recovery in the broader crypto market, with the token price increasing by over 30% for the last 60 days. However, Grin is still 78% off of its all-time high, and with the altcoins being battered as a group looks set to take a hit.

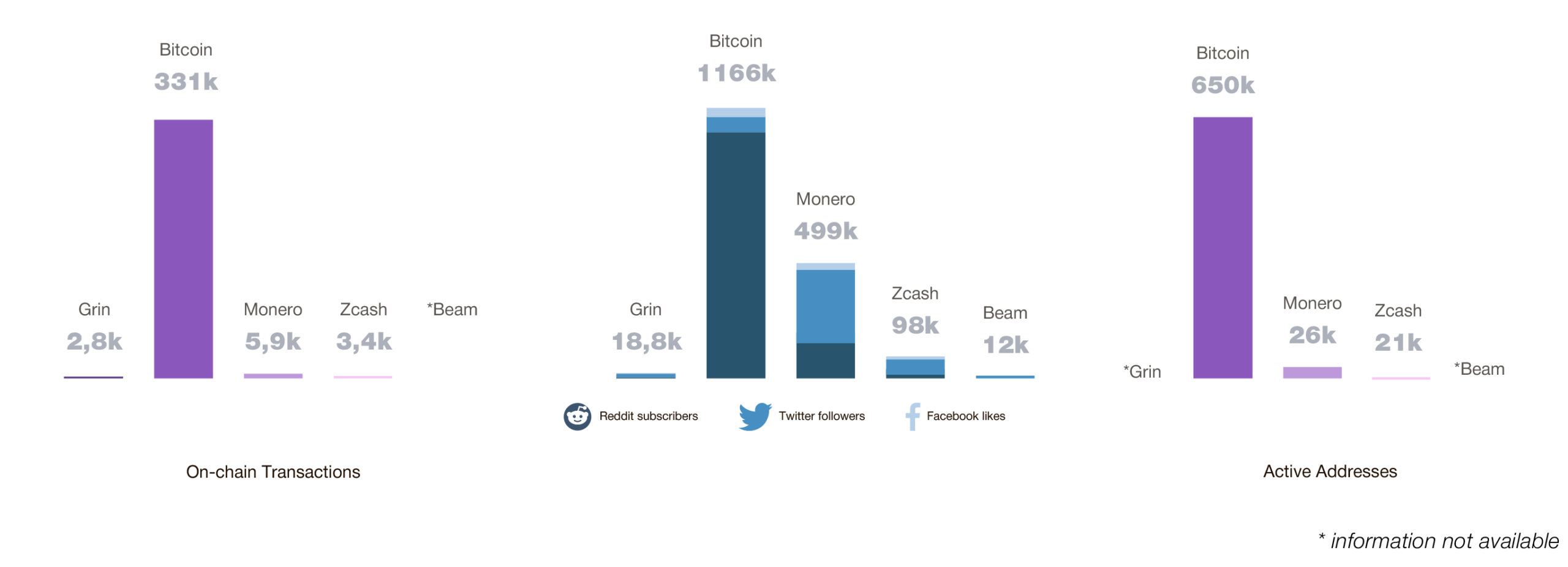

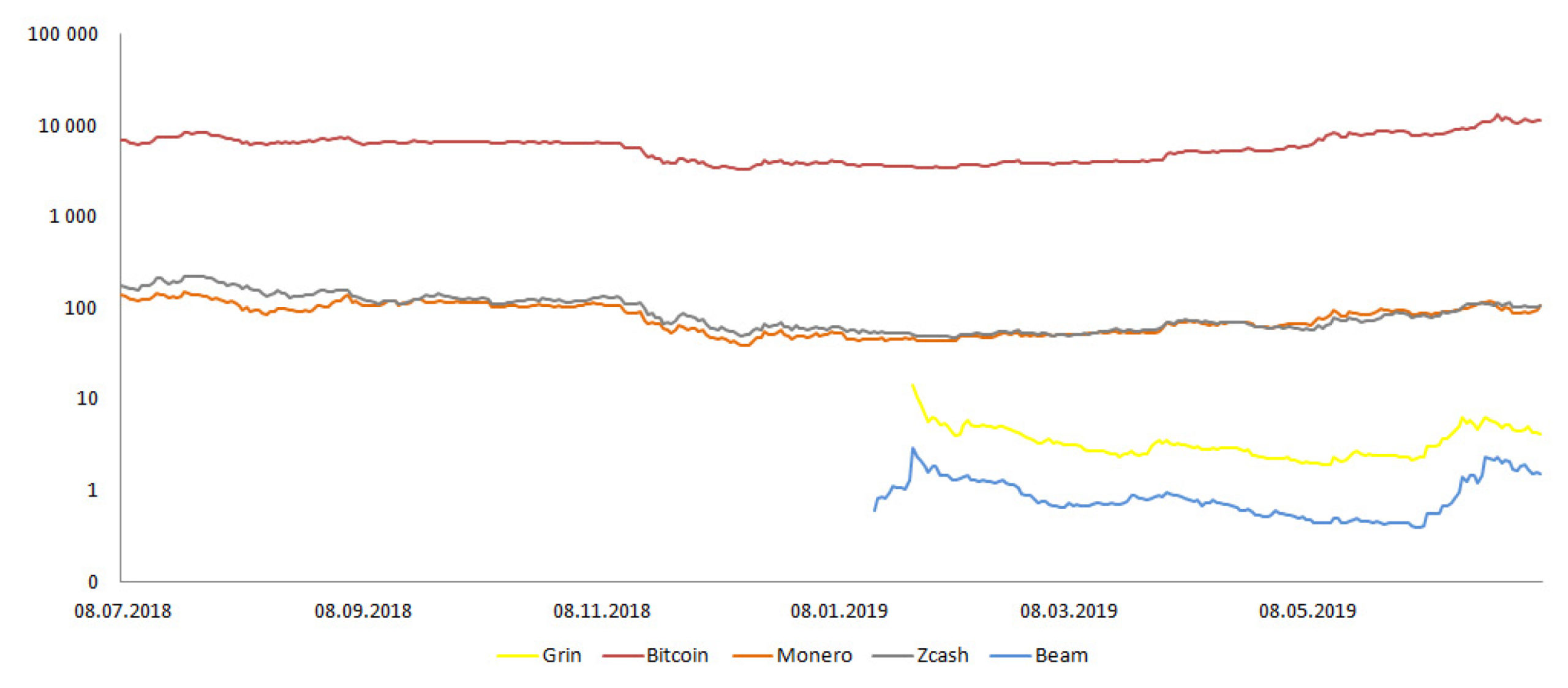

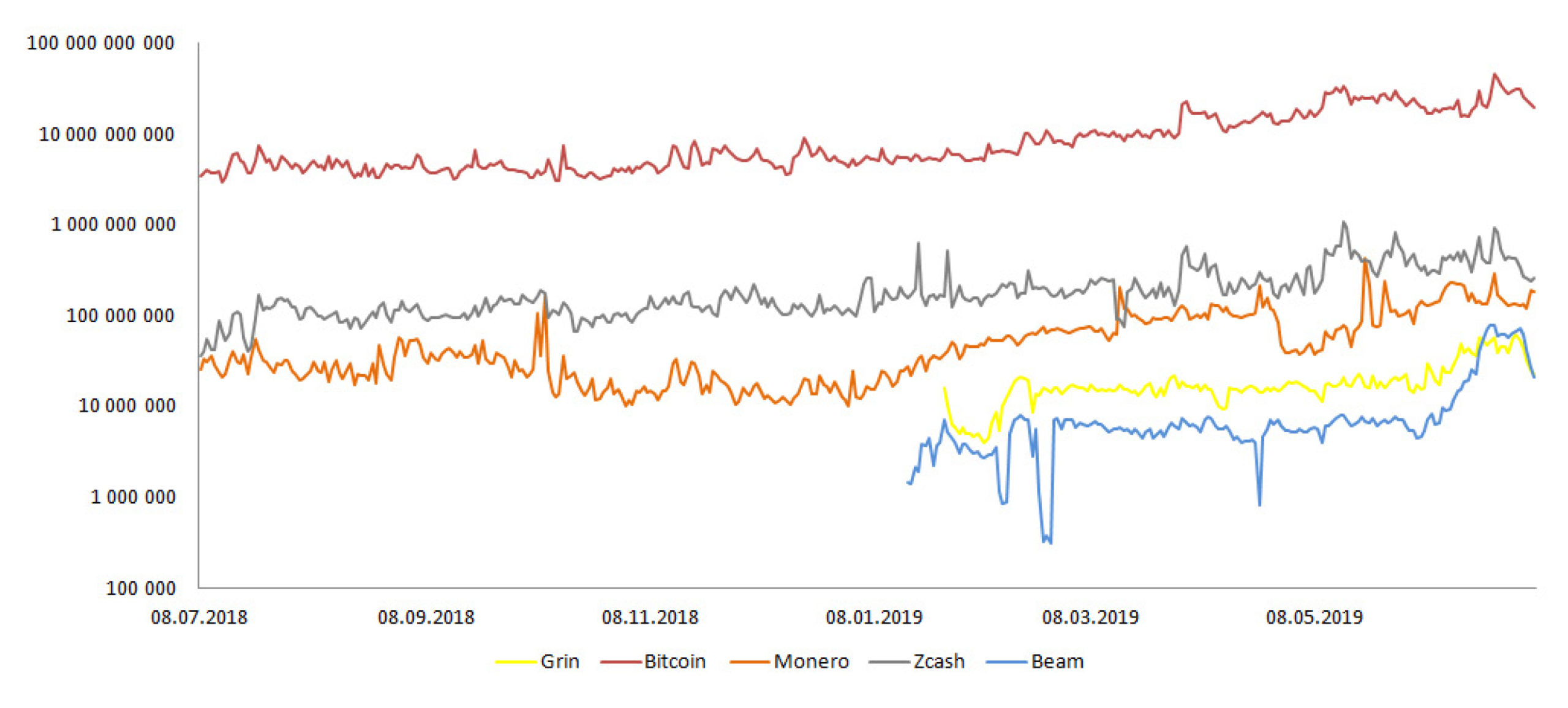

When compared by market cap and volume, Grin remains a fringe project relative to market staples such as Monero and Zcash.

What is interesting is that Beam has outpaced Grin during the recenter recovery, indicating that speculators may be shifting gears to the other MimbleWimble project.

Price Comparison | Source: coinmarketcap.com

Volume Comparison | Source: coinmarketcap.com

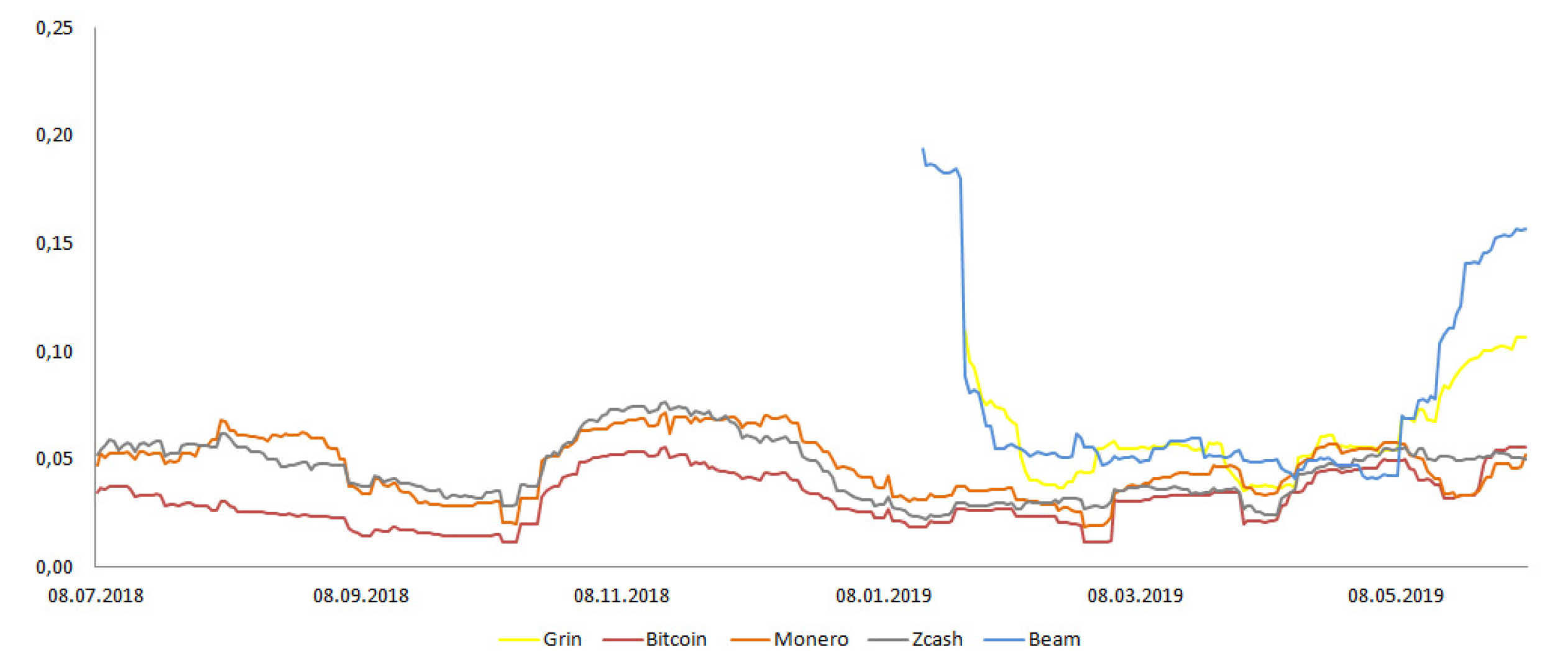

Recent GRIN volatility (30-day) numbers are much higher than most of its competitors, this is likely due to the fact that coin is traded on just a few exchanges, and generally lack the liquidity its more mature competitors have.

Volume Comparison | Source: coinmarketcap.com

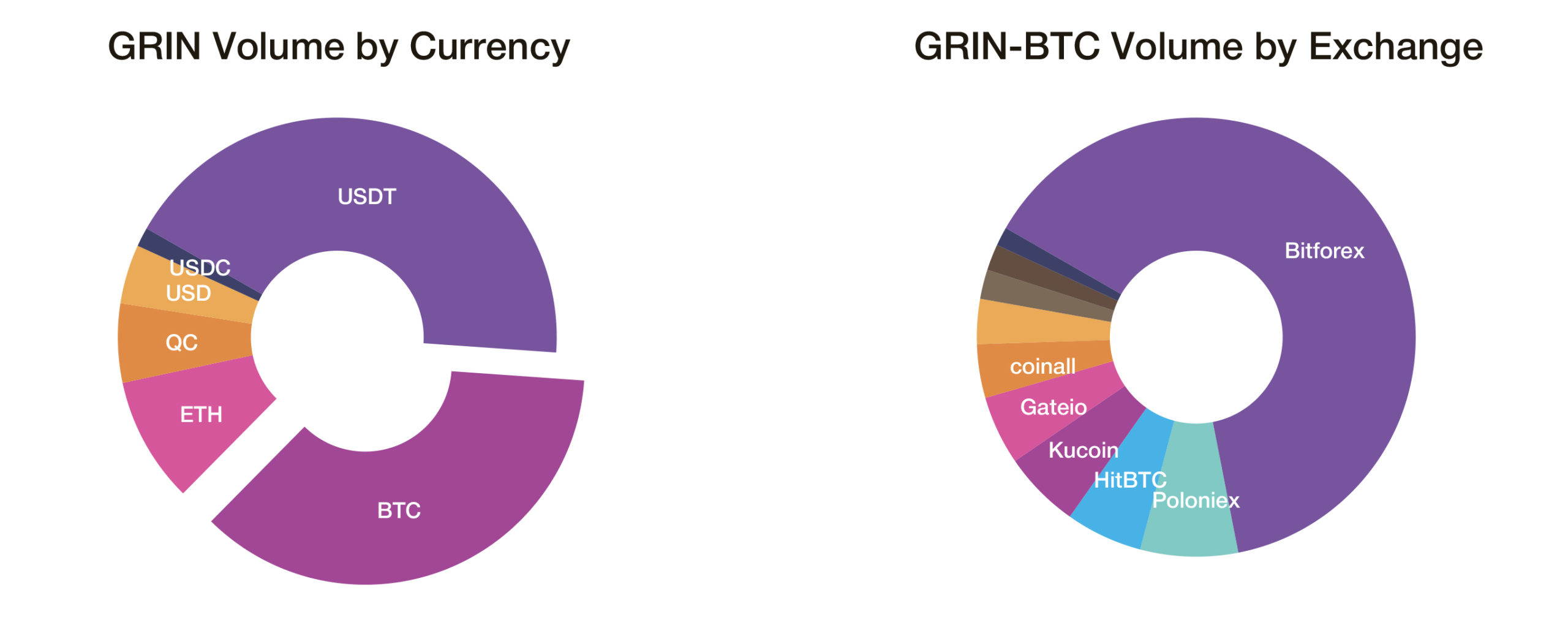

The vast majority of GRIN trading is represented by GRIN/USDT and GRIN/BTC markets, with over 40% in USDT volume. GRIN is only traded on several exchanges, while the major volume is coming from Bitforex, where numbers may be inflated.

Grin was once a majorly hyped project that has still not been listed on the majority of the prominent exchanges. This leaves room for a potential listing catalyst, as the project’s solid standing should eventually get acknowledgment from at least some of the top exchanges.

Conclusion

Grin is one of the few coins out there that has gathered and retained the support from many early adopters and influential projects in the space. However, the project still has a long road ahead in order to prove its long term sustainability. Its ecosystem remains, small and it is still in the process of building the necessary infrastructure to make it convenient for the community to start using the coin.

It is likely that the project will need significant time to solve its problems with UX/UI and improve its liquidity through listings on large exchanges. Only after that will the project be able to start working on expanding its list of use-cases beyond speculation.

Even with much of the hype now gone, the project’s long-term value proposition remains cloudy. In the absence of a coherent plan to develop its ecosystem and grow adoption, Grin appears to be a very risky project.

As such, Grin receives a grade of C+.

The author(s) of this report is/are invested in the following coins: Bitcoin, Beam.