DOGECOIN DIGITAL ASSET REPORT

DOGECOIN DIGITAL ASSET REPORT:

DOGE Review and Investment Grade

TABLE OF CONTENTS

Investment Grade

Fundamental Factors

Summary

Dogecoin is one of the most popular cryptocurrencies in the blockchain industry. However, this project was conceived as a joke, i.e. the founders had no goal to compete with anyone.

The cryptocurrency is mainly used to pay tips to content creators on Reddit and Telegram. There are very few companies that target such a narrow segment of the market within the blockchain sphere, but there are many indirect competitors, which can provide the same services as Dogecoin. DOGE can only compete with its rivals in the short-term, but it will not survive in the long run.

It has a large and friendly community that keeps the Dogecoin network alive. However, the lack of a cohesive team and a well-built financing system has led to a situation where the project has every chance of dying. The roadmap and GitHub activity of the team are nonexistent, so this casts serious doubt on its long-term prospects.

Market Opportunity

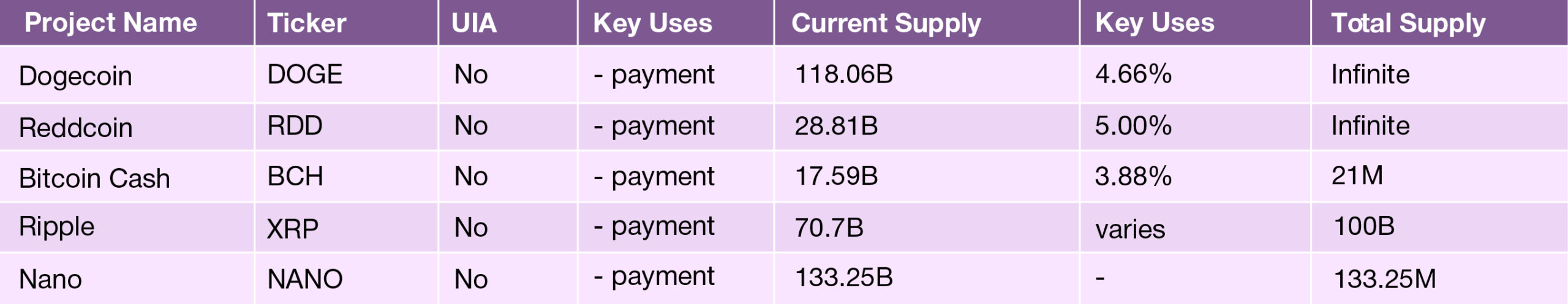

Dogecoin is mainly used as an online tipping system consisting of tipping bots. Users can tip with Dogecoin for providing useful content on popular sites like Reddit and Telegram. There are also many such bots on other blockchains, including Bitcoin, Litecoin, Ethereum, Stellar, Ripple, etc.

The tipping bots are quite simple, therefore any team can develop one. There are many bots on Reddit, Twitter, Twitch, Discord, Telegram, etc.

However, it is difficult to estimate the market size of the tipping bots because there is no public statistics on all of them. Most likely, the size of this market segment is tiny.

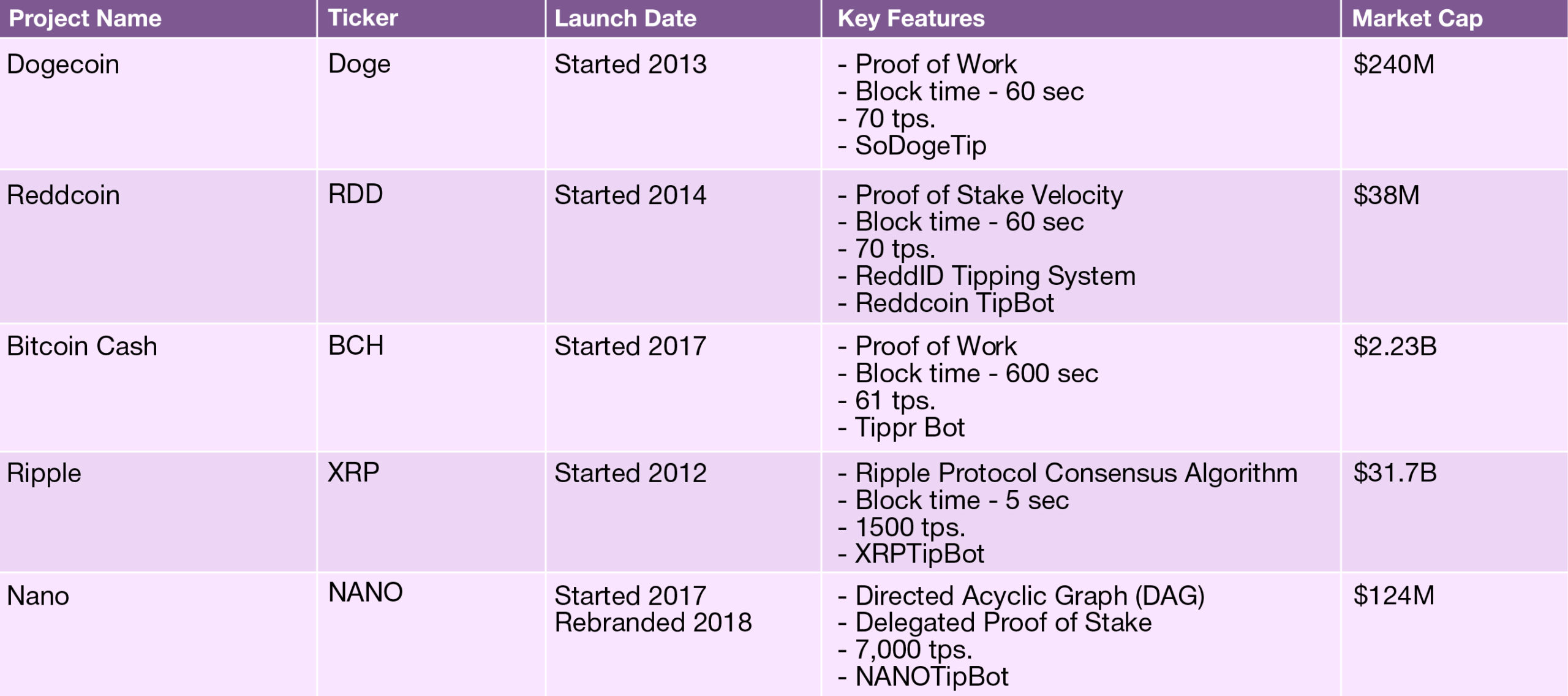

Reddcoin is a social cryptocurrency that was created to enable users to tip content creators in various social networks, and is a direct competitor to Dogecoin. At the moment, its tipping system works on sites like Twitter, Twitch, Justin.TV, and Reddit, but the team intends to expand the number of social networks in the future. While Dogecoin’s team has shown no recent GitHub activity, Reddcoin has gathered a serious team that has been working to create a social cryptocurrency for a wide range of social networks. So, while Dogecoin may have better numbers at the moment, Reddcoin has much better long-term prospects.

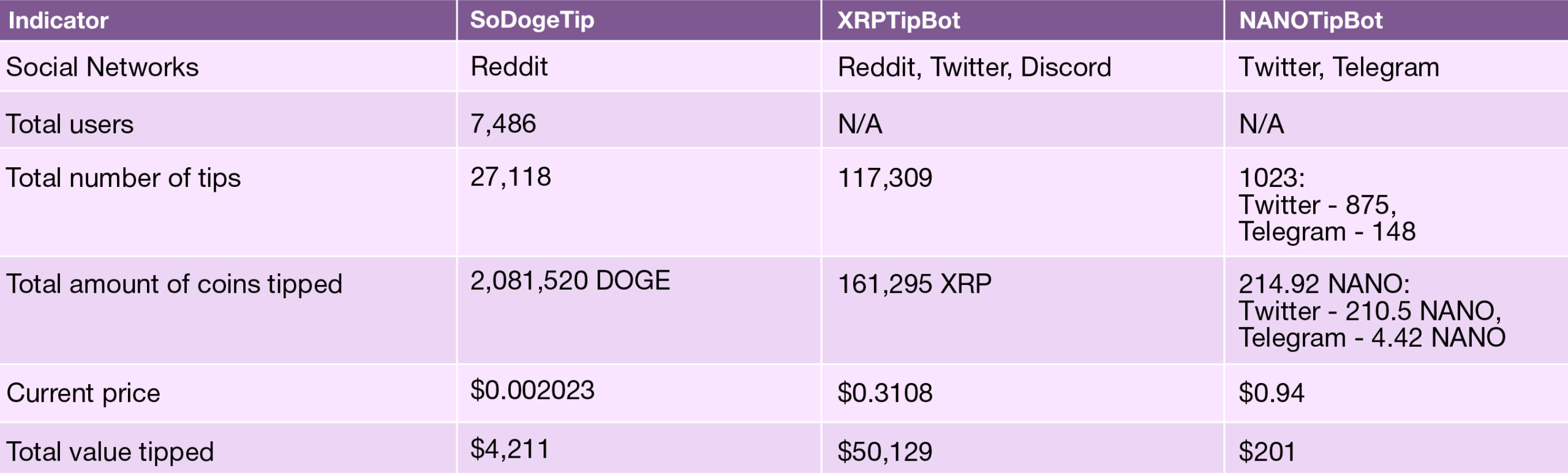

Another competitor is Bitcoin Cash, which is a fork of Bitcoin and has its own bot. Its bot was very active according to data published in August 2018 (total value tipped – $8,328, 1 BCH = $109.44), but it seems that the Tippr bot (BCH tip bot) no longer works. Taking into account that the Dogecoin community is much more active, and SoDogeTip is still functioning, Dogecoin will dominate Bitcoin Cash in this area for now.

An indirect competitor to Dogecoin is XRP, which was conceived as a currency for financial institutions. XRP also has a tipping bot called XRPTipBot, which looks much better than SoDogeTip: the total number of tips and the total value tipped are much higher. Since Dogecoin’s team is not working on the project’s development, its prospects are less promising.

Nano is a representative of cryptocurrencies focused on providing payment solutions and also has its own tipping bot. However, NanoTipBot is a very weak competitor to Dogecoin because the total number of tips and the total value tipped are significantly lower than those of SoDogeTip. Since the Dogecoin ecosystem is already established and very active, it is easy to compete with a new currency like Nano.

Dogecoin has better prospects in the short-term than Reddcoin, Bitcoin Cash and Nano due to its large and active user base. Nevertheless, its prospects are not commensurate with the capabilities of XRP.

Tippin bot (Bitcoin), a Chrome and Firefox browser extension that enables tipping on Twitter, can become another threat in the future. Since this bot is based on the Lightning Network, it allows users to send tips very quickly and with almost zero fee. Considering the size of the Bitcoin community, the Tippin bot can become a serious competitor to SoDogeTip.Tippin bot (Bitcoin), a Chrome and Firefox browser extension that enables tipping on Twitter, can become another threat in the future. Since this bot is based on the Lightning Network, it allows users to send tips very quickly and with almost zero fee. Considering the size of the Bitcoin community, the Tippin bot can become a serious competitor to SoDogeTip.

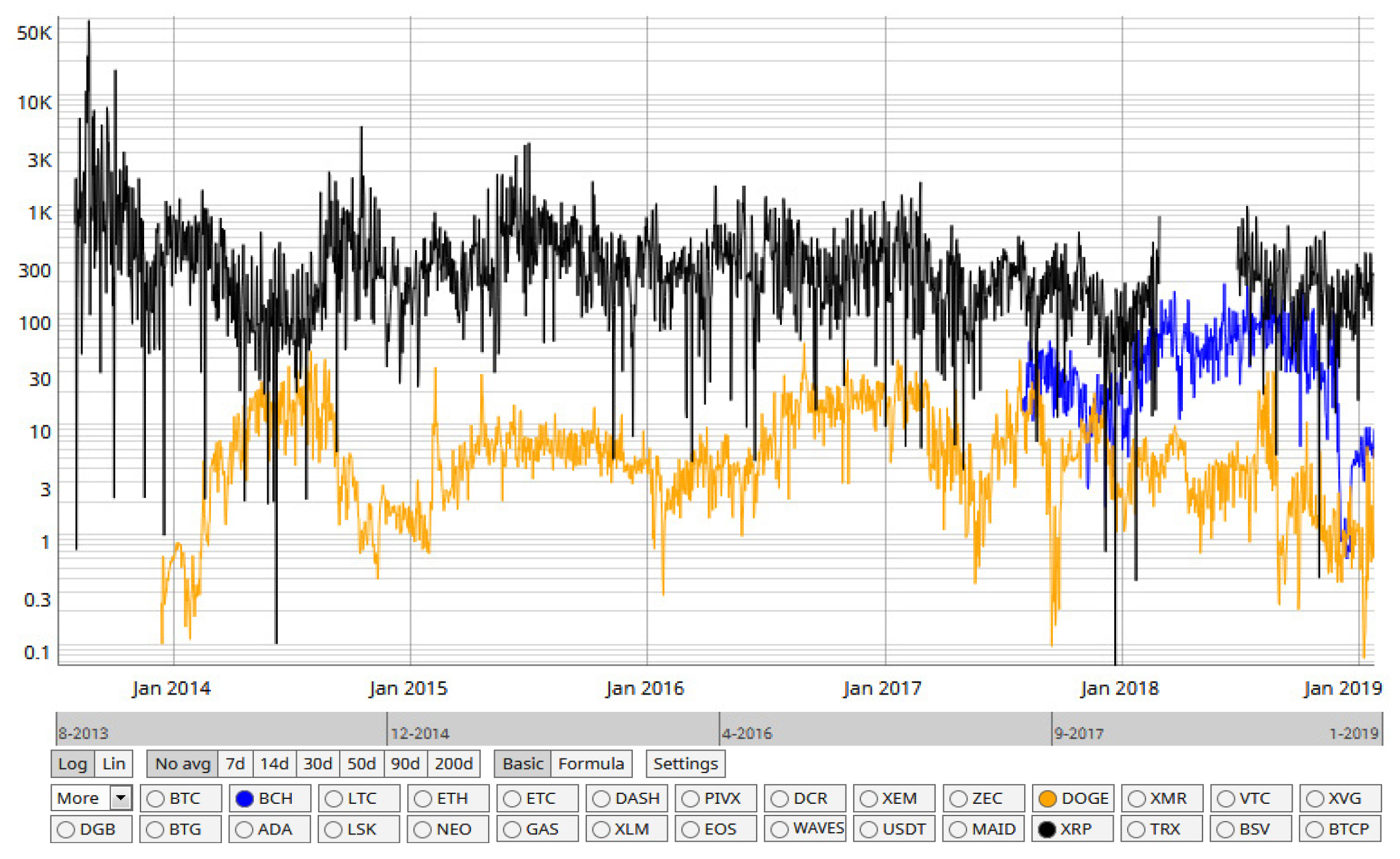

The NVT value of Dogecoin fluctuates between 0.1 and around 30. Its transactions are valued so low because the project has no long-term prospects.

Dogecoin is well known as a tipping system, but there are many cryptocurrencies that offer the same solutions and pose a threat to Dogecoin. Given the absence of any team activity, the Dogecoin prospects are bleak.

Ecosystem Development

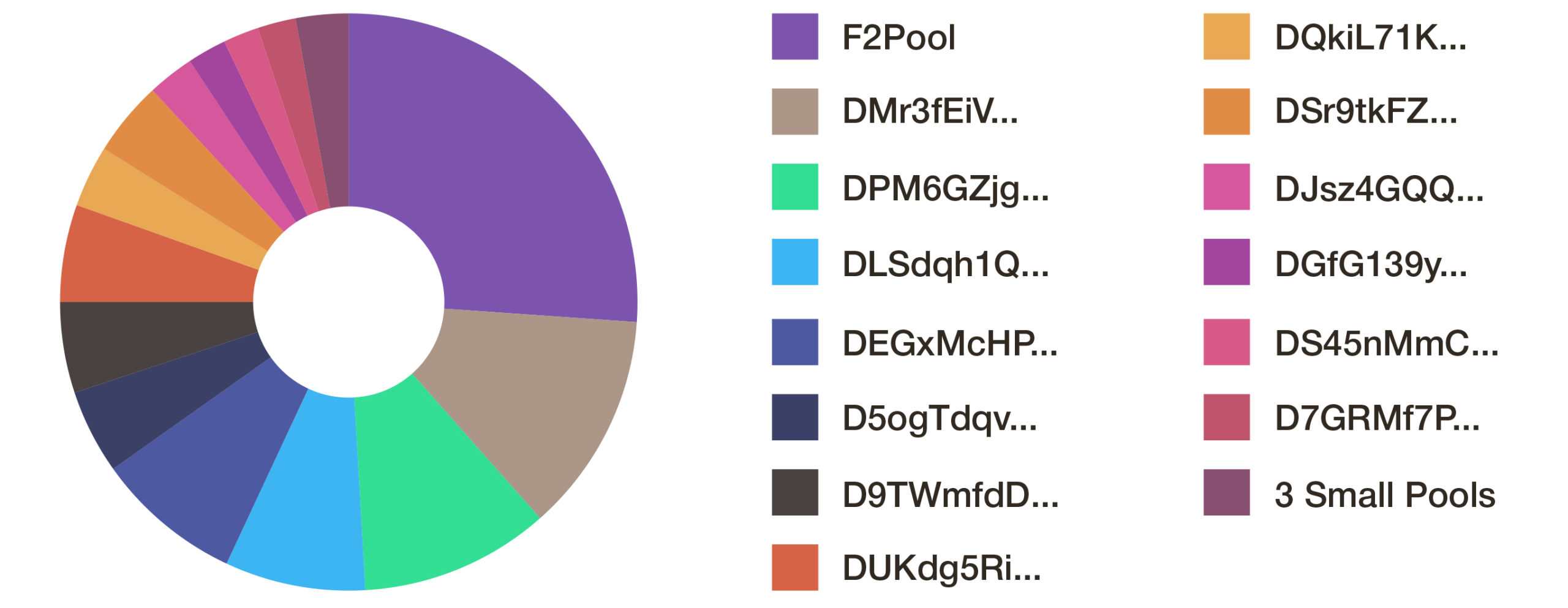

Dogecoin uses a PoW consensus algorithm, so its network is maintained by a network of distributed nodes. There are 114 active nodes that maintain the Dogecoin network, and there are only 17 pools that are engaged in Dogecoin mining. Dogecoin and Litecoin both use the Scrypt hash algorithm that enabled merged mining between these two coins. Therefore, most Dogecoin mining is a by-product of Litecoin mining.

The distribution of computing power indicates the presence of centralization in the Dogecoin network, which can reduce its security and increase its vulnerability to attacks.

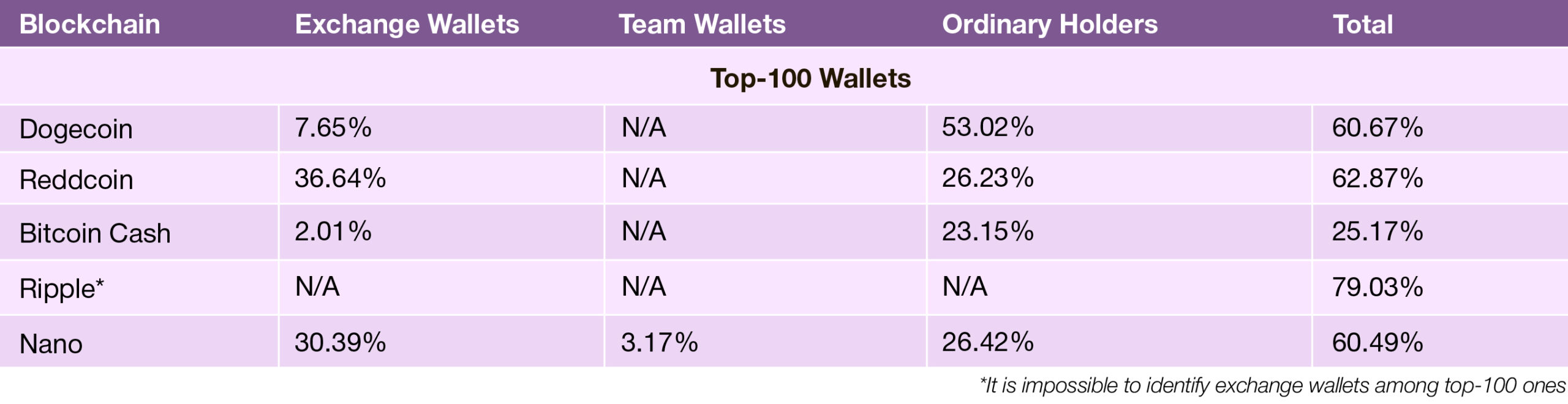

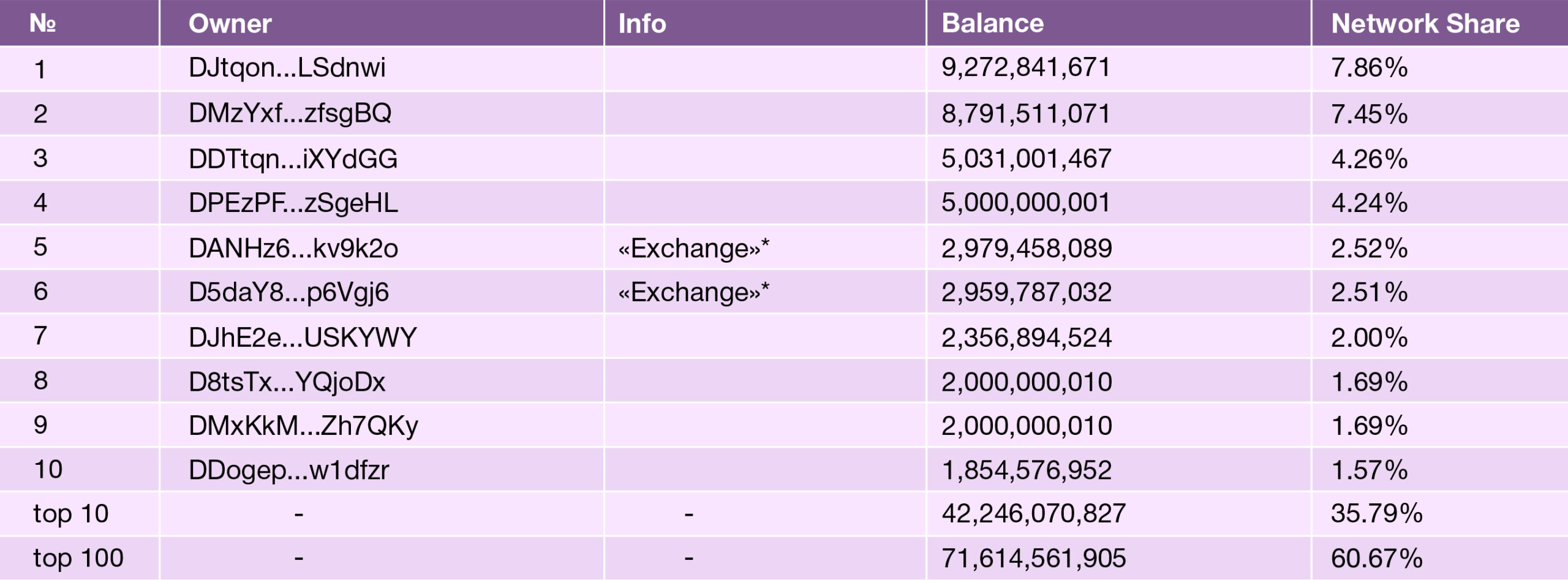

Another factor that indicates the centralization of the project is the wealth distribution. The table below shows that the top-10 wallets own 35.79% of all tokens, and top-100 – 60.67%. This is also an indicator of centralization of Dogecoin, however, the main holders of tokens are ordinary holders and exchanges.

Dogecoin exhibits a much higher degree of centralization among ordinary holders than its competitors.

* Hypothetical exchange wallet should be constantly active. It has a huge number of Ins and Outs | TOP-10 Wallet Distribution

The development of the Dogecoin project depends on the Dogecoin Foundation team and the community of freelancers. The main purpose of the Foundation is to facilitate the use of Dogecoin through promotional and charitable endeavors. The organization is a non-profit and consists of 5 directors: Felix von Drigalski, Jens Wiechers, Josh Mohland, Debbie Ballard, Patrick Lodder. Developers are Max Keller, Ross Nicoll, and Patrick Lodder.

It was active until Jackson Palmer, the founder, left Dogecoin in 2015. Its low activity is also due to the fact that the Dogecoin Foundation has no financial resources. That is, the team has no initiatives to work on the product, which is a serious threat to the project.

Therefore, the future of the project depends on the Dogecoin community. For instance, Oscar Guindzberg partners with CoinFabrik to develop the Dogethereum bridge, which enables to move coins from Dogecoin to Ethereum and back. Ismael Bejarano, Catalina Juarros, and Pablo Yabo from CoinFabrik are working alongside Oscar Guindzberg, and they presented the second stage of the project on September 5, 2018. The full project is available here and a presentation of the product – here.

The next big project for Dogecoin is DogePal. Developed by Tom, big Dogecoin fan and volunteer, with a team of around 5-10 people, they built a social media presence on Twitter, Discord, Facebook and Reddit, created the official website, designed the logo, etc. DogePal is a system that allows people to pay each other in DOGE, using email addresses. It also has an anonymous tipping feature, and its users can create customized invoices. In addition, DogePal platform can be used for advertising purposes. The current number of users is 708. Overall, this project can increase the Dogecoin’s adoption level.

Besides utilizing Dogecoin as a tipping platform, users can also use the cryptocurrency to pay for goods and services. The team built a merchant network of about 52 merchants by 2015, but it has not grown since. A merchant network of this size is too small to compete with other cryptocurrencies.

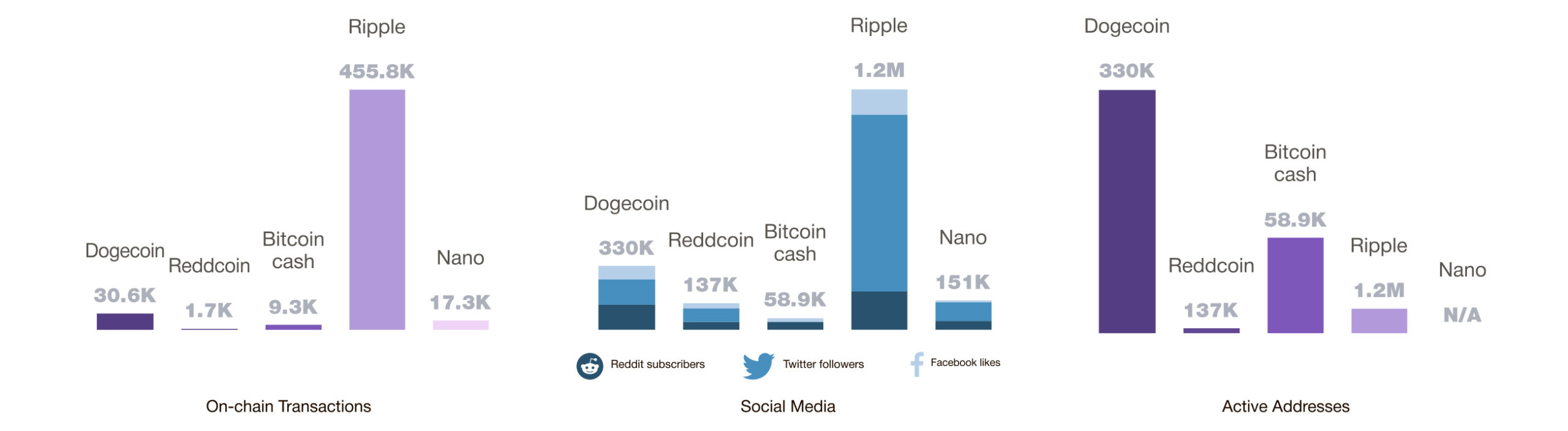

The main component of the Dogecoin ecosystem is its community, which is much more active than the communities of its competitors. That is, the number of transactions per day, the number of active addresses and the support of the community in the Dogecoin network are many times higher.

Dogecoin has built a large and friendly community that loves the project. Therefore, it is easy for it to compete with other projects in its narrow market segment. However, the absence of a strong team and the presence of centralization will negatively affect further growth of the project.

Token Economics

DOGE is the native currency of the Dogecoin blockchain, which is used as a means of payment.

Reward – miners receive 10,000 DOGE for block creation, which is a good incentive for miners to maintain the Dogecoin blockchain.

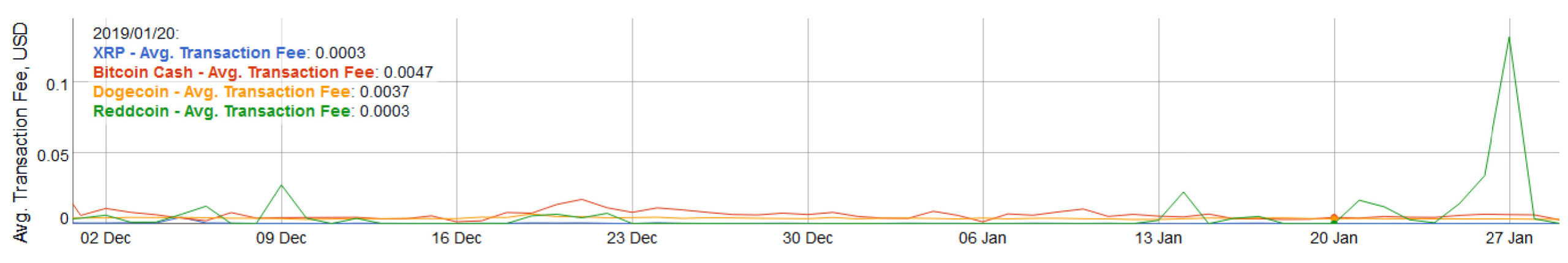

Fees – Dogecoin has a fixed transaction fee of 1 Doge per 1Kb of data. This is too low for a transaction fee to be a good incentive mechanism for miners. Therefore, the team decided to set up a constant block reward to be sure that nodes will maintain the network in the long-term. On one hand, it is good that transaction fees are very low, because users are more interested in using DOGE for daily payment. On the other hand, the Dogecoin blockchain may be vulnerable to DDoS attacks.

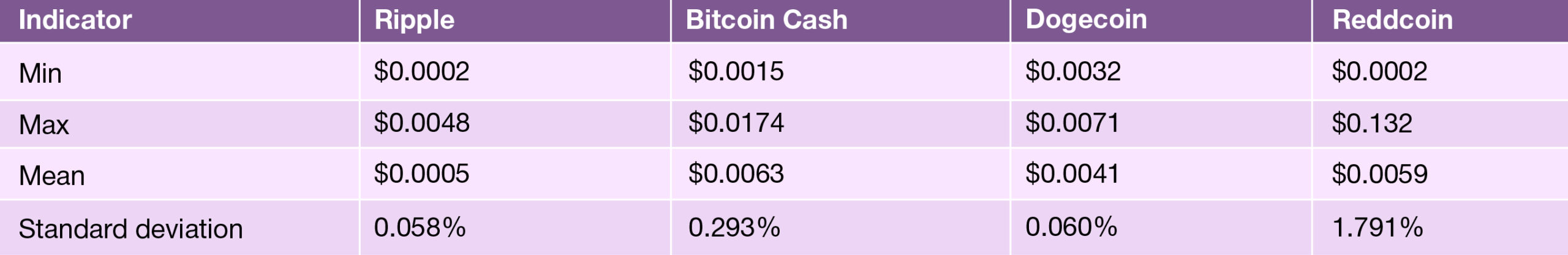

Statistical analysis shows that Dogecoin provides lower transaction fees that are more stable over time. Dogecoin is more competitive than Bitcoin Cash and Reddcoin, but it is not able to compete with Ripple and Nano (zero-fees).

Speculation – DOGE is traded on many of the popular crypto-exchanges.

Payment – One of the uses of the payment utility is fundraising. For example, the Dogecoin community helped raise $50,000 for Jamaican Bobsled Team to go to the Sochi Winter Olympics; $30,000 for World Water Day; $55,000 to sponsor NASCAR driver Josh Wise. After collecting funds for Jamaican Bobsled Team, the DOGE price spiked to its 2nd peak on January 21, 2014. This means that such fundraising programs only strengthen the value of DOGE and increase worldwide adoption.

The mining profitability in the Dogecoin network amounts to $0.1671/day for 1 Ghash/sec. Meaning, miners receive a high enough reward for their work to maintain the Dogecoin blockchain.

However, the inflationary model adversely affects the value of the DOGE, depreciating it over time. While the competitors have fixed supply that appreciates the coins value, Dogecoin’s yearly inflation is one of the highest. From this point of view, Dogecoin is less competitive in the market and is less attractive for users.

The team built the token economics in such a way to incentivize users and miners to use DOGE. But weak use cases and inflation reduces the value of DOGE, and can lead to the collapse of the ecosystem.

Core Team

He is the Co-Founder of Dogecoin. He co-founded Dogecoin in December 2013. Billy Markus is a creator of original Dogecoin code. Currently, he works as a software engineer at IBM and tweets using the handle Shibetoshi Nakamoto.

He is the Co-Founder of Dogecoin. He co-founded Dogecoin in December 2013 and left the team in 2015. Jackson Palmer graduated from the University of Newcastle with BA in Marketing. He has 10+ years of experience in marketing and management. Currently, Jackson Palmer holds a position of Director of Product Management at Adobe.

The Dogecoin team is made up entirely of volunteers.

The Dogecoin Foundation, a Colorado non-profit corporation, was founded on July 1, 2014. The main purpose of the company is to facilitate the use of Dogecoin through promotional and charitable endeavors. However, the team is not active at the moment: the latest updates were posted on Twitter on February 18, 2018, and on July 20, 2015 on the official website. The lack of activity of the team significantly reduces the competitiveness of the project. So, Dogecoin continues to exist due only to the passion of the Dogecoin community.

The negative factor that influenced Jackson Palmer’s decision to leave the project was the activity of a scammer in the Dogecoin ecosystem. The name of the scammer is Ryan Kennedy, also known as Alex Green, who raised $750,000 for the development of an exchange called Moolah. Then he declared bankruptcy and disappeared. After that, “Palmer became disturbed by the commercialization of his joke currency and announced he was leaving Dogecoin behind, as he promised he would if people started taking his joke too seriously”. After Jackson Palmer left the project, the team became inactive as well.

Overall, the team activity is absent, i.e., it is not going to develop the project further. Therefore, the long-term prospects of Dogecoin look very poor.

Underlying Technology

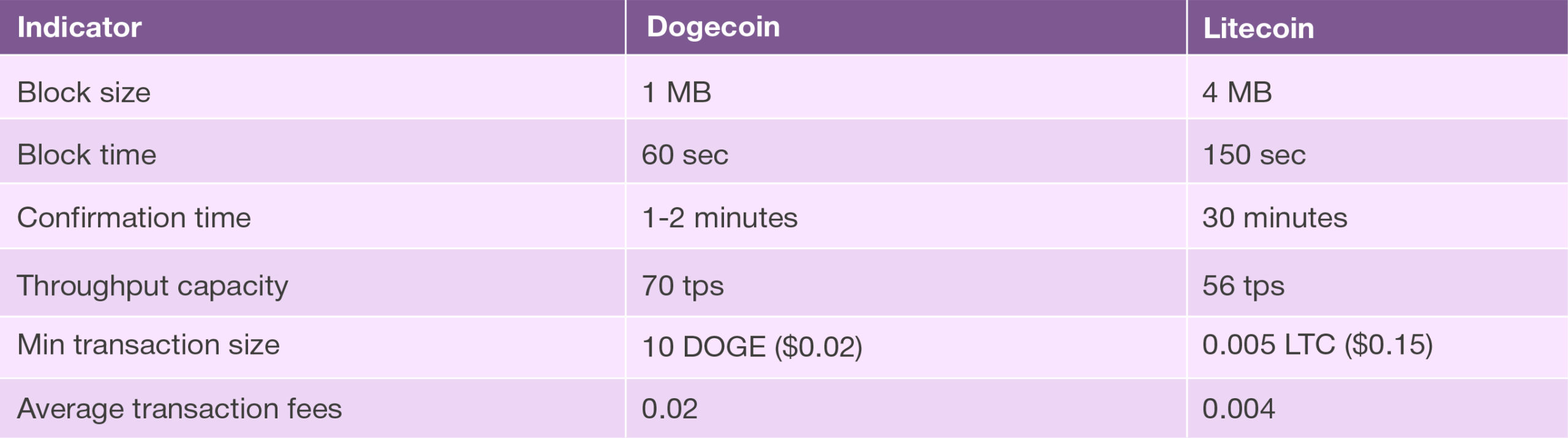

Dogecoin is a fork of Litecoin with improved parameters: block time, throughput capacity, confirmation time.

While Litecoin introduced new technologies such as SegWit and Lightning Network, Dogecoin has used the same technology since it was created.

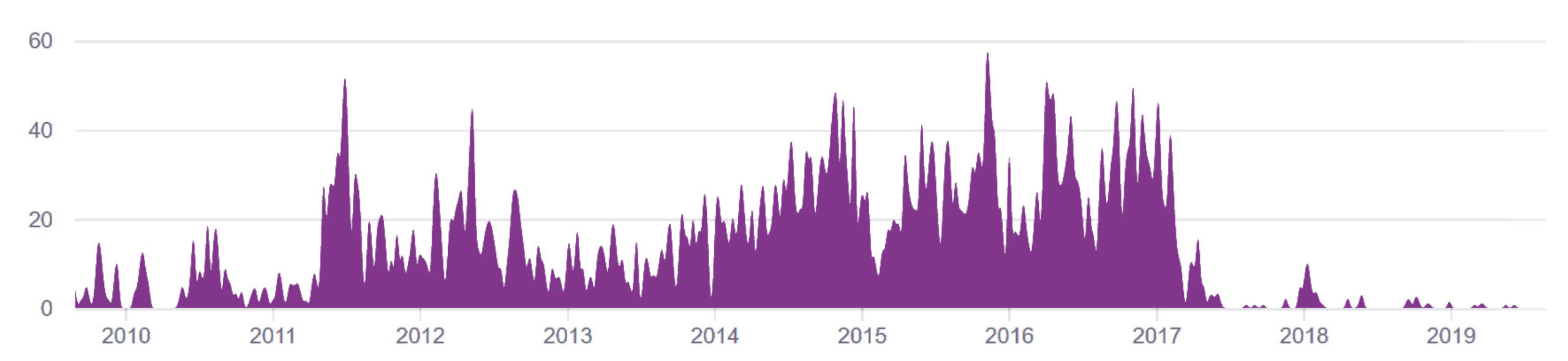

The team is not working on the development of the project, and the lack of GitHub activity confirms that.

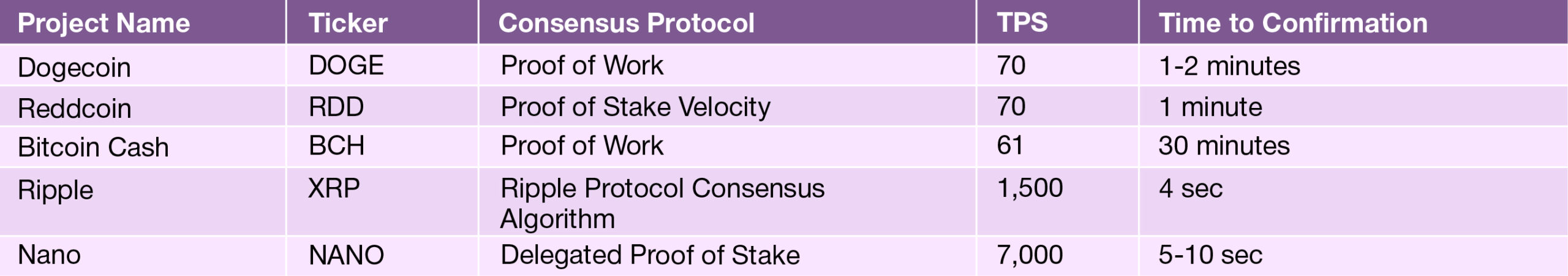

While Dogecoin has less throughput capacity than Ripple and Nano, it has almost the same scalability as Reddcoin and Bitcoin Cash.

Since Dogecoin did not implement any special innovations, it can compete only with ordinary blockchains like Bitcoin Cash and Reddcoin.

However, more active and advanced blockchains will likely dominate Dogecoin in the long run.

Roadmap Progress

The Dogecoin Foundation published the roadmap on September 17, 2014, which is only 50% completed. No activity is observed after July 20, 2015.

Despite the fact that the roadmap is very short and simple, the team did not complete it. This shows the lack of a serious attitude to the project.

Open Membership

Establishing a small set of procedures and policies for membership: completed.

Membership sign-up via website: in progress.

Communications

Find members willing to help with communication: postponed.

Establish a PR team: interim team set-up, until membership is opened.

Website

Develop website for information and communication: completed Develop support and member access options: in progress.

Legal/Compliance

Bylaws: completed

Continue talks with UltraPro with regard to the Trademark situation: completed

Develop election methodology and requirements: in progress

A possible catalyst for the project in this year could be the full launch of Dogethereum Bridge.

Still, the Dogecoin Foundation has no actual development roadmap and has not been publishing regular updates since 2015. Therefore, it is impossible to talk about any long-term prospects.

Token Performance

DOGE coin is in the top-27 coins by market capitalization and it is in the top-47 coins by trading volume (24H).

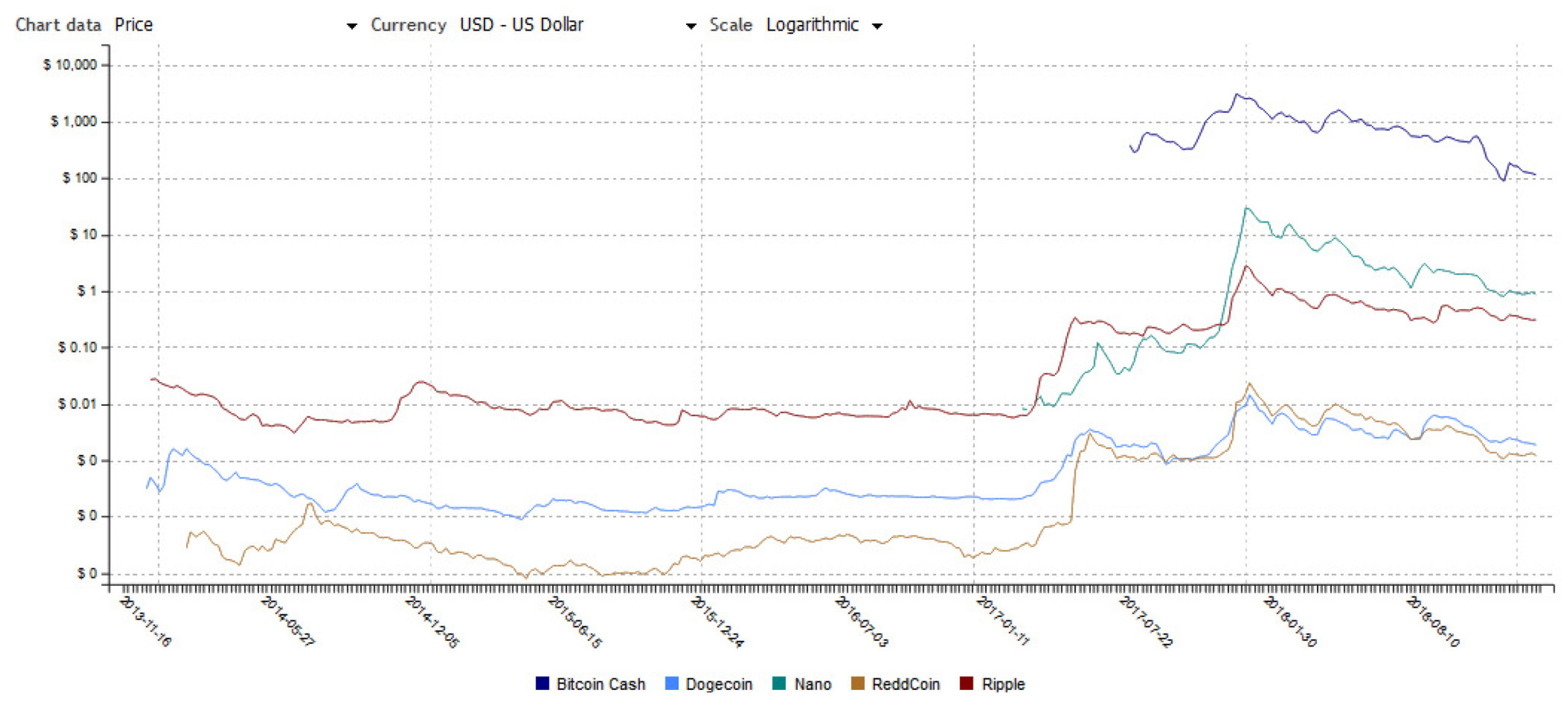

The first time DOGE reached its peak was immediately after its listing on December 19, 2013, when it grew to $0.001512, a 3x increase. The price adjusted following that, but soon DOGE reached its second peak on January 21, 2014 ($0.002335), while the entire market was falling. At first, this growth was caused by the signing of a new partnership with GoCoin in September 2014, but the main driver of price growth was the fact that on January 19, 2014, the Dogecoin community and foundation raised $50,000 for the Jamaican Bobsled Team to help it to go to the Sochi Winter Olympics.

In addition, the increase in the price of DOGE had fundamental reasons in February and September 2014. After that, the DOGE price essentially follows the trend of the entire market, which is quite understandable. Most likely this is due to the fact that Jackson Palmer left the team in 2015. After that, GitHub became inactive, and the team stopped actively working on the project’s development. Therefore, the DOGE price change is mainly speculative and depends on the behavior of the entire market at the moment.

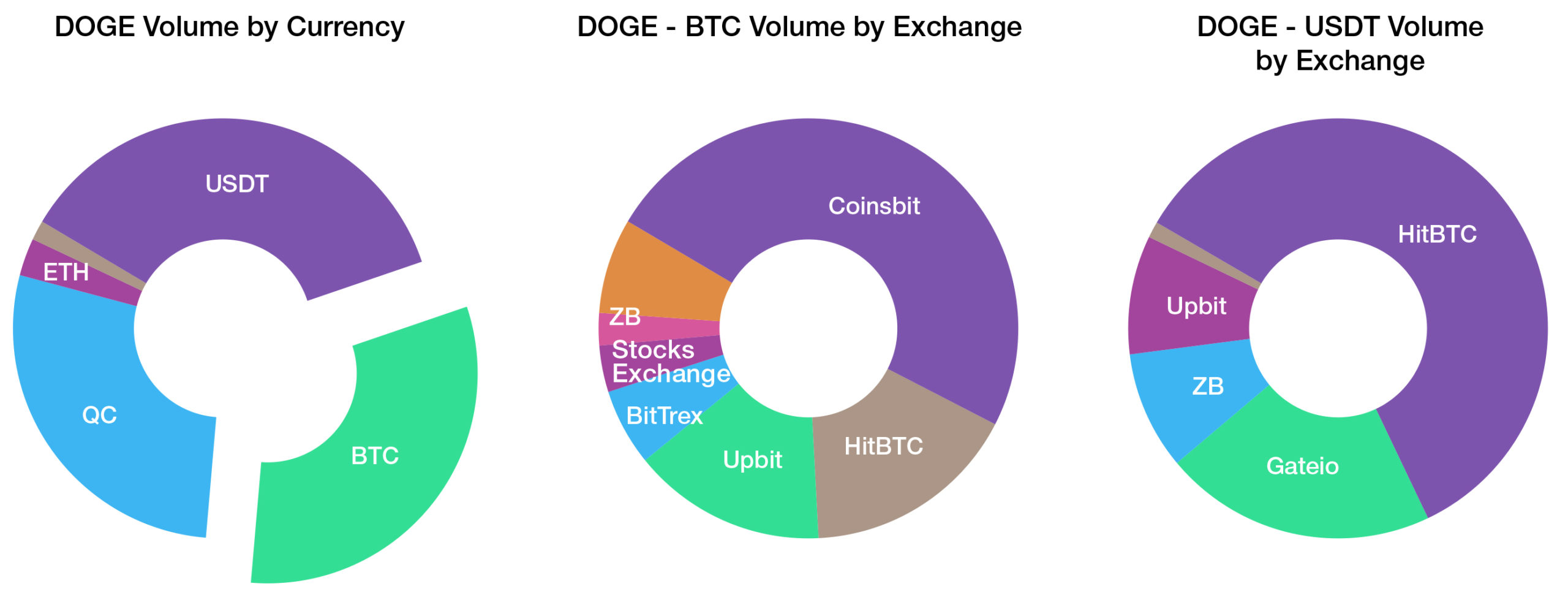

DOGE is mainly traded against USDT (36.24%), BTC (30.60%), QC (29.07%), and ETH (3.14%). Its volume is represented by the Coinsbit (50.03% of DOGE/BTC volume) and HitBTC (57.54% of DOGE / USDT volume), but these exchanges do not seem particularly reputable, as it appears that trades are often done by bots instead of actual traders, on some exchanges. Consequently, the real trading volumes and the liquidity of the coin may be lower. Unfortunately, Dogecoin does not have the financial resources to apply for listing on top exchanges.

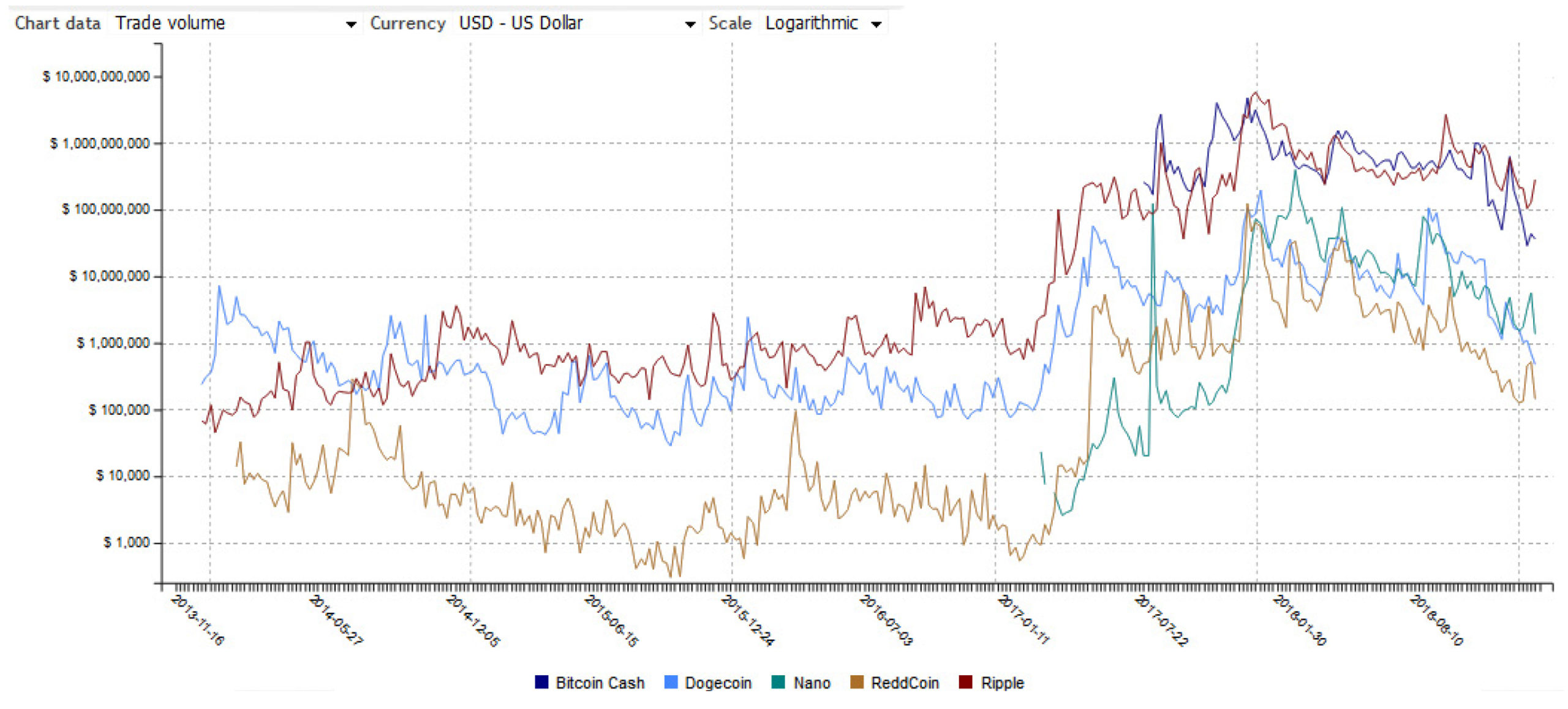

Dogecoin has lower trading volumes compared to Ripple and Bitcoin Cash. Overall, the dynamics of trading volumes among all project are almost the same. It confirms one more time that Dogecoin depends on the entire market. It is well traced starting from 2017.

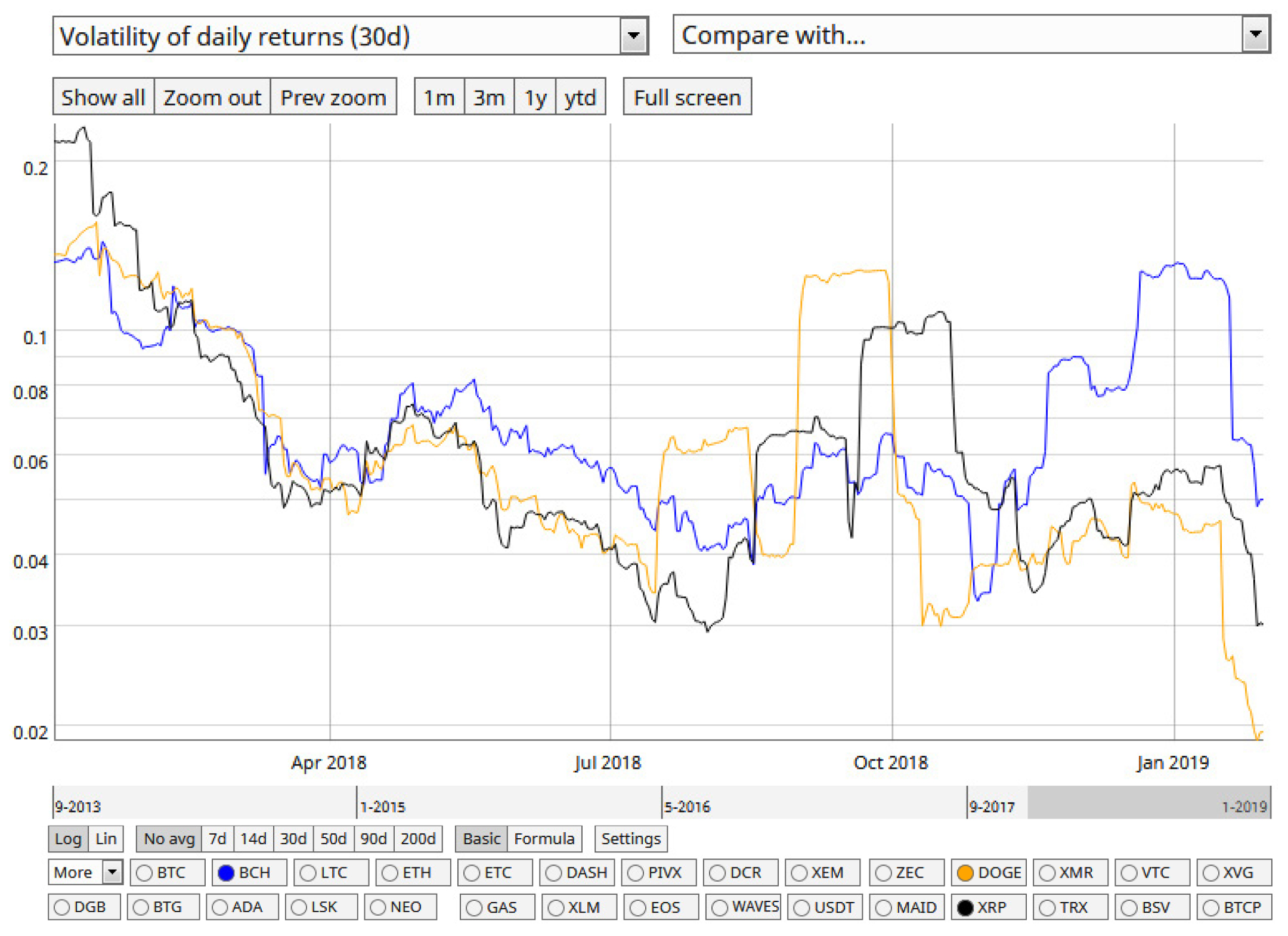

Another clear indicator that Dogecoin basically follows market behavior is its figure of 30-day volatility. However, DOGE is less volatile than its competitors at the moment. This is attractive for regular users.

Conclusion

Dogecoin began as a joke but turned into a serious project. It declared itself as a tipping system, which is popular in the blockchain industry. However, it faces lots of competition in this space. Moreover, this project has several shortcomings that greatly reduce its competitiveness: a weak team, an inflationary model, a lack of a roadmap, innovations and financial resources. These factors indicate that the Dogecoin blockchain will not be able to compete with other projects in the long-term.

The only thing that makes Dogecoin alive is its friendly and large community. Still, it can only maintain short-term competitiveness of the project.

Due to the risks associated with the project, Dogecoin is graded D.

The author(s) of this report is/are invested in the following coins: Bitcoin, Ethereum.