DECRED DIGITAL ASSET REPORT

DECRED DIGITAL ASSET REPORT:

DCR Update

TABLE OF CONTENTS

Investment Grade

Quick Facts

External links

Fundamental Factors

Introduction

Decred has been steadily developing its technology, ecosystem and overall project awareness. This steady stream of incremental changes has improved the project’s positioning in the digital payment space, which the market has failed to appreciate so far.

Awareness has been the main obstacle for Decred, but since the initiation report, the community has taken significant steps to overcome it. The marketing strategy executed by Ditto PR, as well as the broad community effort in regards to listings and token liquidity, have elevated market interest in the project. If this momentum continues to build, it will likely catalyze greater adoption rates of the protocol and ecosystem development going forward.

At the same time, Decred core value proposition as ‘Bitcoin with governance’ continues to improve, as new proposals continue to be submitted and approved through the Politeia system.

This has helped the project build a track record and solidify its case for longevity and sustainability of the network.

With a number of technological and adoption-focused milestones and steady progress, Decred looks significantly underappreciated, even given the current market.

The project continues to improve its awareness and adoption, while, at the same time, supplying a steady stream of technological catalysts. The positive dynamic is indicative of a fundamentally sound project, whose value the market is only starting to realize.

Infrastructure built for evolution

Decred continues to evolve its technology and ecosystem. One of its greatest advantages is that from a technological, financial and governance perspective, it can continue to successfully do so, without compromising its decentralization principles.

Politeia, Decred’s self-governance system continues to be a key facilitator of the project’s progress. The ecosystem has seen 27 new proposals approved since the initiation report, which should strengthen the project’s position in the market.

The release of Decred 1.4, among other things, brought in improvements such as smart fee estimations, performance enhancements, speed optimizations, improvements to the infrastructure and quality assurance.

These incremental improvements add further value and functionality to Decreds initial technology offering.

Additionally, the update included a proposal (99% approval) for adding relative time locks to Decred transactions in order to fully support the Lightning Network (LN), off-chain atomic swaps and more. The Lightning Network is already operational on the mainnet, however, the team does not recommend putting any significant amounts of DCR into it before the implementation is more mature. Nevertheless, LN should help the network scale, as the adoption of the protocol increases.

Part of Decred’s long-term strategy has been based on the idea of Lightning becoming mainstream and empowering all of the surviving networks. Thus, it is encouraging to see the community methodically executing on its vision.

The creation of the Python Toolkit is also promising. It offers a repository of code structured as a set of programming tools, or Python “modules” to enable easy support for Decred in third party applications. This goes in line with the project product-first adoption strategy and also follows the market trend of trying to attract developers from outside blockchain core enthusiast circles.

Decred has had one of the friendliest UX experiences for its wallet and has continued to build on that. The native wallet has had an update with Decred v1.4.0 that included Trezor integration, a new ticket buying process, bug fixes, a design overhaul and more. Now more than ever, sending, receiving and storing DCR is a simple process, which should help with the onboarding efforts.

Decred also improved its block explorer over the summer and it now includes new charts and data visualizations for exploring Decred data as well as improvements in performance, security and architecture. This information is important for users who want to track transactions, hash power, fees and more, and the functionality puts Decred’s analysis tools on a level playing field with projects such as Dash, Stellar and Bitcoin.

Critically, the effort should improve the networks appeal to developers and users, and positively affect adoption. It appears that the community is prioritizing product market fit, and its technology milestones fit in nicely with the overall growth strategy.

Overall, the network has seen a lot of technological improvement this year. Moreover, the team continues to build up and upgrade the infrastructure and release candidates of core software v1.5 are already being tested with the update expected in the near future:

The major changes include a consensus rules change to add block header commitments that was funded by stakeholders in June and an overhaul of the mining infrastructure (dcrd), initial privacy implementation (dcrwallet), experimental LN integration and UI tweaks (Decrediton) and porting a huge set of upstream updates (dcrlnd).

Furthermore, the self-funding model helps the project to continue building and maintaining the infrastructure. It also allows Decred to remain decentralized and independent, without the need to seek additional funding sources.

Since the initiation report, Decred’s treasury increased by over 4% and it’s now around 634,901 DCR (~$10.3M), which shows that the community is taking a careful approach to spending. Moreover, looking at the level of progress, it is reasonable to conclude that the community is quite efficient when it comes to allocating resources for ecosystem development.

New vectors

Decred has long maintained that it is designed to succeed in the long-run. So the project is adding new dimensions to its ecosystem.

The integration of privacy features, which are the first step towards higher privacy for Decred, creates more fungibility of tokens and will likely improve Decred’s positioning in a market where many other competing cryptocurrencies are also implementing privacy features. Moreover, privacy will add value to the project when considering its future potential as a payment provider.

The project uses a mixing process (CoinShuffle++) which is integrated with the ticket buying process, used in consensus, so stakeholders running ticket buying wallets can purchase tickets anonymously. The team has stated that these features require only a hundred lines of code for the core logic, compared to thousands or tens of thousands for other privacy implementations. The team reasons that this should make the upgrade more stable.

The community has also approved the proposal for building Decred’s DEX. It is expected to have no trading fees and require no intermediary token as it will use atomic swaps. If successful, it could significantly improve DCR liquidity and awareness. The launch is planned, before the Q3 of 2020, and fits nicely with the on-going market trend for DeFi solutions.

The deployment of privacy features and the development of the DEX will lay the foundations for Decred to be used as a digital payment provider and should give it a competitive advantage in the future.

Hidden in plain sight

Although the project has shown steady progress over the past years, it has historically received relatively low media coverage compared to other cryptocurrency projects. As a community coin, it has faced challenges with functions like marketing, listings and liquidity support.

However, the proposals in Politeia show that the community has real actionable solutions, in order to help the platform remain competitive in the market.

In recognition of the projects lacking marketing and awareness efforts, the Decred community hired Ditto PR, an external marketing agency to come in and resolve its issues. Evidently, these efforts have been perceived by the community as successful as a second contract was approved for the company in June of 2019. Included in the proposal alongside conventional marketing strategies was the development of a repository of educational materials and third-party content. This material can be used to further clarify to the wider crypto community the value proposition of Decred and help grow its community.

Since onboarding of the PR partner, the project’s team has been actively presenting Decred on different conferences, podcasts, and other media resources. These efforts have delivered an increased merchant adoption, as now over 379 merchants accept DCR as payment. The number of merchants has more than doubled since summer and continues to increase.

The project is also looking to expand its regional focus, there is currently a Politeia proposal to grow Decred’s brand awareness in Latin America. If approved, it could help the project grow its market presence in countries where crypto adoption rate is, on average, much higher than in the rest of the world.

As a community-driven project, DCR has had a more challenging route to get listed on major exchanges. Moreover, the lack of a centralized governing body made market making a complex issue to navigate. This may have contributed to subdued interest in the project.

To resolve this, the community approved a proposal on Politeia to hire i2 Trading as a market maker partner. The market-making activities officially launched on Oct 22 on all exchanges except OKCoin.

Although, the market-making activity is supposed to provide liquidity support rather than drive up the price, it can have a positive effect for a crypto asset.

Decred’s Price Chart

Moreover, Coinbase has stated publicly that they are exploring the possibility of listing Decred on its retail exchange. This would directly expose the project to potentially 10s of millions of investors worldwide and add considerable credibility to the project. This announcement may be riding on the back of investor thesis published by blockchain VCs. Most notably, Place Holder’s investment thesis and Blockhead Capital’s investment thesis explain why Decred is an important project with considerable long term potential as a store of value.

The recent adoption and awareness efforts coming from the Decred ecosystem show that the community is aware of its shortcomings and is putting forth a real effort to overcome them. Given that this has been the Achilles heel for the project in the past, the improvement could catalyze substantial growth going forward.

Conclusion

Since the spring of 2019 Decred has made progress, in terms of technological and ecosystem development, as well as in general awareness.

The renewal of Ditto PR seems to have been a fruitful endeavor as Decred’s social media presence has significantly increased. The market-making and listing developments are encouraging, as greater liquidity should make the underlying asset more accessible and attractive.

Politeia continues to assist the evolution of Decred and make it nimble in the face of a changing competitive landscape.

Furthermore, the quality of the approved proposals is very strong, varied and should improve the project’s long term viability.

If Decred can continue to grow in its awareness efforts and evolve on the technological front, this will likely catalyze organic growth and adoption of DCR going forward. Due to its recent improvements, Decred has been upgraded to a B-.

The author(s) of this report is/are invested in the following coins: BTC.

How to buy DCR

Step 0. Choose your preferred exchange.

DCR can be purchased from several cryptocurrency exchanges, the full list of available exchanges can be seen here.

Step 1. Head over to your preferred exchange.

If you want to purchase DCR, it is a good idea to use Binance. Not only it is one of the biggest liquidity providers for the token but the exchange is also among the most reputable on the market.

Binance allows withdrawals of up to 2 BTC without the KYC. However, users may be required to show evidence that their account registrations are consistent with Binance’s Terms of Use. In case of violation you will not be able to use the platform.

Step 2. Create an account on the exchange of your choice if you don’t already have one.

Step 3. Top-up your exchange balance with some of your BTC or BNB.

On Binance, DCR can be purchased with either bitcoin, or Binance Coin, so make sure to first send over some of the tokens to your exchange wallet. (Don’t forget to double-check that the address you are sending your coins to is correct!)

*Optional: If you don’t own BTC or BNB, the easiest way to buy them is through Coinbase or Binance.

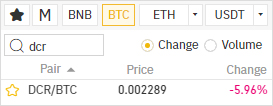

Step 4. Choose your trading pair

Head over to the exchange and choose the currency (BTC or BNB) you prefer to purchase DCR with.

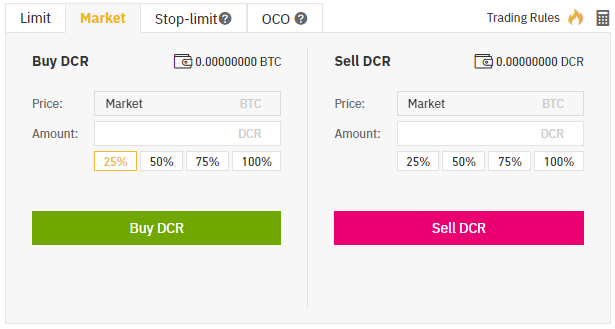

Step 5. Purchase DCR with a market or a limit order.

If you want to buy just a small amount instantly, it is easiest to use a Market Order.

Input the amount of DCR you want to purchase and press Buy.

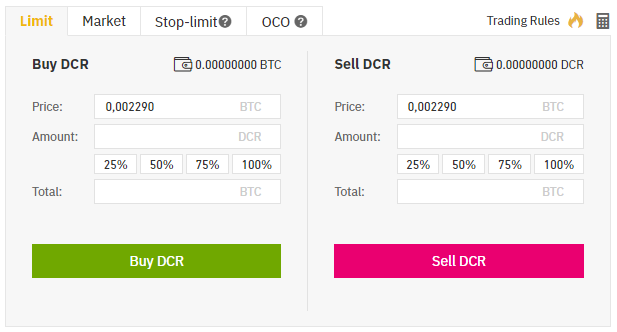

If you need to purchase a large amount of DCR, it is best to use a Limit Order to get the best possible price.

Input the amount of DCR you would like to purchase, and the price at which the order should be filled at and press Buy. (It might take some time for the whole order to be filled if you are purchasing a large amount).

Step 6. Store your DCR on one of the supported wallets for increased security.

To store DCR, you can use Trezor or Ledger for improved security.