CARDANO DIGITAL ASSET REPORT

CARDANO DIGITAL ASSET REPORT:

Update

TABLE OF CONTENTS

Investment Grade

Quick Facts

Funding Information

Raised $79,185,369.72 through 2015 – 2017 through public rounds.

External links

Fundamental Factors

Introduction

Cardano is a proof-of-stake blockchain that SIMETRI last reviewed in September 2019. It’s strongly recommended to read this report before reading this update.

The project started in 2015, with the network going live in 2017. While Cardano aims to be an Ethereum killer, it still faces technical challenges that prevent it from being competitive.

The market of base layer blockchains is becoming more crowded, with certain key players locking in their leads. Therefore, it might be too late for Cardano to change the existing market hierarchy.

For example, while Ethereum and Solana already have working decentralized applications, Cardano still does not have the minimal feature of smart contracts. Moreover, the project’s progress so far doesn’t instill confidence that it will launch smart contracts in October 2021.

Since Cardano hasn’t evolved with the market, we downgrade it to C from its previous grade of C+.

Key Takeaways:

- At the moment, Cardano is a “ghost chain” with no working applications.

- Although the team announced collaborative efforts with several governments, they haven’t yet resulted in anything substantial.

- The ADA token’s price has significantly grown with the rest of the market likely because of hype rather than fundamentals. At current levels, it’s overvalued on a risk-adjusted basis.

Market Opportunity

Cardano’s market presence continues to stagnate due to slow adoption in the government and enterprise sectors. Moreover, the project can’t expand in the decentralized application (dApp) market because of no smart-contract functionality. Meanwhile, the competition in the layer 1 space is increasing, which diminishes Cardano’s potential for growth.

Cardano has signed an agreement with the government of Ethiopia by introducing digital identification for university students. Other enterprise solutions, such as supply chain tracking, KYC onboarding, and product authentication were also developed. These solutions are currently available via Cardano’s private chain Atala and will only launch to the public in 2022.

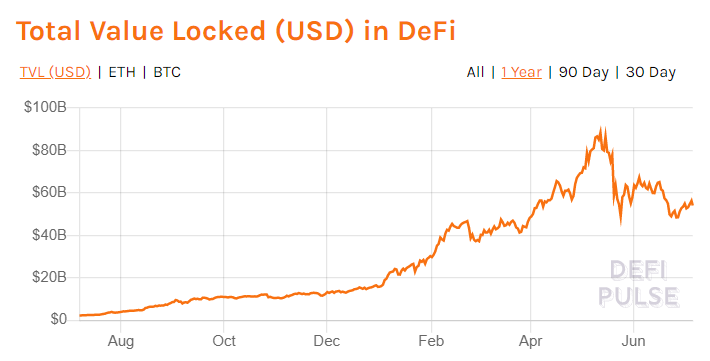

Enterprise development is time-consuming and success is not guaranteed. Thus, we believe that addressing the fast-growing DeFi market is Cardano’s shortest path to an active user base.

Suppose the project provides copies of the same apps on Ethereum or Binance Smart Chain and uses the right incentives, Then it could acquire users with much less effort than its current strategy. DeFi applications have already attracted billions of dollars and thousands of users, ensuring a clear product-market fit.

Total value locked in DeFi in USD | Source: DeFi Pulse.

If Cardano manages to secure even a small share of DeFi and NFT markets, its network activity will explode. Otherwise, while the team builds basic infrastructure for unproven markets, other platforms will continue to capitalize on existing demand. This will likely result in a very hard-to-close gap.

Overall, Cardano’s potential for expansion narrowed for several reasons. The project hasn’t yet reached meaningful adoption in the enterprise and retail niches, and there are not enough signals that this is about to change. Thus, we decreased the project’s grade to 5.8/10.

Underlying Technology

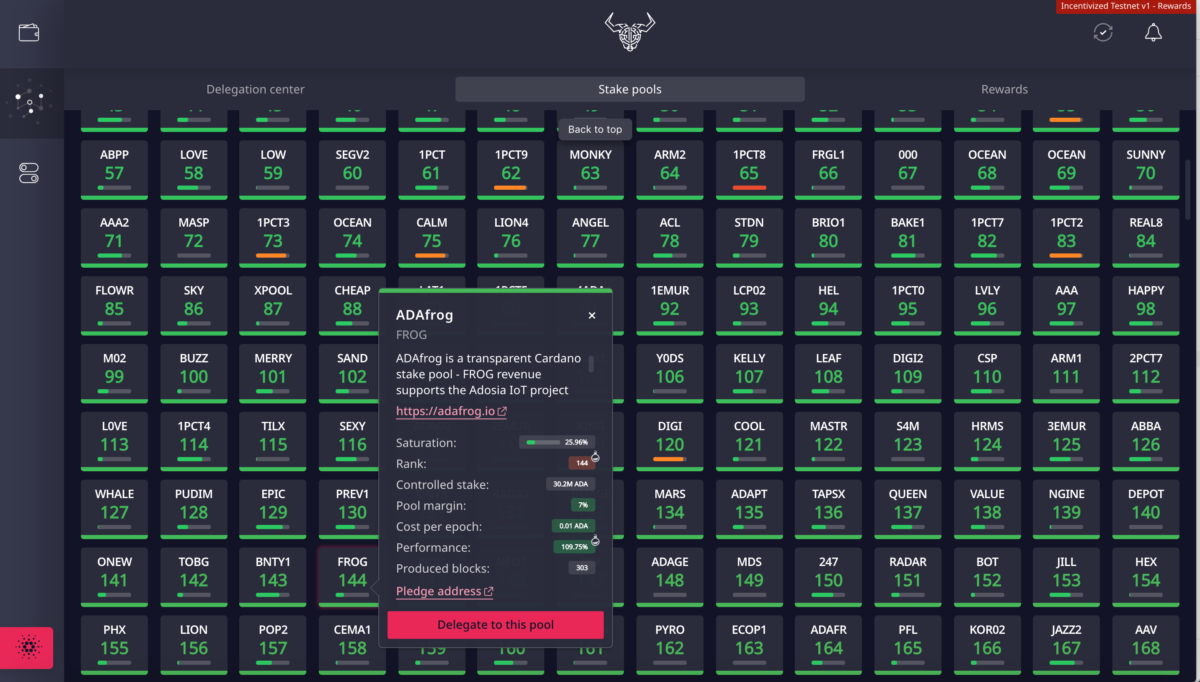

Even after the recent transition to a decentralized proof-of-stake (PoS) consensus, Cardano’s underlying technology is becoming outdated while still not fully functional. Slow development progress contributes to an overall weak infrastructure for the project.

Cardano successfully launched its PoS consensus algorithm called Ouroboros in mid-2020 after five years of development. Back in 2017, Ouroboros was Cardano’s unique selling proposition, which differentiated it from EOS and Tron because of its superior decentralization.

Cardano has hundreds of staking pools that can validate blocks, which is an advantage over EOS and Tron that only feature 21 block validators | Source: ADAfrog.

However, in 2021, Ouroboros no longer has a competitive advantage because new projects like Avalanche and Elrond have similar or better algorithms.

In the absence of smart contracts, the network is only good for transferring and staking ADA. Thus, decentralized apps cannot be built, making Cardano even more outdated than the rest of the layer 1 platforms.

Cardano has also created a smart contract language, Plutus, which is based on the little-used programming language Haskell. Because of Haskell’s small developer base and narrow focus, the Cardano team needed to spend considerable effort modernizing it for their needs. This is likely one of the main reasons for delays in launching its smart contracts.

Even when Plutus is finalized and the smart contracts launch, we don’t expect many developers to move to the network. Plutus requires knowledge of complex programming concepts that will make building even basic dApps difficult.

Overall, this means Cardano’s technology has become outdated before it even goes fully functional. Hence, it will likely remain an afterthought for dApp builders, which is why Cardano’s grade is reduced to 6.5/10.

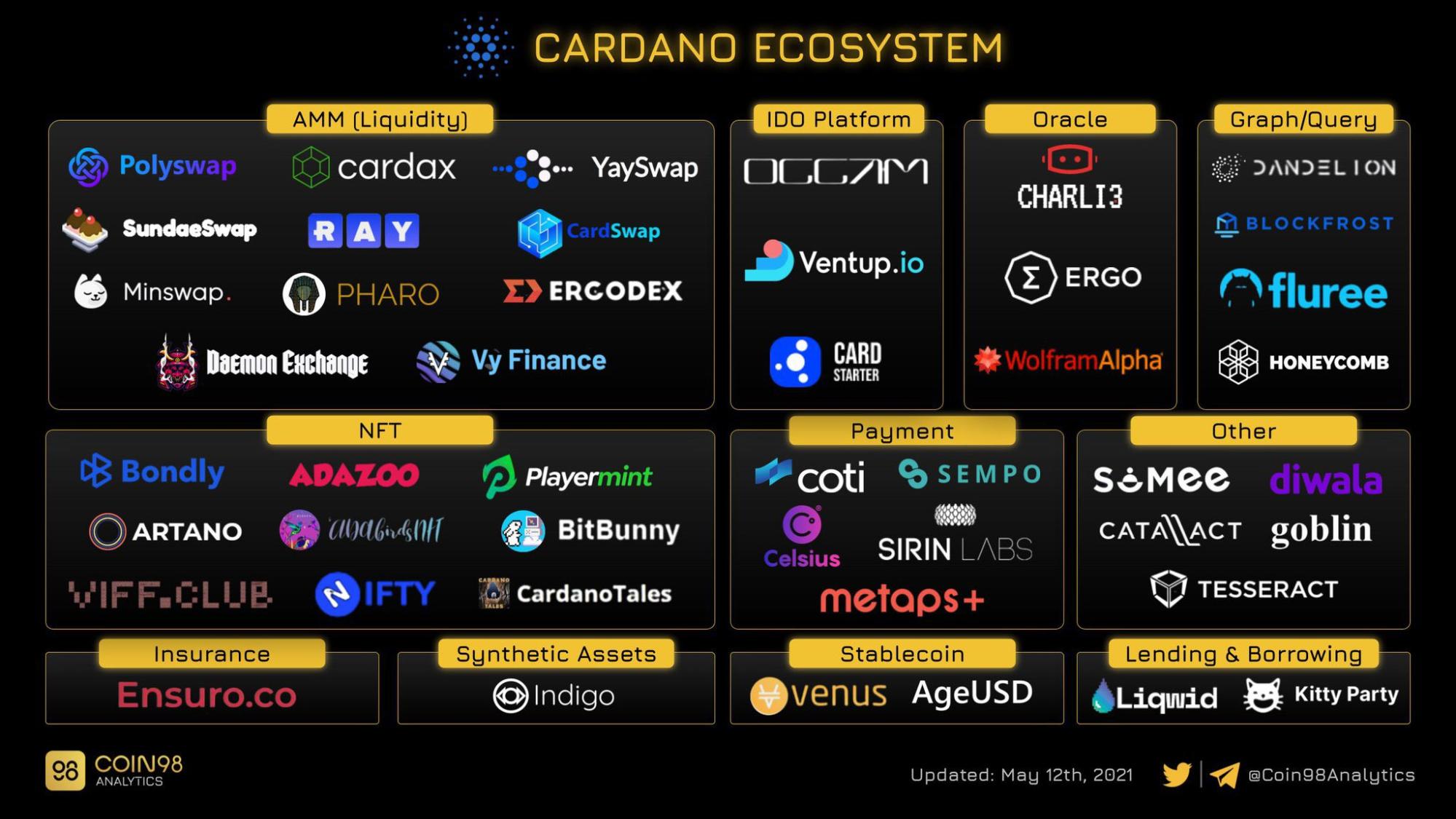

Ecosystem Development

Despite Cardano having a large set of validators, the ecosystem is still underdeveloped. Merely looking at the negligible number of transactions on the network illustrates Cardano’s problem—lack of users.

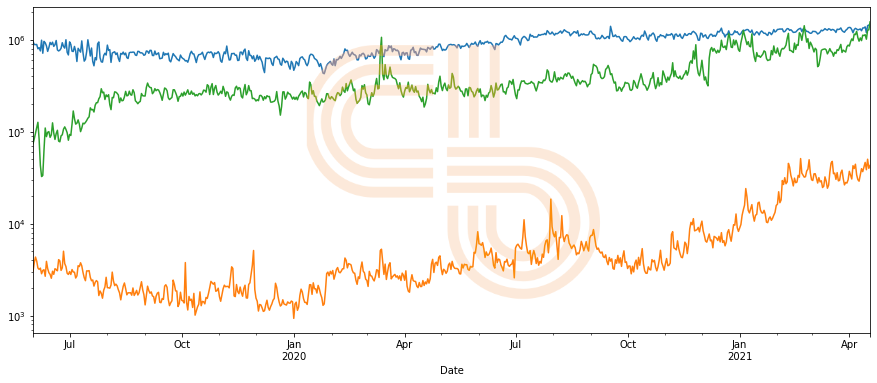

Number of daily transactions on Ethereum (blue), Binance Smart Chain (green), Cardano (orange) | Source: CoinMetrics.

As shown above, the network has low active usage, with only 55,272 active addresses and 27,920 transactions made on its blockchain in the last 24 hours, according to CoinMetrics.io on-chain data as of 22 July 2021.

On top of that, the existing projects claiming to be a part of the Cardano ecosystem don’t contribute to on-chain activity. Although there are some projects that expressed willingness to build on top of the network, they can’t do so without smart contract functionality.

The situation is exacerbated by the fact that some of these projects are already building on other blockchains, and there’s no guarantee that they will migrate to Cardano once its smart contracts are live.

Projects like Bondly and VENUS already have working products on Ethereum and/or BSC. We believe they will expand to Cardano in the future only if there are enough users on Cardano to justify the cost.

Another example is OccamFi, which aims to be a decentralized Cardano launchpad. The project currently runs on Ethereum and helps raise funds in ETH. One of its incubated projects, Theos.fi, will build an NFT platform on Cardano. It recently started its development on Ethereum first as Cardano—lacking smart contracts—is not ready for developers.

No dApps means no usage. The number of active addresses on the network is still very low compared to Ethereum and Binance Smart Chain because, in its current state, the Cardano blockchain does not have much use besides transferring and staking ADA.

Overall, Cardano’s ecosystem is still underdeveloped. While some developers want to build on top of the network, it’s still not possible. Hence, they do not contribute to the on-chain activity and users have little interest in jumping to Cardano. Therefore, we maintain a grade of 5.5/10.

Token Economics

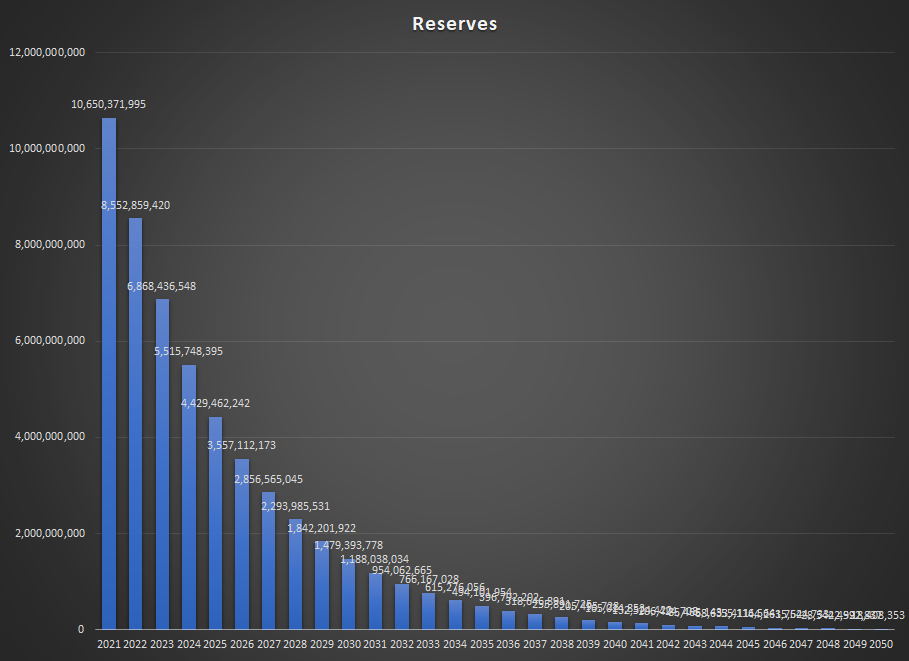

Current token economics look attractive, with approximately 71% of the total supply already in circulation. Moreover, the network does not have any aggressive unlocks in the future.

All of the tokens from investors and foundation are already released, with yearly staking rewards slowly increasing the circulating supply. Inflation is expected to be 2.1% per annum, with 82% of total supply in circulation after ten years.

ADA emissions to circulation | Source: Cardano.

For comparison, the high-profile project called Internet Computer Project has aggressive token unlocks for private and seed investors. These tokens will be released into the market every month with 12x-1,000x of unrealized profit at current price levels. Comparatively, Cardano has little selling pressure from early investors and insiders.

Given that most ADA is already circulating and the expected inflation is low, we improved the project’s grade to 8.0/10.

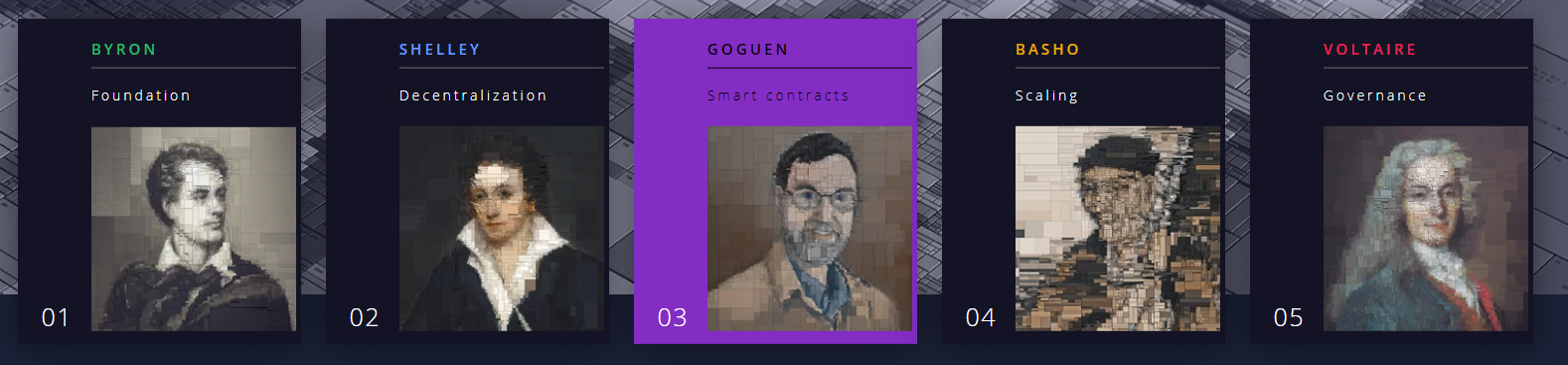

Roadmap

Cardano is far behind schedule, with major milestones already postponed several times.

The Shelley update for staking was completed in Q2 2020, one year later than promised. As part of the Goguen update, smart contacts were planned for 2020, but are still in development.

Given a consistent history of missing deadlines, we reduce the project’s grade to 4.0/10.

Token Performance

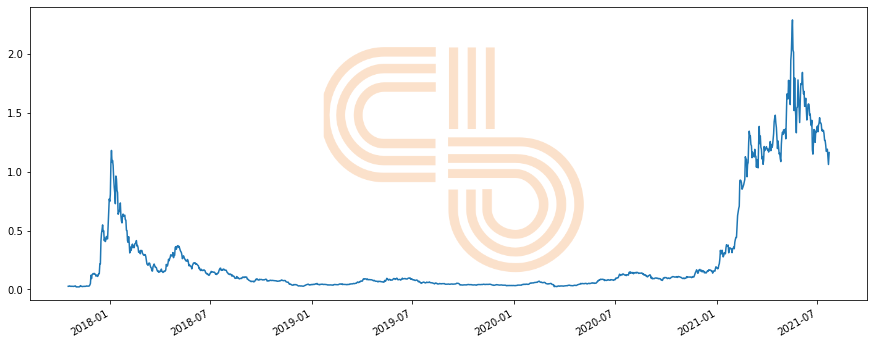

ADA has grown tremendously with the overall altcoin market, mainly due to retail speculation and marketing stunts. We believe that it’s not an attractive investment at the current price levels.

The price growth of ADA since 2020 was impressive. The token went from $0.03 to $1.17 (39x return) and peaked at $2.43 (81x return) in May 2021.

One of the main reasons for such price action is speculative interest from retail investors, marketing by McCann Dublin, and various announcements from Charles Hoskinson and celebrities like Gene Simmons.

ADA is currently ranked 5th by the market cap with a valuation of ~$37.5 billion. Given the absence of smart contracts, we believe that current valuation is inflated on a risk-adjusted basis and is a backward-looking performance measure.

ADA price | Source: CoinGecko.

Still, due to ADA’s impressive run, we increased the project’s token performance to 6.0/10.

Conclusion

Despite retail obsession over Cardano, the project will likely struggle to increase its market share as competition in the layer 1 space continues to grow.

While rivals like Ethereum and BSC already have working technology and growing user bases fueled by thriving ecosystems, Cardano remains behind.

ADA’s recent price appreciation is likely attributed to hype and marketing driving retail speculation.

Thus, we believe the project is significantly overvalued and reduce its grade from 6.5/10 to 6.4/10, which corresponds to a decrease from C+ to C. We do not recommend investing in Cardano at this time.

Disclosure: Of coins mentioned in this report, the authors own ETH, FLOW, and ICP.