BINANCE COIN DIGITAL ASSET REPORT

BINANCE COIN DIGITAL ASSET REPORT:

BNB Review and Investment Grade

TABLE OF CONTENTS

Investment Grade

Fundamental Factors

Summary

Although Binance is less than two years old, it has become one of the most iconic brands in the crypto industry. In 2017, it started as an exchange and has quickly become the standard for stable liquidity and low fees for traders.

The meteoric growth of its user-base enabled Binance to make substantial profits during the ICO gold rush and start to expand beyond its exchange offering.

With Binance Labs, Binance Launchpad, DEX, and the multitude of support tools, the company is transforming into a comprehensive infrastructure player.

However, with the crypto industry maturing, Binance is set to face many of the same risks faced by other projects in the space. The legal landscape is slowly taking shape, which may soon start limiting Binance’s maneuverability in the grey zone, and the arrival of incumbents from the financial industry may be more dangerous than many perceive.

Still, the company and its native asset BNB have so far performed admirably during the crypto winter and remain one of the vital foundational elements of the space.

Market Opportunity

Binance is a major player in several adjacent markets, including trading, token launch and accelerator platforms. At the moment, Binance has a comfortable lead in the centralized exchange sector but has also started to enter the DEX space. The token launch and accelerator functions are carried by Binance Launchpad and Binance Labs, which have acted to support the blockchain startup community and revive the ICO market.

The blockchain industry is an actively growing space for which the trading infrastructure acts as the vital bloodline. Despite the entire cryptocurrency market being currently very volatile and in a bearish state, financial experts anticipate future growth up to $5 trillion in 2022. Should this be realized, exchanges will see an enormous increase in volume.

At the moment Binance is the largest centralized crypto exchange in terms of trading volume. However, there are hundreds of other exchanges out there, which vary in volume, tools and centralization characteristics.

The biggest CEXs by trading volume that present direct competition for Binance are Bitfinex, Kraken, Upbit, and Coinbase. Binance has been successful in using the BNB token as an incentive mechanism to attract traders and create volume.

While Bitfinex and Kraken provide broader functionality and are designed for professional traders, Binance is more suitable for middle-level traders, offers higher trading volumes and more cryptocurrency pairs. By focusing on the needs of the retail customer, Binance has been able to generate network effects very early in its development.

Its focus on fundamentals has separated it from the likes of Bitfinex (which suffered a 120,000 BTC hack in 2016) as one of the most secure platforms available. While the team intends to implement functions such as spot trading, margin trading, and futures, its focus on retail users and trading volume has enabled it to establish a commanding position in the market.

At its inception Binance was envisioned as a crypto-crypto exchange. This has given its rivals a competitive advantage in the space. From this angle, Coinbase can be seen as a major threat. While Coinbase has a much stricter listing policy and, as a result, offers far fewer trading pairs, its fiat on and off ramps make it an attractive choice for users. In fact, it is not uncommon for users to convert fiat into crypto in order to transfer funds to Binance. Moreover, Coinbase provides digital asset custody services for institutions (about $500 mln in assets under custody now), and has been building up its suite of tools through M&A activity. If Coinbase and similar exchanges start to ramp up listings, their regulated nature and fiat capabilities will be tough for Binance to compete with.

The company also must compete with different local exchanges. These exchanges can benefit from local fiat currency ramps, community awareness and more. Local exchanges range in size and could be very small and only locally focused or have substantial volumes and international reach.

Upbit, for example, operates mainly in the South Korean market and yet reaches approximately half of Binance’s trading volume. The availability of KRW trading pairs and positioning in the local space enables it to defend its market. There are other exchanges with similar characteristics like Bithumb, Coinone, and Korbit, and similar dynamics are playing out across Asia, Europe, Africa and Latin America.

Binance has already launched several fiat-to-crypto exchanges, including Uganda in October 2018 and Jersey in January 2019, and it plans on launching at least two fiat-to-crypto exchanges on every continent. However, local players will still be able to maintain some presence in their respective markets and major regulated exchanges will be able to offer capabilities and services that Binance does not, until the latter chooses to subject itself to stricter regulation.

By its nature, the crypto industry strives towards decentralization. That is why centralized exchanges may not be an optimal solution for the ecosystem in the long-term. There are already a number of ready-made DEX solutions that represent various degrees of decentralization.

The crypto big three of Ethereum, EOS and Tron have hosted a number of DEX solutions, while the likes of Stellar and Waves have also spawned their own alternatives. Some claim better security, others lower transaction costs or better UX/UI, but all suffer from a fundamental lack of liquidity.

Without stable liquidity an exchange has very limited use. Now, with established exchanges like Huobi and Binance entering the fray, this issue may finally be addressed. Centralized exchanges have an existing user base and if the crypto community ends up favoring DEXs over centralized options, they will likely be able to capture the volume necessary to offer stable asset markets.

Among the major centralized exchange players, Binance is ahead of the curve when it comes to DEXs. It has already launched the testnet of its DEX, and intends to ensure high liquidity by attracting its existing client base and providing a user-friendly interface. In addition, the Binance DEX will work on its own blockchain to ensure high bandwidth. The BNB token will be used inside the blockchain to pay for network transactions.

At the moment this exchange appears centralized, because it works on a limited number of nodes, but it will become more decentralized over time.

Again, Binance has shown a preference for quality over quantity, focusing on transaction speed and market formation to start. Being the trendsetter, Binance is trying to position itself as a true market leader and start to form moats based on network effects.

As crypto exchanges grow their size and influence, they begin to encroach on traditional financial services space. So it is no surprise that Binance is starting to see competition from the incumbents, with two prominent examples being Bakkt and ErisX.

Bakkt is an exchange platform developed by Intercontinental Exchange, a leading operator of global exchanges, which aims to launch 1-day futures contracts of physically delivered Bitcoin. As a regulated exchange platform, it will offer a range of services from custodial to fiat on/off ramps and physical delivery of futures contracts.

Similarly, ErisX will enable users to trade physically delivered futures for Bitcoin, Bitcoin Cash, Ethereum and Litecoin. The expected arrival of these to regulated platforms could significantly alter market shares for existing players and bring on a wave of institutional money.

Given the resources, partnerships and investors of these projects, they can easily become key players among cryptocurrency exchanges. Furthermore, they may have an easier expansion path, as the investors and partners have access to user bases that by far exceed the size of the entire crypto industry.

To this point, the retail user has shown tame interest for decentralized trading services. If the trend persists, institutional players may be able to obtain a significant competitive advantage because of their regulated nature and access to vast user pools.

The regulated exchanges, both incumbent and crypto-native, present the biggest threat to the expansion of the Binance exchange business in the medium-term future.

In addition, Binance sees its future not only as a leader in the market of crypto exchanges but also as a major infrastructure player as a whole. Therefore, the team is actively opening new markets for itself as a token launch platform (Binance Launchpad) and as an accelerator for crypto startups (Binance Labs).

Binance Launchpad is a unique platform that provides full advisory services for projects and intends to conduct at least one Initial Exchange Offering monthly. An IEO is similar to an ICO, but in this case the placement is made through an intermediary – an exchange. This could spark the revival of the ICO market, if investors and projects see a concrete path to liquidity. However, Binance is not the only exchange to be developing such a product, with Huobi, and Bitmax already joining the party, and OKEx, Bittrex, and KuCoin not far behind.

Still, high trading volume and a large client base provide high liquidity, which should give Binance a major advantage in the IEO space.

Also, Binance is increasing its positive influence on crypto industry development through its unique Binance Labs crypto accelerator. This is an investment fund that invests in projects like public blockchains, DEX, wallets & payments, stable digital currencies, security token platforms, and dApps. It has already successfully invested in 12 blockchain projects, with more to come.

Influenced by rapid and widespread development of Binance, the BNB token gained wider use in the crypto industry.

As a result, the community might start using BNB not only to get a discount when trading, but also as a payment coin. Thus, the Binance coin can start to compete with cryptocurrencies like Dash.

At the moment, Dash enjoys wider implementation as a payment coin. However, while Dash has an extensive merchant network and developed infrastructure, Binance has a huge client base and intends to launch a technologically advanced blockchain. Given Binance’s resources, its worldwide brand recognition and existing partnerships, BNB has the potential to gain widespread adoption among merchants through listings on Pundi X and similar platforms.

To summarize, Binance has a developed infrastructure and significant resources to dominate most of its business endeavors. So far it has occupied its niche only as a centralized exchange, but Binance has potential to become the most successful token launch platform and crypto accelerator. Binance’s team will also increase its presence in the crypto world as a decentralized exchange and a payment coin.

This means that the value of BNB token will only grow.

The long-term prospects of Binance also depend on success of institutional exchanges, which can attract huge investments in the crypto industry and potentially overshadow Binance.

Underlying Technology

The Binance Coin (BNB) is an ERC-20 token that will be converted to a native coin after the launch of the Binance Chain Mainnet. The main purpose of launching its own blockchain was to create an alternative marketplace for issuing and exchanging digital assets in a decentralized manner. Binance DEX will be built on that blockchain, enabling users to utilize BNB to pay transaction fees.

Binance decided to build a very simple chain to provide high bandwidth and cope with the large trading volume. Its blockchain uses the Tendermint BFT consensus algorithm without embedded smart contracts. Thus Binance Chain only supports functions for trading and issuance of new tokens. Also, while the current transactions-per-second rate of the blockchain is a couple of thousands, it can be scaled up if needed.

The Binance blockchain is maintained by a number of nodes:

- Validator Nodes

Maintain the Binance Chain/DEX data, validate all the transactions, and collect fees. For the testnet Binance’s team elected only 11 test nodes to ensure high performance. As time goes on, more validators will be added to the Binance network. - Witness Nodes

Do not join the consensus process and produce blocks. They store the Binance blockchain, propagate the chain state around the network and broadcast transactions to all other nodes. - Accelerated Nodes

Provide more secure and faster lines to access the Binance blockchain. This node is a special infrastructure built around Validator Nodes to facilitate accelerated transaction routing and provide richer, faster user interfaces. There are only 2 accelerated nodes on testnet, but this number will be increased.

Binance launched a testnet of its DEX in February 2019, which looks very simple and centralized. The team is focused on making it reliable and fast, so that it can handle a large amount of transactions. Afterwards it intends to improve the exchange functionality and increase the number of validators over time to make Binance Chain more decentralized.

At the moment the team is working on launching the Binance Chain mainnet. Its testnet uses BFT consensus algorithm, but mainnet will be based on BFT+DPoS. Following the launch, the team is going to enhance the adoption of Binance DEX, to which end it plans to increase the number of markets on its DEX. In the initial version all coins will be based on the Binanсe Chain. Native inter-chain mechanism is not supported in Binance Chain on its testnet.

It is impossible to transfer coins between Binance Chain and other chains, such as Bitcoin or Ethereum network directly, but this may become possible in the future.

In terms of scalability, the Binance blockchain appears to be on equal footing with leaders like Tron, EOS, and Stellar. However, in terms of features, Binance Chain is not comparable with its competitors, because it only supports basic trading functionality.

While this may be enough for Binance’s immediate goals, its technological solutions lack any novelty or breakthrough characteristics.

Overall, Binance’s team intends to build the best decentralized exchange on the market. Therefore, the Binance blockchain is designed in such a way to handle a great amount of trading volume and provide a high level of UI/UX.

Ecosystem Development

Binance is a blockchain ecosystem comprised of CEX, DEX, Labs, Launchpad and Info. While Binance CEX operates on centralized servers, Binance DEX operates on the scalable Binance Chain. Its testnet uses the Tendermint BFT consensus algorithm and works on 11 nodes that are controlled by Binance partners. This indicates the centralization of Binance DEX, but the team claims that the most important thing for them is to ensure high performance and security, and then to make it more decentralized. This clarifies the centralization issue.

In addition, it may seem that there is centralization in the wealth distribution among the BNB holders (top-10 wallets hold about 70% of the coins). However, this is an advantage of Binance, because about 49% of all coins remain in its exchange, which indicates several positive qualities: high BNB liquidity and practical use of the coin (discount on trading fees, voting for coin listing, participation in IEOs on Binance Launchpad).

Another sign of centralization is the fact that the ecosystem development mainly depends on the activity of Binance’s team. However, this has brought great success to the project and enabled it to become a leader in the global market of centralized exchanges in less than 2 years. Given the product quality, the size of financial resources and the experience of the team, this exchange will most likely remain in the leading position in the future.

Currently, Binance has listed more than 140 cryptocurrencies, which attract traders to the exchange. To achieve such a success, the team focused on the crypto-crypto model and chose a place of jurisdiction with more favorable regulation (Malta). Moreover, the active position in relation to the ICO listing has allowed it to attract attention from the crypto community. Thus, Binance ensured fast-growing trading volume and a huge client base. The user-friendly interface, high liquidity and high security satisfy new traders who then remain on this exchange.

Binance is also interested in listing the best ICO coins. For this purpose, the team even conducts competitions for a free listing, which increases the chances of projects to list their digital assets. However, the majority of projects are expected pay high listing fees (~up to $1 million), which adversely affects the exchange’s reputation and leads to indirect losses of trading volume and client base. Regarding this issue, Binance argues that it donates listing fees to charity, which slightly clarifies this situation and improves its image.

Nowadays, the Binance brand is known to everyone as a top centralized exchange, but the team intends to expand its business model. Binance is developing the Binance DEX because the team believes that cryptocurrency trading should be decentralized as well. Moreover, the Binance team has the necessary resources to make Binance DEX the leader of the decentralized exchange market.

The team has already launched the testnet of Binance DEX with a friendly user interface on the scalable Binance blockchain. Since its centralized exchange has huge trading volume and client base, the team may also be able to provide high liquidity on its DEX, and therefore to quickly obtain a leadership position in the space.

The team intends to charge a listing fee of 2,000 BNB in order to prevent the listing of scam projects. First the team will decide on listing, and after the launch of the mainnet the Validator Nodes will vote for the listing of a particular project. This provides an opportunity for the community (through the nodes) to participate in the development of the exchange.

Another important component of the Binance infrastructure is Binance Launchpad, which gives hope for the revival of the ICO and generates an increased demand for BNB. This is a unique token launch platform on which IEOs of BitTorrent, Fetch.AI and Celer Network have already been completed successfully. Moreover, the team intends to conduct at least one IEO on this platform monthly, which will also increase the activity of the entire crypto community.

To make participation in the IEO on the Binance platform more honest and transparent, the team decided to conduct a lottery instead of a first-come-first-served system. Thus, Binance responds to the rapidly changing IEO market, listens to its community and adapts to the market.

Binance also intends to expand its presence in the crypto industry by working on the development of the entire blockchain infrastructure. To this end, Binance’s team created Binance Labs, an investment fund that finances various projects.

Binance Labs has already grown 12 projects: OasisLabs, MobileCoin, Republic, Certik, Pivot, CRED, Contentos, Cocos, Terra, Koi Trading, Capitalise, and BitTorrent. It also intends to hold the second season of the incubation program in March 2019 and is ready to invest $500,000 for a 10% equity in start-ups.

Binance’s team is also convinced that in order to develop the blockchain industry, it is necessary to pay more attention to education. Therefore, Binance Academy, Binance Info, Binance Research have been made available to users to follow market trends and learn blockchain basics.

Binance takes an active position in relation to the development of the entire blockchain infrastructure, which ensures its long-term viability. At first the team built its brand around its centralized exchange, which attracted great attention from the crypto community. Now Binance can enter other crypto industry segments using accumulated resources.

In addition, Binance decided to make its contribution to the development of the charity sphere, which increases loyalty to the company. The team created the Blockchain Charity Foundation to bring full accountability to this field, enhance financial efficiency and resolve the issues of trust.

Such an active position of the Binance team has led to the creation of one of the largest communities in industry. It is not surprising that the Binance’s client base by far exceeds the community size of its competitors, both centralized exchanges and well-known blockchains.

Nevertheless, Binance’s dominance is restricted by its presence in under-regulated domains. Until the issue of fiat ramps is resolved, Coinbase and other regulated players will be able to continue to expand their influence.

Binance’s team is also actively working to increase the adoption of BNB by signing new partnership agreements. The most known of them are shown in the table below.

Binance takes an active position in relation to the development of the entire blockchain infrastructure, which ensures its long-term viability. At first the team built its brand around its centralized exchange, which attracted great attention from the crypto community. Now Binance can enter other crypto industry segments using accumulated resources.

Token Economics

BNB is an ERC-20 token built on Ethereum, but it will be swapped to the native Binance blockchain when the Mainnet is launched. This token was conceived for trading fees payments. But right now, the Binance coin has many implementations and is considered a cryptocurrency.

Binance has various types of fees: trading fees, withdrawal fees, listing fees, etc.

Trading fees – If a trader does not utilize BNB to pay trading fees, then each trade will carry a standard fee of 0.1%. Traders can receive a 25% discount on trading fees using BNB. The discount rate will decrease by 50% each year: 1st year – 50%, 2nd year – 25%, 3rd year – 12.5%, 4th year – 6.75%, 5th year – no discount.

Withdrawal fees – are dynamic and automatically adjust based on the market conditions. Current withdrawal fees can be found here.

Listing fees – a project should pay $100,000 to list its digital asset on Binance DEX.

Binance’s team will make all listing fees on Binance CEX transparent and donate 100% of them to charity. Projects’ teams can propose a listing fee.

Transaction fees – users utilize BNB to pay transaction fees on the Binance blockchain. Fees can be paid in any asset, but the network would charge BNB first and apply a discount if the address has the BNB balance. The fees will be adjusted periodically.

Reward– fees paid on the Binance blockchain will be equally distributed among all Validator Nodes.

Voting – users can utilize BNB to vote for free listing of a certain project on the Binance exchange. Voting power depends on the amount of BNB held by a voter.

UIA – anyone can pay a fee and issue a token on the Binance blockchain.

Speculation – BNB is traded on many exchanges.

According to bitwiseinvestments.com, Binanсe is the only non-regulated exchange of the top-81 with 100% real trading volume, which is not the case for its competitors. This means that the high liquidity of assets on the Binance exchange is real, and it is attractive for traders.

Payment – BNB is also used in other payment systems. Users can utilize BNB on platforms like TravelbyBit, Mithril, Gifto, DENT, AERON, and others. In addition, BNB holders can use its tokens to pay for travel expenses, gifts, and aircrafts in the pilot shop, and other goods. Also, users can buy anything from stores that use the XPOSdevice by Pundi X.

Binance’s team held the Token Sale on July 2017 and collected around $15,000,000. The token distribution looks as follows: 100 million – ICO, 80 million – Founding Team, 20 million – Angel Investors. The team has used all financial resources raised during ICO for development, marketing, branding, and other expenses.

BNB will grow in value in the long-term because Binance has built a deflationary model of token economics. The team announced that it would use 20% of its profits to buy out part of BNB tokens and burn them quarterly. Most likely, the team does not buy all the BNB from the market because they can burn BNB from its reserves. Overall, the token supply will be reduced to 100 million. Since operating activities generate an annual profit of about $446 million, this allows the team to keep their promises. As a result, current token supply has already decreased to 189 million.

Binance’s team has built an effective model of token economics, which supports wide practical use of BNB. This ensures the stability of financial resources in the company, which uses them to scale the Binance infrastructure. This, in turn, leads to an increase in demand for the Binance coin, and moves its price upwards. This effect is also enhanced by the team’s continued reduction of the total supply of coins. Overall, the BNB economic model will ensure long-term competitiveness of Binance in the market.

*These values can vary depending on BNB price (Note: a further burn was conducted in April 2019, at which point 829,888 were removed from circulation.) | Binance Coin Burn Rate

Core Team

The CEO of Binance. He has extensive experience in trading systems. CZ founded BijieTech, which powers 30+ exchanges in Asia. He also co-founded OKCoin and helped launch their futures trading platform. CZ was developing trading systems for Fusion Systems Ltd and Tokyo Stock Exchange. He also was the Head of Technology at Blockchain.info team and helped grow its service. This experience makes him an excellent CEO of Binance.

The Chief Growth Officer of Binance. He has graduated from Cornell University with MEng. in CS. Ted Lin leads the growth, commercial and education initiatives at Binance. He worked as EMEA General Manager, Sales & Marketing at Infortrend Technology, Regional Sales Head at Transcend Information.

The Head of Binance Labs. She graduated from Stanford University Graduate School of Business with an MBA in Entrepreneurship, Investment. Ella has over 14 years of interdisciplinary experience in VC and frontier technologies. She was the youngest investment director of KPCB, one of the most prominent VCs on Sand Hill Road. Ella also co-founded XiaoduoAI, which provides NLP solutions to more than 3,000 clients.

Binance is a blockchain ecosystem that consists of Exchange, Labs, Launchpad, Info, Academy, Trust Wallet, and Blockchain Charity Foundation (BCF). As a consequence, Binance formed an international team of approximately 400 people, which has vast experience in both financial and crypto industries. They worked in several exchanges and developed a wide network of partnerships, a key factor for success. The company was founded in China and then was registered in Malta, which has more favorable regulation for crypto business. However, the current location of the team is unknown, which indicates some of its secretiveness.

Binance’s team has huge ambitions and is capable to implement them. It working effectively in all branches of its business. The increase in the BNB price under bear market conditions is an indicator of their success. In addition, Binance is constantly recruiting people to scale their businesses faster. From a financial point of view, the team also shows excellent results, reaching an annual profit of $446 mln in 2018. Overall, Binance’s team shows promising long-term potential.

Roadmap Progress

Binance does not have an official roadmap, but the team announces their plans and achievements in their blog. Also, the CEO Changpeng Zhao conducts AMA to answer all important questions, which indicates the transparency of the team.

Currently the team is working on a number of projects: Binance exchange, Binance Chain, Binance DEX, Launchpad, Labs, Academy, Research and Blockchain Foundation Charity.

Binance Exchange:

- Increase the presence in local markets around the world in the next few years, i.e. the team intends to launch at least two fiat-to-crypto exchanges on every continent.

- Add functions: OCO, trailing stops, visible orders, margin trading using smart contracts.

Binance Chain and DEX: the Mainnet launch date will be announced later. This is the most important project for Binance’s team which will be released in 2019.

Binance Launchpad: Matic is the next upcoming IEO in April 2019. The team plans to conduct at least one IEO on its platform monthly.

Binance Labs: Binance Ecosystem Fund invests in public blockchains, DEX, wallets & payment, stable digital currencies, security token platforms, and dApps. Binance Labs has already helped to launch 12 projects and will conduct Season 2 of its Incubation Program in March 2019.

Binance Academy and Research: Academy will publish new articles to educate users. Binance Research will provide professional and deep analysis for investors to increase the quality of information in the crypto space.

Blockchain Foundation Charity: intends to support charitable activities in order to develop innovative, sustainable, transparent and decentralized solutions in this area.

Overall, Binance has a lot of plans for company development. It has a very strong, stable team and financial system that will allow Binance to survive in any market conditions. In his AMA, CEO CZ said how he sees Binance in 5 years:

“We want Binance to be the infrastructure builders, so we want Binance to either build infrastructure ourselves or invest in other projects that build infrastructure. We want to be the guys building the roads if you use the physical world as an analogy. We want to be the guys building the road so that other people can build buildings in the city.

In terms of infrastructure, what does that mean? That means exchanges, wallets, faster blockchains, more decentralized exchanges. Anything that has to do with core infrastructure, we want to build.”

Binance’s team actively interacts with its community to get feedback and respond quickly to it. This company is transparent and has long-term prospects to become a leading infrastructure player in the blockchain industry.

Token Performance

BNB token is in the top-8 coins by market capitalization and it is in the top-14 coins by trading volume (24H).

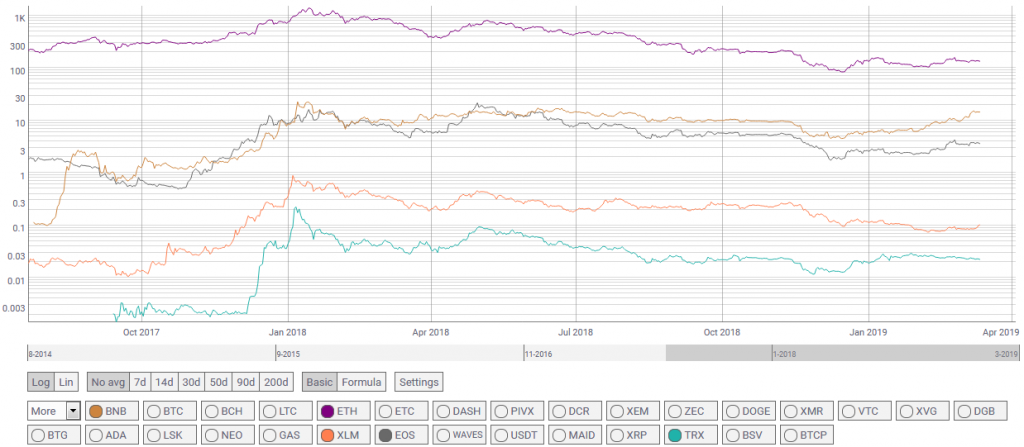

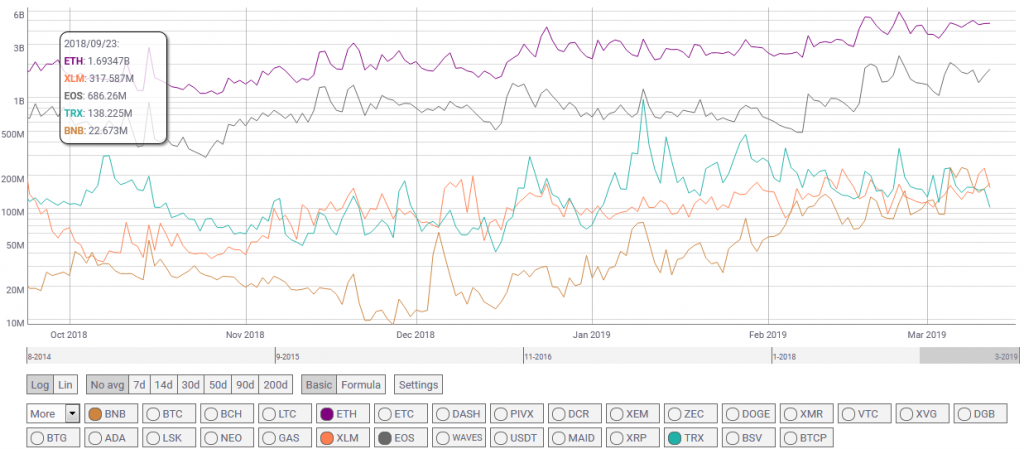

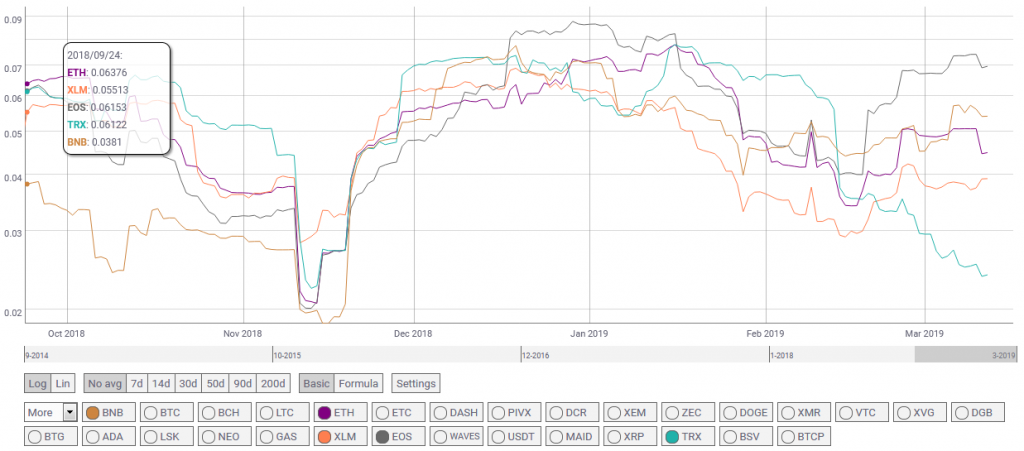

The Binance coin followed the market until December 2018, but then the price began to outperform and outpace the market dynamics. This was due to increased demand for the coin caused by the launch of Binance Launchpad and Binance DEX. As a result, the BNB price has grown about three times during the last 3-4 months. Such a positive trend may continue further, as the demand for BNB will grow. Thus, the BNB coin showed better results than its nearest infrastructure projects.

BNB trading is represented by two main pairs – BNB / USDT and BNB / BTC. This suggests that traders may trade BNB with BTC to pay transaction fees on Binance. Most likely, traders also trade in the BNB / USDT pair because they consider BNB as a valuable investment asset.

Changes in trading volume also highlight BNB among its competitors, because the infrastructure development of Binance led to an increase in price and trading volume. Almost the same dynamics is also observed in EOS, while the volumes of other coins gradually grow or fall.

The BNB volatility is not significantly different from the overall market volatility.

To summarize, the BNB coin outperforms its competitors among infrastructure projects. This allowed the Binance coin to become one of the most popular in the crypto industry.

Conclusion

Binance has triumphed over all of its competitors and has become a top centralized crypto exchange. In addition, the team intends to become a leader in other segments: decentralized exchanges and local markets.

Binanсe is actively involved in the development of the entire crypto industry as a whole: they launched Binance Labs to finance start-ups; launched Binance Launchpad to revive the crowdfunding market; launched educational projects to educate the crypto community; and other projects. This has made Binance one of the key infrastructure players in the blockchain industry.

Binance’s team is experienced and ambitious, and is able to realize their plans and achieve long-term success. Its effective model of token economics provides them with the stability of financial resources and ensures the practical use of BNB. The rapid rise of its price amidst bear market conditions underscores the success of this project and indicates a significant interest from investors.

In general, the brand of Binance has become one of the most popular in the crypto industry and its recognition as a top player will only grow over time.

Due to the risks associated with the project, Binance is graded B+.

The author(s) of this report is/are invested in the following coins: Ethereum.

How to buy BNB

Step 0. Choose your preferred exchange.

BNB can be purchased from several cryptocurrency exchanges, the full list of exchanges can be seen here.

Step 1. Head over to your preferred exchange.

If you want to purchase BNB, it is a good idea to use Binance. Not only is it one of the biggest liquidity providers for BNB but the exchange is also among the most reputable on the market.

Step 2. Create an account on the exchange of your choice if you don’t already have BNB.

Step 3. Top-up your exchange balance with some of your BTC or USDT.

On Binance, BNB can be purchased with either Bitcoin or Tether so make sure to first send over some of the tokens to your exchange wallet. (Don’t forget to double-check that the address you are sending your coins to is correct!)

*Optional: If you don’t own BTC or USDT, the easiest way to buy them is through Coinbase and Bitfinex.

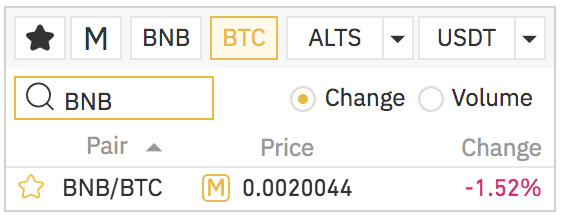

Step 4. Choose your trading pair.

Head over to the exchange and choose the currency (BTC, or USDT) you prefer to purchase BNB with.

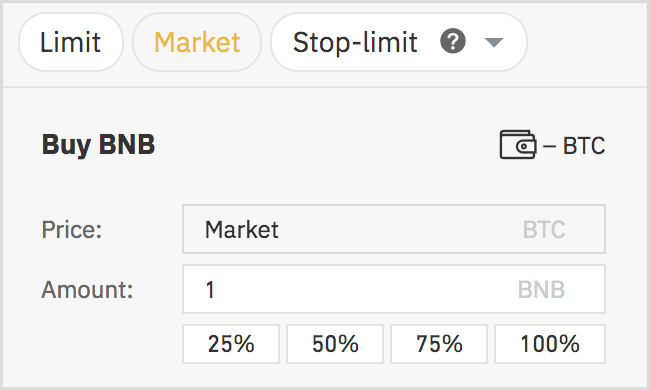

Step 5. Purchase BNB with a market or a limit order.

If you want to buy just a small amount instantly, it is easiest to use a Market Order.

Input the amount of BNB you want to purchase and press Buy.

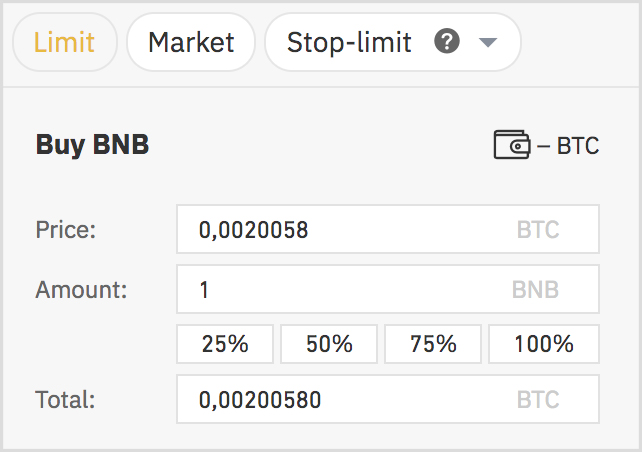

If you need to purchase a large amount of BNB, it is best to use a Limit Order to get the best possible price.

Input the amount of BNB you would like to purchase, and the price at which the order should be filled at and press Buy. (It might take some time for the whole order to be filled if you are purchasing a large amount).

Step 6. Store your BNB on one of the supported wallets for increased security.

To store BNB, you can use Trust Wallet, or Ledger for improved security.