ZCASH DIGITAL ASSET REPORT: ZEC Update

Zcash Has Strong Privacy, but Nobody’s Using It: Research

TABLE OF CONTENTS

Investment Grade

Quick Facts

Funding Information

External links

Summary

Zcash is not the number one choice for people that are looking for privacy. Yet, the number of shielded transactions on the network continues to remain small.

Looking at the long-term prospects of Zcash, it is not showing much progress on the adoption side. The project needs to find use cases for its technology that would help expand its ecosystem. Otherwise, it will not survive in the long term.

Key Takeaways

- Zcash is having a hard time creating the necessary network effects to satisfy its purpose.

- The competition is evolving, while the project is falling behind its rivals.

- Positive technological developments and upgrades planned for this year might have a speculative short-term effect on the price.

Fundamental Factors

Introduction

In the initiation report that we published more than a year ago, we had several concerns with Zcash.

First, and probably most important, is the absence of adoption. People were using Zcash, but nearly no one was using its privacy features. Since then, Zcash made some improvements to simplify the use of shielded transactions. However, this was not enough to significantly grow the adoption of the project’s private transactions.

We were also concerned with the competition in the market. Bitcoin continues to be one of the main risk factors for all of the privacy coins in the market. As Bitcoin’s privacy and payment features improve, there might not be a need for other payment alternatives. The “payment use case” is not as popular as it was back in 2017 and earlier. Moreover, the ubiquity and popularity of stablecoins make these payment projects much less relevant.

However, it looks like the market is entering a bull cycle, which means that speculators will primarily drive it. Now, the market does not care much about the long term fundamentals and gets excited about the upcoming developments of the project.

For this kind of audience, Zcash has several important catalysts in the upcoming month.

The most important is, arguably, November’s Halving, which is planned to decrease the coin’s inflation and lower the supply pressure on the price of ZEC. Zcash will also roll out other important updates to the protocol, which could support ZEC price appreciation in the medium term.

Also, it looks like the Zcash Foundation and Electric Coin Company (ECC) resolved their disagreements over financial issues. The project will have enough money to continue the development and fund the ecosystem. In a bull market, these factors should support the appreciation of the token price.

Nevertheless, fundamentally, Zcash needs to find use cases for its project that will help expand its ecosystem. Otherwise, it will not survive in the long term.

Market Opportunity

From the market opportunity perspective, Zcash did not gain any market share over the last year. To the contrary, the project was rather losing the competition. This happened for several reasons.

The first is that payment coins are losing their popularity. Projects that focus on the payment use case (private and non-private) are having a hard time creating the necessary network effects to satisfy their purpose; it’s hard becoming a second Bitcoin.

With the growing DeFi sector especially, it became apparent that being just a payment coin is not enough. Ethereum, which was not meant to be a payment coin, in the beginning, is now a more popular payment coin than any other altcoin in the market.

With projects like Incognito (which aims to bring Monero-like privacy to Ethereum and all of its DeFi ecosystem), other privacy coins may become irrelevant.

Moreover, with the growing popularity of stablecoins, payment coins will have an even harder time finding adoption. If we are going to see private stablecoins (which we probably will sooner or later), there will be not many reasons to use any other privacy coin.

Still, even under current market conditions, Zcash continues to lose the adoption race to its closest competitor, Monero. When people look for privacy, they most likely use Monero, not Zcash.

Given all of these factors, the market opportunity of Zcash does not look any better than what it was a year ago. In fact, it looks worse. Therefore, we are downgrading its grade from 8.0 to 6.5.

Underlying Technology

Since the initiation report, Zcash has achieved some notable progress in improving its underlying technology. Technology remains the strongest side of this project.

On July 15, the project integrated its fourth major upgrade, Heartwood. The update helps improve the anonymity of Zcash miners so miners can receive coinbase transactions right in their private wallets.

Heartwood also introduced several other improvements, such as Flyclient. It enables interoperability efforts, cross-chain integration, and light-client use cases. Interoperability features are especially important since it will allow building efficient cross-chain communication and pegs between Zcash and other blockchains.

Before Heartwood, Zcash implemented another update in January 2019, named Blossom. It helped improve scalability and user experience by cutting block times in half.

Overall, the technological upgrades that were implemented during 2019 and the first half of 2020 helped the project grow the number of shielded transactions.

Since March of this year, the number of such transactions has grown from 4% to 7%, approximately 1% per month. Although the number still remains small, there is some hope that it will grow in the future. According to the project, the goal for this year is to increase this number to 30%.

In the upcoming month, the project will continue various developments, such as R&D of greater network-level privacy for Zcash, fund/develop hardware wallet support for shielded addresses, deploy Foundation-run infrastructure, create more support for light wallets, and many others. The project is also preparing to roll out its Canopy upgrade in mid-November.

Overall, from a technological standpoint, Zcash is a healthy, developing project. There has been a good level of progress on this site. Therefore, we are revising our grade from 8.0 to 8.3.

Ecosystem Development

However, the project is still at the same place from the ecosystem development perspective as it was a year ago. Although there are many exciting developments planned in the future, they are unlikely to have an immediate impact on the project’s ecosystem.

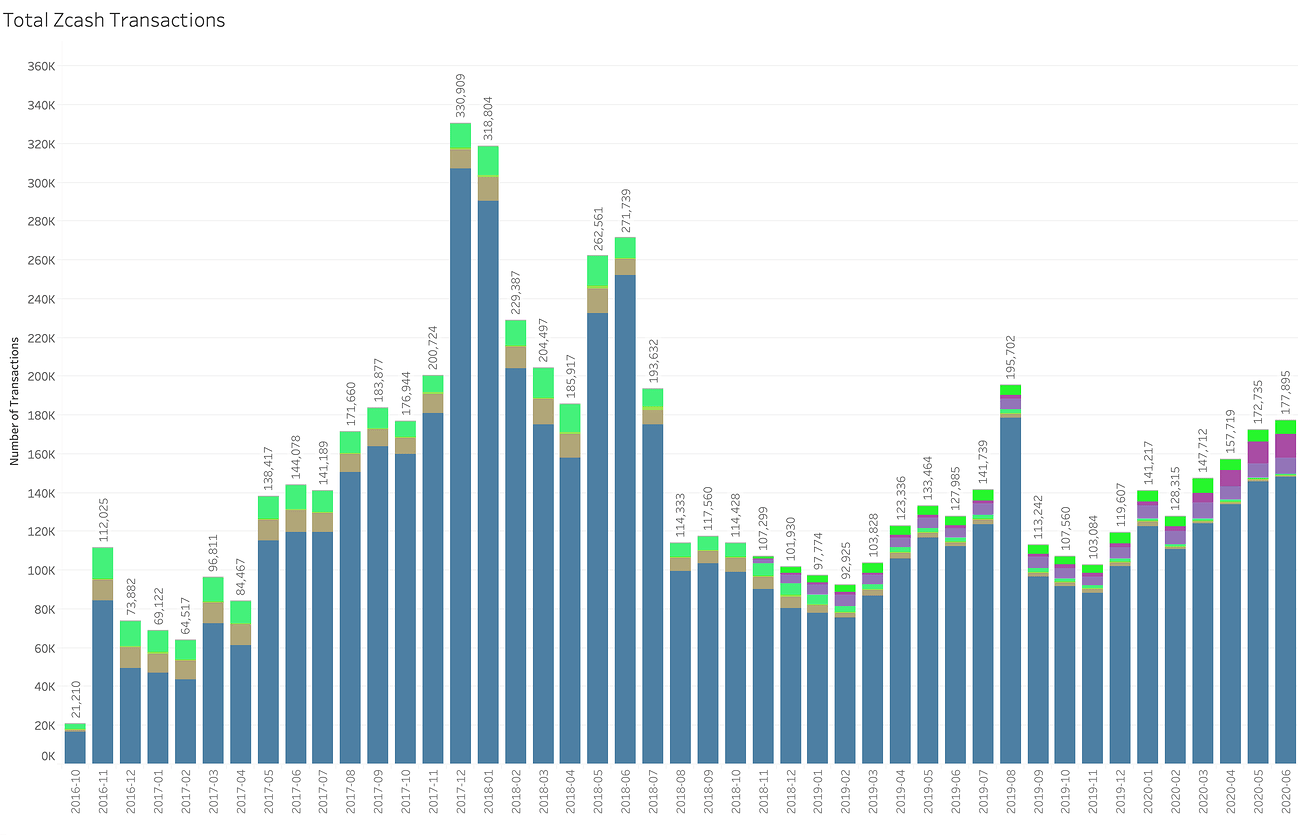

As can be seen from the Total Transaction Statistics, the number of transactions on the Zcash blockchain is highly correlated to overall market sentiment. This year, so far, has been positive for Zcash (and for many other altcoins), as the number of transactions has been growing month over month.

The vast majority of transactions on the network remain transparent and can easily be traced by firms like Chainanalys. To solve this issue, the project is planning to convince at least one major exchange to offer shielded support.

So far, however, the project had only faced difficulties with exchange listings. Just recently, the Japanese cryptocurrency exchange Liquid delisted ZCash (along with other privacy coins) in order to apply for a license to operate in Singapore.

The status of privacy coins still remains highly uncertain. They continue to face an existential threat as regulators continue to crack down. In June of this year, the Criminal Investigation Division (CID) of the IRS, had a job posting on the government’s official contracting website looking to hire private contractors to get more visibility into privacy coin transactions used in illicit activities.

Regulatory uncertainty has a negative impact on the ecosystem. Nevertheless, the project is not planning to discontinue development. On the contrary, it is taking steps to expand the ecosystem.

Total Zcash Transactions | Source: https://forum.zcashcommunity.com/t/measuring-shielded-adoption/35022

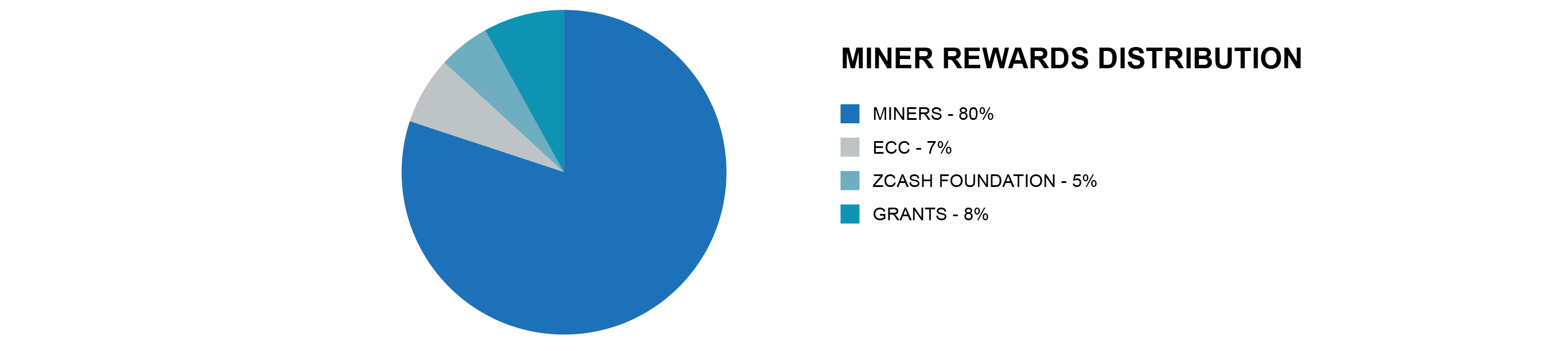

In November of this year, the project will move to a new funding model, where 20% of the network mining rewards will be spent on infrastructure and marketing and development. Meanwhile, 8% of these funds will be allocated to “Major Grants” to external development projects that are independent of the Zcash Foundation.

The foundation is already working on establishing a Major Grant Review Committee in order to allocate these new funds.

The new funding model should establish a solid financial foundation for all of the major ecosystem players while helping fund other projects that will bring value to Zcash.

To further expand the ecosystem, Zcash is developing its interoperability features and is planning to bring privacy to the Cosmos project. Zcash wants to take advantage of Cosmos’s network effects by giving Cosmos users access to its anonymity through an IBC-enabled pegzone. This should help Zcash grow its anonymity set.

All things considered, Zcash has several positive ecosystem developments this year. However, it will likely take time before they will have a considerable impact on Zcash’s ecosystem. Therefore, we are upgrading the ecosystem grade just slightly, from 5.5 to 5.7.

Miner Rewards Distribution | Source: https://www.coindesk.com/zcash-cryptocurrency-first-halving-inflation

Token Economics

This year, the token economy of Zcash is going to significantly improve, primarily due to the halving event that is set to happen in November. The block reward will be cut in half, from 6.25 ZEC to 3.125 ZEC. This will significantly decrease inflation, and with it, supply pressure on the token price.

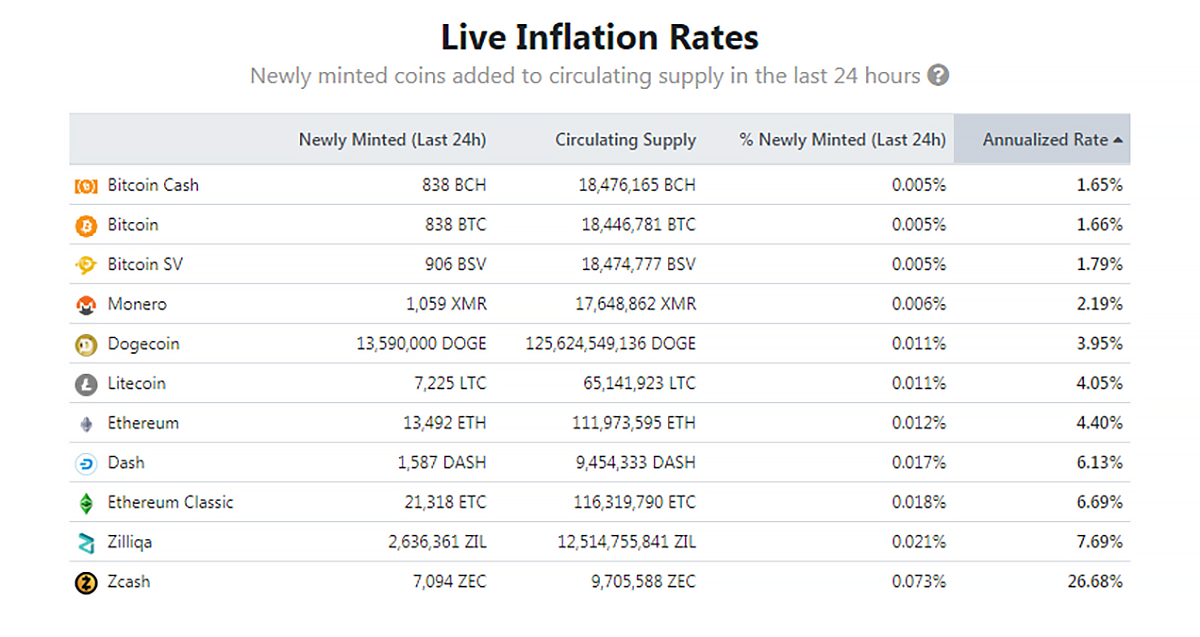

Currently, Zcash has the highest inflation rate compared to other major cryptocurrencies.

The other major event is a change in the funding model.

The project is discontinuing the founders’ reward that lasted for four years since the launch of the project. The founder’s reward was basically a 20% tax on miners (15% was allocated to a group of investors and founders, and 5% available to ECC).

Initially, the idea was to discontinue the founder’s reward after four years into the project’s life. Developers thought that this would be enough time to build a community and rely on donations for further development.

It didn’t turn out this way in practice. There wasn’t a big enough community around Zcash, and donations were insufficient to sustain the company. So, it came up with a new funding model (the one that we described in the ecosystem section), which should be beneficial to the project.

Overall, there are positive improvements in the project’s token economy. Therefore, we have increased our grade from 7.0 to 7.5.

Team

Zcash continues to be supported by two main entities, the Zcash Foundation and the Electric Coin Company. Both entities are actively hiring developers to work on protocol upgrades.

Despite the disagreements over the Zcash trademark that both entities had, all of the issues were resolved and in November 2019. The ECC donated the trademark to the Foundation, and both parties agreed and signed an agreement governing the use of the intellectual property.

Under the new agreement, both parties must agree on the network upgrade, which is intended to create a new consensus protocol for Zcash.

If there is a disagreement, the chain will split, and both parties may lose the right to the trademark.

Each party can terminate the agreement, in which case the trademark rights would be awarded to the other party.

Overall, although an agreement was made, there is still room for future tensions that might possibly happen between the Zcash Foundation and the ECC. Therefore, we maintain our grade for the team at 8.0.

Roadmap

Zcash Engineering Roadmap:

- A newly redesigned Zebra, with complete chain state tracking/validation by April 2020 (NU3 activation) and full wallet support coming soon after.

- Foundation-run infrastructure and development support for light wallets.

- Cross-chain integrations for Zcash.

- Hardware wallet support for shielded addresses.

- A simplified threshold scheme for multisignature spends of shielded funds.

- Research and development toward greater network-level privacy for Zcash.

- General ecosystem improvements.

Zcash has a very detailed roadmap for this year. The project has set clear goals on the development and business side. Some of the main milestones for this year will be the hard fork and the launch of the Canopy upgrade.

Due to the detailed roadmap and improved progress on the development side, we upgraded our grade from 6.8 to 7.0.

Token Performance

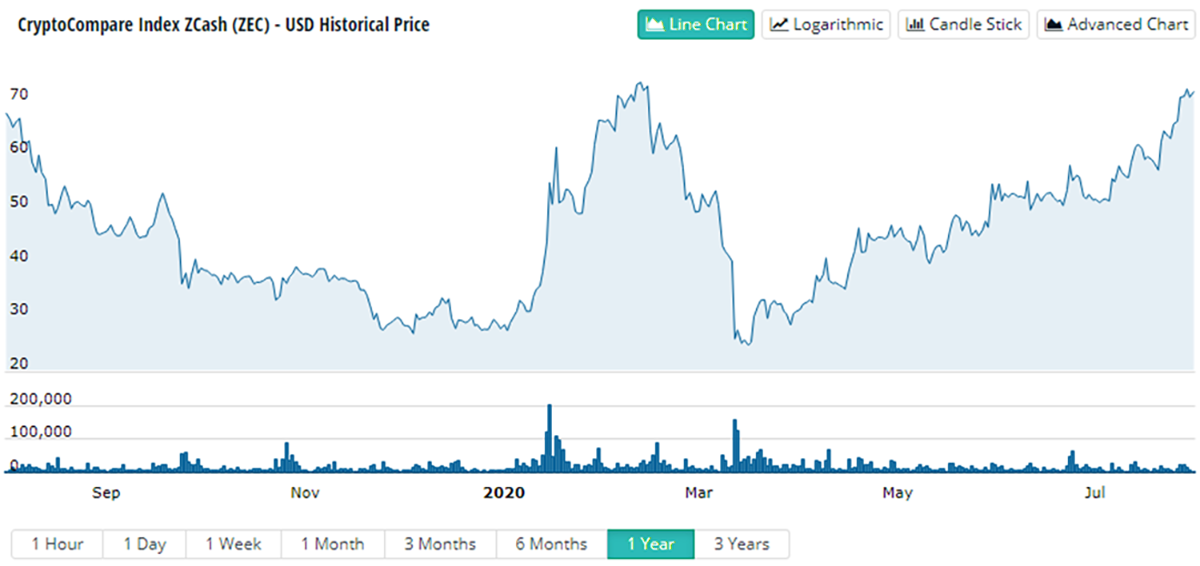

Since the March crypto market crash, Zcash is showing a strong recovery this year. This might be due to several reasons. First, the overall market conditions are good. Second, the coin is approaching the halving, which is always a very bullish event for any PoW coin.

So, the market might still see further growth of ZEC up until November. Therefore, we are revising our grade from 5.0 to 6.5.

Zcash USD Historical Price | Source: https://www.cryptocompare.com/coins/zec/overview/USD

Conclusion

Despite all the positive developments that happened over the course of this year, Zcash still remains a project that focuses more on R&D than real-world use cases.

Although the project clearly has robust technology and a strong team with funding, the widespread adoption of ZEC is still distant.

In our reports, we are trying to evaluate potential long term prospects of crypto projects. Looking at the long term prospects of Zcash, it is not showing much progress on the adoption side, which is a sign of major concern.

With this said, we are maintaining our grade for Zcash at C+, which means that in our opinion, this project is not investable over the long term.

However, we still think that the ZEC price might rise in the medium term due to the upcoming halving event and overall positive sentiment in the market. This might be an opportunity for speculation.

The author(s) of this report is/are invested in the following coins: BTC, ETH.