US elections and CPI print

Bitcoin and the broader crypto market showed resilience, especially compared to stock market distresses, after the U.S. Federal Reserve increased the policy rate by 75 basis points. Bitcoin buyers managed to hold the $20,000 support level, despite hawkish rhetoric from Fed Chair Jerome Powell, who said it was “too soon to discuss a rate hike pause.”

Powell added that the markets should be more focused on how high the Fed will raise rates and how long it will keep monetary policy restrictive than the pace of the increase. While the Fed’s warning was loud and clear, traders chose to focus on positive adoption news.

Texas-based money transfer giant MoneyGram has announced a new cryptocurrency service that allows customers to buy and sell Bitcoin, Litecoin, and Ethereum. Earlier, Western Union had filed three trademarks covering digital wallets, commodities derivatives, and brokerage. Additionally, Meta (formerly Facebook) added an NFT marketplace to Instagram, making digital collectibles available to 2 billion users.

The market also started to focus its attention on the midterm U.S. elections. Investors have arguably started to price in a Republican party win, which is seen as a favorable outcome for the crypto industry.

However, crucial economic data in the Consumer Inflation Index (CPI) for October comes out later this week. If the data shows that inflation continues to run hot, risk-on assets such as stocks and crypto will have a tough time materializing on a possible post-midterm election pump.

Inflation Inflation Inflation…

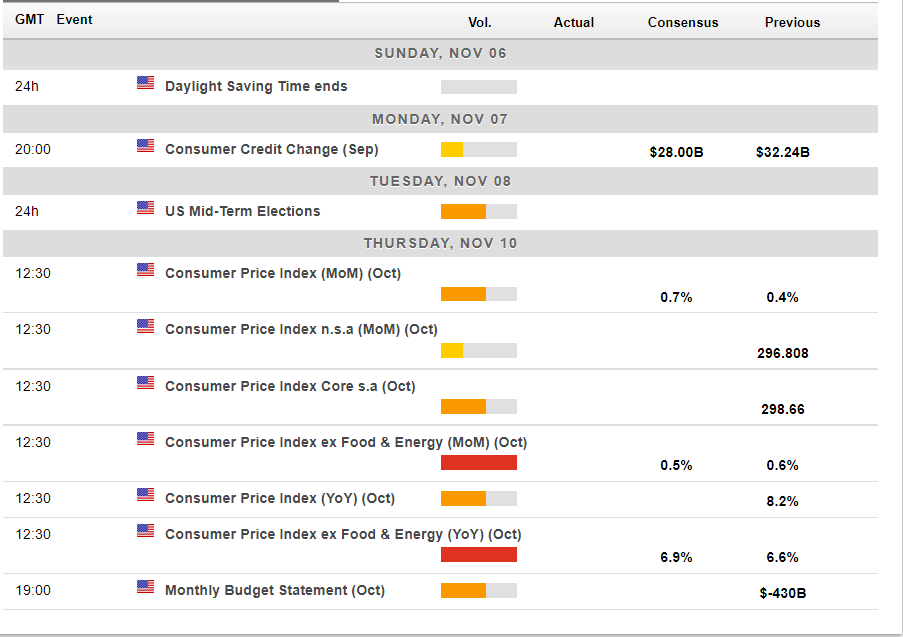

This week’s economic calendar is all about the Consumer Price Inflation (CPI) data from the U.S on November 10. The market expects inflation to have cooled from 8.2% to 8.0% in October, with core prices dropping to 6.5% from 6.6% in September. A higher-than-expected CPI print could send stocks and the crypto market lower by the end of this week.

I firmly believe that inflation will increase while the Ukraine war rages on. We only have to look at the banning of Russian commodities and the rise in oil prices to understand this straightforward fact.

Currently, oil prices are 60% higher than pre-COVID-19 levels and show no signs of dropping soon. The negative trend will likely continue as the U.S. government handicaps its industries, particularly energy. Let’s stick to the adage, “the trend is your friend until it’s not.”

When does the bearish cycle end? When global conflicts dissipate, the U.S. dollar shortage ends, or new global energy and commodity outlets are sourced. But I am not betting on it happening anytime soon.

Economic calendar for the week starting November 6 (Source: Forexlive)

Midterm Election Madness

The market’s focus is on the midterm elections. As I understand, the Republicans have expressed more openness to cryptocurrencies and blockchain technology due to their preference for less government oversight. Hence, a Republican win could be bullish for the crypto market.

Additionally, the heavily red state of Texas has become a hub for cryptocurrency mining since China outlawed mining operations in the country in July 2021. At the same time, the state of Wyoming has achieved a reputation as “one of the top blockchain destinations in the world” for its crypto-friendly legislative positions.

Not to get political, but the red party winning back the House and Senate could be positive for the geopolitical climate as the Republicans could try to broker peace talks in Ukraine. The Republicans may also attempt to establish new energy deals for the United States.

Currently, the world’s largest reserve currency is facing a risk of de-dollarization, with countries exchanging their dollars for other currencies and gold. The de-dollarization is accelerating, with the international political alliance, BRICS, ramping up the pressure on trade tariffs as the Chinese yuan starts to challenge the SWIFT banking system.

If the Democrats manage to come out on top, it’s unclear how the cryptocurrency market will be affected and whether or not a post-midterm rally will commence. However, the chances of more weakness in the crypto market are high.

Let’s face it; the Democrats have done little to end the ongoing war and made things difficult by imposing economic sanctions. On top of that, several Democratic party members are hyper-critical of the digital asset class, including Senators Elizabeth Warren and Sherrod Brown, which is particularly damaging for the crypto market.

On-chain Analysis

Investors have welcomed the latest volatility in Bitcoin’s price after weeks of boring price action. However, on-chain indicators suggest that it is still relatively early in the bear phase, raising doubts about a sustainable parabolic trend soon.

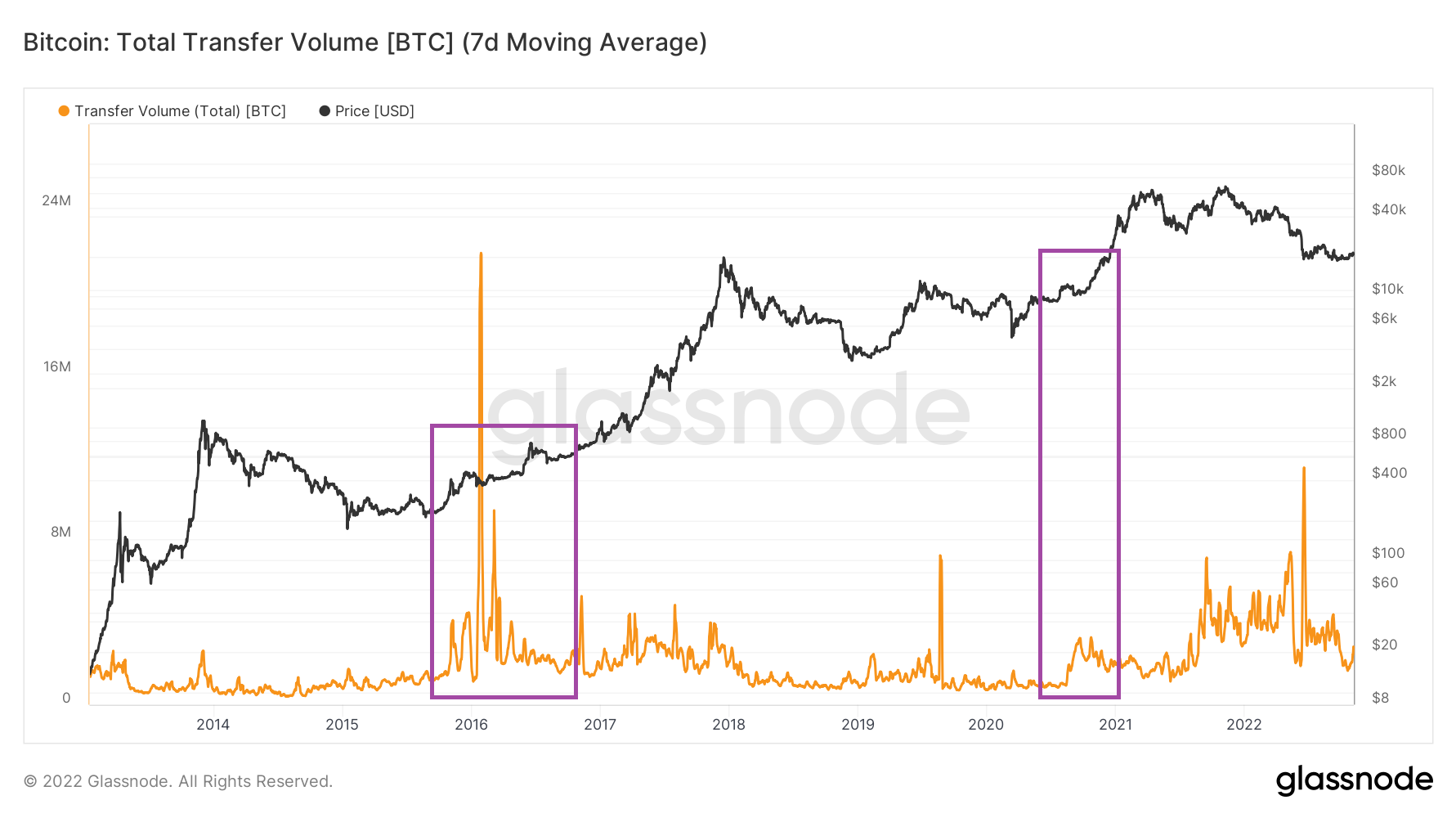

The Bitcoin network’s total transfer volume dropped to a 16-month low, indicating a lack of interest in the crypto market due to a lack of quick earning opportunities. In the past, the bearish and accumulation trends were characterized by low transfer volumes of around 1 million BTC. Activity usually picks up right before the start of a parabolic trend.

Bitcoin 7-day average transfer volume (Source: Glassnode)

In the most recent cycle, increased on-chain activity extended more than previous bullish cycles, a testament to the outstanding growth the crypto market witnessed last year. However, transaction volumes have been dropping since October 2022. It appears that BTC has just entered the long-term accumulation stage after heightened activity since late 2020.

The Bitcoin whales, characterized by balances holding BTC worth more than $5 million, are holding the least amount of Bitcoin since January 2021. If you look at the previous cycles, an increase in whale holdings precedes a parabolic price trend, and the accumulation could take months.

Currently, the whales are moving in the opposite direction, suggesting more pain or sideways action before a sustainable upward price trend can occur.

Percentage supply of Bitcoin held by whales. Source: Santiment

BTC/USD Technical Pivot

Last week, we had anticipation of a Fed pivot. This week, we have not only a potential election pivot but also a technical pivot. I have been very vocal about the importance of the $21,700 level for several weeks now. It is the level in the sand for me right now.

Failure to get or hold above this level will be a massive clue that this current rally will not hold up and fade quickly like previous bear market rallies.

Should BTC hold above the pivot and continue well past this area, I would be looking for $24,000 or $25,000 before Christmas. All bets are off for sellers if the price moves above $25,000, and $30,000 will likely follow quickly after a breakout.

However, the above remains a long shot. My primary scenario is a flip back toward $18,000 and then a spectacular crash to at least $14,000.

BTC/USD daily chart (Source: TradingView)

ETH/USD Breakout Level

Many crypto pundits are making the case that ETH has outperformed Bitcoin over recent months and remains a safer bet as ETH’s price has doubled since the year’s lows.

I don’t buy this argument because the bottom in ETH was much lower. Moreover, the reality is that ETH is still down over 65 percent from its all-time high, while BTC is down by around 68 percent from the peak. Go figure.

The technicals clearly show the breakout zone this week is around $1,757, so keep an eye on that level which also coincides with the 200-day moving average, around the $1,700 level.

Until the weekly price closes above the 200-day MA, I wouldn’t get too excited about a positive recovery.

ETH/USD daily chart (Source: TradingView)

Show Me LTC/USD Fundamentals

There is a lot of excitement about LTC as it continues to rally. However, nothing has changed fundamentally or technically for Litecoin. Rallies are probably selling opportunities as the trend is bearish. Until LTC gets back above $230, I will maintain this stance.

BCH and LTC share many similarities, such as their utility, consensus mechanism, and how awful these assets look on a historical price chart. Both these tokens are trading way below their bull-bear support levels and have disappointing on-chain movements.

An LTC buying opportunity around the $30 level appears far more interesting. Even if LTC doesn’t get back above $230, it will likely probably test $90 one more time.

LTC/USD daily chart (Source: TradingView)

Election playbook

The playbook for crypto is relatively straightforward this week. If we see a Republican party win in the U.S., batten down the hatches because crypto will probably pump very nicely into the Christmas and New Year period.

I suspect the opposite is valid for a Democrat win, and 2023 could be much worse than this year. Even mixed election results will likely be messy in any regard. Without a big red party win, the focus probably turns back to the Fed, Ukraine, and what happens to the economy next.

At the same time, a stronger-than-expected CPI print towards the end of the work week could also quickly derail positive sentiment. Markets hate uncertainty, so I don’t expect any meaningful price action until after the election results and CPI print are out later this week.