The Ethereum merge trade

If you followed crypto social media circles over the last week, it should be evident that Ethereum merge is the leading narrative in the space. And why shouldn’t it be?

Moving to an environmentally-friendly Proof of Stake (PoS) mechanism from the existing energy-intensive Proof of Work (PoW) is a big step forward, given the importance of ESG in global finance. Plus, the event is often called “triple halvening” because of the reduction in ETH issuance post-merge from 4.3% to around 0.22% annually. Improved sustainability and reduced token inflation over the long term should benefit ETH price.

The point of today’s newsletter is to highlight the “merge trade.” The merge trade covers price action driven by the hype around the event. And it isn’t limited to ETH alone but affects other projects. I will discuss some of them below.

According to notes from leading Ethereum developer Tim Beiko, the tentative date for the merge is September 19, 2022. Over the next two months, you may benefit from awareness of these opportunities.

Lido

Lido is a DeFi platform that enables users to stake ETH on the Beacon Chain together in a pool. This lets users with less than the minimum required 32 ETH participate in the staking process. Lido also keeps access to staked ETH in the form of stETH. Otherwise, staking on the Beacon Chain is one-way with no withdrawals.

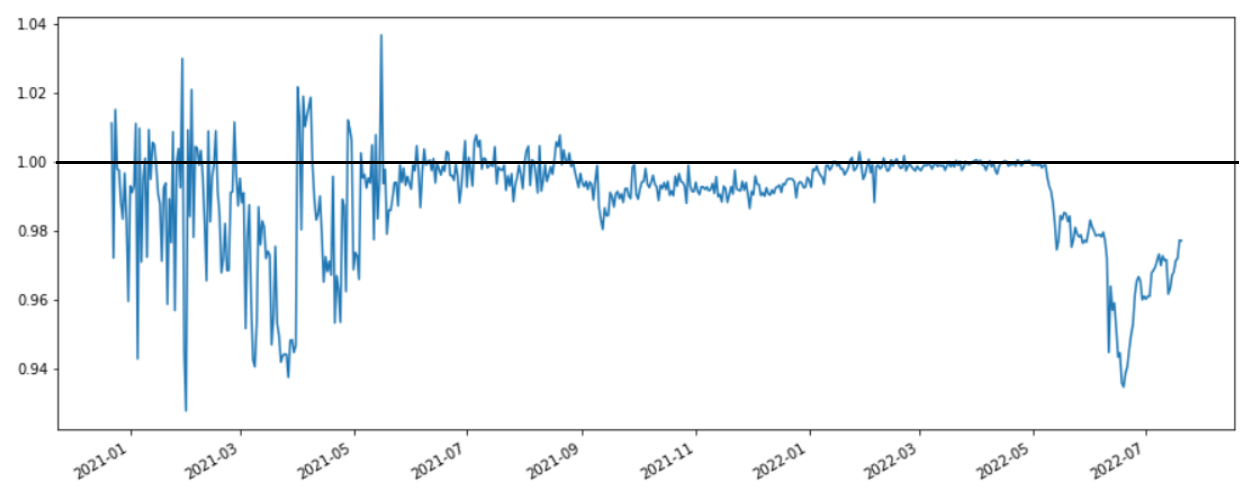

Recently, stETH was trading at a significant discount to ETH because of the market downturn and concerns around a Celsius sell-off. However, things have improved since Celsius filed for bankruptcy and alleviated fears of further selling. Since the merge announcement, the discount in stETH reduced from 0.96% to 0.98%, nearly bringing it to parity with ETH.

stETH/ETH price chart. Source: CoinGecko.

The Lido DAO token (LDO) benefited from the merge news. The token’s price surged from $0.9 to $1.6. Still, LDO may present a decent buying opportunity over the next few weeks if the plan is to exit slightly before the merge happens.

Rocket Pool

Rocket Pool is similar to Lido, albeit smaller in size. Recently, the team introduced changes to improve the project’s capital efficiency. They reduced the minimum requirements for operating an ETH validator node from 16 ETH to 4 ETH and added a Staking-as-a-Service offering for institutional clients.

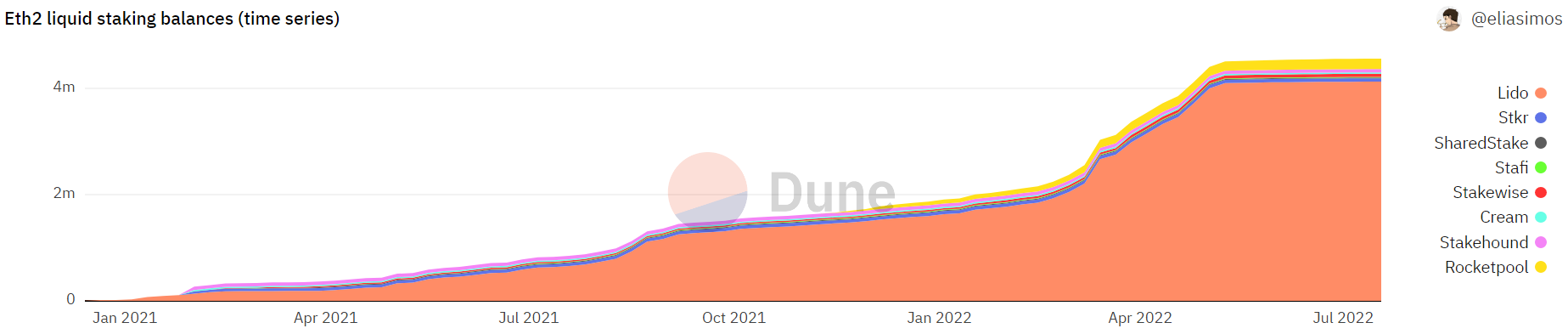

Rocket Pool accounts for 4.3% of the total ETH staked on liquid staking protocols compared to more than 90% for Lido. Source: Dune.

Rocket Pool’s native token, RPL, surged 56.7% since the merge date announcement. The team’s timely upgrade and the resultant price action make RPL a good choice for those betting on the merge trade to continue.

Ethereum Classic

The merge trade narrative for Ethereum Classic is that it will provide a safe haven for existing Ethereum miners. The event has presented an opportunity for ETC proponents to sell the idea of “real Ethereum,” just as they did after the DAO hack. Since the merge date announcement, ETC surged 45% as it started grabbing attention on social media.

Leading upto the merge, this narrative might intensify. Source: Twitter.

Potentially, ETC appears as a hedge against a technical mishap during the merge, which is not impossible given the difficulties of shifting from one consensus mechanism to another. If bugs are identified during the event, the ETC price may rise significantly. It should also benefit other competing Layer-1 blockchains chains like Avalanche and Solana.

As the developer community and institutional money remain focused on Ethereum, the Ethereum Classic hedge narrative should be very short-lived. However, it’s still a decent bet short-term.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.

Stay safe!