Swimming with sharks

Remora is a category of suckerfish that uses some natural adhesive on its top to stick to bigger fishes like whales or sharks. They swim with big fish to catch leftovers and get protection from predators.

To become successful in crypto, smaller fish like us should follow the remora strategy. By sticking to the strategies of bigger fishes in the ocean, average investors can capture gains early.

Source: iStock.

One of the easiest ways to track whales on Ethereum is Nansen. The data analytics platform tags large funds and profitable ETH wallets as “smart money.” You can identify these wallets on Nansen from the 🤓 emoji next to a wallet’s info.

Today, we will explore how to use Nansen to track token movements by large funds and gain valuable insights from it. The caveat is that Nansen standard subscriptions cost $400 per quarter, which you may account as your initial investment. You can also start with a one-week trial subscription for $9.

Tracking Large Funds

Go to the ‘Smart Money’ section of Nansen’s platform and then select ‘Segment.’ Filter only large funds.

First deselect the ‘All’ segment and then search for ‘Fund.’

Nansen’s Fund leaderboard tracks the biggest hedge funds and venture capitalists in the industry such as Alameda Research, Wintermute, and Andreessen Horowitz.

Then, select the ‘Token Holdings’ tab and sort the list of ‘Top Holdings’ in a descending order for the last 30 days. This will help in identifying tokens that funds added in large amounts in the last month.

However, not all entries are buy orders. Many other sources can change a fund’s token balance, such as vesting early investment rounds, withdrawing from a liquidity provider (LP) pool, or receiving funds from a cross-chain bridge.

While the buying from exchanges adds value to the token, the unlocks from investment rounds may lead to a sell-off, and receiving funds from DEX pools and bridges may be non consequential because ownership doesn’t change.

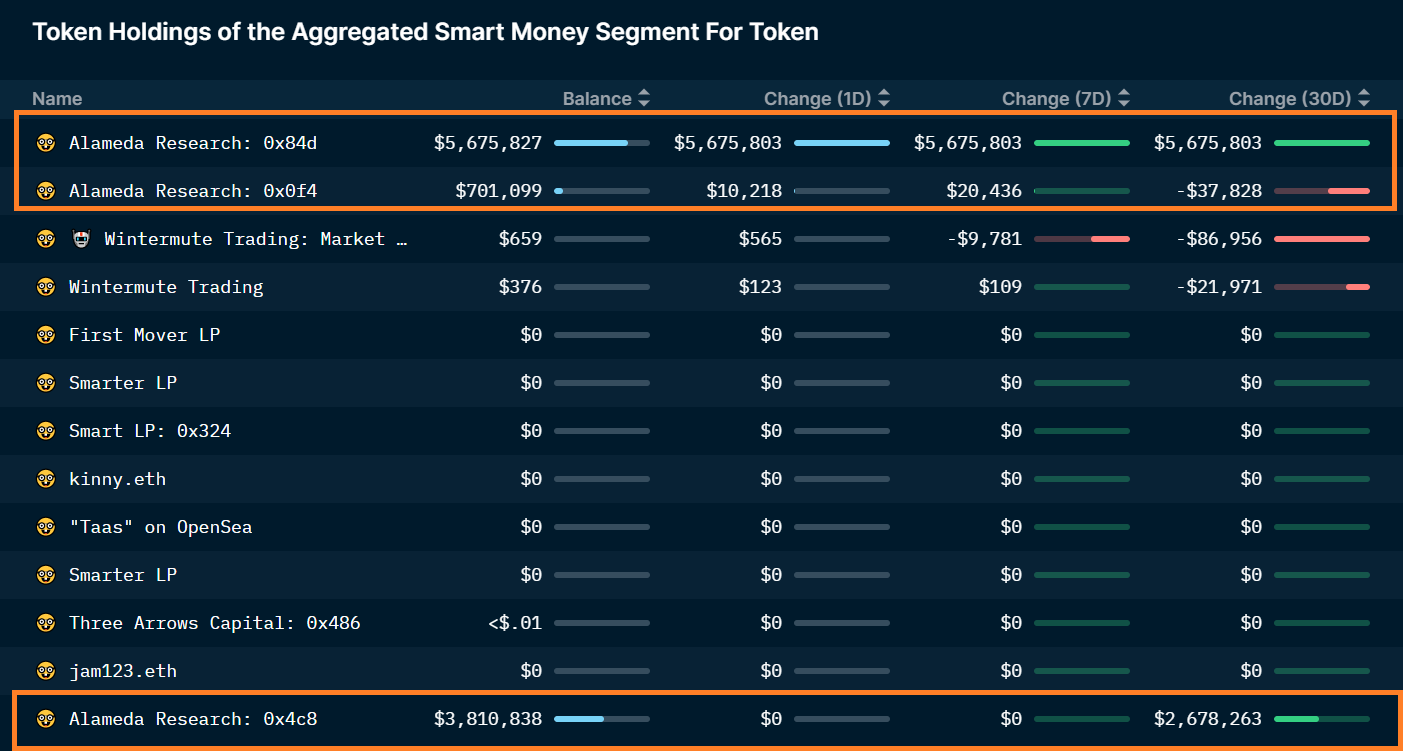

From the above list of tokens added in the last 30 days, let’s take a look at FTX (FTT). Apparently, top funds added around $5.7 million worth of FTT in the 24 hours, and around $8.3 million worth over the last 30 days.

To dig further, go to the ‘Smart Money – Token Profiler’ to identify the funds making the purchase.

For FTT, the top buyer is Alameda Research. Interestingly, in the last 30 days, Wintermute Trading’s FTT balance reduced by around $100,000.

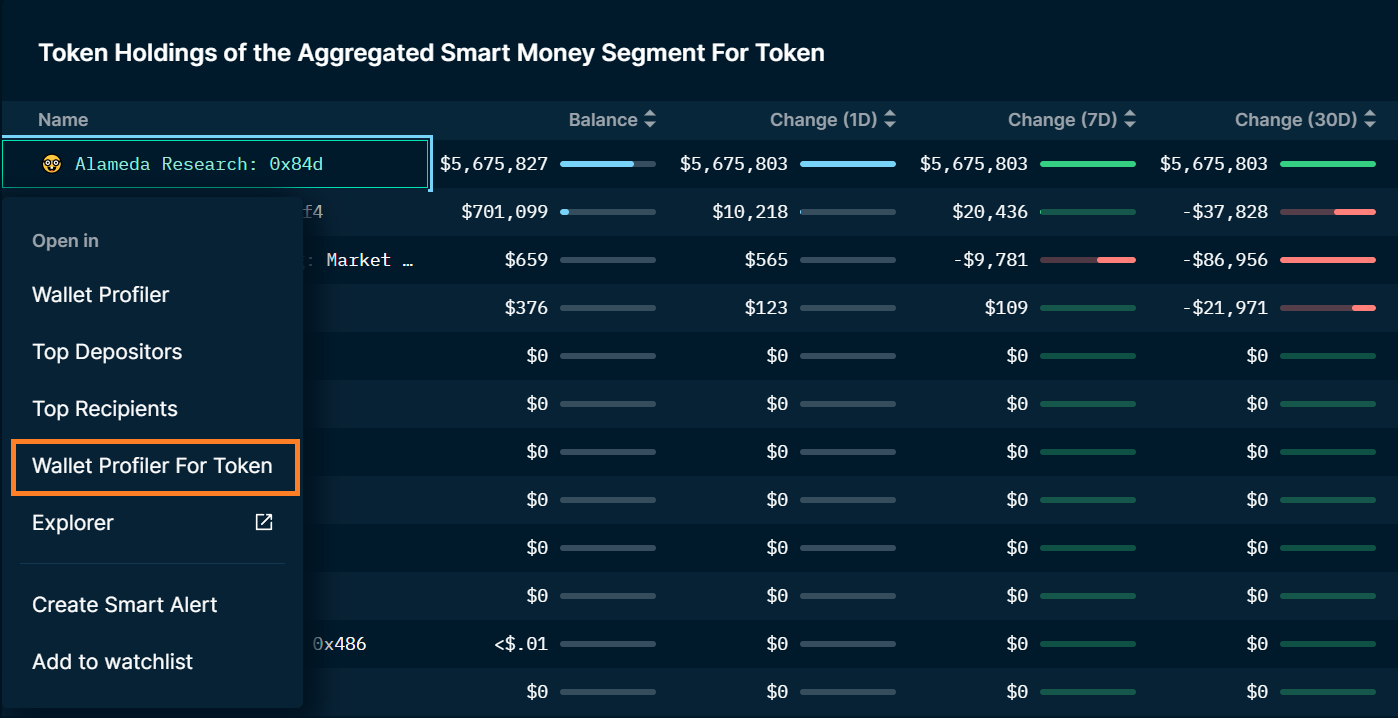

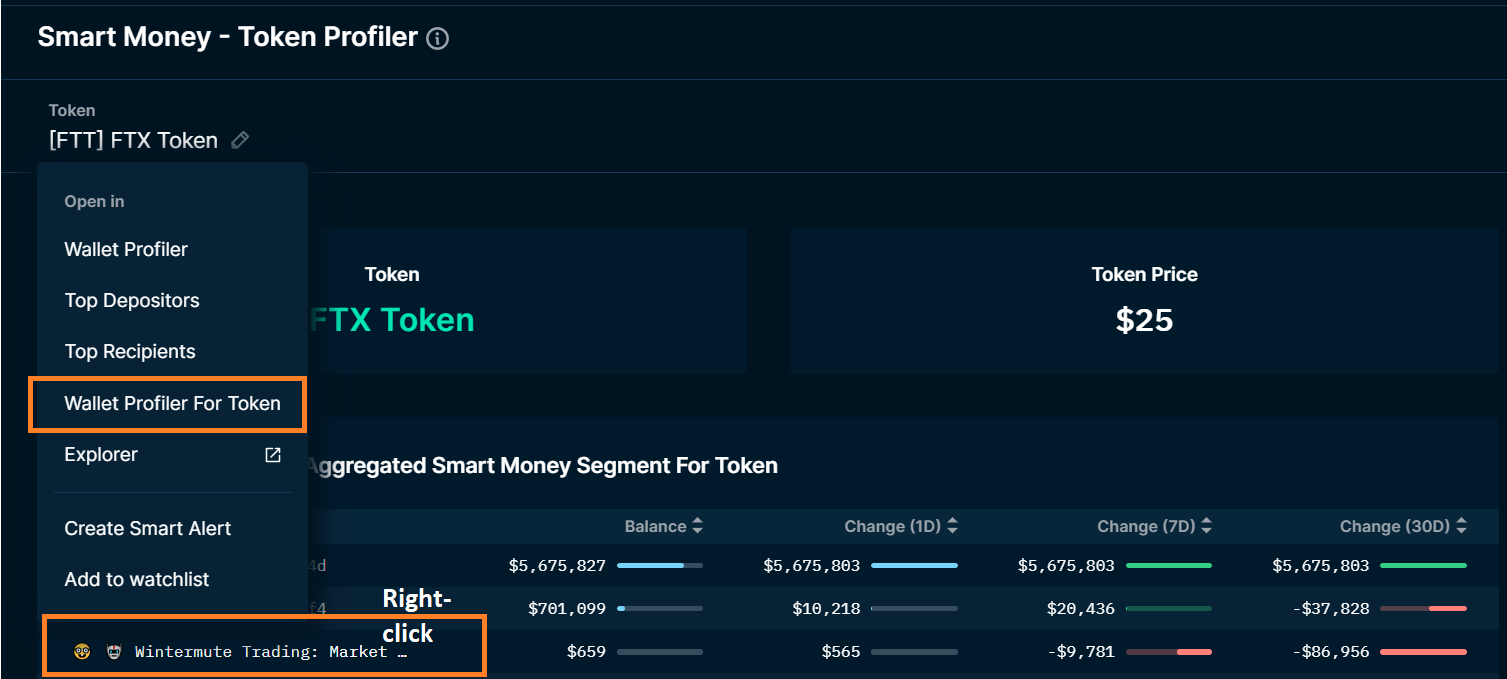

Now, let’s look at the source of funds added to Alameda’s wallet (we’ll later take a look at Wintermute’s wallet as well.) To track a fund’s transactions for a particular token, right click on the address and select ‘Wallet Profiler For Token.’

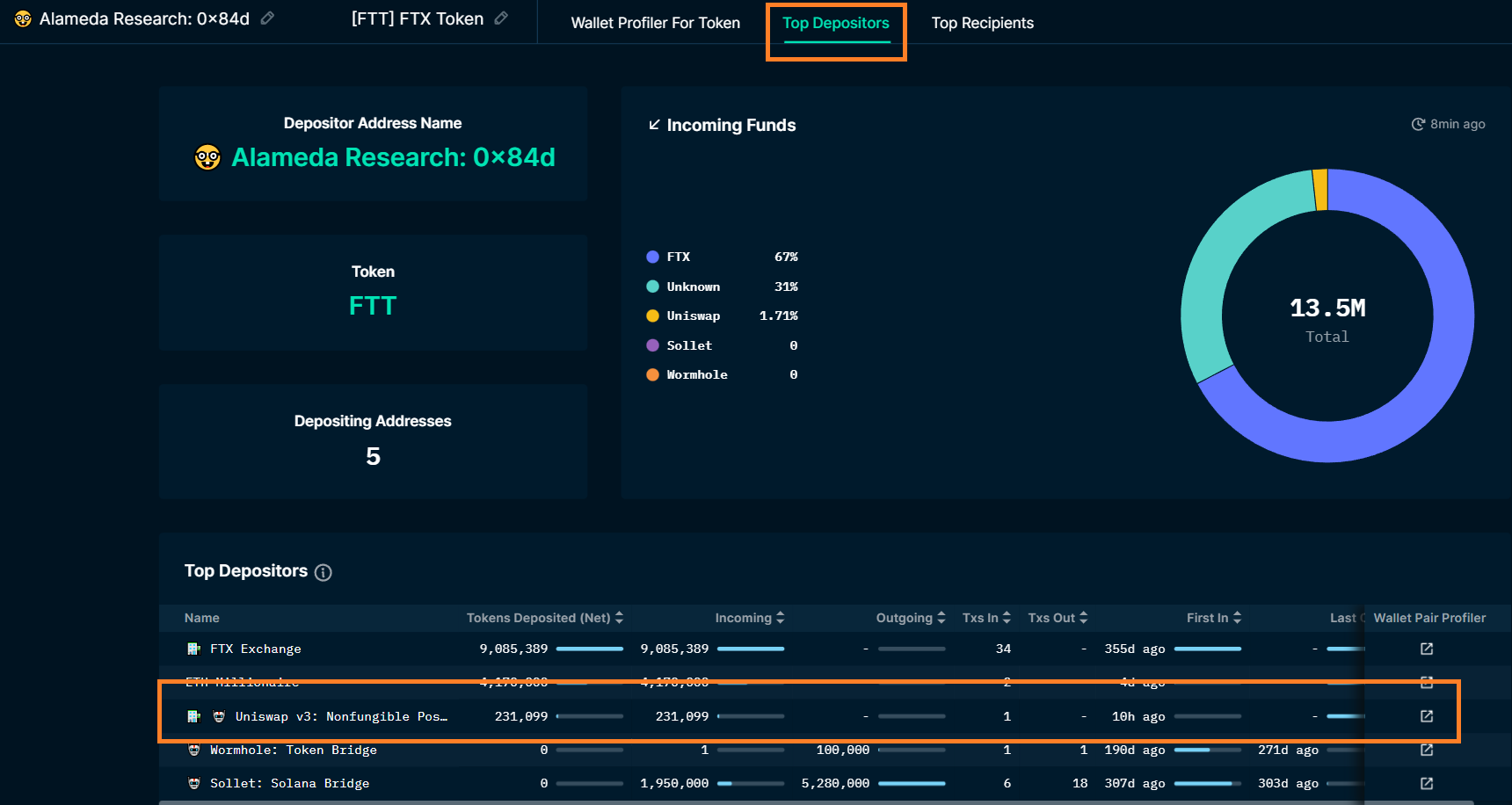

The top transactions include two 4.17 million FTT token transfers, one incoming and other outgoing sent to FTX exchange. This is a yellow flag as any tokens moved to exchanges are possibly sold.

To identify the source of the $5.7 million FTT token addition, we should look at the ‘Top Depositors’ to the Alameda Research’s wallet. Here we find that 231,099 FTT (worth ~$5.7 million) was unlocked from Uniswap V3: Nonfungible Position Manager. Alameda didn’t buy those.

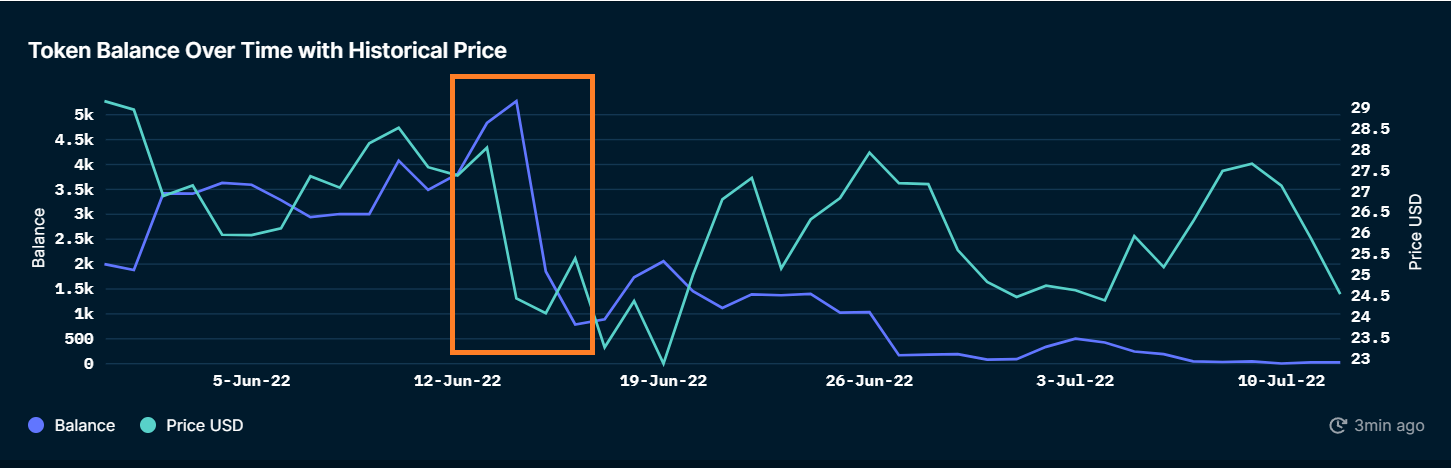

The other notable FTT movement in the last month was around $100,000 worth FTT outflow from Wintermute’s balance. Let’s take a deeper look into that. Similar to the previous step with Alameda’s wallet, we’ll go back to the FTT token page for ‘Smart Money – Token Profiler’ and to Wintermute’s ‘Wallet Profiler for Token.’

The first thing I noticed was a massive decrease in Wintermute’s balance in mid-June, which coincides with the falling price of FTT.

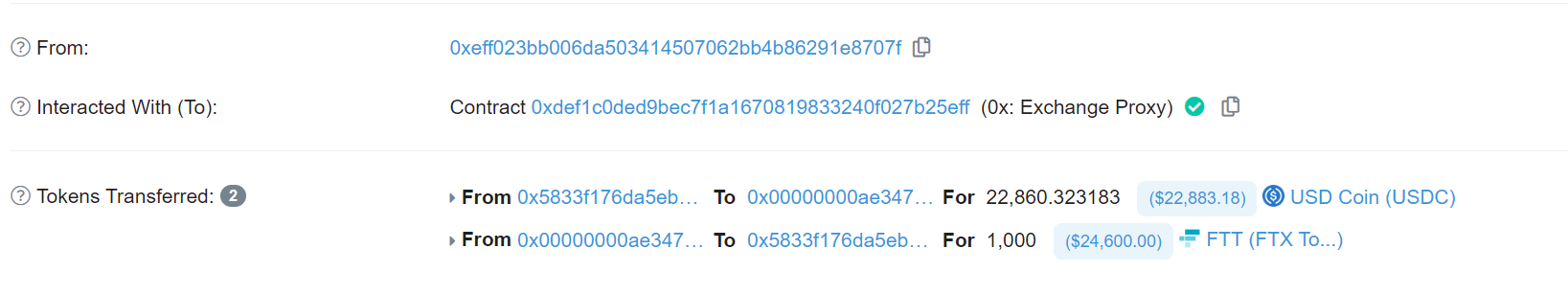

If you notice Wintermute’s transactions top transactions, if you can find the exact date and sources of reduction in FTT balance. Looking at the ‘Tx’ for 1,000 FTT, we can see that Wintermute exchanged FTT for USDC on 0x Exchange.

Thus, a quick overview of the FTT token concerning Funds tells us that Alameda is unlocking its position on Uniswap, which is quite irrelevant, while Wintermute has reduced its FTT exposure significantly since June. These are not ideal signals of buying, in fact, quite the opposite.

You can use the above tools to see what large players are doing and potentially replicate their strategies. Once you’re confident in the fundamentals behind a token, you can track top funds to see if they have been selling or buying recently. There are many other on-chain strategies that we can implement on Nansen for staying ahead of the market.

Good luck.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.

Stay safe!