Sellers return

Bitcoin and the cryptocurrency market came under extreme downside pressure last week as the top coin eroded all of its hard-fought price gains in August.

BTC started the trading week by hitting a new multi-week high above the $25,200 level. However, the rally quickly faded due to weak buying interest as global macroeconomic concerns again took precedence over market sentiments.

Firstly, the Federal Open Market Committee (FMOC) meeting minutes from July revealed a hawkish stance of the Fed, determined to curb inflation. This crushed the market’s hope of a dovish outlook in the wake of peaking inflation and dropping oil prices.

Secondly, the looming energy crisis in the euro-zone area is causing the U.S. dollar to rise against the British pound and euro. A strong greenback usually means weakness in Bitcoin. An escalation of the crisis could further strengthen the dollar and create selling pressure on BTC.

Several regulatory factors also caused market jitters toward the crypto market. According to Fox Business journalist Eleanor Terrett, the U.S. Securities and Exchange Commission (SEC) may charge Ethereum creators with selling unregistered securities in the U.S.

Moreover, the second largest cryptocurrency also faces the threat of protocol-level censorship due to U.S. sanctions and the involvement of centralized validator sets like Coinbase. Fear of a regulatory crackdown before the Merge likely made buyers nervous.

It appears that the bear market rally is over, and the long-term bearish trend that started after last November’s peak is now threatening a drop to new yearly lows.

Macro Doesn’t Look Good

As mentioned above, a background of a global economic slowdown, looming energy crisis in Europe, aggressive U.S. Federal Reserve rate hike action, and worsening Ukrainian war makes for a harsh environment for risk-on trades.

If I were to bet on safe-haven trades over the coming months, I would probably look to the U.S. dollar. As a long-term bet, the buck is not a smart one. However, the U.S. dollar can still gain significantly against other counterpart currencies into the year-end.

Bitcoin does not fare well when the greenback breaks out against other major currencies. If the DXY index gains another 5 to 10 per cent, it could present a credible negative catalyst to drive prices lower.

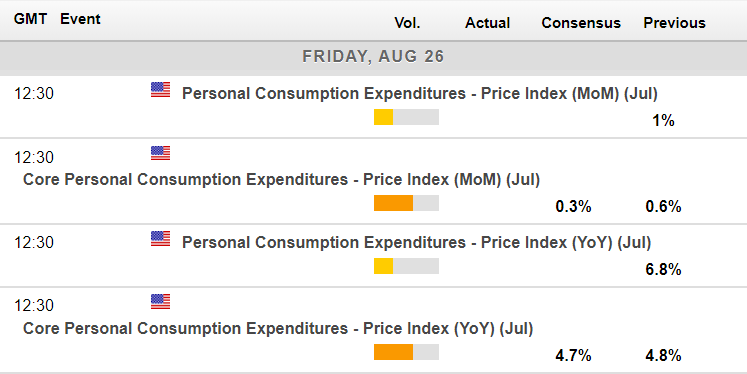

This week, an important market moving news for the greenback and Bitcoin will be the release of the Personal Consumption Expenditure (PCE) index for July. The Fed prefers PCE to gauge inflation over the popular Consumer Price Inflation index, which basically includes the broadest set of goods and services.

The release could be a market mover if a significant downtick occurs, similar to the recent CPI release. Analysts expect a 4.7% annual increase for core prices, down from 4.8% in June. If the print exceeds expectations, it’ll likely revive the fear around another steep rate hike in September.

Economic calendar for this week. Source: Forexlive

Resistance from the Options Market

The timing of the options market expiration and Bitcoin’s crash suggests that the negative volatility on Friday may have been options-induced. The options orders on the largest crypto derivatives exchange, Deribit, occur at 8 am UTC. A significant drop in price hours before the expiration hints that some large market makers may have been at play.

BTC/USD 1-hour chart. Source: Trading View

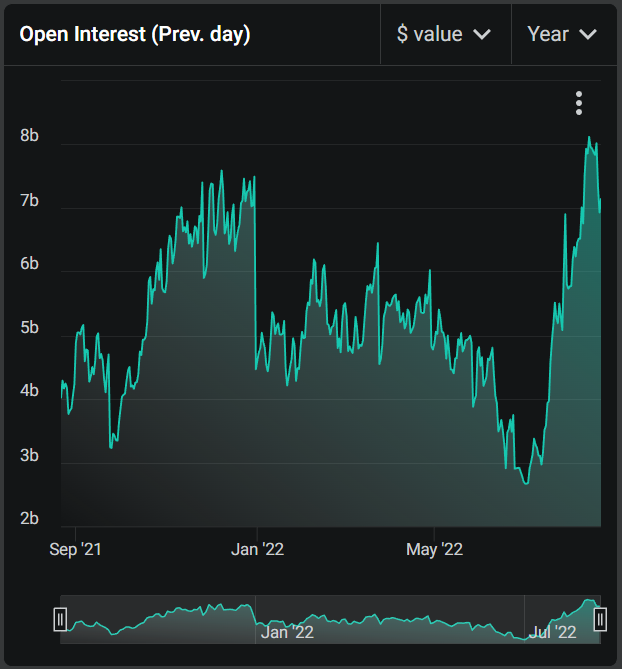

In the last few weeks, the open interest (OI) volume for options contracts has increased considerably, especially for ETH options. Led by the Merge hype, the OI volume surged above October 2021 highs and surpassed Bitcoin’s OI for the first time.

The put/call ratio of the options market indicates buyers purchased over three times more call options than puts. Thus, sellers, usually sophisticated market makers, likely pushed the price right before expiration to earn the premiums from buyers.

ETH Options Open Interest volume on Deribit. Source: Deribit

The volatility risk also exists for this Friday, with $1.1 billion in ETH options and $900 million contracts expiring. The maximum pain price for ETH and BTC is $23,000 and $1,500, respectively.

Currently, Bitcoin is trading at around $21,000, while ETH trades near $1,550. In case of upside, watch out for resistance to the upside in Bitcoin’s price at $23,000. More weakness is that ETH towards $1,500 is also expected as the monthly and weekly contracts expire.

Changing Bias Towards Bitcoin

Changing your bias on the market can be tricky when you are in a high-conviction trade. Despite the bullish technicals, BTC did not hit my target of $26,500.

Last week’s sudden reversal has caused me to re-evaluate my opinion due to the speed and ferocity of the reversal on Friday. A bleak possibility of an options-driven crash or liquidation hunt by whales exists. However, this theory only has credibility if Bitcoin recovers most of last week’s losses in the first couple of days of the U.S. trading week.

For bulls to take back short-term control, we probably need to see the Bitcoin price revisit the scene of the crime, meaning last week’s breakout level, which is $22,700.

This would be my market pivot for the BTC/USD pair this week. If bulls can anchor the price above this level, then $23,500 and $24,200 would be the following targets to watch.

One of the most frustrating parts of the latest bearish reversal is that it leaves a tiny margin for another shot at $30,000 due to the poor technicals and the sheer amount of time the market took to reach the current August high.

The weakness and sudden failure indicate that Bitcoin and the crypto market are probably headed towards cycle lows. The main risk is that the market could slip lower than the current yearly low.

If sellers gain control under $21,000, the likelihood of more steep downside increases considerably. I think it will be a very tough road back for Bitcoin if the price breaks below $19,800 support. While a bit too early to make the call, $12,000 seems possible during this bearish attempt.

BTC/USD Daily chart. Source: Trading View

ETH’s Point of No Return

While the Ethereum Merge narrative and massive spot purchases of ETH since the beginning of July instill some hope of a bullish revival, the speed of the decline from the $2,000 level has raised a massive red flag. Thus, looking on a higher time frame for “point of no return” levels is crucial this week.

If we look at Ethereum’s former all-time price high from 2018, we can potentially get a clue about the “point of no return” for the second-largest cryptocurrency.

In 2018, ETH peaked at around $1,419 and took nearly three years to break that level before moving slightly above $4,000 last November. This would be the area to watch this week. A weekly closing below this level could spell trouble for ETH buyers.

The ETH/USD pair tanked last week after breaking under $1,800. This would be the weekly pivot and a make or break level for Ethereum regarding whether this is a genuine breakdown or possibly a bear trap.

ETH/USD Daily chart. Source: Trading View

XRP Bullish Hopes Shattered

The XRP price declined along with the broader market. With the market now unsure and the XRP SEC case still in full swing, it’s probably not a good time to sit in uncertain trades that could pull back by double-digits.

The $0.3300 level is probably the market pivot to watch this week. A move under this level and XRP looks doomed to go below $0.3000. If this area holds, a move back to $0.3580 or even $0.3800 could be on the cards.

Worryingly, my bearish target for the total crypto market capitalization is around $500 billion if the market moves lower from here and cracks below the yearly low of $766 billion. This would mark almost a further 50 per cent decline from current levels. Thus, currently, I am staying flat on the crypto market.

XRP/USD Daily chart. Source: Trading View

Playing The Odds

Several factors make me cautious about buying after last week’s sudden and very steep downturn. The bear market catalysts such as low buy volumes, the poor economic backdrop, and the rising U.S. dollar are back in full swing. Sitting on the sidelines best describes how I feel about the crypto market after the recent reversal.

Should we see Bitcoin rally above the $24,000 level and Ethereum breaking $1,800, I would reevaluate my short-term bearish stance. Until that happens, I will probably look for an opportunity to ride the next wave lower.