FTX implodes

Bitcoin and the entire cryptocurrency market crashed last week thanks to the Alameda Research-FTX exchange fallout. The news of the exchange’s liquidity crisis has sparked fears of contagion, the potential extent of which is still unknown.

The situation escalated quickly. What started as a selloff of $500 million worth of FTT tokens by Binance ended up revealing a $10 billion hole in the FTX exchange.

The FTX implosion has had widespread repercussions across the entire crypto market. Crypto lending platform BlockFi has halted customer withdrawals, blaming a “lack of clarity” on FTX. Crypto.com also paused withdrawals for stablecoins on Solana, one of the leading projects under FTX-Alameda’s wing. Rumors of Sam Bankman-Fried being detained in the Bahamas are also doing the rounds.

The FTX crisis also overshadowed the U.S. economy’s favorable Consumer Price Index print. The low CPI number indicates that inflation may have peaked, leaving space for a potential Fed pivot. The U.S. dollar and U.S. Treasury yields fell as Fed members from many districts expressed their views that a measured approach would be appropriate, hinting that the rate hike cycle may have peaked.

However, macroeconomic events have little to do with crypto right now. The liquidity crisis is the most crucial issue for the crypto industry. Crypto investors are either selling or withdrawing their coins on exchanges at a rapid pace. The widespread bank run scenario is a proxy liquidity test for the industry.

Additionally, the price slump is putting pressure on the supply side. The BTC mining industry looks like it could be headed toward imminent capitulation unless we see a quick recovery above the $19,000 level.

The likelihood of a positive recovery is slim as I expect prolonged negative shocks from the FTX implosion across the entire crypto industry. To make matters worse, the increased risk of regulatory oversight is another unpredictable factor looming over the markets.

Poked the Regulation Bear

The events surrounding FTX last week shocked the market and have created much uncertainty in the industry. While the liquidity crisis from the bank run remains the main problem, another risk could be brewing in increased regulations.

Sadly, many exchanges still lack the credibility and trust of established banking institutions. Thus, the concerns are not totally out of proportion. The skeptic in me thinks there is much more to the FTX story.

Critical thinking is sorely missing in today’s society thanks to 10-second attention spans spawned by cellphone addiction and TikTok videos. However, we need to look past the headlines and think about the outcomes of the FTX episode with our brains.

The outcome of recent events will likely lead to the notion that highly regulated digital currencies are the only solution ahead. The regulators will get to choose what to trade and especially what not to trade, and it won’t be long before central bank digital currencies start to compete with existing dollar-pegged stablecoins. For those who can read between the lines, you see where I am going with this.

Right on cue, the White House and U.S. Senate Banking Committee members have called for proper cryptocurrency regulation. “Without proper oversight of cryptocurrencies, they risk harming everyday Americans, and this is something that clearly we monitor and we see as an important issue,” White House press secretary Karine Jean-Pierre said in a media briefing last week.

What this means in the near term for crypto is debatable, but in all probability, it will not favor the industry. At the same time, the present liquidity crunch continues to cripple the industry. I am going out on my sword to say that we will probably see more extremely bad news and price volatility in the coming weeks.

I expect crypto to be dragged through the mud for some time before a potential buying opportunity appears. Regular readers of my PRO BTC Trader newsletter will know that I have been calling for a massive reversal from the $21,500 level and an eventual drop to the $14,000 area for the past two months.

I will discuss this more in the technical analysis section later in this article and where to look for clues of a potential market bottom.

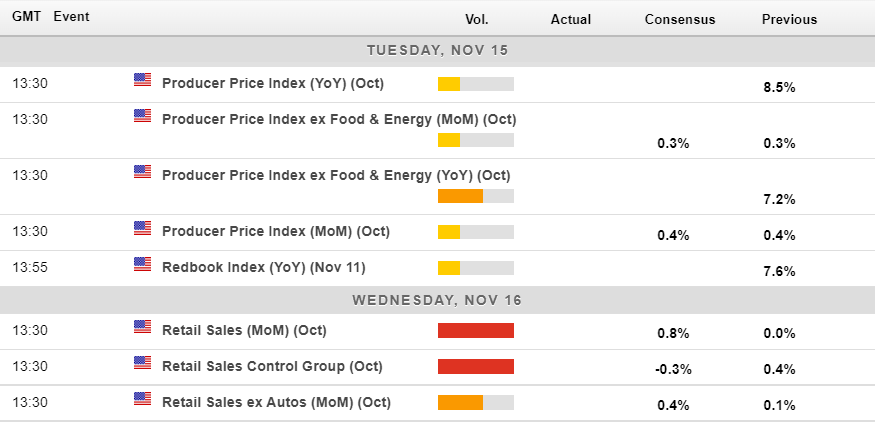

Economic Calendar for the Week

Notably, the economic calendar is quiet this week compared to last week. The latest CPI print at 7.7% was a particularly bullish catalyst for the stock market. However, the Alameda-FTX issue eclipsed the positive effects of this news. This week, consumption and inflation data top the economic calendar.

The Producer Price Inflation index and retail sales data from the U.S. economy comes out Tuesday and Wednesday. The PPI data is unlikely to affect the markets because it’s neither Fed’s preferred inflation gauge (the personal consumption expenditure (PCE) price index) nor the market’s. So expect the peak inflation narrative and Fed pivot optimism to grow over the next few weeks.

Additionally, the dollar’s weakness following the CPI release also sets the scene for a solid reversal in crypto once the dust settles on FTX and any other major players than fall by the wayside.

It is also worth paying attention to Chinese news. Preliminary signs have that the country could be easing lockdown restrictions have emerged, which is a positive sign for risk assets.

The economic calendar for this week (Source: Forexlive)

Bitcoin Miner’s Dilemma

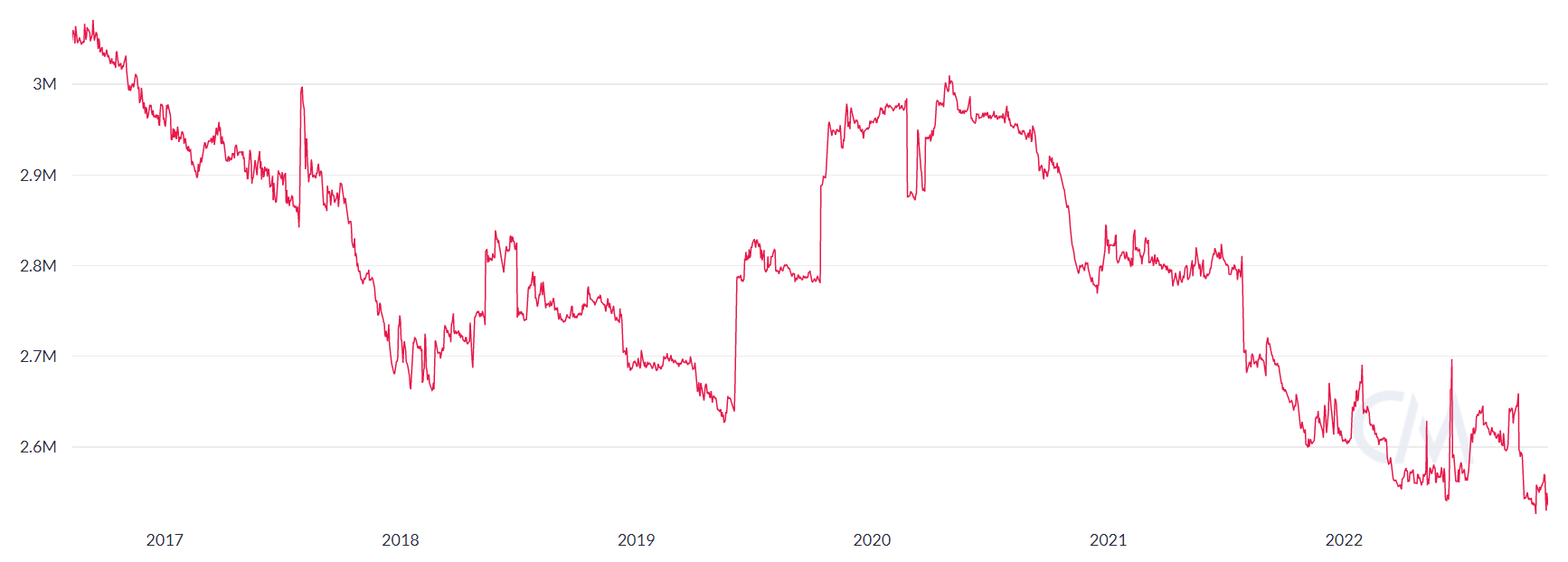

Last month, I mentioned that Bitcoin’s mining industry was under a lot of stress. While some public companies face insolvencies, private entities are likely to perish due to poor business conditions.

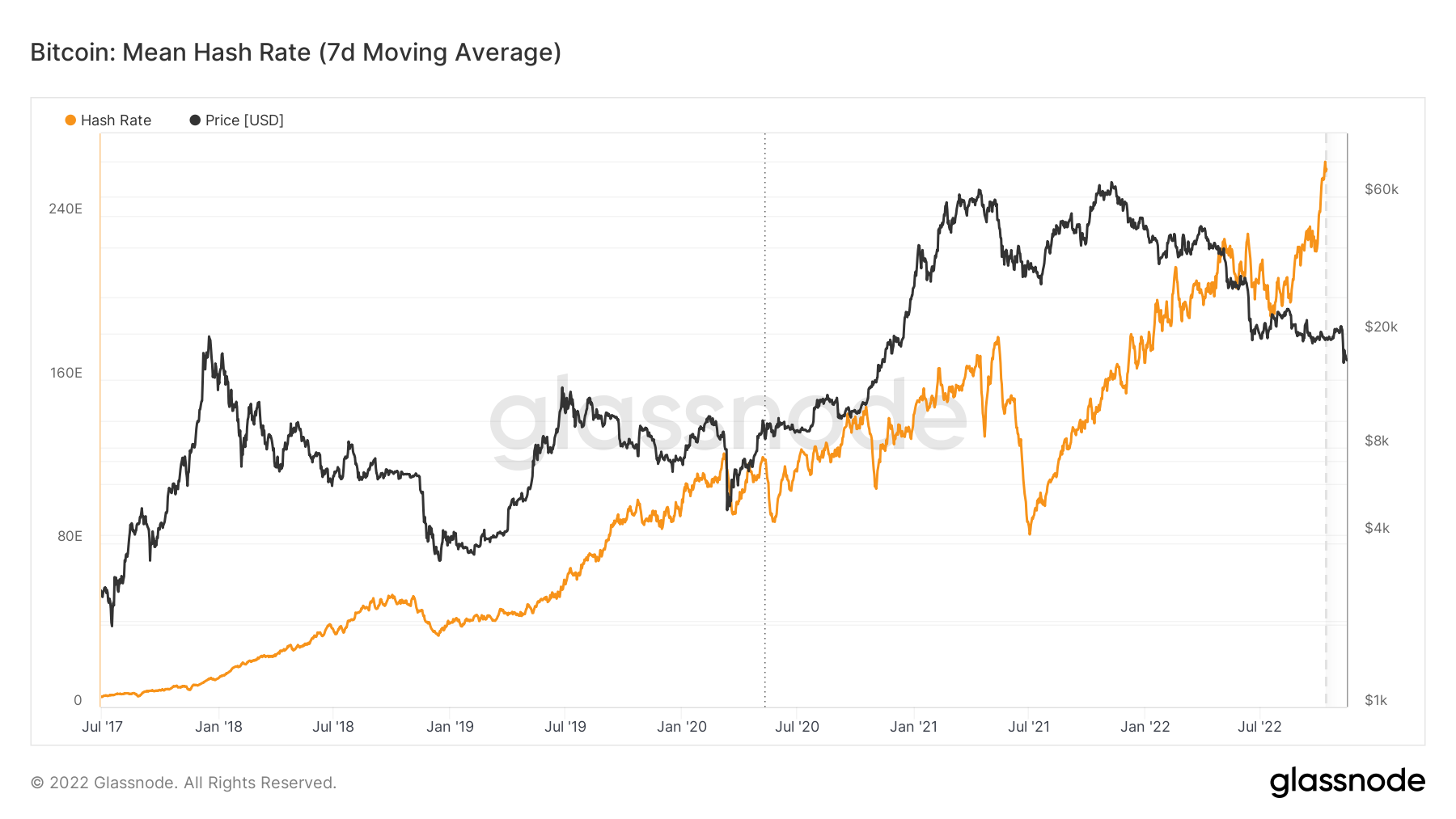

The recent FTX-led crash has only exacerbated the problem. Now, all mining entities are spending their own money to run the machines. As only a few of the existing miners will have the capacity to do that, the total mining hash rate will decrease.

Bitcoin production cost vs price (Source: TradingView)

The mining industry will look to find an equilibrium with the price. And there will be a lot of turbulence as it reaches a new state. The exodus of miners, termed “miner capitulation,” is usually a bearish event because the insolvent businesses typically sell more BTC in the short term to cover wind-down costs.

The holdings of Bitcoin addresses that received BTC from mining pools have dropped below June 2022 lows as miners have had to spend newly mined BTC to cover running costs.

Holdings of Bitcoin addresses that received BTC from mining pools (Source: Coinmetrics)

On top of that, the mining hash rate has surged tremendously over the last few weeks owing to the delivery of the most efficient machines from the orders placed last year. Due to the additional pressure from the recent price slump, we will likely see a substantial dip in the hash rate soon. As I mentioned, the capitulation event will likely accompany strong sell pressure from miners, worsening the current market situation.

Bitcoin’s 7-day mean hash rate (Source: Glassnode)

Bitcoin’s design makes mining cheaper as the number of participants decreases. After the capitulation, the selling pressure would decrease as only efficient miners who remain will start to accumulate again. However, it has to pass the capitulation test before that.

A Missed BTC/USD Shorting Opportunity

Every trader’s biggest frustration is missing a damn good trade. Last week was particularly annoying for SIMETRI and PRO BTC Trader subscribers and myself. A long-planned trade worked exactly as planned. But the entry was missed by a Danny Devito-sized fingernail.

I signaled the trade in question eight weeks in advance—a short entry set at $21,500 and a target of $14,000. Unfortunately, it missed my entry point by $22 as BTC topped around $21,478. With that particularly shameful trade not so much a distant memory, it’s time to look ahead to the next one.

I will use the total crypto market capitalization chart as my primary tool. The $520 billion crypto market cap target is the big picture downside target, so longs look attractive to me for BTC when we reach that area.

BTC/USD Daily chart (Source: TradingView)

ETH/USD Requires More Patience

I see a lot of chatter about buying ETH at $1,000 or $900. However, I have some reservations about this entry point. I personally would be looking lower in terms of a pick-up spot, around $500.

ETH will probably only rise in the future. That’s the long-term game plan with the most liquid smart contract blockchain. However, it doesn’t mean those pesky whales won’t push Ethereum to unthinkably low prices.

I am in no hurry to buy any ETH yet. This is just the first innings for the FTX saga, and as more bad news unravels, I will wait until my target for the total crypto market capitalization is reached.

ETH/USD Daily chart (Source: TradingView)

$500B: You Heard It Here First!

Regular readers of my PRO BTC Traders newsletter will know I have been targeting a global crypto market capitalization of $500 billion for several months.

I don’t recall the exact date I first spotted it on the charts, but I have been boring people senseless discussing it in my webinars.

I won’t divulge all the secrets on the charts about why this area is a huge price magnet. But needless to say, there’s a lot of evidence for why I am confident to keep saying it, and for me, this is the primary target for the plungers and the point of maximum pain for retail investors.

Crypto Total Market Capitalization Daily chart (Source: TradingView)

It Has Only Just Begun

People much smarter than me predict that the FTX saga will kick off other bankruptcies in the crypto space. This part is a no-brainer, given the scale and extent of FTX-Alameda’s portfolio.

With this in mind, there should be more pain among investors, and the crypto industry’s name will get tarnished many times over. We’ll see epic amounts of FUD.

On-chain, off-chain, and sentiment data are yet to show actual “sell your granny” type panic, but it’s probably coming. The big question for me is, does this happen before Christmas, or will it be dragged out until 2023?

Nevertheless, I’d keep an eye on the half-a-billion-dollar crypto market capitalization level and skyscraper throwers-type panic ahead. In the interim, forget broader financial markets and politics; crypto-specific newsflow should dictate the current pricing.