Fed decision week

Bitcoin’s price finally staged a much-needed range breakout last week. It rallied towards $21,000 thanks to bullish crypto-specific news and the U.S. Federal Reserve’s downgrading of interest rate hike expectations.

Reports suggesting Twitter is working on a web 3.0-based crypto wallet product also uplifted buyer sentiments. A large section of the crypto community felt Elon taking over Twitter could be bullish for BTC and DOGE, hence why both are pumping in tandem.

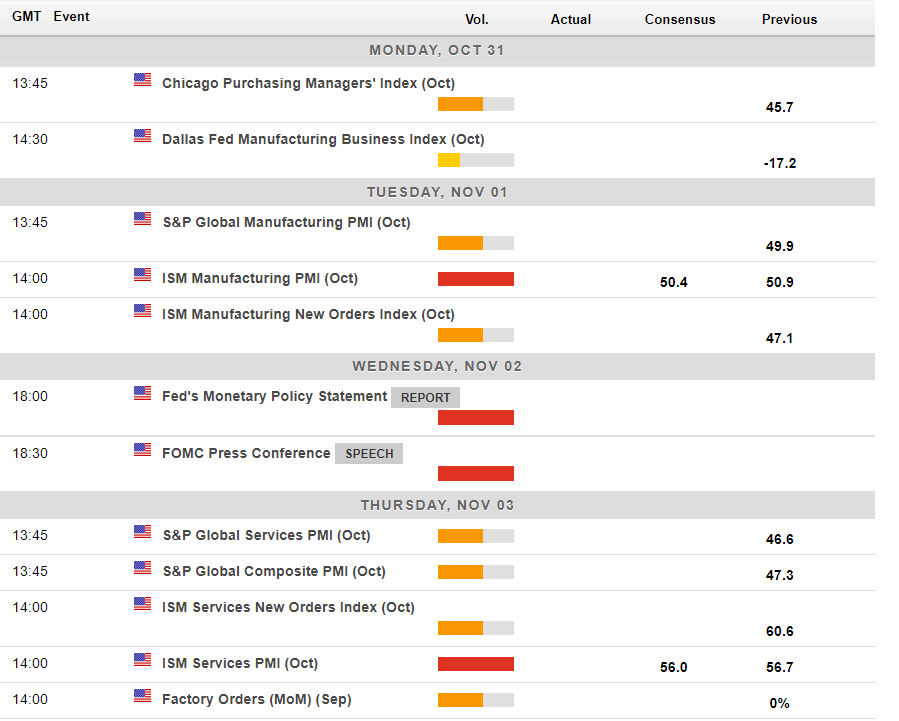

BTC also benefited after the Purchaser’s Manager Index (PMI) data, a survey of manufacturing and service firms, revealed that demand in the service sector (where most Americans work) plummeted from 49.3 to 46.6. The reasons were reduced client demand, elevated inflation, and higher interest rates.

A slowdown in demand helps curb inflation and reduces the fear of aggressive interest rate hikes. Financial advisors from BlackRock Inc., the world’s largest hedge fund, also said they expect “pivot language” at the next Federal Open Market Committee meeting. However, a report from The Wall Street Journal over the weekend raised concerns about a potential Fed pivot.

Other reasons for concern include a possible sell-off due to miner capitulation. Bitcoin miners have remained profitable since June this year but are now running out of their working capital reserves stocked up from last year.

While the chances of a medium-term bullish breakout are increasing, much will depend on the Fed’s policy rate statement on Wednesday and the market’s reaction to it.

Cracks in the Fed Pivot Theory

Last week, BlackRock, the world’s largest asset manager, suggested that the Fed could pivot away from its current policy of aggressive rate hikes to address the market’s liquidity crisis. BlackRock’s analysts expect a 75 basis point rate hike from the Fed in November, but language that communicates smaller rate hikes in December, January, and February meetings, leading to a pause at around 4.75%.

With $10 trillion in assets under management as of January 2022 and more political connections than you can swing a stick at, it is hard to argue that BlackRock may know something the average asset manager may not.

That being said, it is prudent to keep an open mind as to whether the Fed will start to talk down the pace of rate hikes at this week’s meeting. A Fed pivot should be bullish for the crypto and the stock market. However, there are several other things to consider as well.

While the Fed could start to sound less aggressive due to some very nasty data points released this month, we also have to consider that the Fed looks very closely at unemployment—and the U.S. unemployment rate number dropped last month.

Additionally, Nick Timiraos of The Wall Street Journal, popularly seen as the Fed’s media leak, reported that given the rise in consumer spending, there are reasons to believe that the Fed will continue on its path of quantitative tightening.

With inflation still above the Fed’s target of 2%, we have to consider that a pivot is not the most obvious choice right now. I believe that crypto could get a knee-jerk pump from some of the initial Fed policy statements, but the realization that inflation is still rampant and the Fed is still in wait-and-see mode could eventually cause rallies to be sold.

It is also worth noting that earnings season is in full swing. While the corporate calendar is less hot than last week, it will be intriguing to see third-quarter results from Coinbase this week, given the industry’s struggles. PayPal will also release its third-quarter results, and it will be interesting to see how it performed.

Economic calendar for the week starting October 31 (Source: Forexlive)

Miner Capitulation Risk

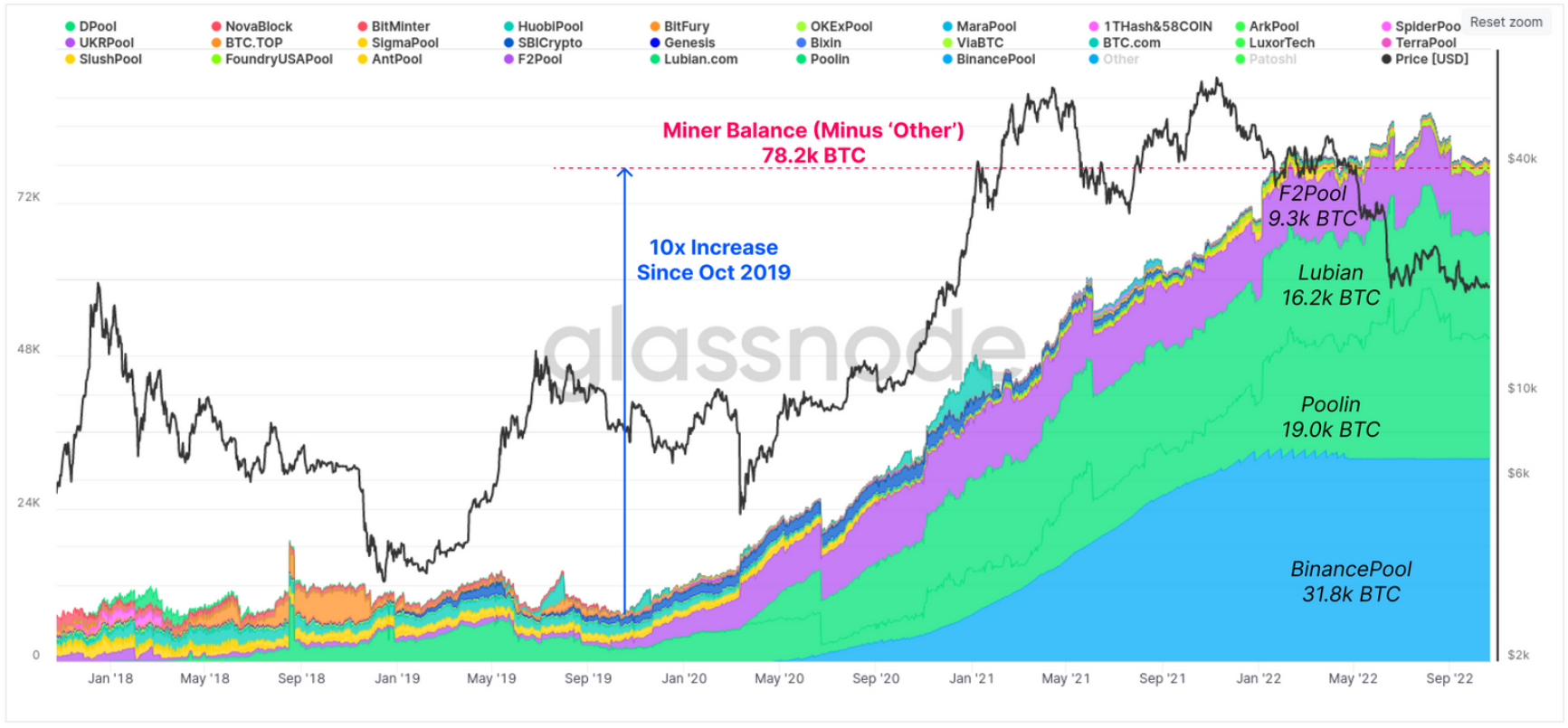

A rumor about miner capitulation surfaced on social media last week after the largest publicly traded mining company, Core Scientific Inc., published a disappointing financial statement. The mining firm has reportedly depleted its 9,000 BTC reserves to cover costs and is currently left with only 26 BTC.

Capitulation occurs when miners must liquidate a significant portion of their BTC treasuries to cover costs. A capitulation event usually accompanies a sudden price slump in the short term. Historically, these events have also marked a bottom in Bitcoin’s price.

In this cycle, the market witnessed one capitulation event in June when nearly 10% of the total hash rate declined after a large sell-off from miners. Since then, many miners have remained under pressure with negative profitability.

The Bitcoin price is trending in the mid-range of the production cost band (Source: TradingView)

On top of low prices, the competition in the Bitcoin network has grown vertically since August. Last year, many mining companies bulk pre-ordered hardware with delivery times spread across 2022. As new machines go online, the hash rate grows, adding more pressure on the existing miners who struggle to remain profitable.

Bitcoin hashrate 7-day moving average (Source: Glassnode)

According to Glassnode, Bitcoin miners hold around 78,200 BTC (worth around $1.5 billion), which introduces the risk of a sell-off if the stress continues. The wallet balances of top Bitcoin miners have stagnated since June, and if the pressure continues, some miners may have to make tough decisions, adding selling pressure to the market.

Bitcoin miner balances (Source: Glassnode)

A Crucial Week for BTC/USD

In my humble opinion, this week’s price action will likely determine the direction of Bitcoin for some months. All the ducks are lining up in a row for a breakout or the continuation of the protracted bear trend.

If we compare Bitcoin’s price action to a game of poker, then “the tell” could be what happens to Bitcoin around the $21,500 to $21,700 area this week.

If we see Bitcoin taking out this area with relative ease and strong buying demand, we could see a coming test of the $24,000 to $25,000 price range into the year-end.

However, should Bitcoin’s price get rejected from this key technical area, we could see a resumption of the multi-month downtrend and new yearly price lows over the next few weeks.

BTC/USD daily chart (Source: TradingView)

ETH/USD Breakout Clues

ETH broke above its long-term support and resistance area at $1,420, increasing optimism among buyers. The next significant resistance point for the second-largest crypto is around the $1,760 level from its 200-day moving average.

If ETH breaks above $1,760, the current bullish trend should continue. The Parabolic SAR indicator is close to giving its first weekly buy signal since April.

However, personally, I am expecting a termination of the bull move around the $1,700 to $1,760 area this week and a resumption of the bear trend. I am prepared to be proven wrong, which will happen if we easily see the $1,760 area broken this week.

ETH/USD daily chart (Source: TradingView)

BNB/USD Test

BNB is currently one of the cleanest price charts, making it easier to trade. Looking at its weekly price action, you can see that BNB/USD repeatedly gravitates towards technical areas like $220 and $330.

BNB looks to be approaching one of its favorite technical zones this week at $330. The bullish trend should terminate or continue to new highs around the $500 area if the $330 price level is broken decisively.

I remain skeptical that BNB can surpass $330 without a bullish crypto-specific price catalyst. This week, I will look closely around the $330 area for clues as to BNB’s next 50 percent price move.

BNB/USD daily chart (Source: TradingView)

Finally Some Movement

After months in the doldrums, things are finally starting to look up, and we could see some explosive price action into the year-end.

I think we are far more likely to see one more big down leg in the crypto market before a genuine recovery takes hold. This is primarily due to the dire macroeconomic environment and the fact that inflation has probably yet to peak.

Quantitative easing was undoubtedly one of the primary price catalysts for crypto in 2020 and 2021. Since the monetary methadone has been pulled away, risk-on assets have struggled. Moreover, the Fed continues to increase interest rates aggressively. Without a solid crypto-specific price catalyst, I have my doubts about sustainable price rallies.