“Definition of Making It”

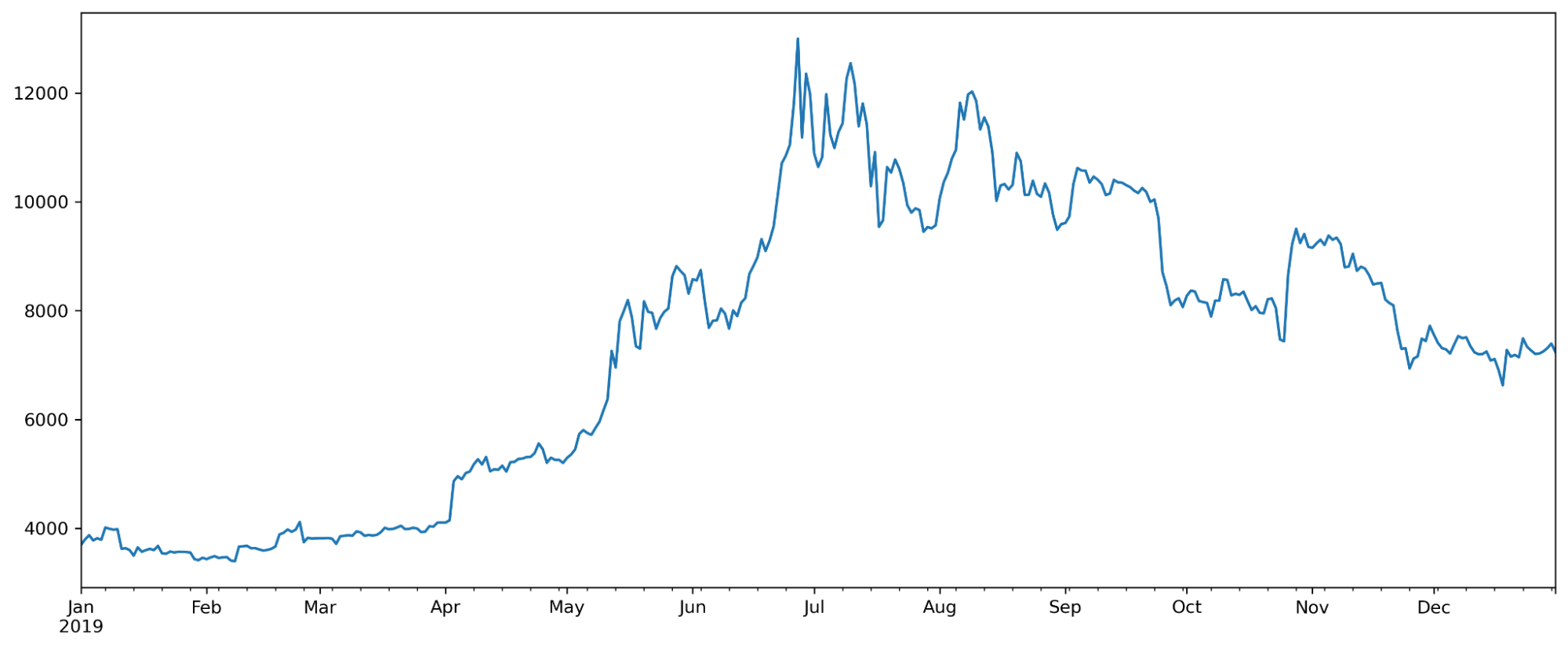

Do you remember 2019? If not, no worries. Here’s the chart.

Source: CoinGecko.

There’s a reason I’m asking whether you remember 2019. Many people remember 2017 and 2021 because those were bull markets. 2019 was not, at least it didn’t feel like it, and yet BTC went up 3x in the first half of the year.

In January 2019, the market stumbled across an idea of how to revive the ICO concept. Binance launched its first IEO, Bittorrent, and it was highly successful.

The subsequent wave of optimism pushed the market up for a while, but the IEO trend started to die off. At that time, most had PTSD from 2018, so holding or buying after the peak of the IEO mania was a nerve-racking experience. Yet, that was a winning tactic.

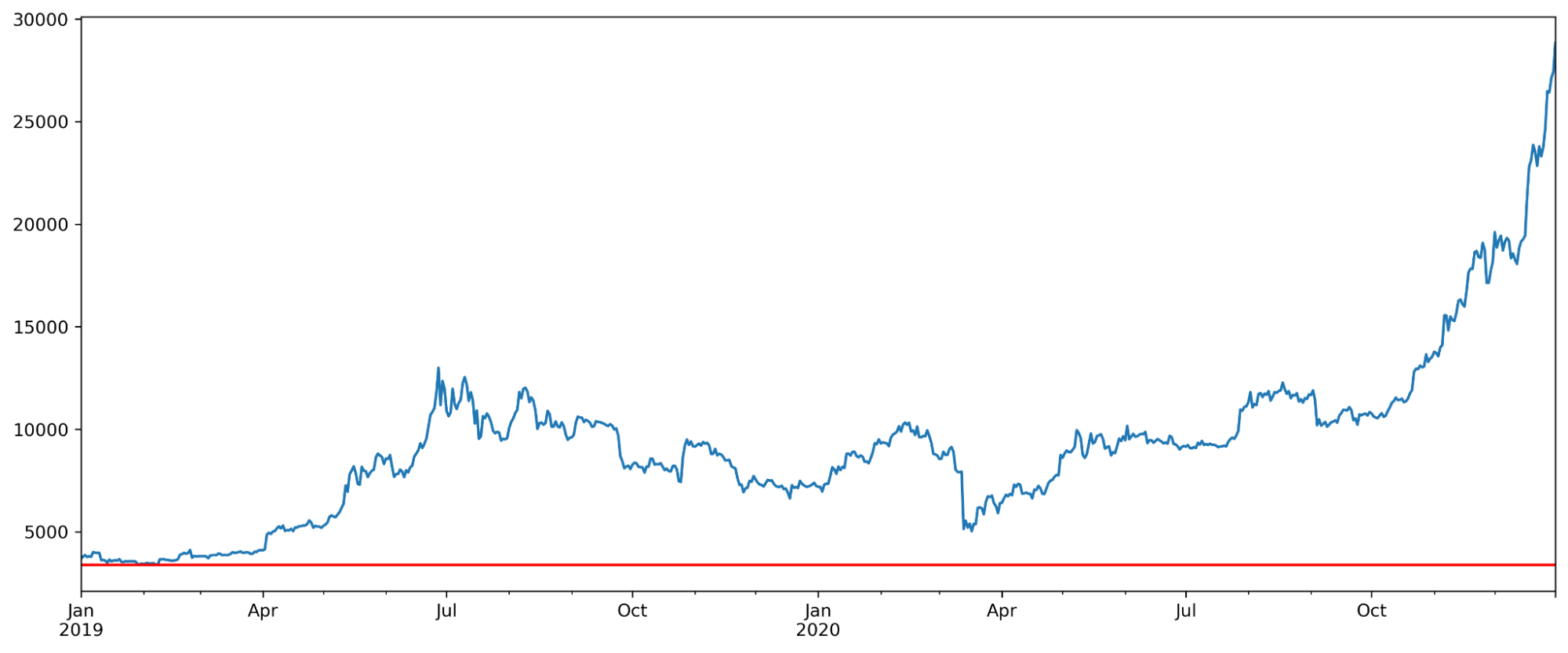

Early 2019 was the best time to enter the market. Source: CoinGecko.

Over the past several issues of the Digest, I’ve been saying that there might be more pain ahead for the market. I still stand by this, but I don’t want to discourage you from responsible practices like the good ol’ dollar-cost averaging.

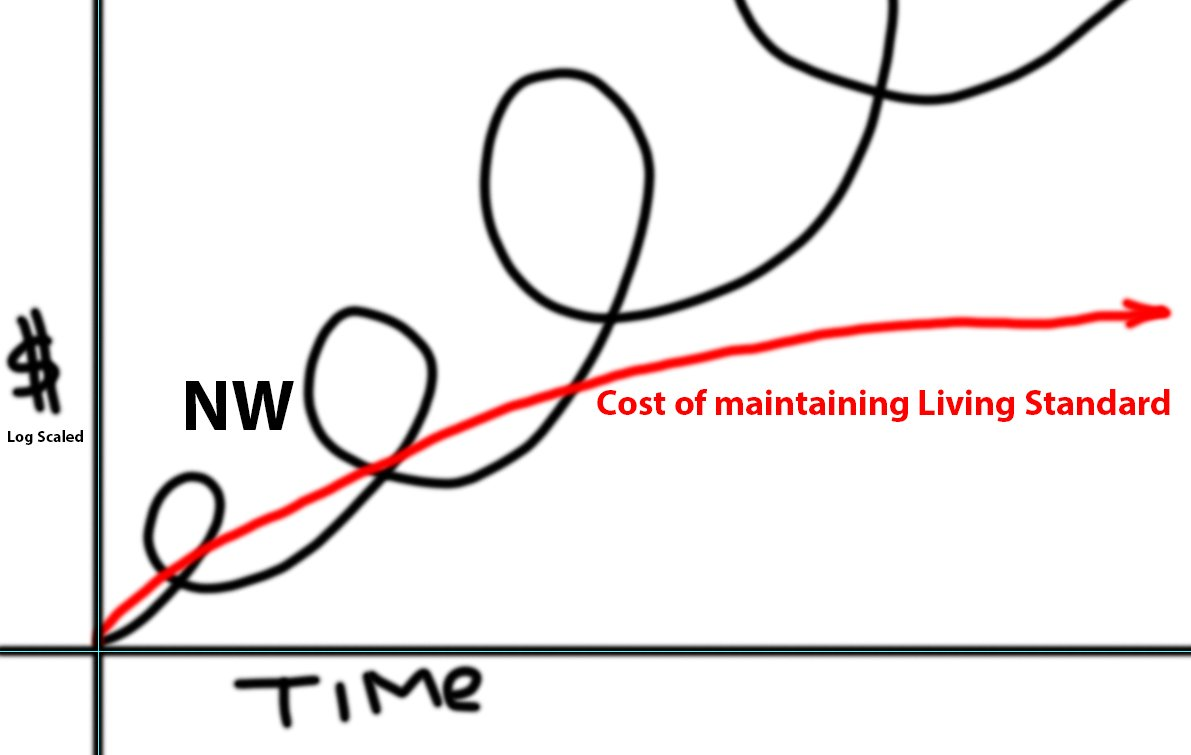

Below is the chart once posted by a famous anon figure in the crypto space, Tetranode. It’s titled “Definition of making it.”

NW stands for “net worth.” Source.

Although we might see some negativity in the future and prices might tank, they won’t necessarily decline to the current levels, or below. That will be especially true if we get a small rally as we did in 2019.

There are two ways to win in a bull market: slowly scale in during bad times or quickly enter when the bull starts. I tried slowly scaling in during the summer of 2020 and quickly realized it wouldn’t work. So, if you aren’t ready to buy a lot of crypto all at once, it may be worth keeping the dollar-cost average despite the potential continuation of the bear market.

How do you know you aren’t ready to buy a lot at once? Imagine you sense an upcoming bull market and buy. Now, remember the 2019 chart. Would you become nervous from seeing your gains evaporating closer to the end of the year?

If yes, you are probably better off slowly accumulating because seeing your portfolio fluctuate wouldn’t give you strong emotions as you wouldn’t even remember your average purchasing price.

Our networths will make roundtrip after roundtrip, but if we manage to survive and hold onto assets and accumulate them even when they decline, we should win.

SIMETRI Portfolio – Flat

Take care

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.