Buyers shows some life.

Bitcoin buyers attempted to take out the $22,500 resistance level last week on the back of solid gains in the US100 Nasdaq and a relatively less hawkish U.S. Federal Reserve. However, the uptrend faded during the weekend due to macroeconomic conditions and the emergence of potentially large sellers.

Last week, the US100 Nasdaq received a boost from a fall in energy prices, particularly oil prices. The notion that the Fed may not implement a 75 basis point rate hike at the next policy meeting helped boost buyer sentiments.

Additionally, a report that China’s Ministry of Finance is considering a purchase of 1.5 trillion yuan ($220 billion) of special bonds in the second half of this year was seen as a positive catalyst.

However, some of the steam from last week’s rally fizzled out after the release of the non-farm payrolls statistics beat economists’ prediction with an increase of 372,000 jobs, way higher than consensus expectations of 268,000. Essentially, a robust jobs market allows the Fed to push for a 75 basis point rate hike to curb inflation.

In an interesting turn of events, the embattled cryptocurrency lender Celcius paid off its $440 million loans from MakerDAO, freeing up 21,962 BTC collateral. Later, Celsius was found sending these funds to crypto exchanges like FTX.

While the above event created negative pressure on Bitcoin, the fears of a marketwide contagion dissolved to some degree after the loan repayment. Celsius has yet to pay their customers, whose assets have remained locked with the lender since June.

Besides the Celsius sell-off, two other sources of negative pressure in Mt. Gox rehabilitation and Grayscale unlocks are creating FUD in the market, and rightly so. Together with negligible to no macroeconomic improvement, these events create a potent reason for traders to practice extreme caution heading into the second half of July.

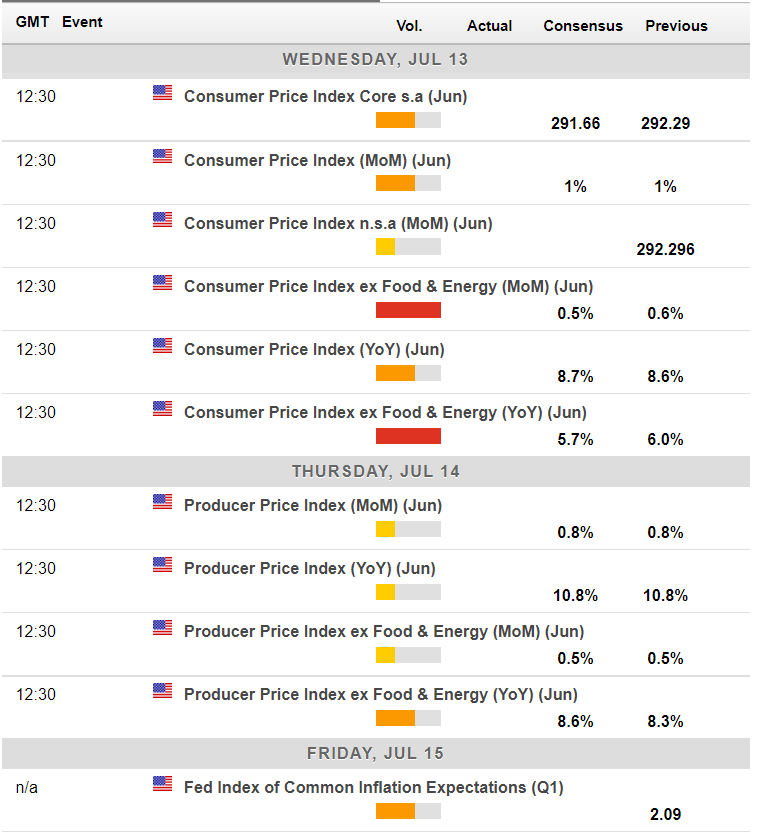

CPI Print

The biggest price driver for crypto is still the U.S. economy. Wednesday’s release of the U.S. Consumer Price Inflation (CPI) report will play a huge hand in determining the market’s mood.

Economists expect an 8.8% CPI print for June, a 0.2% increase from last month’s numbers. An increase in inflation when the job market is holding strong growth allows the Fed to remain aggressive with interest rate hikes. Thus, creating headwinds for stocks and crypto.

On the contrary, if the number is lower than expectations, risk-on assets like stocks and crypto may surge strongly as fears of aggressive rate hikes fade. For reference, oil prices fell since mid-June. However, just before the reversal in oil prices, WTI crude oil prices reached a peak of $122.11, threatening a high inflation rate for the month.

Economic calendar for this week. Source: Forexlive

Mt. Gox and Grayscale FUD

On July 6, 2022, the creditors received an email regarding the beginning of payments soon. Currently, the creditors are sitting at a 35x profit to the price of Bitcoin in 2014, when the Mt. Gox hack occurred.

The trustees hold 137,000 BTC worth around $3 billion at current prices on paper, accounting for 0.72% of the current circulating supply of Bitcoin. It creates a possibility of a massive market dump.

Notably, in the last eight years, multiple discussions between the creditors and trustees saw some creditors being bought out by investment funds at a discount. Moreover, the creditors can now be classified as long-term investors who have seen around three cycles of boom and bust in crypto. With Bitcoin’s price trading near 2017 high after falling from a peak of $70,000 may encourage some creditors to hold it longer.

The Mt. Gox situation should create a strong headwind for Bitcoin when the repayment begins. However, widespread fear in the market may exaggerate the real selling pressure from the event, possibly creating a buying opportunity during peak FUD. The repayment is expected to begin in August.

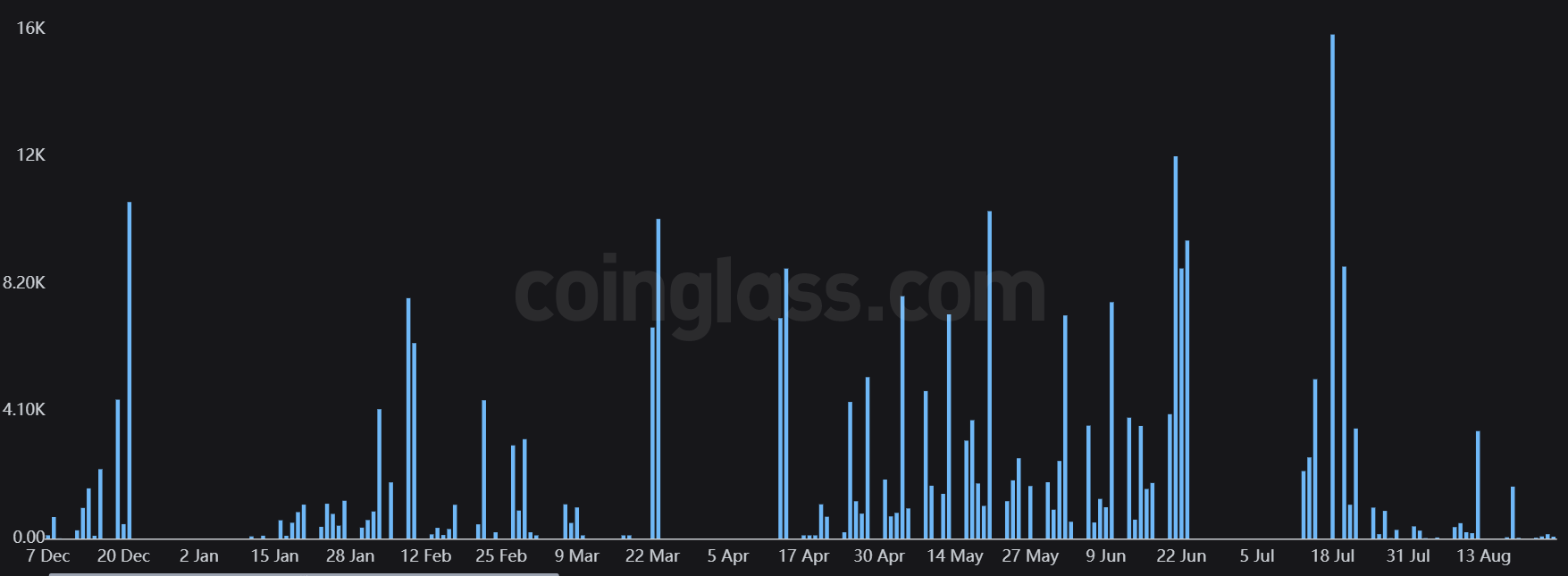

Another prominent sell pressure may arrive from Grayscale unlocks starting this week. The GBTC unlock will begin on July 14, which means buyers can sell their GBTC shares in the market.

A total of 41.6k BTC (worth $852 million) will enter the market in July via Grayscale shares. While we do not know the holders’ identities, there is speculation that Three Arrows Capital holds some or a significant portion. If that’s true, they will likely be forced to liquidate their holdings to repay creditors. Overall, if the market does not rally before the unlocks, it could spell trouble for BTC and the broader market.

Grayscale GBTC unlock dates. Source: Coinglass

200-Week Moving Average is Key

The 200-week moving average remains the most important technical indicator to watch this week. Buyers faced a significant rejection from it last week upon its first valid attempt to conquer it.

Interestingly, the total market capitalization of crypto holds support above its 200-week moving average, with sellers unable to make any traction below it over the last five weeks. It is hard to become bearish toward BTC while the entire market remains above the 200-week, especially considering Bitcoin makes up a large weighting of the total market capitalization.

In short, if Bitcoin can make strides above the $22,500 area this week, then $23,200 and $24,000 is entirely possible. The longer BTC remains under the $22,500 level, the more it weakens the short-term bull case.

BTC/USD Weekly chart. Source: Trading View

ETH Looking More Bullish

Technically, Ethereum looks more bullish than Bitcoin. Last week’s upside move saw buyers moving the ETH price above its 200-week moving average at $1,213 with relative ease. However, towards the weekend, it faced pressure due to a decline in Bitcoin’s price and closed the week just below it at $1,166.

This week, it becomes imperative that ETH storms pass the $1,300 resistance level and the price stays above this critical technical area. If that can happen, simply put, the sky could be the limit for the ETH/USD pair.

The former yearly low, around the $1,700 level, remains a very valid upside target. Although it appears a far-fetched target now, based on the previous behavior of the ETH/USD pair, it has often been drawn like a magnet to areas of extreme technical importance.

On the downside, a new low under the $1,000 level should be considered extremely bearish. Sustained weakness under this area could open up an attack towards the $900.00 one more time.

ETH/USD Weekly chart. Source: Trading View

Will XRP Play Catch-up?

While we are on the topic of the 200-week moving average, Ripple’s XRP has lost quite a bit of value below the indicator at $0.5000. It underscores how far XRP/USD has sunk in recent months, making XRP an interesting play. Currently, XRP is probably oversold compared to other tokens, which are currently flirting or somewhat above their respective 200-week moving averages already.

Weak fundamentals and lawsuits in the U.S. have adversely affected the value proposition for the once-popular cryptocurrency. Still, its price action has been clean from a technical perspective, making it a potential choice for traders.

If market-wide recovery resumes, the XRP/USD pair could levitate towards the $0.5000 level. Given its current pricing, this type of rebound could bring significant gains.

The criteria, however, is that the XRP/USD pair holds firm above the $0.3100 area. Moving above the $0.3800 level would kick-start the next leg higher this week. The chances are that XRP could move towards $0.4000 as we advance and hopefully $0.4400.

XRP/USD Weekly chart. Source: Trading View

Watch Out for Market Movers

The market action will probably start to pick up after the release of the U.S. CPI report Wednesday. The June report will be instrumental for market sentiment in setting the expectations before the FED policy meeting on July 27, where it will announce a rate hike.

Bitcoin’s inability to get above its 200-week moving average raises doubts on whether the pioneer crypto can now continue to build on last week’s gains and take out another batch of resistance levels. However, the fact that the crypto total market cap chart remains above its 200-week moving average provides a glimmer of hope that the market can still head higher.

As has been the case recently, the U.S. economic outlook and price action around the 200-week moving averages on both Bitcoin and the crypto total market capitalization remain the key narratives to watch this week.