BTC Support holds on Thanksgiving

Bitcoin’s price recovered toward the $17,000 level last week after trading platform Genesis downplayed a rumor that it might be the next to fall following FTX’s collapse. The Thanksgiving Holiday buying also appeared to kick in, adding to the positive move.

BTC started the previous week under pressure, hitting a fresh two-year low after on-chain transaction data showed that the hacker who stole roughly $372 million from the FTX exchange was slowly converting the funds from ETH to renBTC, sowing confusion among onlookers.

However, later in the week, the possibility that an agreement with creditors or fundraising by Genesis’s parent company, Digital Currency Group, could avoid insolvency mildly alleviated some of the recent stress in the crypto market. There are still many unknowns to this story, however, and it’s not yet clear how well this will end.

Binance hogged the limelight as the exchange doubled its industry recovery allocation to $2 billion. However, the confidence among industry participants was shaken deeply after the FTX debacle, and Binance’s altruism is failing to lift market spirits.

This week, the U.S. Senate will hold a hearing on the FTX fallout and possible contingency plans, where I expect lawmakers to propose strict regulations in this week’s FTX hearing.

On-chain data shows that miner and retail investor capitulation is underway. Given that BTC is holding firmly above $16,000 and U.S. stock market conditions are favorable towards risk-on assets, a short-term relief rally can likely take place. However, I wouldn’t get too excited about a sustainable bullish move.

Don’t Get Excited

A few signs have emerged since last week, suggesting the possibility of a relief rally. The market’s sentiment reached extremely low levels, showing the start of retail capitulation. On top of that, positive pressure is also building from the traditional markets as U.S. stocks turn higher. Although a short-term bullish rally could be afoot, unresolved stress points can create significant headwinds for BTC.

The hashtag “#dead” has recently been circulating rapidly on social media platforms. As the most bearish sentiment adjective you can find, this is a sign of traders giving up on the market rebounding.

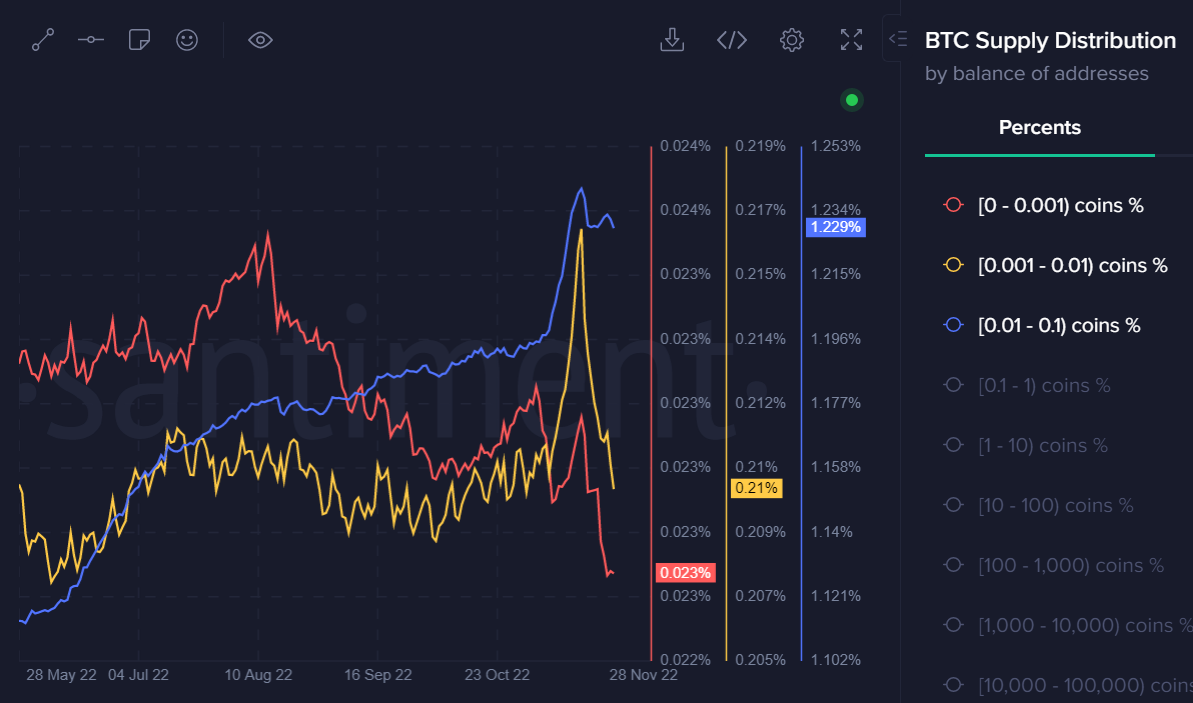

Ironically, this capitulation word has historically been most prevalent when the market rebounds, suggesting that the current rise could have legs. The Distribution data of BTC shows a considerable decline in holdings of addresses with less than 0.1 BTC, further confirming the panic sell-off among retail investors.

Holdings of BTC addresses with a balance of <0.1 BTC (Source: Santiment)

This means we could expect some more upside in the coming weeks. However, don’t get excited, as I still believe this is another minor recovery within a larger bear market. I told the same thing to Bloomberg last week when they asked for my opinion. I suggested that rallies toward $18,000 would be a solid selling opportunity.

The pessimism stems from the fact that there’s a strong likelihood that we haven’t reached the end of the contagion following the FTX collapse. The recent revelations around Genesis Global Trading and its parent company Digital Currency Group facing liquidity issues is a potent red flag—one that could take down the largest Bitcoin investment instrument, Grayscale, with it.

Additionally, Oxford Economics, a global economic forecasting and econometrics leader, has said that it only expects China to exit from its zero-COVID policy in the second half of 2023. This would be hugely bearish for the global economy as lockdowns in China add to a shortage in the global supply of goods and services, which increases inflation.

Considering the above, I strongly suspect risk-on sentiment will remain subdued until at least the first quarter of 2023. I won’t look too far ahead at this stage; my crystal ball or long-term price chart says we could see $42,000 in late 2023 if the $9,000 support zones hold. You heard it here first!

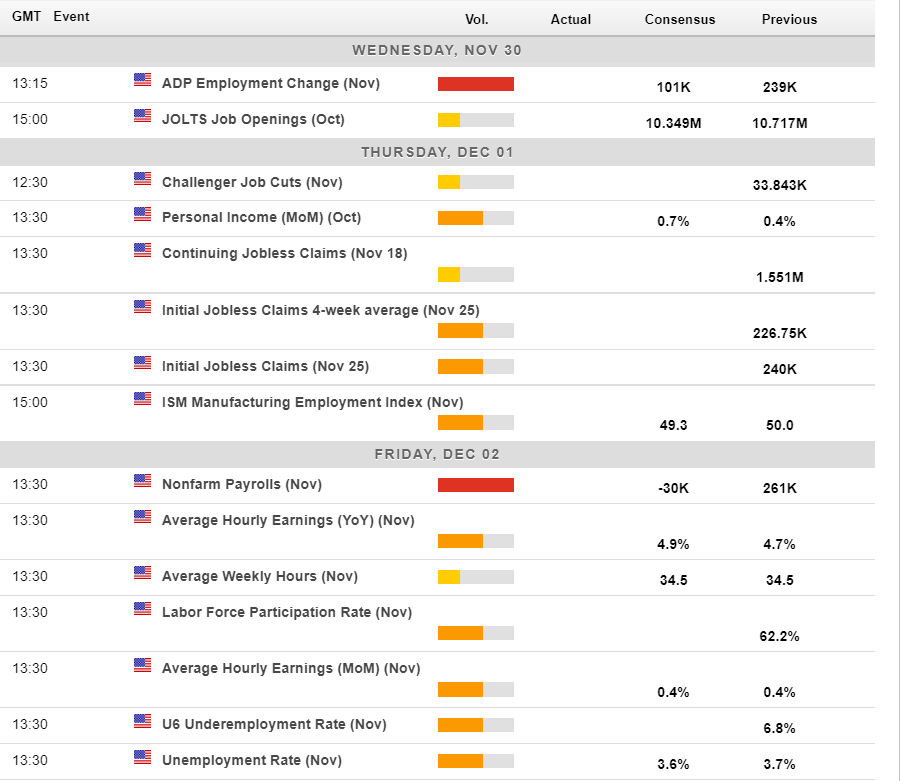

Economic Calendar For The Week

The release of the October federal policy rate meeting minutes caused the U.S. dollar index to plunge as Fed members gave a further nod to slowing rate hikes.

This week, market participants will hope that the United States job situation continues to hold up. However, a weaker jobs market could add some headwinds to the ongoing recovery in BTC.

The Fed has been vocal about keeping the unemployment rate low and keeps a close watch on it. Last month, the unemployment rate started to tick higher. Traders will be watching the number closely this week for a sign of job market stress, which could derail the positive sentiments around risk-on assets in expectations of a Fed pivot.

The economic calendar for this week (Source: Forexlive)

Bitcoin Mining Industry Purge

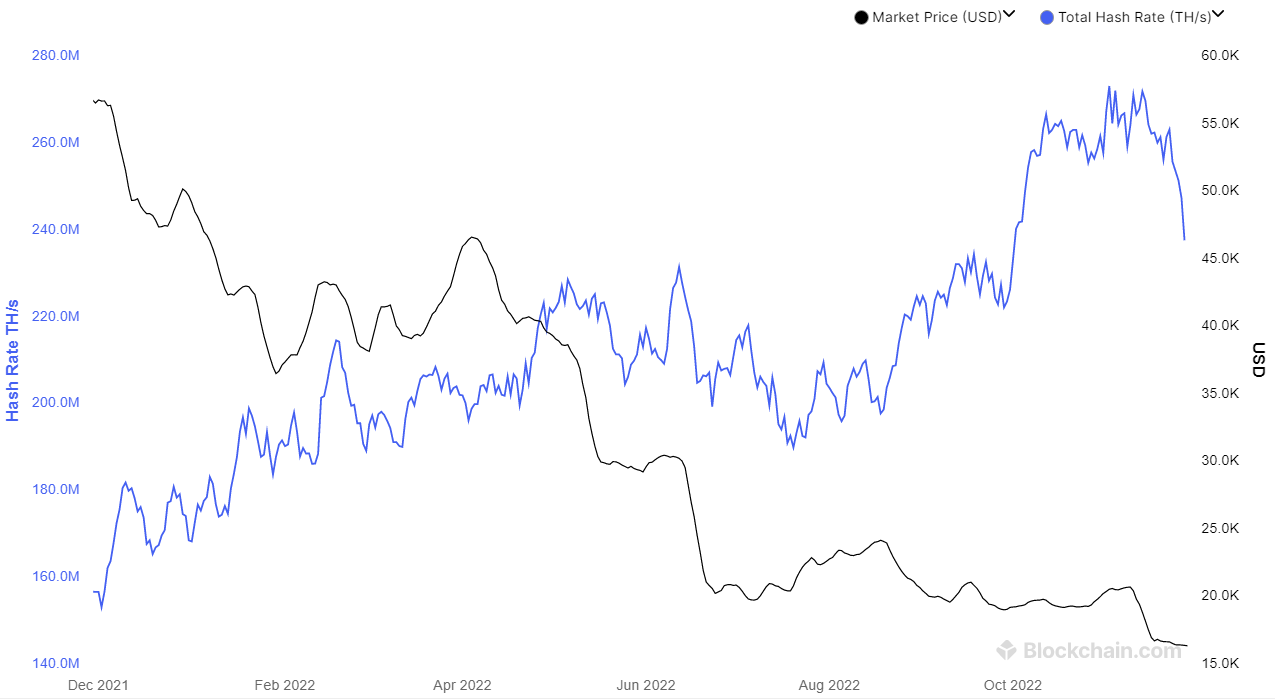

As predicted over the last few weeks, a capitulation of the Bitcoin mining industry has begun as operators turn their machines off due to all-time low profitability. The network’s hashrate dropped nearly 10% over one week.

Bitcoin network’s hashrate (Source: blockchain.com)

For most of the month, the miner’s sell pressure remained strong as most operators paid to run their operations after Bitcoin’s price dropped to $16,000. Bitcoin did not drop to a new monthly low due to the miner’s sell pressure this month, which is a sign of strength. However, buyers will now have to undergo the test of capitulation, where the selloff may increase due to wind-down costs.

For now, it’s encouraging to see that miner holdings have increased significantly, raising the possibility of a short-term pump. The one-hop supply of Bitcoin miners, which measures the BTC holdings of addresses that received BTC from mining pools, has risen to July 2022 highs, following which BTC surged to the $25,000 level.

Bitcoin one-hop miner supply (Source: Coinmetrics)

Over the medium term, however, the risk of increased sell pressure from miners is still viable until Bitcoin’s price trades below $28,000, the break-even operating levels for the least efficient miners. Thus, the purge of old machines will likely continue in the next few months, forcing them to sell BTC to cover wind-down costs.

If BTC buyers can resist a price drop in the upcoming miner capitulation, we’ll likely see miner holdings increasing toward bullish break levels (shown by the black line in the chart above). It will be interesting to watch how the hashrate trends relative to the price over the next few weeks to assess if conditions are suitable for miner accumulation.

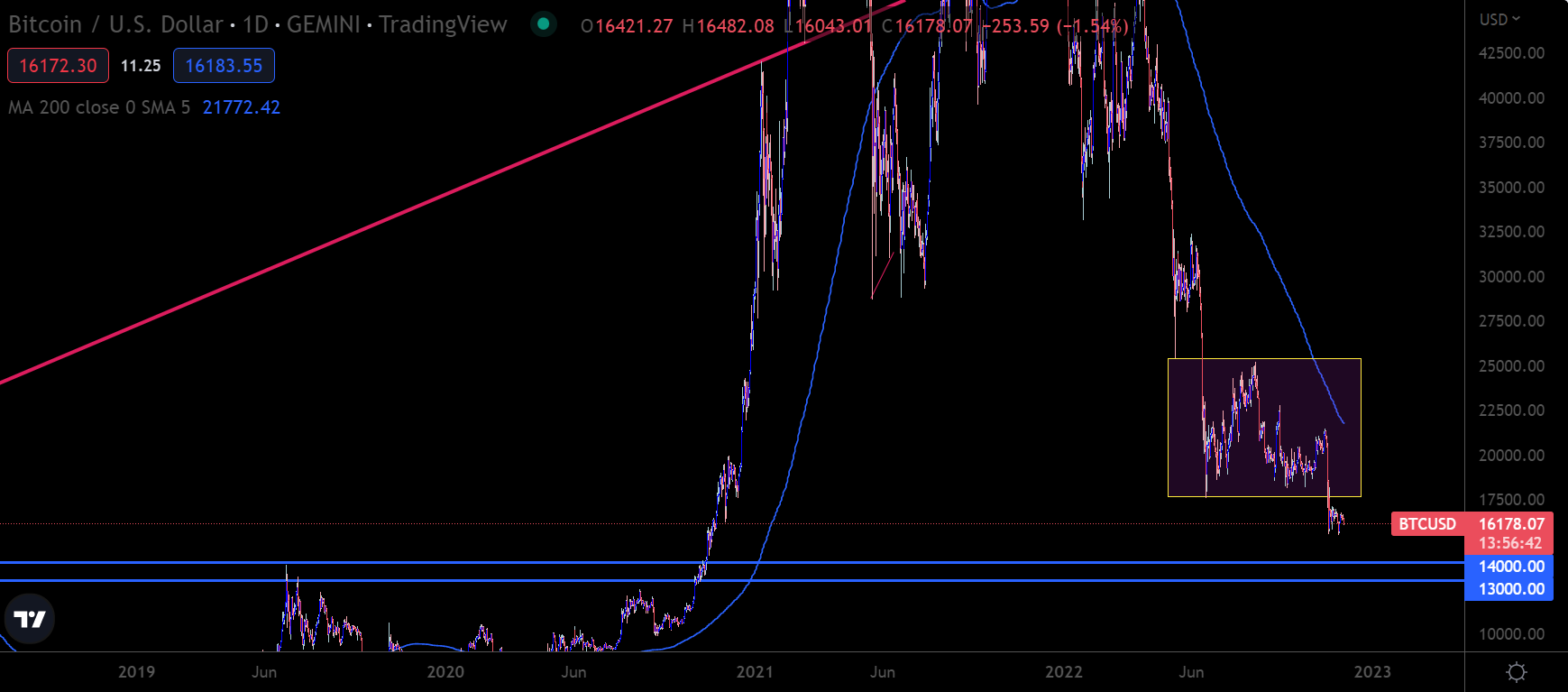

BTC/USD Nervous Trading Range

The crypto market has witnessed a relatively quiet trading period over recent days, with the average daily trading range dropping alarmingly. Unfortunately, the charts allude to more prolonged periods of this frustrating range trading.

The $16,000 to $17,000 range will likely dictate the price action, with any overshoots towards the $18,000 area to be aggressively sold. On the downside, a breakdown below November’s low of $15,500 could trigger a drop to $14,000, where I would consider a long position.

BTC/USD daily-hour chart (Source: TradingView)

ETH/USD Triangle Watch

I expect to see more temporary upside in ETH. However, it will likely be a slow process without any meaningful fundamental changes or news specific to Ethereum.

I expect more upside because a descending triangle breakout is currently underway across the lower time frames, which will likely push ETH toward $1,300 and higher.

However, I do eventually expect ETH to leak around the upper $1,300 or the crucial support and resistance level at $1,420 before the next bearish move drags the price below $1,000.

ETH/USD daily-hour chart (Source: TradingView)

Not Buying LTC/USD

LTC/USD’s latest push toward the $80.00 area has surprised many, especially since nothing has changed for LTC fundamentally.

Price ramps supported by tweets and artificial pump-and-dump moves such as we are seeing now often fizzle out. These two facts strongly support the thesis that the LTC up move is about to reverse.

LTC has a firm price correlation with BTC, so the risk is that if we see Bitcoin tagging $18,000 again, Litecoin could hit the $90 mark. I still feel LTC could provide a good selling opportunity at around $80 or $90.

On the contrary, if the price moves above $100, then selling would not be appealing, but unknown bullish factors could be at work that have yet to reveal themselves.

LTC/USD daily-hour chart (Source: TradingView)

Edging Higher

Putting it all together, my primary scenario this week is for the market to remain range bound and test the patience of traders.

My secondary scenario would be a break above the $17,000 level and crawl toward the $18,000, whereby I expect the rally to terminate. Another favorable scenario is a move toward the $14,000 or $13,000 level, which would become a decent buying opportunity.

There’s a lot of uncertainty in the markets around the FTX contagion and the possible insolvency of Grayscale’s parent company, DCG. Until there’s more clarity on the issue, taking short-term positions appears risky.