Bid-to-Earn

Blur is arguably the fastest-moving protocol in the NFT space. It represents everything active NFT traders have been asking for, and makes NFTs look more and more like fungible tokens.

Wait, weren’t NFTs supposed to be different from fungible tokens? Wasn’t that the whole point of calling them “non-fungible”?

We discussed this many times internally and concluded that the market wants to treat NFTs as “something to trade.” Indeed, art might be heavily influencing the prices of some assets in some collections, but for the vast majority, the floor price is the eye magnet.

Blur developers are chads because they understand what the market wants: the possibility of comfortably trading NFT collections at their price floors. The project’s airdrop goes in line with this as well.

So far, Blur has been moving bids closer to floor prices: this is advantageous to sellers and shows the benefit of using the platform instead of OpenSea. You can help Blur chads and get rewarded at the same time.

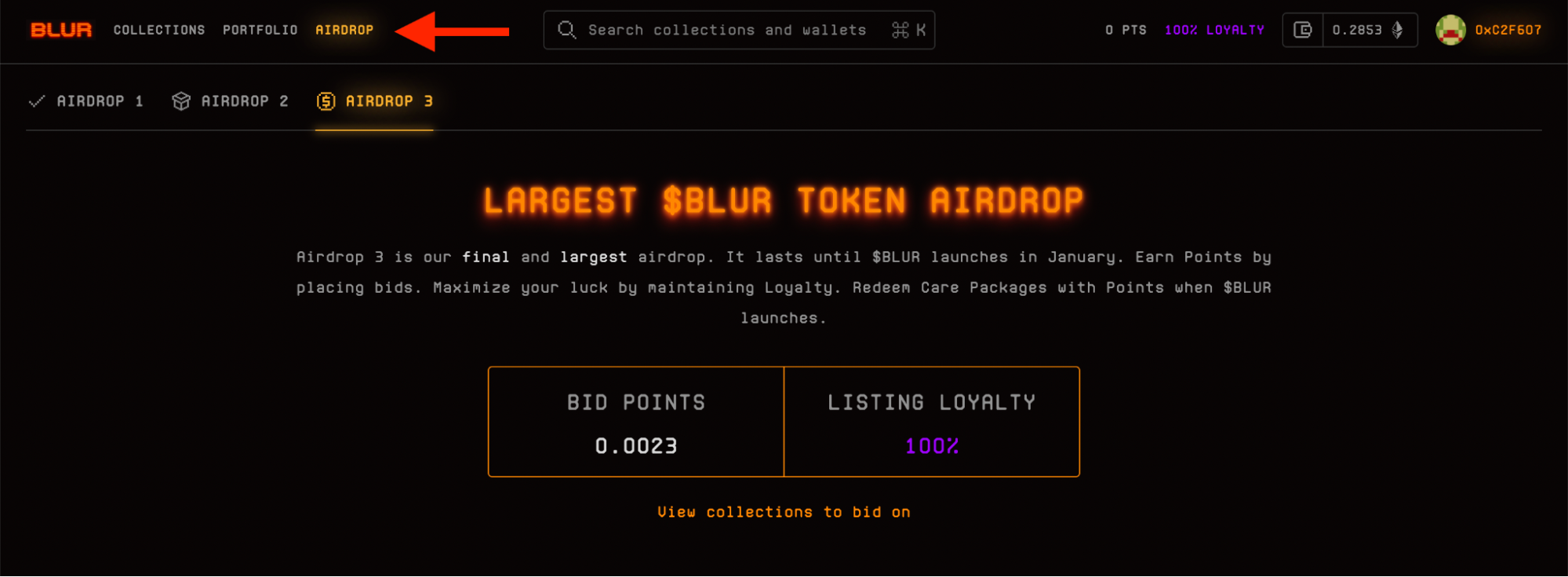

The third stage of Blur airdrop rewards liquidity on the buy side, which is vital for people who want to sell their NFTs instantly. Interestingly, having buy-side liquidity also gives buyers peace of mind. If they know there will always be someone to sell their NFT to, they will be more eager to buy, even if they end up never selling their collectibles.

The following quest requires interacting with ETH, but realistically you shouldn’t need to spend more than $10 because once you put money onto Blur, you won’t need to make more transactions to place bids. Hence, you will need to spend only while entering and exiting the platform (around $2 for each transaction).

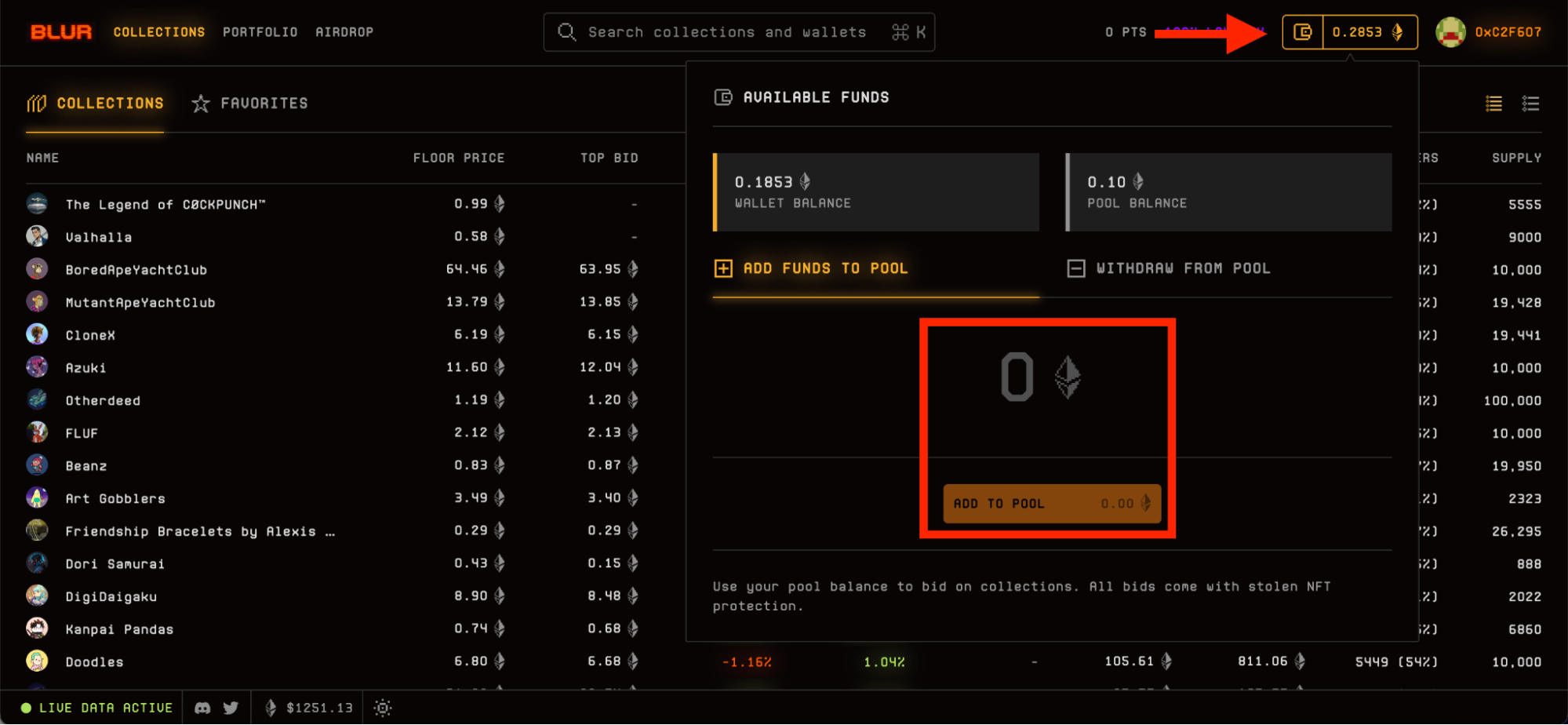

Open Blur and click on the wallet button in the top right corner next to your wallet. You will see your wallet balance next to your Blur pool balance. Add some ETH in your Blur pool. It shouldn’t be a lot.

Next, open the “Collections” tab and look for ones with a top bid smaller than your pool’s balance. My pool size is 0.1 ETH, so I’m looking for top bids below that, preferably in the 0.01-0.05.

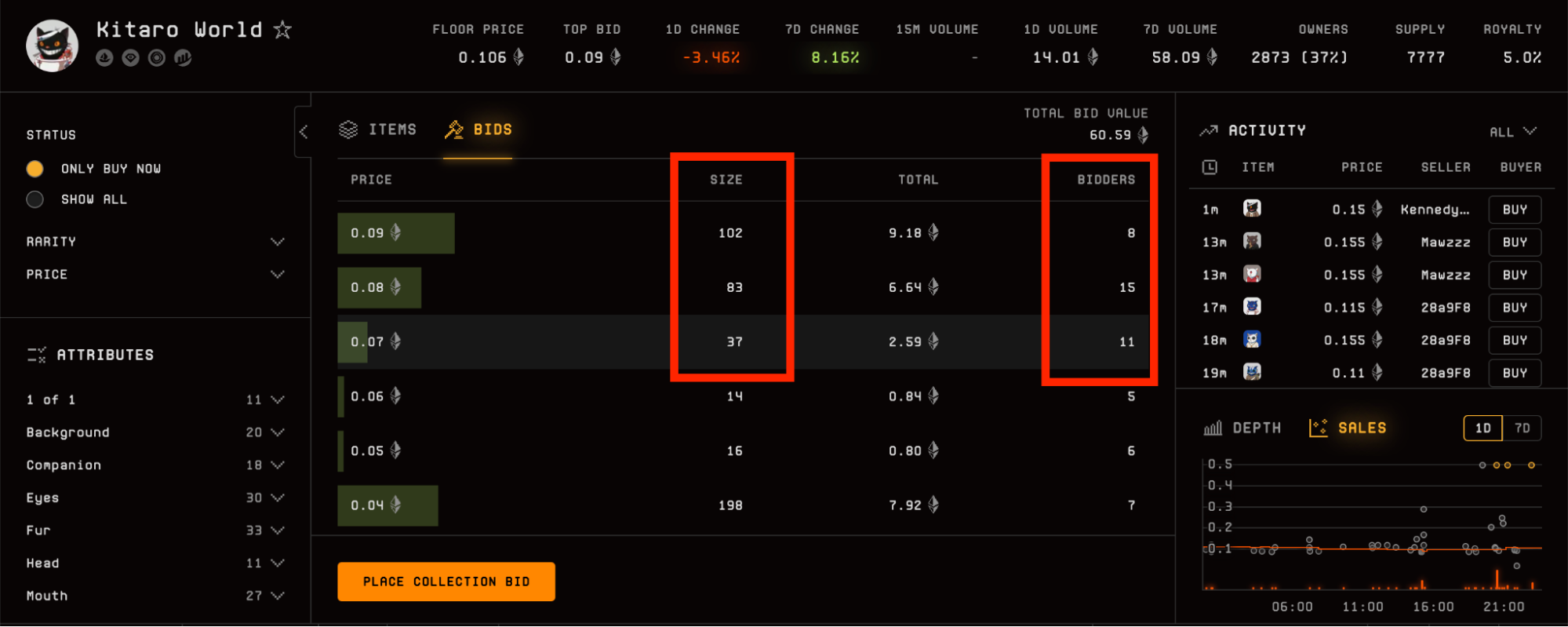

Once you find such a collection, click on it. You need to inspect the bids first. Since you don’t actually want to buy NFTs (so as to save your bankroll), you want to ensure that there are many bids above yours. The screenshot below shows an example of a risky collection: only 3 NFTs are needed to be sold for the 0.01 bid to start absorbing sales.

Find something safer, such as the collection below. Here you have almost 200 NFTs worth of buying power if you place a bit at 0.07 ETH, which isn’t too far from the floor. However, bear in mind the number of bidders: if this number is small, bids may vaporize in a snap.

Ideally, you want to place bids closer to the floor, but playing it safe shouldn’t hurt. After all, you aren’t spending much money, so even if you don’t get a substantial airdrop, it won’t hurt as much as being left holding some worthless NFT bag.

Cancel your bids and re-bid as much as you want. Check the collections list every once in a while to find ones with fat buy-side liquidity.

The more capital you have deployed as bids for longer, the more points you have. Track your progress in the Airdrop tab.

It might appear that this strategy requires active involvement, but as long as you monitor your bids and bids above them, it doesn’t require much time. Performing several 2-minute checks a day should be sufficient.

That’s it for today, thank you for your time.