$5,000 ETH

Everybody likes Arthur Hayes’ writing style. Regardless of how accurate his predictions are, his way with words is hypnotic.

In his latest piece, Arthur explores different potential outcomes on two subjects: the Fed pivoting away from raising rates, and the Ethereum Merge. If you haven’t read it, I suggest doing so here.

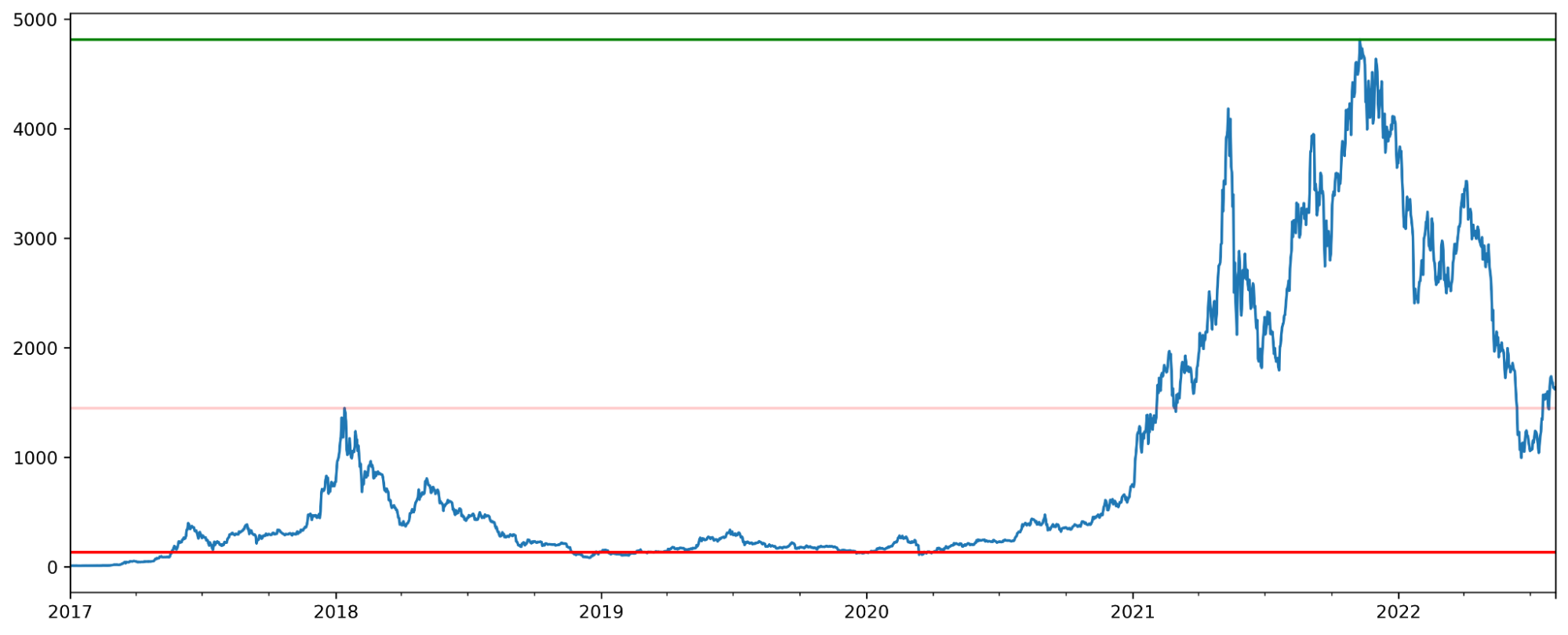

In this short section, I want to entertain the idea of the $5,000 ETH target that Arthur considers “conservative” if the Fed starts printing money and the Merge goes according to plan.

I’m not too fond of price targets. I think they drain energy and attention for the wrong reasons. An investor only cares about risk and reward. Let’s look precisely at these metrics.

I took the peak of ETH this cycle, the previous cycle’s peak, and the previous cycle’s absolute low. Take a look.

Source: CoinGecko

From where ETH is, if the bottom is near the previous peak, the potential risk is about 11 to 12%, while the upside potential is almost 300% if ETH reaches at least its previous peak (which is lower than the $5,000 proposed by Arthur). On the other hand, in case of an extremely bearish outcome, the drawdown could be over 90% to the previous cycle’s low. I’ll leave it up to you to decide whether this is likely.

We also have to consider volatility and compare ETH with other assets to conclude whether it’s a good investment, but that’s not the point. The point is that there’s significant upside on the major cryptocurrency at these levels in a “conservative” scenario.

With that said, remember the #1 rule of crypto: survive. Nobody knows when ETH will reach its previous all-time high, if ever. Arthur might be a good writer, but he doesn’t know the future.

If survival is taken care of, though, there’s no good reason to be completely out of the market. After all, we’re fishing for the bottom, and the fish might be getting away given the circumstances. Volatility and potential drawdowns are the price the market will take for this fish.

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.