Zero to One in Crypto.

The crypto industry is still in its formative stages. Narratives and emotions are the primary drivers of the cryptocurrency market. Many times, memes can influence price growth more than fundamentals.

When reviewing any crypto project, it’s essential to understand the big picture. What’s in the market’s spotlight? Who drives the narrative? Is it sustainable or a fad?

By understanding the market’s state of mind, you can avoid the biases that trip up most retail investors. Each team and every community will always praise their products, so it’s easy to get a false perception that you’ve stumbled upon an undervalued crypto gem.

Today we’ll discuss how we view ongoing trends and narratives at SIMETRI. This perspective should help you understand how the space matures, why old projects with big ambitions like EOS and Tron stagnate, and why decentralized finance is rising.

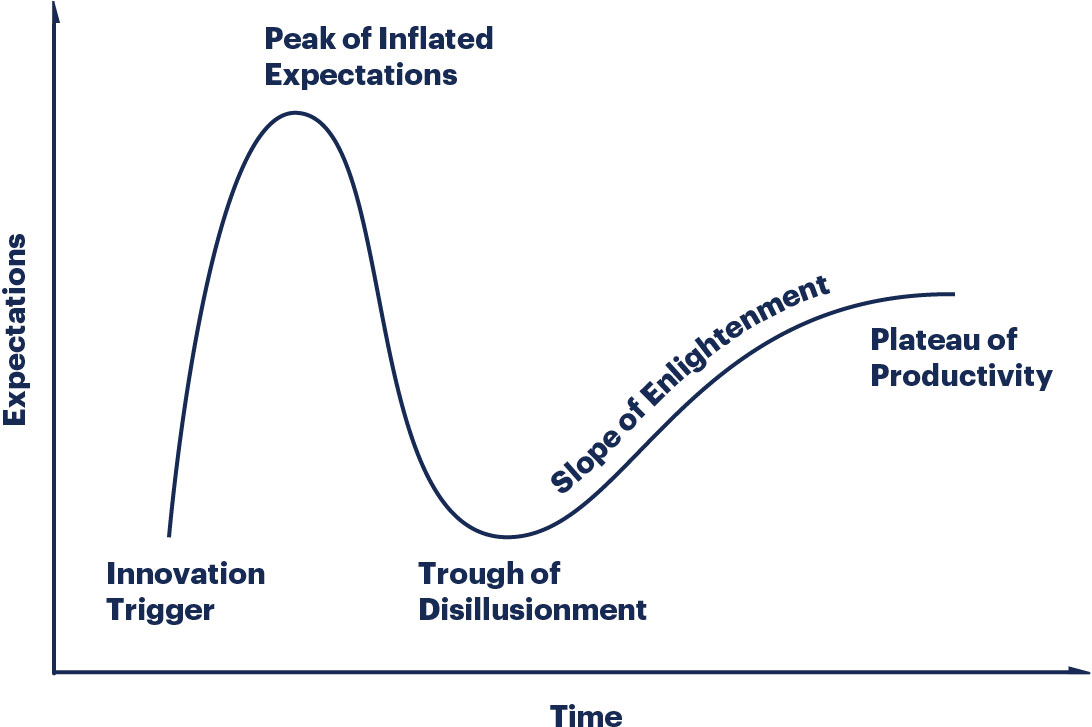

The Hype Cycle

Gartner, one of the world’s largest research and advisory firms, is spot-on with its analysis of how excitement towards new technologies change over time. The chart Gartner came up with is called ‘Hype Cycle’ and is used for all emerging technologies, such as machine learning and 5G.

The Hype Cycle | Source: Gartner

Cryptocurrencies, too, evolve according to Gartner Hype Cycle. While Bitcoin and Ethereum acted as innovation triggers, they’re not the focus of today’s email. From an investment standpoint, it’s more interesting to look at the Cambrian explosion of crypto startups during the infamous ICO bubble of 2016-2018.

New technologies create excitement. When you see companies doing something futuristic, you can’t help but become fascinated. Media generates buzzwords, which amplify the sentiment and suck more people into the new trend.

“Blockchain,” “decentralization,” and “interoperability” gave birth to numerous projects with inflated valuations. Overall, in just 2017, ICOs raised over $9 billion. Hundreds of millions were lost to scams, such as Pincoin and iFan.

The most curious fact about ICO Hype Cycle is that almost nobody cared about live implementations even while expectations surged. For instance, EOS raised over $4 billion in June 2017 but only launched its mainnet a year later. Similarly, Filecoin only recently launched its mainnet, while its ICO ended in 2017.

During the ICO craze, projects could attract hundreds of millions of dollars just by releasing whitepapers. However, a lack of commercially viable products soon threw the market into a downward spiral. That’s when crypto startups went to ‘Trough of Disillusionment.’

But why was there a lack of commercially viable products in the first place? It turns out, beyond the high failure rate of startups in general, the big ambitions of these crypto startups made it so they were bound to crash from the get-go.

Zero to One in Crypto

“The perfect target market for a startup is a small group of particular people concentrated together and served by few or no competitors. Any big market is a bad choice, and a big market already served by competing companies is even worse. This is why it’s always a red flag when entrepreneurs talk about getting 1% of a $100 billion market.”

Starting small and making incremental advances is one of the key lessons from the dot-com bubble of the 1990s. Peter’s main point is that while network effects are powerful, reaching them is only possible if a startup initially operates on a small scale.The majority of large ICOs failed to deliver on their visions. We don’t see growing EOS traction (raised $4 billion), widespread adoption of Finney phones by Sirin Labs (raised over $157 million), or mass migration from messengers like Telegram to Status Network (raised $100 million).

When the crypto market goes from ‘Trough of Disillusionment’ to ‘Slope of Enlightenment,’ the community realizes the importance of having something tangible and useful. And that’s how smaller projects can earn the market’s spotlight.

Uniswap, Aave, YFI—none of these projects promised to bring crypto to every household or challenge existing payment rails like Visa. Each of them had a clear value proposition for the small group of users involved in DeFi. They have working and evolving products which are actively used.

DeFi is slowly changing the crypto landscape; many of the niche’s projects are already among the top-100. While there will be market cycles, DeFi expansion will most likely be a sustainable long-term trend, which will shift the market’s priorities.

Recognize the Trend

The key to successfully riding the market’s trends is reacting to them instead of forcing your strategy. Always look at the broader market, understand who is coming to invest and why.

For example, Bitcoin’s ongoing growth is mainly driven by institutional investors. Companies are rushing to diversify their portfolios with BTC. Traditional businesses are slow to adopt innovation. So, they will be unlikely to “ape” into altcoins anytime soon.

However, an influx of new retail players will likely fuel the ICO era’s large projects since the old narratives remain relevant to unsophisticated market players.

When the excitement about blockchain grows, some ‘influencers’ praise tokens with fundamental issues, such as XRP, just because they have large market caps.

Source: Twitter

Meanwhile, DeFi projects with growing traction among sophisticated crypto users will continue developing, bringing the market to the ‘Plateau of Productivity.’

Each of these market-moving forces has its own unique features, requiring a different investment strategy.

Let the market guide you, and don’t fall in love with any specific project—especially if it doesn’t have a minimally working product. For instance, interoperability-focused Cosmos still doesn’t even have the bare minimum in interoperability features. Its market value is purely driven by speculation on what it might one day achieve.

At SIMETRI, we approach the market from both a sentiment and fundamental perspective, allowing our members to make smart investment decisions regardless of which approach they use.

Even so, at the end of the day it’s the better product that will win in the long game. Make your bets on the companies that are building things that people are using (and paying for) today.

Even so, at the end of the day it’s the better product that will win in the long game. Make your bets on the companies that are building things that people are using (and paying for) today.[/vc_column_text][vc_empty_space height=”40px”][/vc_column][/vc_row]