Bitcoin Made History, Alts to Follow.

If you have been in the crypto space since 2017, congratulations, you survived crypto winter. Get ready to reap the rewards of strong hands in 2021. For newcomers, welcome, you witnessed Bitcoin make history (again).

When an asset breaks all-time-highs (ATH) uncertainty is high. While the sentiment is positive, nobody knows how high it will go before reaching the top. You can rely on various clues, but it’s a game of chicken with probabilities.

But I know one thing with certainty. After Bitcoin breaks its all-time high altcoins will follow. It’s simply a matter of time. BTC growth provokes the expansion of the entire crypto market cap, then ‘alt season’ kicks in to bring small cap valuations to previously unseen levels.

Still, as we pointed out across previous issues of the Portfolio Digest, the upcoming alt season will only come when bitcoin price action calms. Patience is the key here.

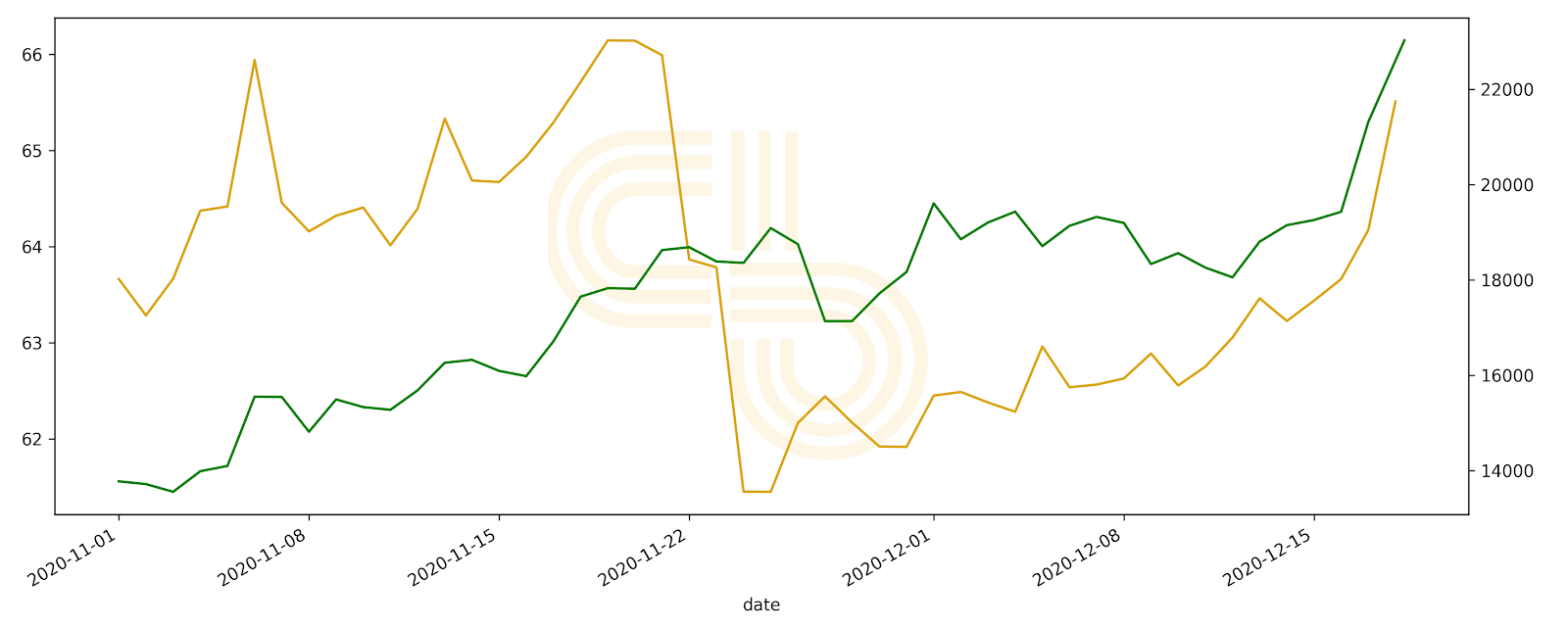

Currently, BTC is hogging the market spotlight. Should its momentum continue then liquidity will flow out of altcoins as traders exit their altcoin positions to ride the wave. You can observe this behavior by looking at Bitcoin dominance.

Bitcoin price (green) and dominance. Source: CoinMarketCap and CoinGecko

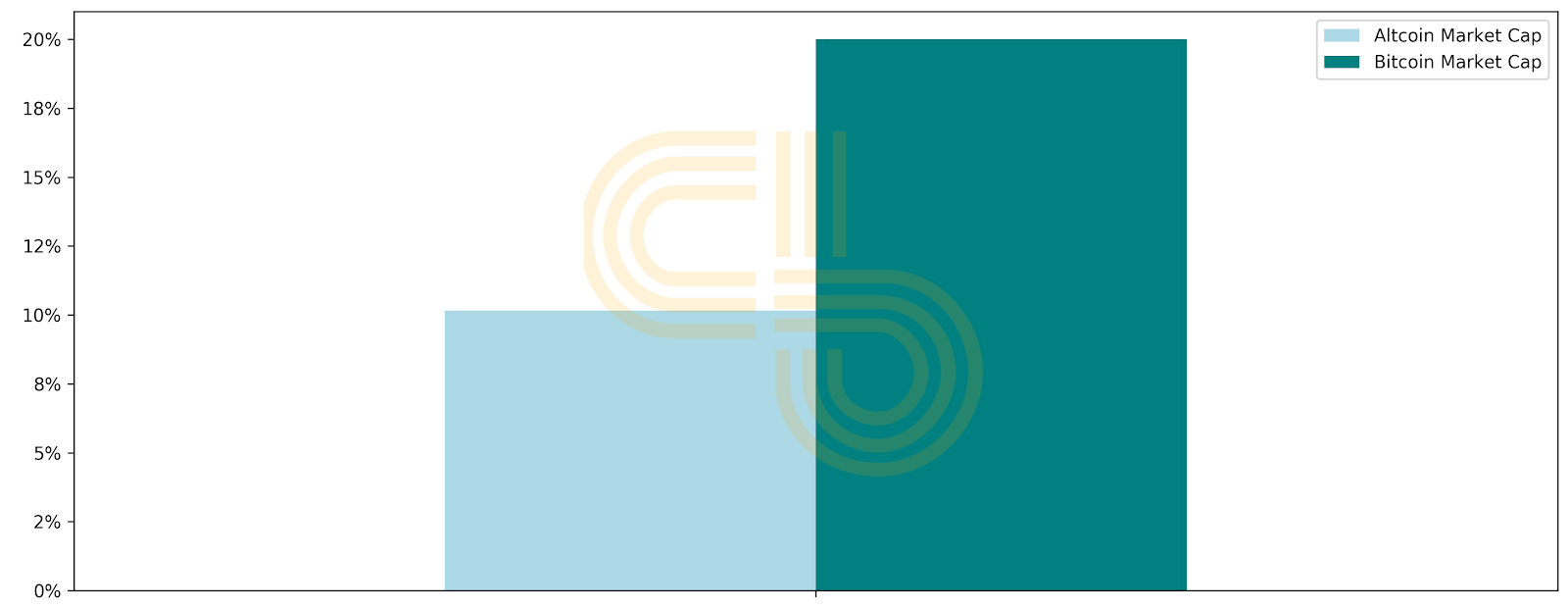

Since Dec. 14, Bitcoin’s market cap increased by 20%, while alts’ market cap grew by only 10%. Given their risk profile, altcoins typically need to show higher returns than Bitcoin. These numbers indicate that alts are “coiling up” and will explode in value when the time comes.

Growth of BTC market cap (dark green) vs. growth of altcoin market cap.

Source: Coin Dance

According to our latest overview from Pro BTC Trader, we will likely see a pullback on BTC in the short term. Given that bitcoin’s volatility is harmful for alts, it’s not reasonable to expect altcoins to move to a new ATH in the short term.

After the pullback, however, bitcoin will likely enter a sideways channel before it will make a next major move. Our lead Bitcoin analyst, Nathan Batchelor, considers that this time the sideways channel will be between $19,900 and $24,000.

Now, onto our Picks’ performance…

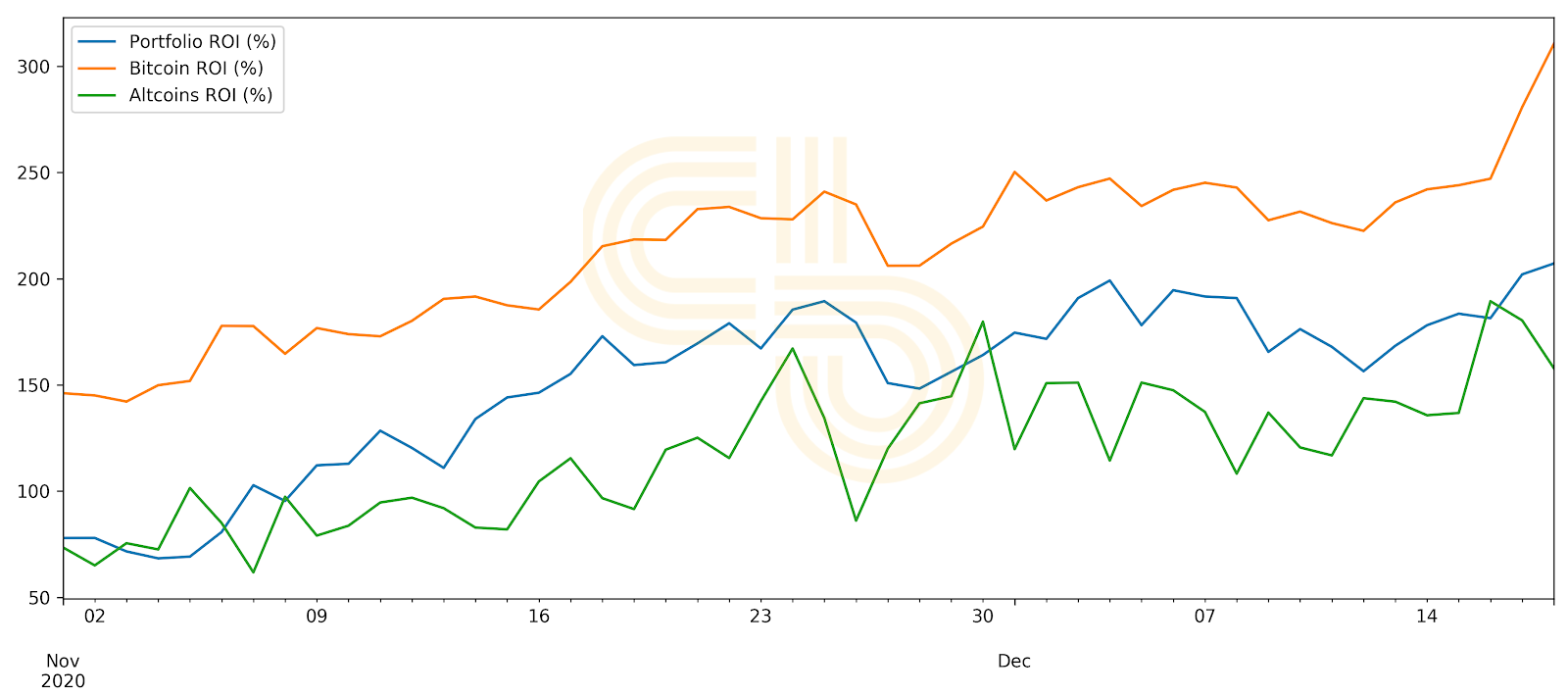

SIMETRI Portfolio Is Resilient

SIMETRI Portfolio, once again, has shown its resilience during BTC price swings. While the broader altcoin market suffers from bitcoin’s growing dominance, our picks continue to show impressive growth while the broader altcoin market stagnates. We already observed a similar pattern before and it’s pleasant to know that it’s consistent.

The Portfolio’s ROI broke our last tracked ATH at 557% and after a slight retracement is now holding at 555%. While this is a good news, we may see the performance decline in the short term due increased BTC volatility.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.