October 19 Crypto Market Roundup

The recent upside momentum in BTC started to cool last week, following news that the cryptocurrency exchange OKEx suddenly suspended crypto withdrawals while one of its key custodians cooperated with an investigation.

The OKEx development caused traders to remain cautious, as data showed that 220,000 BTC is currently held in OKEx exchange wallets. Furthermore, the company failed to release a timeline or stated criteria for resuming withdrawals.

However, Bitcoin continued to hold above the $11,000 level, as Stone Ridge followed Microstrategy and Square Inc by purchasing massive amounts of BTC, as part of the company’s treasury reserve strategy.

Bitcoin also continued to share a strengthening correlation with the S&P 500, and remained extremely sensitive to news surrounding the second COVI-19 stimulus package.

Bitcoin Transfer Volume OKEx Exchange

Source: Glassnode.com

On-chain data surrounding Bitcoin remained exceptionally positive last week, with a number of key metrics suggesting that the cryptocurrencies recent bullish breakout has room to run higher.

Bitcoin’s network hash rate and network difficulty hit fresh all-time high’s last week. Data also showed the number of unique Bitcoin wallets being created hit a new record all-time high.

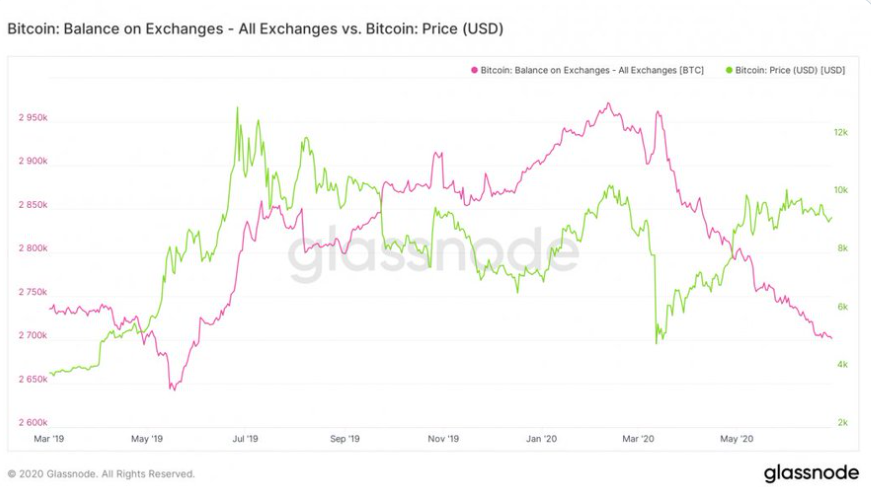

Cryptocurrency on-chain and data intelligence providers, Glassnode, highlight that increasing amounts of Bitcoin are moving away from exchanges and being transferred to non-custodial wallets.

Crypto behavioural analytics platform Santiment also noted that Bitcoin holding distribution metrics are showing an increasing amount of addresses holding a significant chunk of the premier cryptocurrency.

BTC Balance on Exchanges

Source: Glassnode.com

Volatility data from the crypto analytics platform also showed that Bitcoin’s 3-month volatility hit a 16-month low on the options market last week.

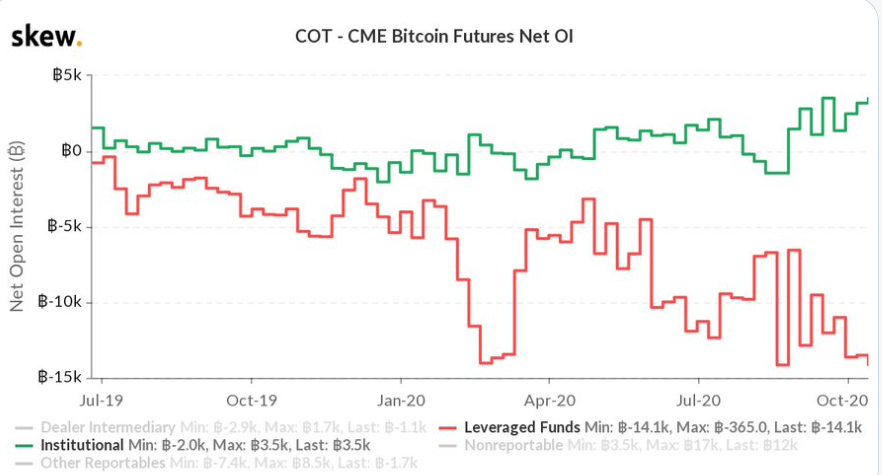

However, last week’s Commitment of Traders report showed that institutions had placed record amounts of bets towards the price of Bitcoin would continue to rise.

Margin retail positioning data on a number of popular cryptocurrency exchanges also showed a clear bullish bias towards BTC, with almost 90% of traders now long BTC on the Bitfinex exchange.

The Crypto Fear and Greed Index showed that traders had moved away from a state of “greed”, and were now “fearful”, following the negative news surrounding the OKEx exchange.

Source: Skew.com

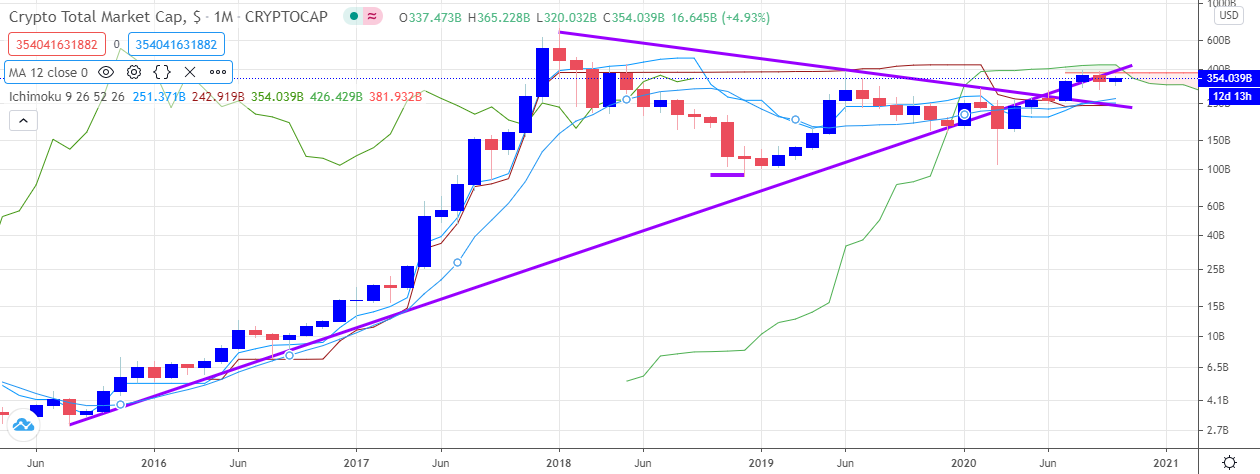

The total market capitalization of the cryptocurrency market traded between the $365 and 342 billion levels last week. Spot volumes for the total market capitalization started to dissipate, following a notable pick-up during the previous week.

The top altcoins rallied to fresh monthly highs, however, the pullback in Bitcoin caused them to surrender early-week gains. Stellar Lumen and Bitcoin Cash were amongst the top outperformers.

During my upcoming webinar, I will be charting Stellar Lumen (XLM), Cosmos (ATOM), Bitcoin Cash (BCH), and Bitcoin.

Source: Tradingview

The Week Ahead

Bitcoin is set for another pivotal trading week, as traders are expecting that the pioneer cryptocurrency could go on to rally to a fresh 2020 trading high prior to the U.S. election.

Broader financial markets are slowly coming to the realization that a second coronavirus stimulus bill may not be approved until after the election.

If a stimulus bill is agreed prior to the election, it will be a huge bonus for U.S. equity markets and market sentiment, and this could in turn be the major bullish catalyst that sends Bitcoin above $13,000 again prior to the election.

Something else to watch is news surrounding more institutions moving into Bitcoin as a treasury strategy. Many analysts are speculating that recent moves by Microstrategy, Square Inc, and Stone Ridge may just be the tip of the iceberg.

Bitcoin has remained sensitive to this type of news, and it is now becoming apparent that price dips are being used as opportunities for large players to accumulate BTC at a cheaper rate.

The correlation with the S&P 500 is once again worth paying attention to. The S&P 500 has formed a notable cup & handle pattern, which is exceptionally bullish from a technical perspective.

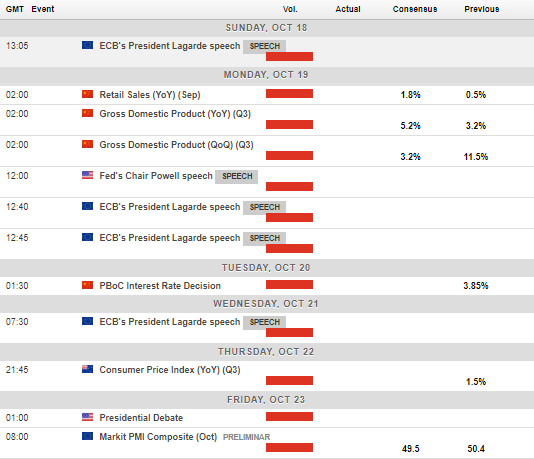

Looking at the economic calendar this week traders have a key speech from Chair Powell, the last U.S. election debate, important Chinese data, and more stimulus talks to contend with.

We also have to consider the worrying rise in global coronavirus cases. Markets may be able to handle a continued rise in global coronavirus cases, although news of countries locking down again could tip markets over the edge.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) probably needs to start to rally above $12,000 this week to remain on track for a hitting new all-time before November 3rd, as time is almost certainly starting to run out ahead of the U.S. election day.

Should we see Bitcoin failing to rally this week, it may cause spot traders to start to liquidate positions, as it may be just too risky holding longs this close to the U.S. election.

Ideally we need to see follow-through in BTC, after the breakout rally above $10,800 earlier this week. Once again, failure for BTC bulls to do so over the coming days may worry longs.

Traders have been struggling to close the daily cable above the $11,500 resistance level over recent days. Should we see so buyers managing to stabilize the daily candle above the $11,500 level then we a test of the $12,000 area is likely to follow.

Once above $12,000 I would be surprised to see Bitcoin turning lower any time soon. I would expect $13,500 or $14,000 to be hit relatively quickly. If BTC gets above $14,000 I believe the $16,000 level could be achieved.

To the downside, the $11,000 level remains absolutely key for the short and medium-term bull case. A sustained loss of the $11,000 level and Bitcoin could fall back towards the $10,550 to $10,300, and would more than likely start to decline back towards the $9,000 level over the coming weeks.

BTC/USD Daily Chart

Source: Tradingview

|

Ethereum (ETH) is once again trading at a critical juncture, as the second largest cryptocurrency trades between the $360.00 to $390.00 price range. Lower time frame analysis shows a bullish inverted head and shoulders, which is implying that a $60.00 rally is likely to take place if neckline resistance is broken, at $390.00 Medium-term analysis is also reasonably bullish, as the ETH/USD is holding above the neckline of a much-larger inverted head and shoulders pattern, located at $360.00, that holds a $250.00 upside target. Traders should be aware that a major technical breakout remains valid while the cryptocurrency trades above the $360.00 level. The projected target of the larger bullish pattern could see the ETH/USD pair testing towards the $600.00 region. Looking at the downside potential for the ETH/USD pair, weakness below the $360.00 level could cause Ethereum to test towards the $330.00 support area. Should we see sustained weakness under the $330.00 level then technical traders are likely to turn bearish towards Ethereum, and target the $280.00, and possibly the $230.00 area. |

ETH/USD Daily Chart

Source: Tradingview