Volatility Ramps Up

Bitcoin incurred another major bout of volatility last week, as a number of important factors caused the top crypto to fluctuate within a huge weekly trading range.

BTC briefly fell under the $29,000 support level as Bitcoin miners continued to sell into rallies. Data also showed that the BTC Mining Index hit an eight-year high last week.

BTC also incurred extreme bouts of volatility due to the massive $4 billion options expirations event, and extreme market moves in traditional financial markets.

BTC eventually rebounded back towards $39,000 after Elon Musk Tweeted positive commentary towards Bitcoin. Musk’s comments marked a major reversal of fortunes for the BTC/USD pair.

BTC/USD One-hour Chart

Source: Tradingview

A number of data points showed that whales used last week’s price pullback to accumulate Bitcoin. Data from on-chain behavioral platform Santiment showed that for the first time since June 24th last year a second wallet with 100,000 Bitcoins emerged.

Data from Santiment also showed the largest spike in Token Age Consume since the start of the year around the lows of the week. This telegraphed that BTC could be preparing to make a major directional move.

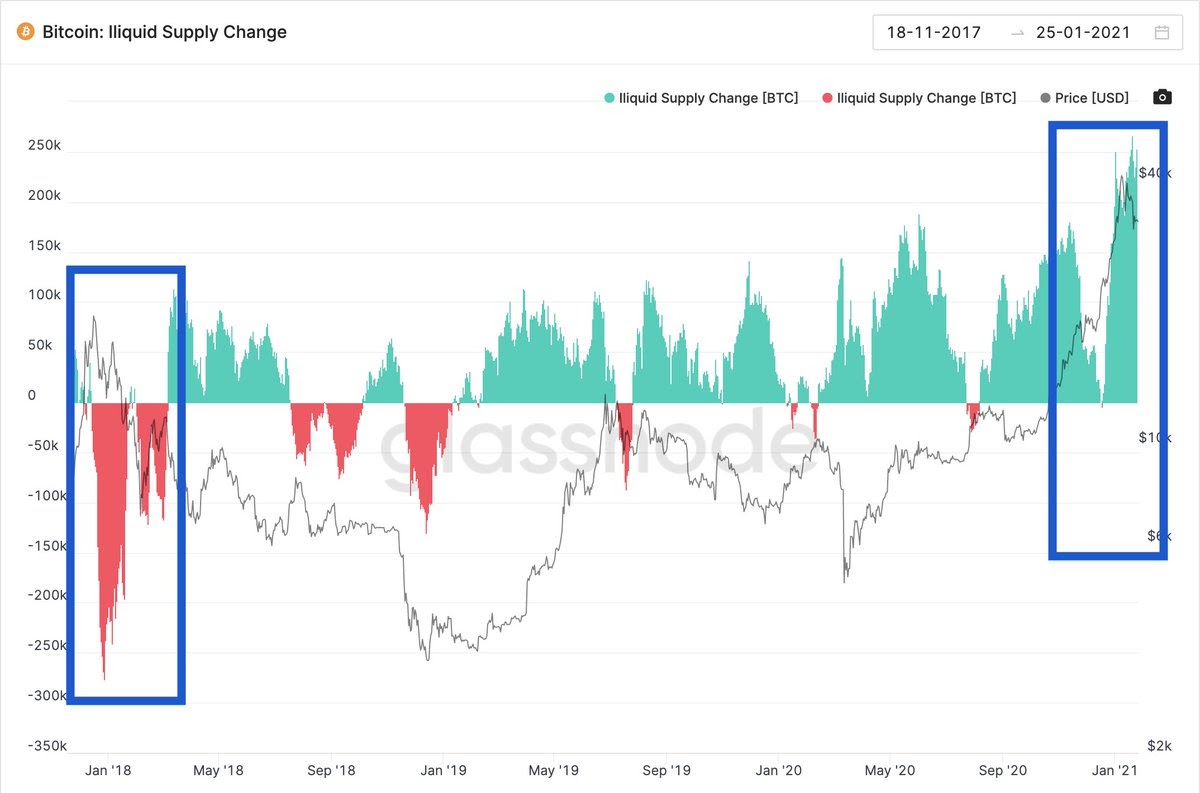

According to on-chain and market intelligence platform Glassnode BTC whales continued to accumulate massive amounts of Bitcoins on pullbacks, which was the polar opposite of the January 2018 pullback in BTC.

BTC Liquid Supply

Source: Glassnode

Data last week also showed that Grayscale Investments went on another spending spree and bought around 1,000BTC as the flagship cryptocurrency started to correct lower.

Nasdaq-listed giant, Marathon Group, also announced a $150 million Bitcoin purchase on Monday as part of its treasury reserve strategy.

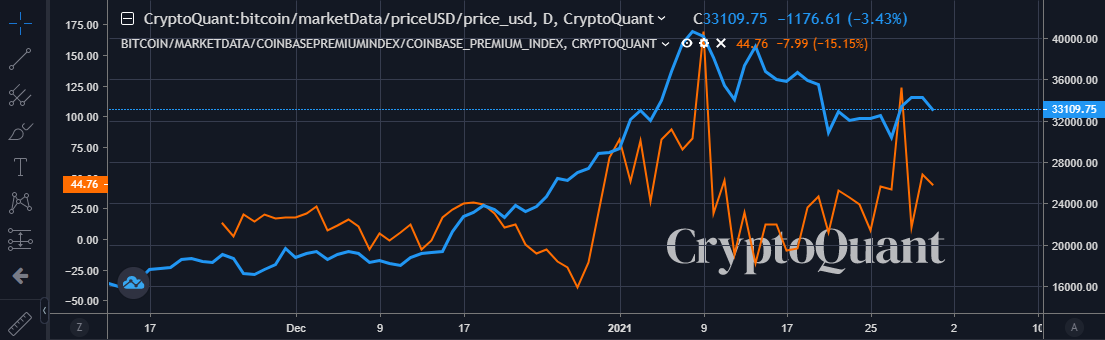

CryptoQuant’s Coinbase Premium Index, which essentially highlights bullish spot buying pressure also remained in positive territory as BTC started to recover.

BTC Coinbase Premium Index

Source: Cryptoquant.me

The crypto total market capitalization plunged towards the $855 billion area last week. A notable triple-bottom pattern formed after sellers were unable to break the monthly low and a recovery took hold.

Bitcoin’s market dominance fell towards the 62.60% support level last week and subsequently exploded higher as BTC recovered and Ethereum came under downside pressure.

Dogecoin was a major story in the crypto space and also caught the attention of mainstream media as traders from notorious online forums helped to pump the DOGE/USD pair higher.

Source: Tradingview

The Week Ahead

The expected trading volatility from last week did not disappoint, and as I have previously stated mining selling and BTC options expirations played a major role towards the market moves over the last several days.

Last week I mentioned “Bitcoin will need to firm above the $35,000 level this week to encourage the notion that the ongoing bull trend is alive and well. If buyers are successful then the BTC/USD pair still remains on-track for $40,00 and possibly $55,000”.

I continue to feel that BTC will probably head much higher if bulls can hold the price above $35,000, and that the path ahead will look more certain if the $40,000 is achieved.

The large amount of whale and institutional BTC purchased around the lows of last week cannot be ignored, and continues to suggest that a new all-time is probably coming sooner rather than later.

Perhaps the only stone in Bitcoin’s shoe in the near-term is going to be the Lunar New Year. A massive amount of Chinese crypto traders could be about to book profits, and this could be a reason why more volatility and pullbacks could arise again this week.

While I am largely speculating that Chinese BTC selling is going to be the cause of a potential pullback it is certainly worth acknowledging the risks that lay ahead for BTC over the Lunar New Year period at least.

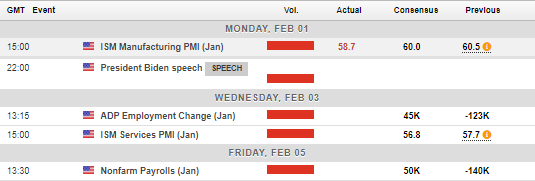

In terms of the economic docket this week, the United States monthly jobs report will probably be the big market mover alongside the unemployment rate and wage inflation data.

Stimulus talks and the ongoing Main Street Vs Wall Street battle also have the ability to cause more price volatility and set alight a new short-term trend.

Source: Forexlive

The technicals surrounding Bitcoin (BTC) are very tricky at the moment. Until we see serious traction either side of the $30,000 to $40,000 price range then choppy trading action should be expected.

Price is stuck inside a large triangle pattern highlighting traders’ ongoing dilemma as BTC/USD makes higher lows and higher highs in the short-term, but fails to hold intraday gains, just to add to the technical confusion.

I suspect that Chinese new year could throw some spanners in Bitcoin’s directional path over the coming days. Sadly, we may have to wait until after the mentioned holiday period before a long-lasting short-term price trend emerges.

In terms of technicals, sustained weakness below the $29,000 level should trigger heavy selling, while gains above $40,000 should cement a test towards the $42,000 area.

The long-term picture for Bitcoin still looks good while bulls defend the $29,000 area. A large ascending broadening wedge pattern continues to point towards $55,000 as possible target.

With whales buying in recent price drops and a number of important on-chain metrics now reset, it would not be difficult to imagine BTC hitting news highs in February.

Source: Tradingview

Ethereum (ETH) is in a tricky spot right now, following bulls failure to hold the second-largest crypto above the $1,440 level for any significant period of time last week.

Furthermore, price action surrounding ETH looks, dare I say it, slightly toppy. ETH/BTC is also poised to correct even lower after staging a false upside breakout last week.

All things considered I would not be surprised to see Ethereum heading lower before it starts to challenge towards its all-time high again.

In terms of solid pick-up spots I would be interested in $970.00 or even $860.00 if a major correction in the ETH/USD pair came to fruition, in expectation of $2,000 this year.

Should ETH/USD start to hold above the $1,440 level again, and we see BTC/USD strength, then a new all-time high could easily be achieved.

ETH still has major upside targets, and an extremely bullish weekly chart. My problem at the moment is that I believe the risk of a stronger correction is getting higher, and the better trade could be to buy extreme price dips under $1,000, rather than breakouts above $1,400.

ETH/USD H4 Chart

Source: Tradingview

Last week I said “ I would not be surprised if Chainlink (LINK) pulled back one-more time to test $19.80 before lift-off. If this does happen, and this support area holds again, then it may be the last time LINK/USD will settle around $20.00 before a parabolic move takes hold”.

Chainlink got within touching distance of $20.00 support level last week, and subsequently took-off higher after testing this important support region.

However, the upside momentum in the LINK/USD pair has been sorely lacking since the mentioned reversal, and the expected rocket ship towards $30.00 failed to materialize.

Overall, the technicals are fantastic for LINK/USD while above $20.00, but we need to see follow through this week or sellers may just try their luck again and take a stab at critical support.

LINK/USD Daily Chart

Source: Tradingview