A Boomer’s Guide to NFTs.

Non-fungible tokens, or “NFTs,” are getting an astounding amount of traction. Some members are wondering why an 8×8 piece of pixel art can go for thousands of dollars. NFTs don’t generate cash flows like, say, lending platforms, and they are practically useless. Yet their prices look surreal.

If you don’t understand what the hype is all about, don’t worry, you don’t have to. Analyzing the NFT market doesn’t require knowledge of the latest trends in art or music, data is enough to determine whether the space is investable.

Is the blockchain space ready for mass adoption of NFTs, or will the hype be short-lived? Today, we will take a look at the numbers and find out.

NFT Market Opportunity

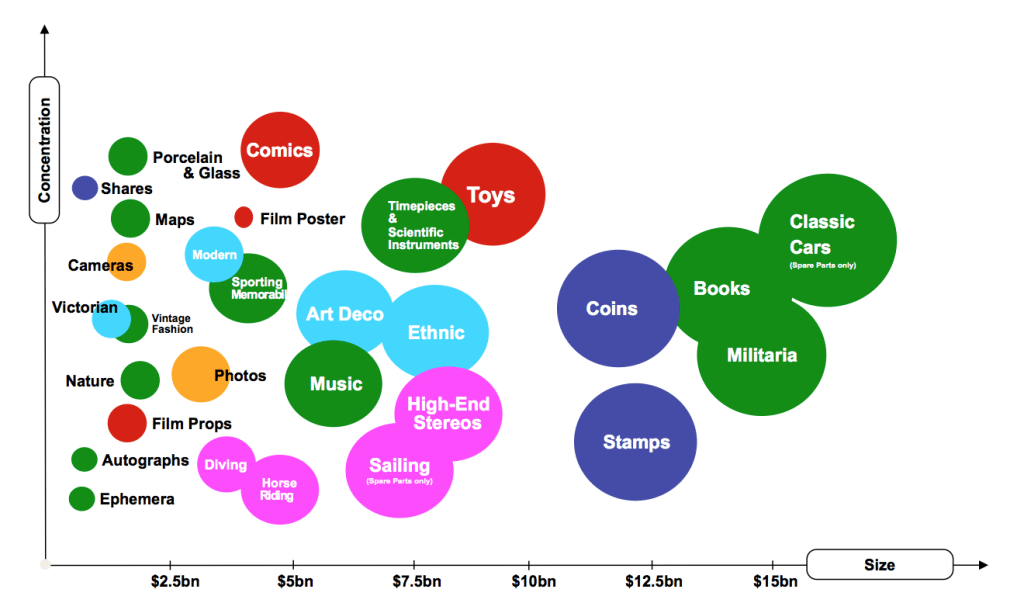

The market size of collectible items exceeds $130 billion, which creates a lucrative opportunity for the NFT market. Collectibles aren’t just a hobby; they can be used as financial instruments, which is why high net worth individuals pay attention to this market.

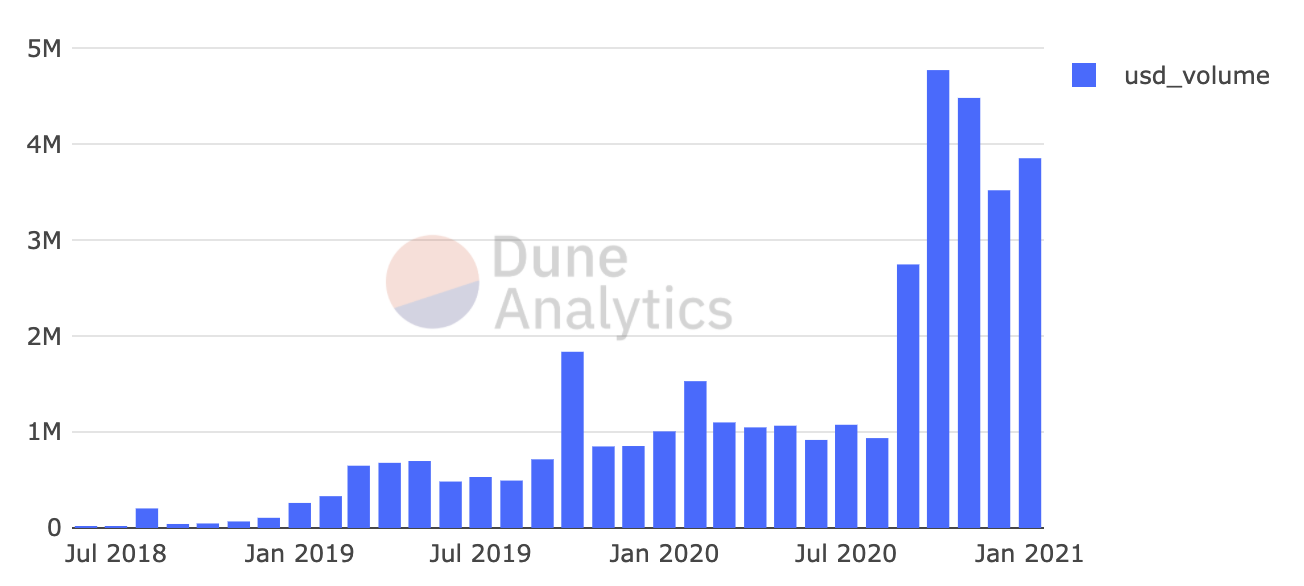

Consider total volumes on one of the largest NFT platforms in the blockchain space, OpenSea. The maximum registered monthly volume was just under $5 million. Hence, the NFT niche has a lot of room for growth.

OpenSea monthly trading volume (USD). Source: Dune Analytics.

Interestingly the sizes of the markets for coins and stamps are considerably larger than other categories. It will be interesting to see whether people previously interested in collecting fiat banknotes would be more interested in blockchain-based money.

Collectibles by type. Source: TechCrunch.

The key for NFT adoption is recognition among the next generation of consumers—Millennials. By 2030, these buyers will have an enormous amount of disposable income and are already predisposed to purchasing digital assets.

NFT Audience

Coins, stamps, and fine wines have been around for centuries, but you likely won’t encounter many youngsters collecting physical items unless they’re connected to comics or games. The younger generation prefers digital collectibles, the same way they prefer bitcoin over gold.

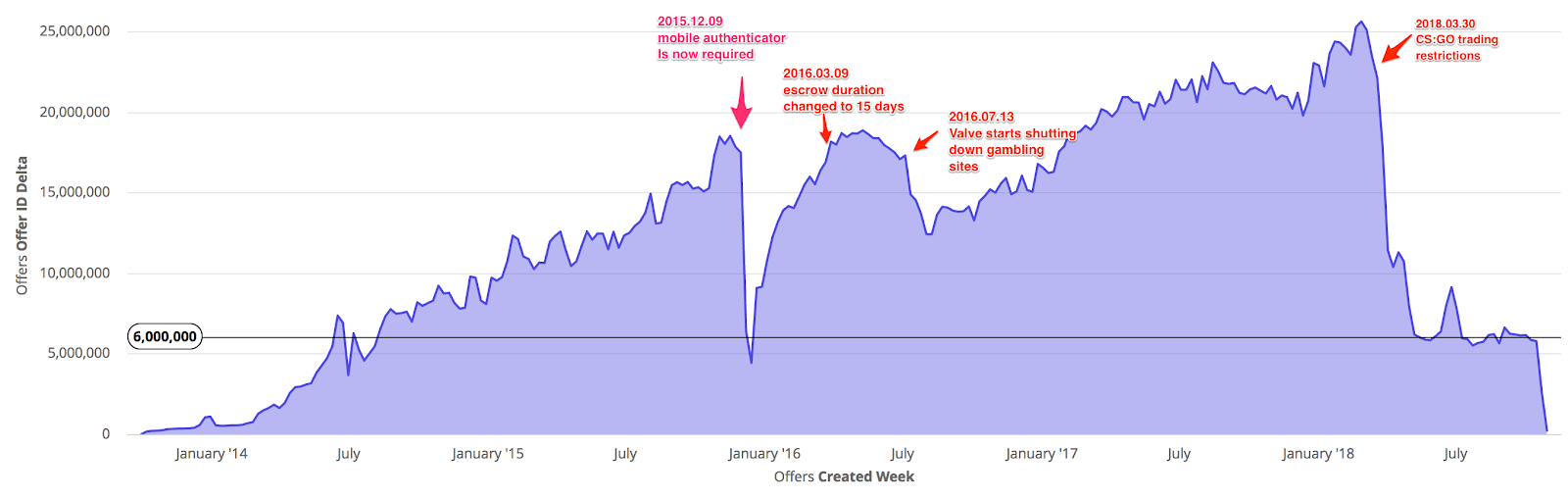

One great example of surging interest in digital collectibles is on video game marketplace “Steam.” The service is the primary way people purchase and manage PC video game collections.

Initially, Steam was designed for buying and playing games. However, as the ecosystem expanded, the platform introduced in-game items and a marketplace. The addition of trading was more than ten years ago and has grown into an enormous market for digital goods.

The market turned out to be extremely successful. Speculative interest was so high that companies created tools like Blockfolio, but for Steam Community Market.

Number of trading offers created on Steam Community Market. Source: Reddit.

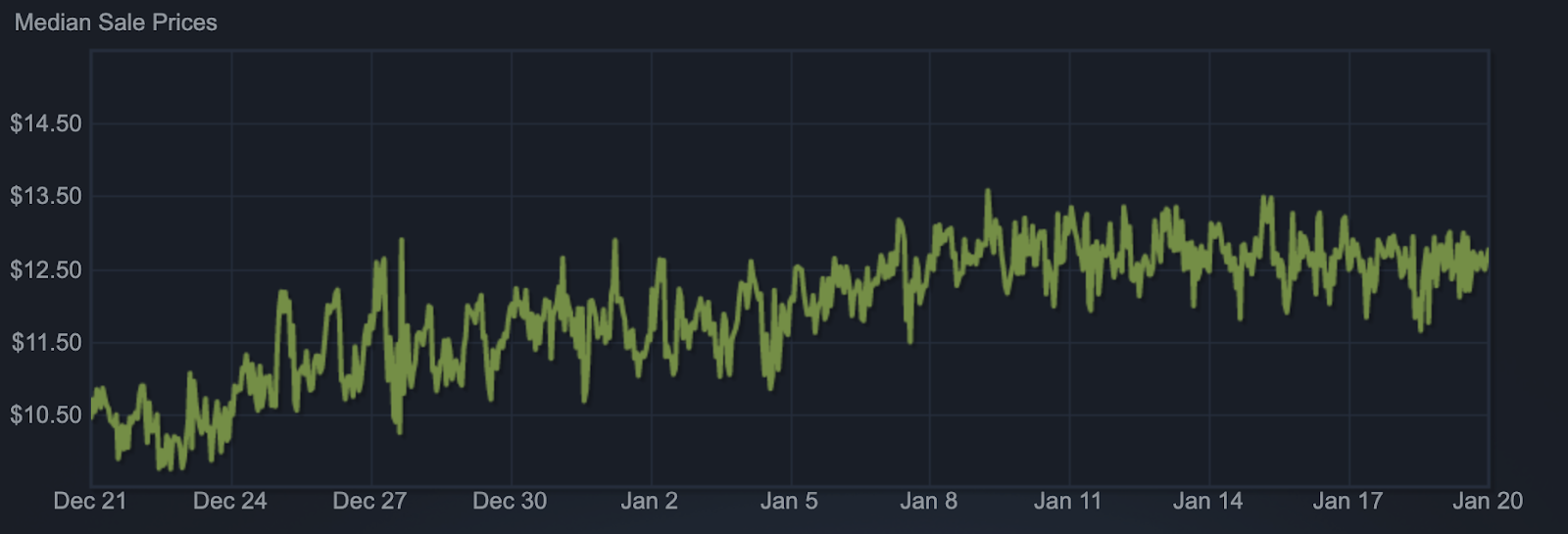

Like currencies and equities, in-game items on the Community Market have price charts. This shows that a large audience of users treats digital collectibles as assets.

Median sale prices for AK-47 Phantom Disruptor in Counter-Strike: GO. Source: Steam.

Tokenizing in-game items alone can make NFT volumes skyrocket. Nowadays, the gaming industry has more interest than movies and TV and is on track to unseat sports as the king of pastimes.

Traditional fantasy sports also provide a world of opportunities for NFT startups. For instance, Sorare, a fantasy soccer game built on Ethereum, has won soccer fans over and internationally-renowned sports clubs and high net worth individual investors.

In December 2020 alone, the platform generated $1.9 million in revenue from selling its digital sports cards. For comparison, the platform generated $30,000 in the same month in 2019, suggesting extreme growth.

If you’re interested in testing out NFTs, one of our sponsors, Sorare, is offering ten free collectibles to Crypto Briefing readers.

Overall, NFTs hold great potential. But, their adoption is stifled by the complexities of blockchain technology.

NFT Problems

Blockchains aren’t user friendly, which is what all developers of decentralized applications are continually trying to overcome. Verifying the origins of an Ethethereum-based NFT token, purchasing it, and securely storing it requires at least basic blockchain technology knowledge.

However, the majority of creators and consumers aren’t crypto enthusiasts. The quote from Beeple, who sold his NFT for $66,666, illustrates the situation perfectly:

Source: Beeple.

NFTs won’t get wide adoption until the necessary infrastructure is in place. The experience for collectors should be seamless. Otherwise, many of them will not stick around.

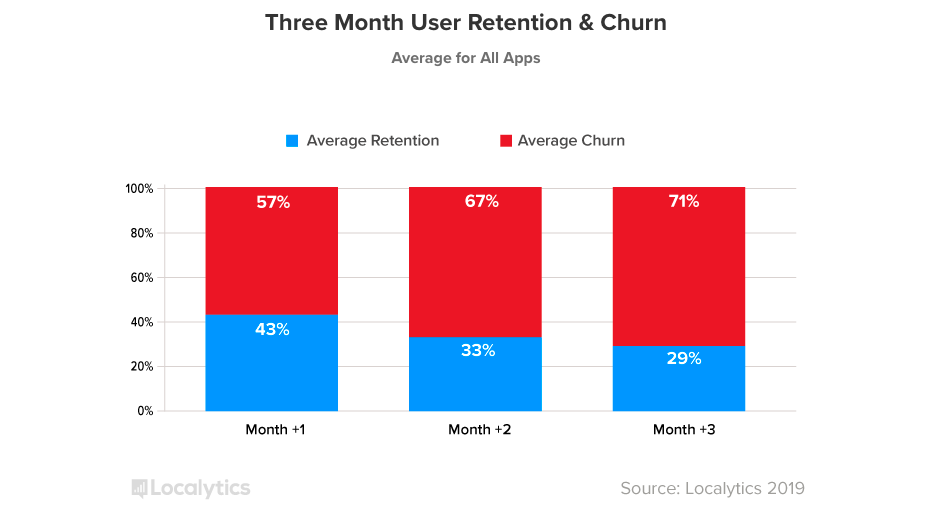

Low user retention happens even on traditional apps, which don’t introduce new concepts like transaction costs and private keys.

Average mobile app user retention (blue) and churn. Source: Appcues.

Platforms like Rarible, OpenSea, and Bounce Finance try to improve the experience for both creators and collectors. However, it’s clear that the industry is not yet ready for a proper NFT bull run just yet.

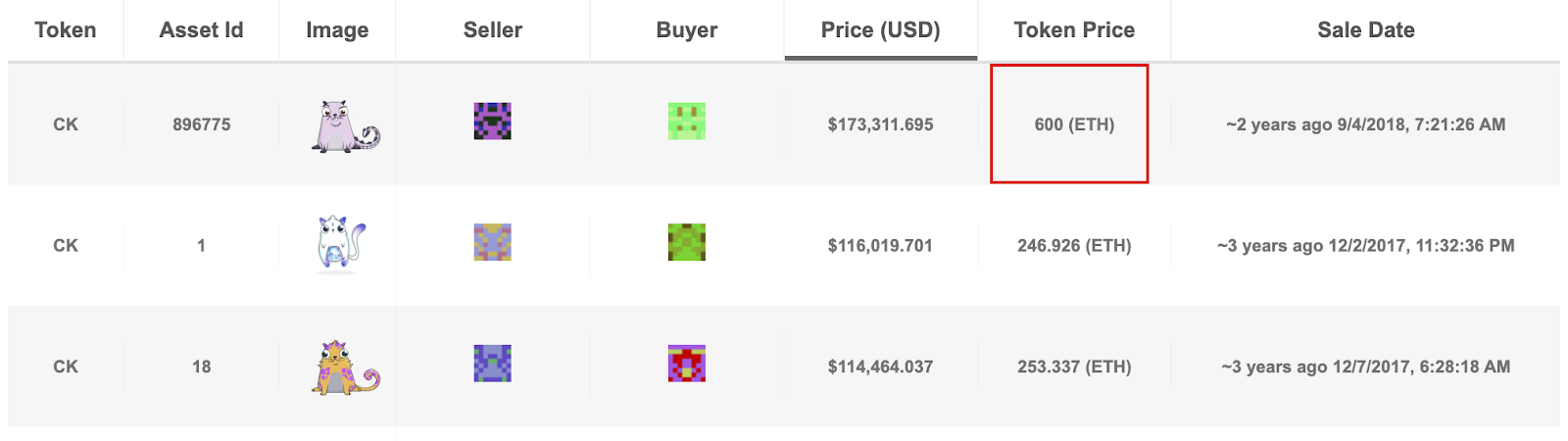

Although NFTs have tremendous potential, the ongoing hype will likely be short-lived. Much of the interest comes from inflated prices, but some of these prices are because of wash trading.

NFT wash trading started to appear as early as such tokens became a thing. For instance, one of the most popular NFT-focused apps of its time, CryptoKitties, saw a digital cat with no unique traits being sold for 600 ETH.

To sum it all up, you shouldn’t discard NFTs even if you wouldn’t buy one yourself. Although this niche doesn’t look too serious, it provides terrific investment opportunities.

Still, you should exercise caution when making investment decisions. NFT prices inflate wildly during the bull market, and they will likely plummet faster than other crypto assets during a crypto winter.