Provide Liquidity Without Risk.

The market is still in the indecisive stage so there’s not much to look at in terms of price action. Fortunately for us, DeFi has given us other ways of making money outside of trading.

Today I want to bring back the topic of liquidity provision. We have a tutorial on how to provide liquidity on Uniswap v2, but for most of our members it was still too complicated. We want you to actually give this a try.

Meanwhile, liquidity provision (LPing) may be a good way to earn passive income for crypto holders, especially when the market moves sideways.

Today I want to show you a simulator that gives you an opportunity to try being a liquidity provider (LP) without putting real money on the table. Similar to paper trading, this is a great way to hone your skills and gain confidence.

Liquidity provision is one of the base concepts in the DeFi space. Unlike centralized entities like exchanges and banks, DeFi protocols don’t custody, or hold, your assets. So, they have to attract liquidity from users to provide services. In return, protocols give liquidity providers (LPs) a small reward.

On the surface it looks simple. You put your money into some pools for a while, earn fees, and exit—hopefully at a profit. However, something called Impermanent Loss (IL) complicates things.

If you want to learn more about IL and the risks of LPing, take a look at this issue of Insights. The high-level summary is that IL can eat into your profits and even result in losses.

Technically, you can calculate potential IL before entering a pool and see whether the reward is worth the risk, just like any investment. However, it may be psychologically difficult to put real money on the table with something so complicated. That’s where LP Royale comes in handy.

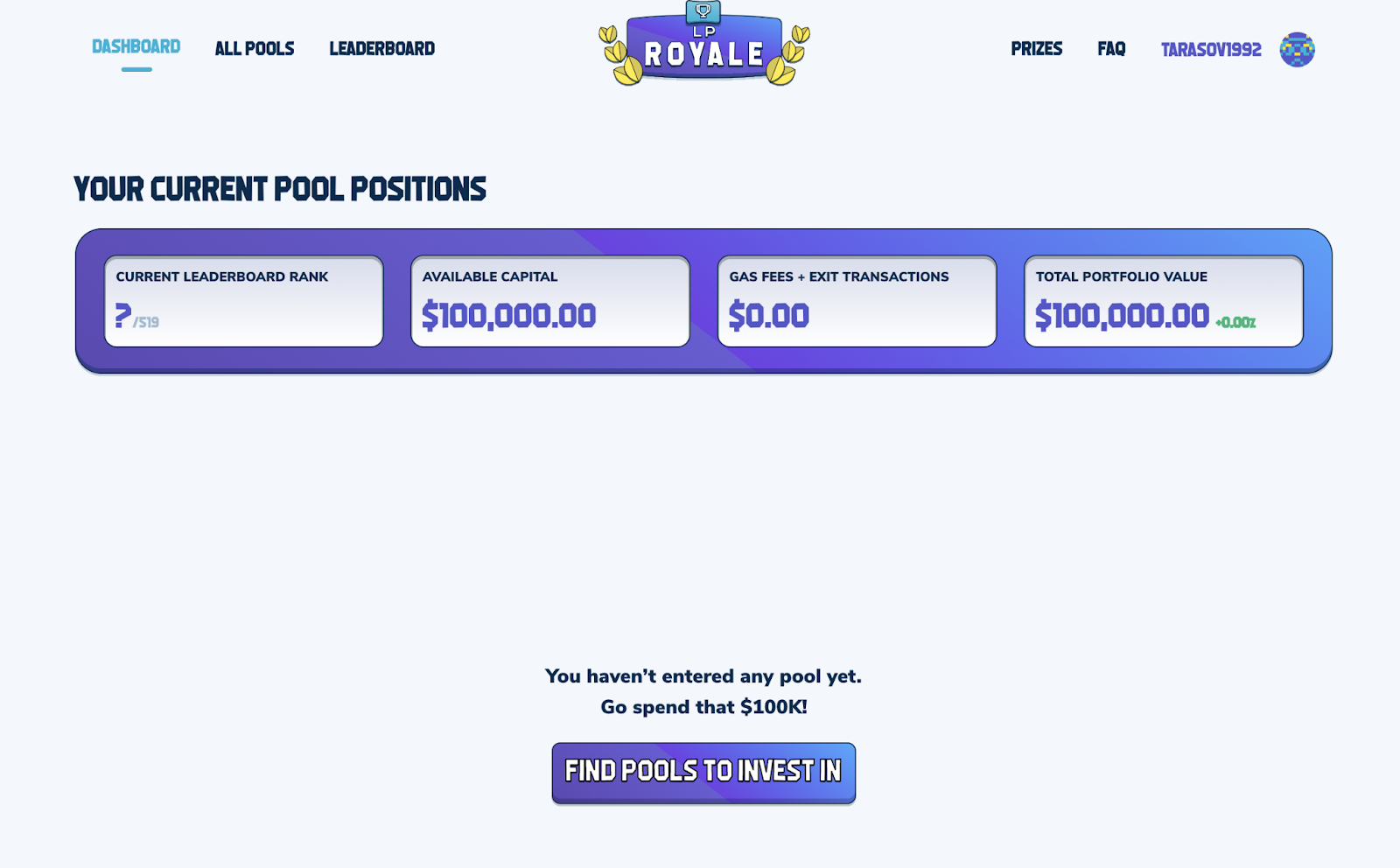

LP Royale’s concept is similar to demo accounts on stock trading platforms. You get $100,000 in test money that you can put in test pools. You register with an email and don’t provide an Ethereum address anywhere on the platform.

To start, head over to LP Royale’s home page and click on the ‘Sign Up.’

Once you register, the service will send you a login link. Follow it to see your dashboard. There’s a button to search for liquidity pairs.

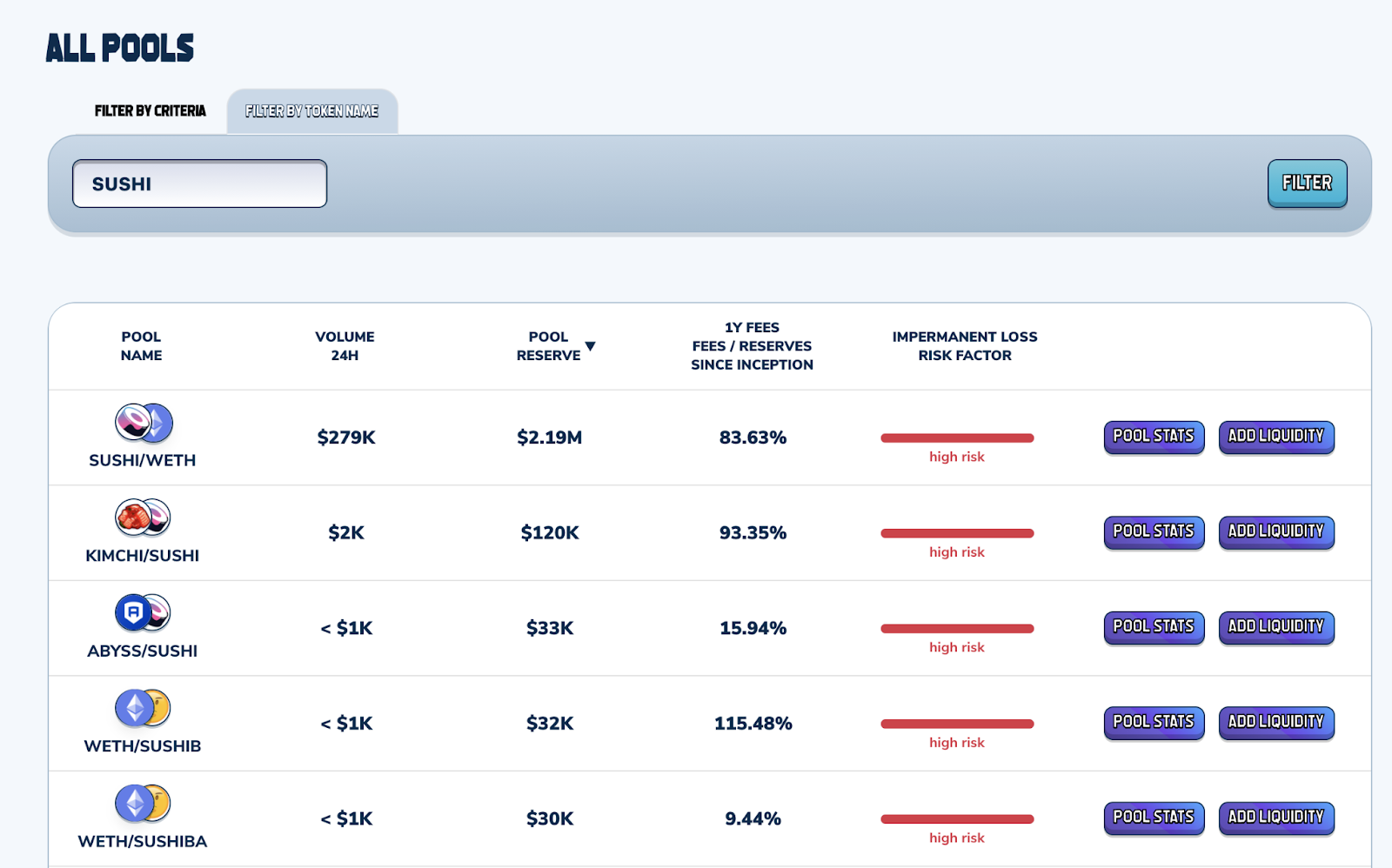

You may be interested in the pools with the tokens you have in your portfolio. To find them, choose the ‘Filter by Token Name’ tab on the ‘All Pools’ page and you will see all the options.

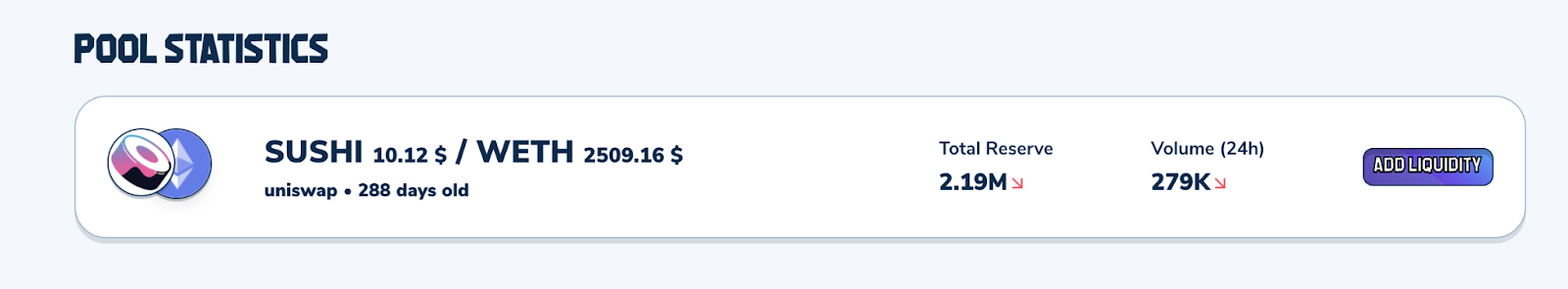

The high-level indicators like ‘Impermanent Loss Risk Factor’ may put you off but they are not representative of what the real IL is. To get more information, click on ‘Pool Stats’.

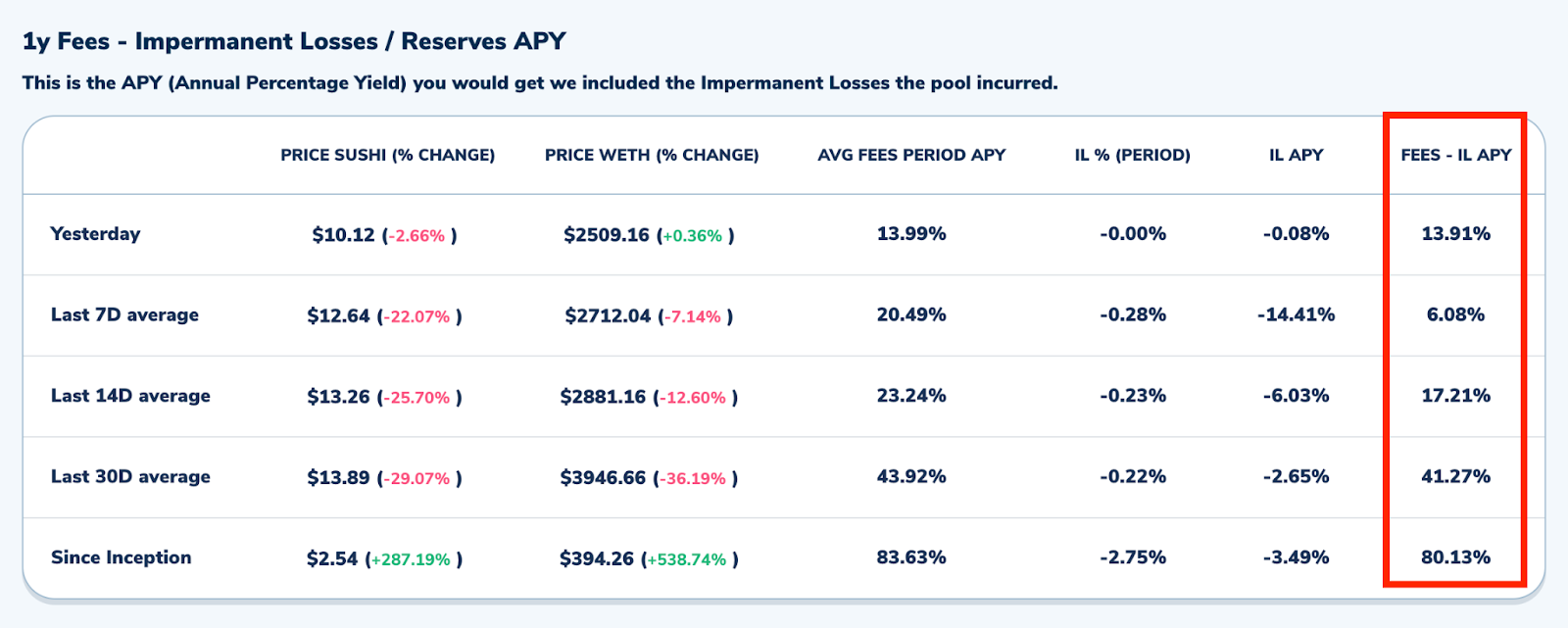

At the bottom of the first tab ‘APY vs. Impermanent Loss,’ you will find more precise stats on how much fees you get after accounting for IL.

In the case of the picture above, fees outweigh IL, which is a positive sign. You can try LPing in this pair. At the top of the page, you have the ‘Add Liquidity’ button.

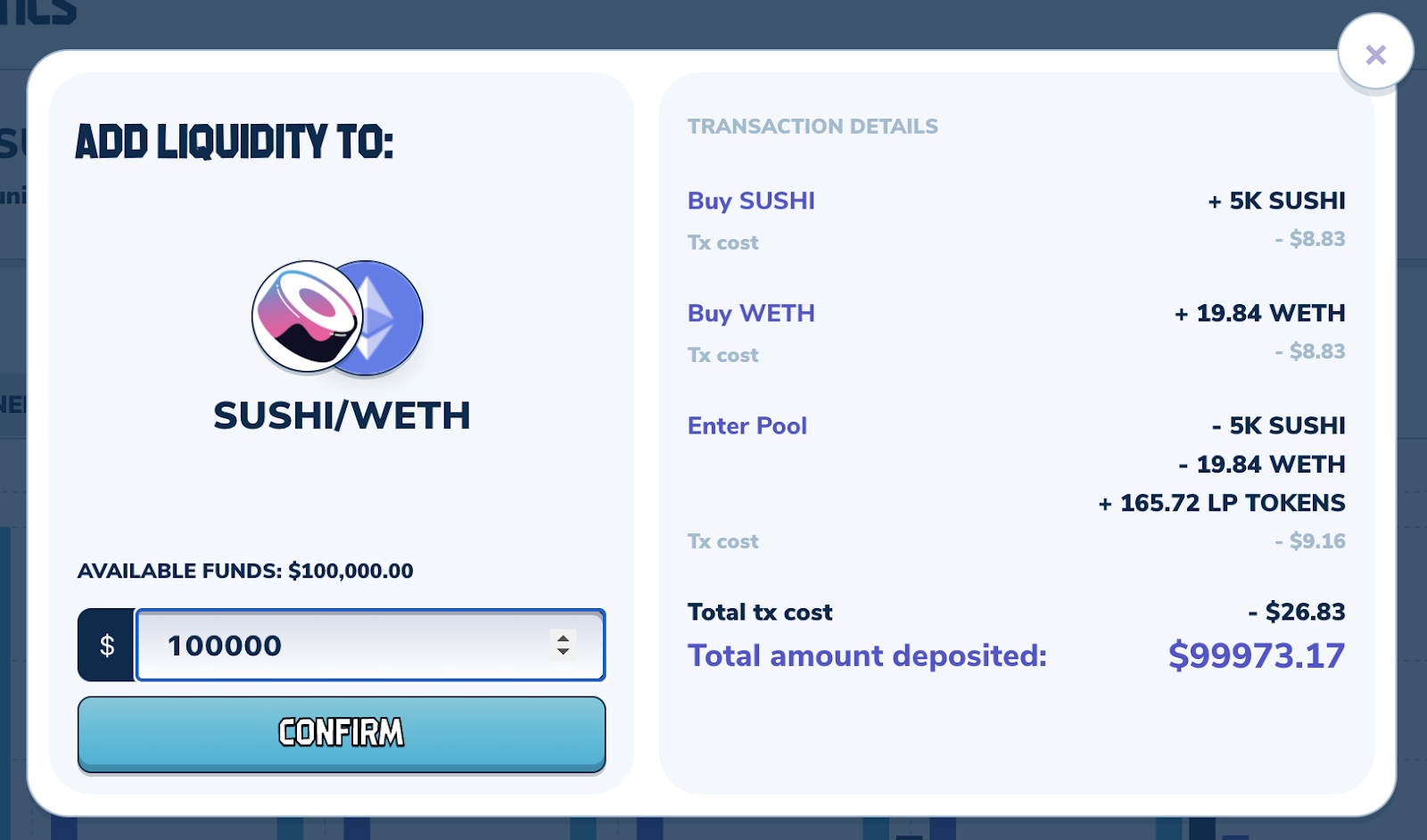

The app will show you a transaction like it would happen in a real setup. To LP, you need to buy SUSHI and Wrapped ETH in a 50/50 ratio. Once you deposit them, you get LP tokens that represent your ownership rights. Finally, there’s a cost for doing transactions on Ethereum.

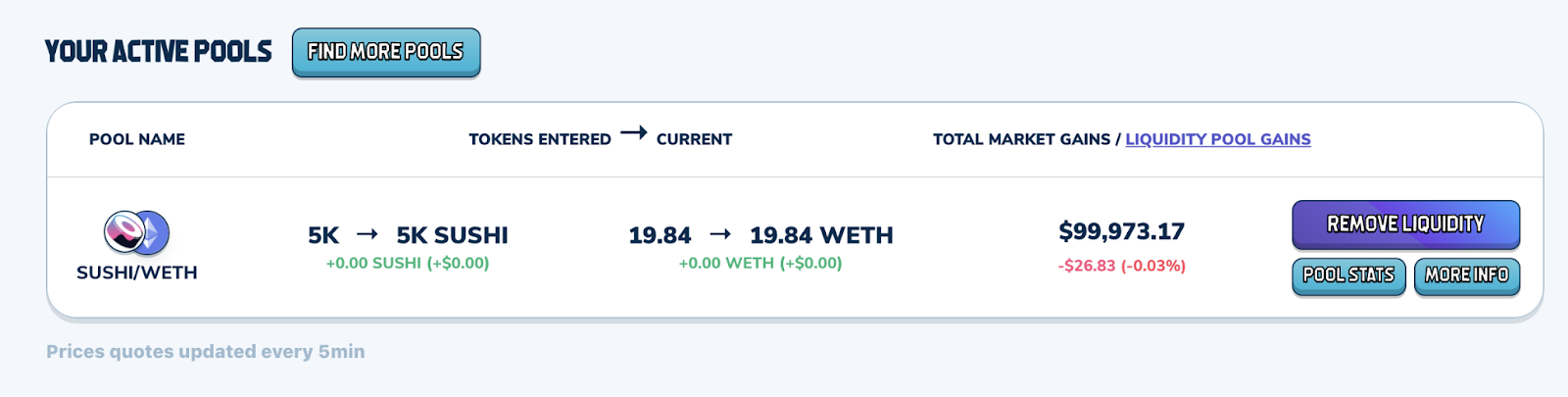

When you add liquidity, the app will direct you back to the dashboard, where you can manage your live pools.

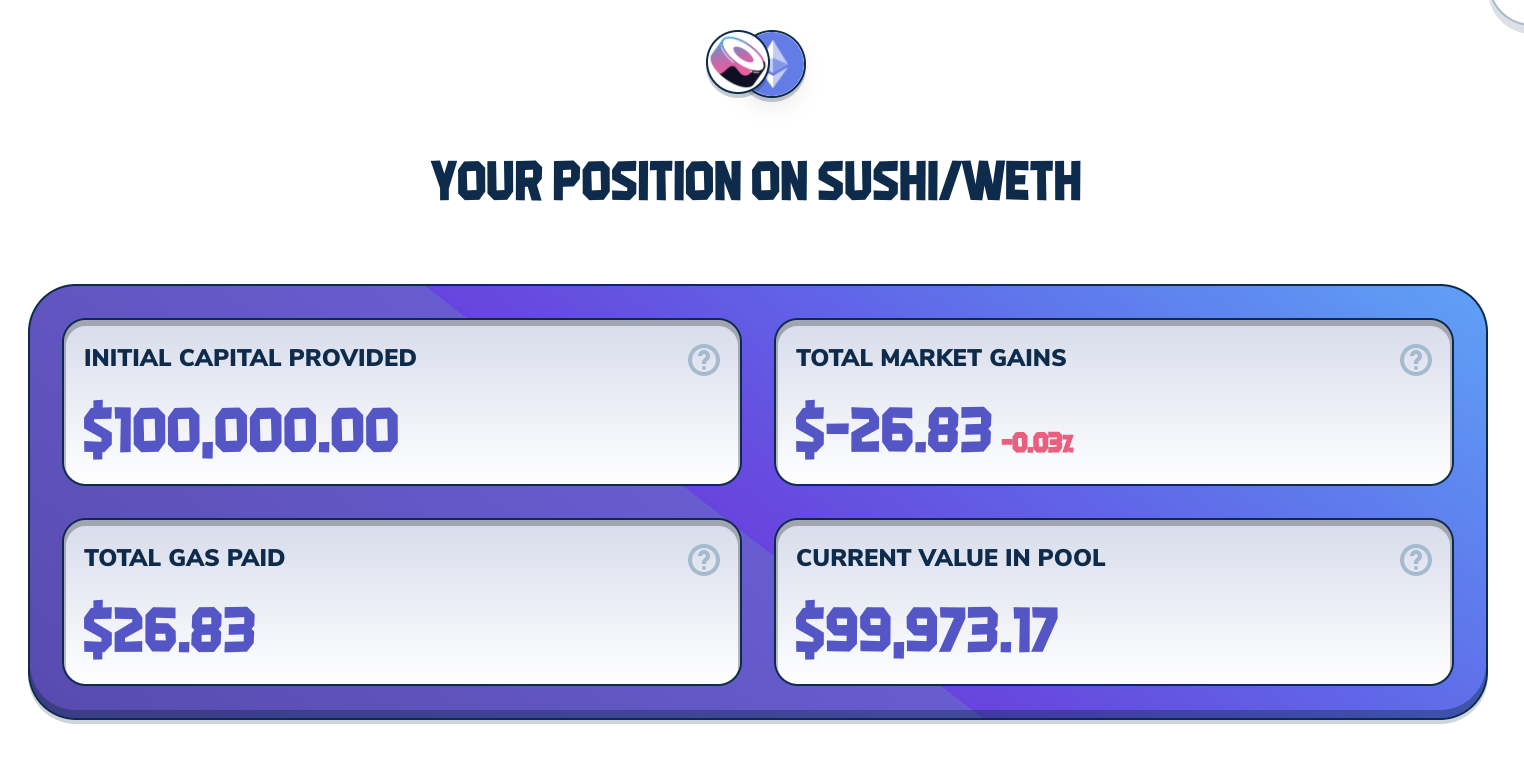

If you click the ‘More Info’ button, you’ll get a detailed outline of your gains/losses along with additional details.

Note that transaction costs are factored-in as expenses. That’s one of the primary reasons why LPing with small amounts on Ethereum is not profitable. If you LP with $100, you may lose up to 50% of your principal on transaction fees alone.

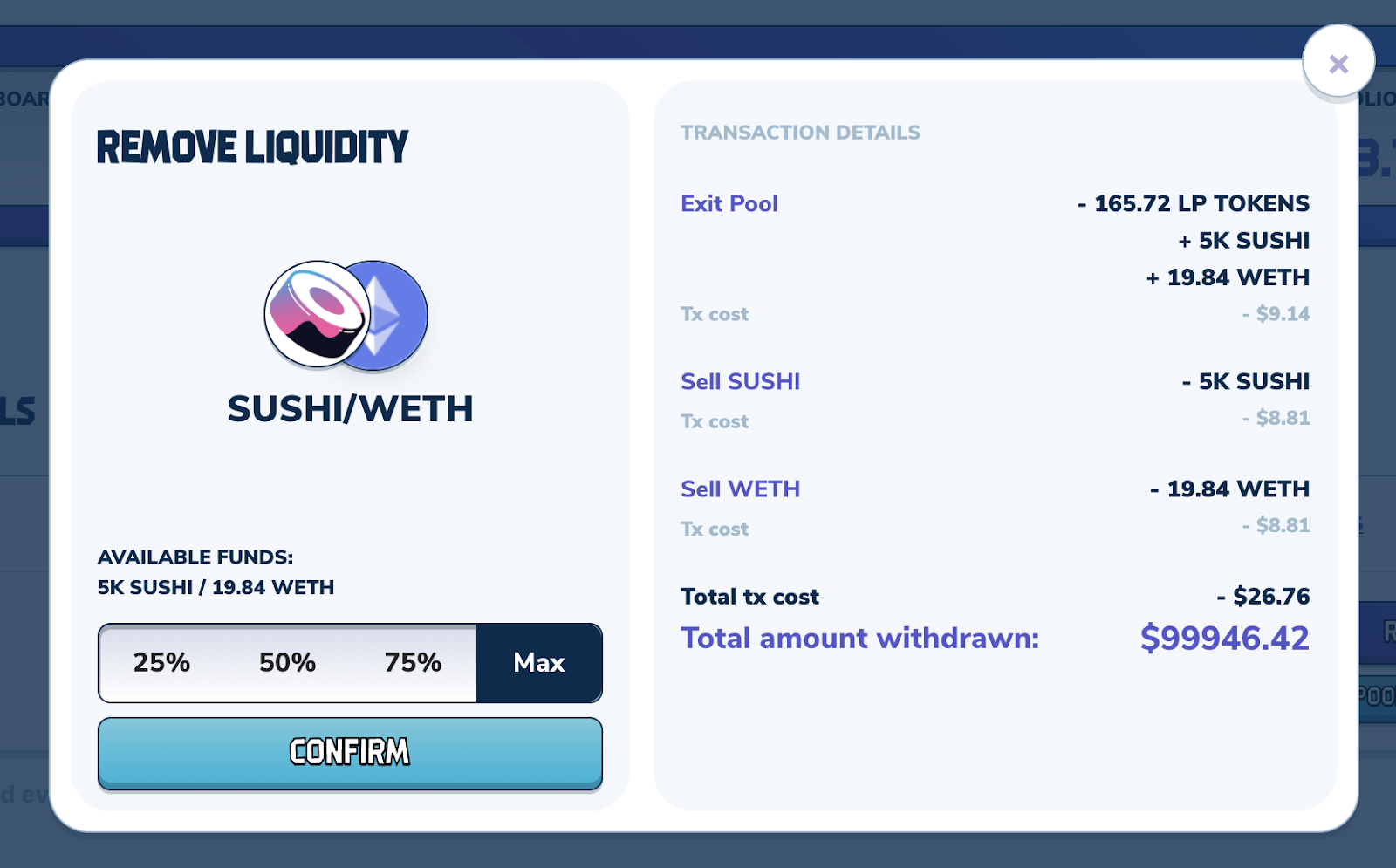

When you’re done LPing or want to decrease your position, you can remove liquidity by clicking the corresponding button in the Dashboard. Keep in mind that removing liquidity also incurs transaction costs that are factored into the returns.

Once you get more comfortable with LPing, you can compete with other players. There’s a Leaderboard and Prizes for the most profitable LPs. On the other hand, you may just want to start real LPing and to rake in real coins.

And there you have it. I hope this guide will help some of you gain confidence in LPing and finally pull the trigger on it. Good luck!

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH, BNB and MATIC. Read our trading policy to see how SIMETRI protects its members against insider trading.