Moving Money Across Chains.

With the rise of the multi-chain narrative, bridging assets across various networks has become essential. It’s got to a point where every new blockchain launches with a dedicated bridge that allows asset transfers from popular chains like Ethereum to attract initial liquidity and users.

But let’s say users need to move funds from Arbitrum to Optimism, or Solana to Polygon. In this case, they would likely have to first bridge to Ethereum and then to their desired chain. Currently, using Ethereum as a “middleman” is cumbersome and costly; however, third-party bridges are being deployed to solve this problem.

Today, I will highlight the current most-used bridges and assess their affordability, convenience and safety.

Hop Protocol

Built by top-tier Ethereum software company ConsenSys, Hop Protocol is a good choice for bridging across the popular Ethereum Virtual Machine (EVM)-compatible chains: Polygon, Arbitrum, and Optimism.

The app’s user experience is simple and convenient. Plus, it has adequate liquidity for tokens like ETH, USDT, USDC, and DAI.

The liquidity is high enough to facilitate low-cost transfers even to obscure networks like Gnosis. On top of that, in some cases, slippage can be positive, which means that a user receives slightly more tokens than they send.

In this case, due to the higher liquidity on mainnet than the rollup, the platform gives you more on Optimism than you had on Ethereum mainnet. Source: Hop Protocol

All in all, Hop Protocol is a great bridge for Ethereum rollups with a good user experience and ample liquidity. However, it’s not a good fit for those looking for EVM-compatible chains that aren’t Ethereum rollups.

Synapse

Under the hood, there are technical differences between Synapse Protocol and Hop, but from the user perspective, these two are very similar. As an advantage over Hop Protocol, Synapse protocol lets users bridge to even more chains.

Synapse supports 15 blockchains, which includes all the top EVM-compatible chains—rollups (Optimism, Arbitrum, Metis), sidechains (Polygon, Boba Network), and other Layer-1 platforms (Fantom, Aurora, Cronos Chain, Avalanche, and BNB Chain). However, Synapse doesn’t have bridges to Solana and the Cosmos yet.

There’s sufficient liquidity for stablecoins and ETH across all the listed blockchain platforms. The daily bridge volume has fluctuated between $20-$50 million over the last few weeks, which is on par with other top-tier cross-chain bridges.

The fee for bridging using Synapse is 0.05% in addition to the gas fee on the originating blockchain, which is reasonable. Overall, Synapse is a decent alternative to Hop for those who operate across many different EVM chains.

Celer

Celer is an independent interoperability protocol built on Tendermint, like Cosmos. Its bridge enables users to transfer funds and send messages across 11 blockchains.

The bridge has adequate liquidity for USDT, USDC, and ETH distributed evenly across the most popular EVM-compatible chains. Celer also has deeper than average liquidity for Fantom, BNB Chain, and Polygon. It also supports transfers to Boba Network, Metis, Astar Network, Aurora, and Harmony.

The liquidity provider fee for transfers on Celer is less than 0.05%, the same as Synapse. Overall, it looks much like Synapse, but may prove useful for users wanting to bridge on and off more obscure chains like Astar Network.

Multichain

Multichain is one of the first cross-chain bridges. The platform provides bridging across 18 blockchain platforms. However, the caveat here is that its user experience is subpar compared to other bridges and liquidity is concentrated on only a handful of chains.

The platform has adequate liquidity for USDC across popular networks. However, for other tokens and stablecoins, liquidity is available on fewer chains and is usually concentrated on specific ones like Cronos and Fantom. The liquidity for ETH is so thin that the platform cannot even bridge between chains like Avalanche and Polygon.

99% of Multichain’s ETH liquidity resides on Fantom, making it ideal for a transfer onto Fantom, but not for other blockchains.

All in all, Multichain doesn’t make much sense unless the destination chain is Fantom.

Wormhole

Like Multichain is Fantom-specific, Wormhole is largely Solana-focused. Although it supports around ten blockchain networks, including top-tier ones like Avalanche, Ethereum, and Polygon, the liquidity and bridging activity is concentrated around Solana, followed by Terra and BNB Chain.

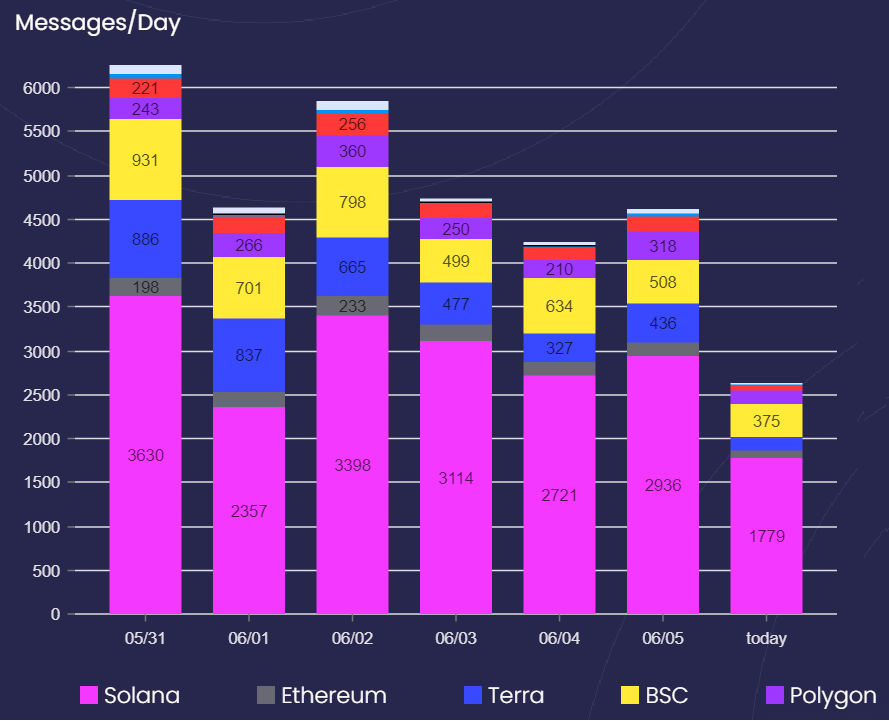

More than half of Wormhole’s bridge transfers are on Solana (pink), followed by BSC (yellow), Polygon (Purple), and Terra (Blue). Source: Wormhole Explorer

Earlier this year, Wormhole was hacked for $322 million—one of the largest DeFi hacks in history. Even though the lost funds were restored by Jump Capital, users should still be concerned about the platform’s safety.

Moreover, if another hack were to occur, it’s unlikely Jump Capital would be able to bail Wormhole out a second time because they incurred significant losses trying to prop up Terra’s LUNA and UST—an endeavor that ultimately failed.

Stargate

Stargate is a relatively new platform with decent liquidity for USDT and USDC across several top-tier EVM compatible blockchains.

The team claims Stargate has high security because it has a checking mechanism between oracles and relayers that send transactions. However, these oracles aren’t fail-proof, and some people in the industry have expressed concerns about their reliability.

So far, Stargate’s bridges have been primarily focused on EVM compatible chains, but the platform plans to enable connections with other ecosystems like Cosmos and Polkadot. Thus, it may be interesting for people active outside the EVM realm.

For now, though, Stargate is still in its infancy. It does not provide a significant advantage over its competitors, which support a wider variety of blockchains and tokens.

Final Words

In summary, liquidity across the cross-chain bridging ecosystem is inclined towards specific ecosystems. Wormhole caters to Solana users, Multichain focuses on Fantom and Hop Protocol along with Synapse and Celer target EMV-compatible chains. Thus, a user must select a bridge based on their origin and destination.

The most liquid bridge tokens continue to be USDT and USDC, followed by ETH. Users looking to bridge other tokens should verify if liquidity is deep enough for their token of choice before attempting to bridge.

There are solutions to pass money around between EVM, Solana, and some of Cosmos ecosystem blockchains, but beyond that it’s mostly a void.

As for the security concerns, none of these bridges are 100% safe. Some are more trusted by the community, but users should be extra cautious. The most rational approach for large sums of money is splitting them into batches of smaller transfers to reduce risk.

Happy bridging!

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.