Low Risk Trades.

When it comes to NFTs, fewer people feel willing to take risks or go through the pain of becoming allowlisted in the latest hot project. However, there’s still profit to be made, especially now that Ethereum transactions have significantly reduced.

Lower transaction costs encourage more active trading, and teams behind profile picture (PFP) projects are adjusting to the risk-averse feeling amongst investors like you and I.

As a result, many projects are quickly moving towards no-discord, no-roadmap, and no-utility offerings. The benefit of not providing all these community features is lower production costs, which translates into lower prices, and lowers risks for traders, thereby keeping them engaged.

Today we’re focusing on identifying quick trading opportunities in this lower-cost, lower-risk environment. We’ll use a few websites: NFTGO, gem.xyz, traitsniper.com, and a Twitter bot to help us to spot and confirm an emerging trend to trade.

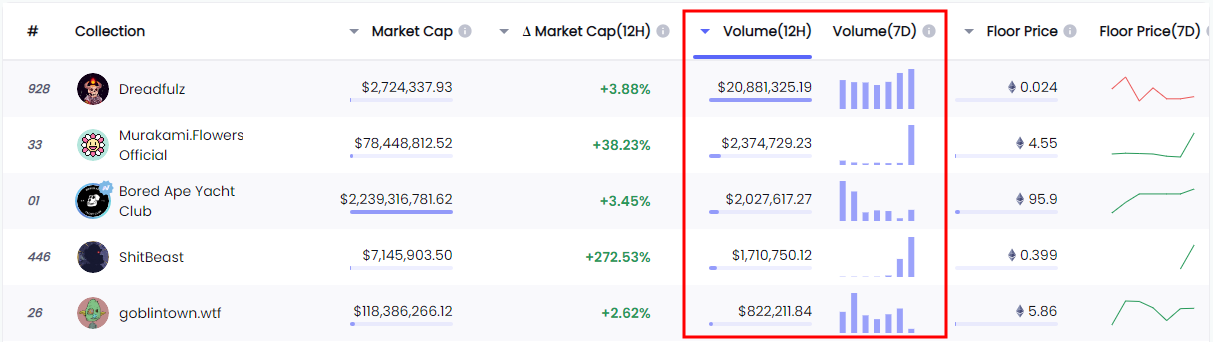

I’ll begin on NFTGO, which I find helpful for spotting emerging trends. First, I want to show you what to avoid, then what to look for. Start here on the top collections page, focusing on the ‘Volume(7D)’ bar graphs.

Before we begin our analysis, set the time scale lower, ideally to twelve hours or less, and then sort by that same column. Doing so allows us to see the seven-day trends on the bar graphs, and focus on what has been trending most in the selected time frame.

You should see something like this:

Let’s break down the information into a few key elements and understand what it tells us. My starting point is the bar graphs.

You can see a variety of trends. Firstly, over the last seven days, Dreadfulz has been trending upwards in volume. This looks great, and the floor price of 0.024 ETH is suitable for a low-risk trade. However, the floor price is trending downwards, suggesting people are increasingly exiting their positions, pushing the price down. This isn’t something we want to be involved in.

Murakami.Flowers has seen a sudden spike in volume, so something interesting has happened, but we missed it. Now, at 4.55 ETH, it’s too expensive and risky.

That leaves goblintown.wtf and the wonderfully named ShitBeast. ShitBeast’s floor price is low, trending upwards, and has only been doing so for two days. At 0.399 ETH, this looks tempting. But as with Murakami.Flowers, we’ve probably missed the boat here. I’ll show you why.

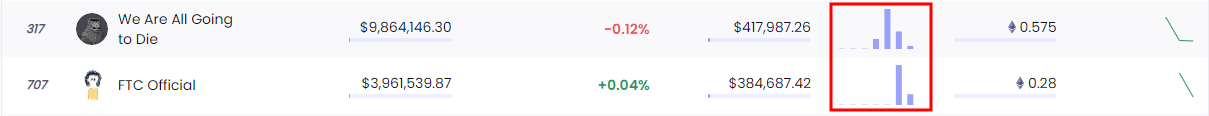

The projects on the screenshot above have bar graphs like many of these low-cost PFP projects that can be seen at the moment. They trend upwards for just one or two days, and then investors quickly sell their NFTs at a profit before the market moves on. ShitBeast has probably already peaked.

It might seem counterintuitive to show you examples that are too late and generally no good, but it’s essential to understand what a high chance of failure looks like to avoid it.

We can now see the kind of project we want to trade: low cost and something that has been trending for 24 hours at the most. To find these projects, switch to using Gembot on Twitter.

Gembot reports ‘notable [sales] above 5 ETH in value or 15 items’ as soon as they happen. It’s a helpful tool that allows us to identify NFT collections trading in high numbers.

Scrolling through Gembot’s feed over the last few hours reveals numerous potential low-cost projects selling in large quantities. As before, search for them in NFTGO to rule out unsuitable ones.

Searching the feed for a while reveals that boredassgoblins collection grabbed traders’ attention. Considering the current craze around goblins, this adds some short-term good fundamental prospect of there being a market to sell onto.

Surprisingly, boredassgoblins don’t show up on NFTGO, suggesting they may be new and well-suited to our trade, or that the website doesn’t track all collections. Confirm this by checking other sites.

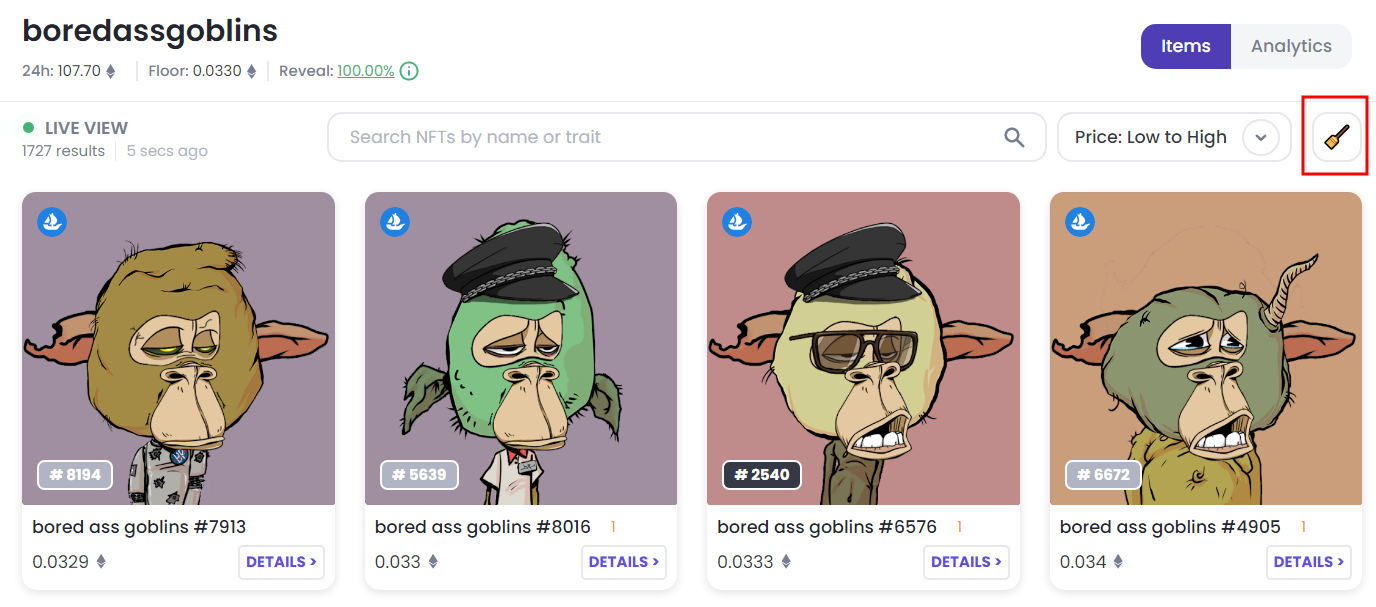

They are listed here on gem.xyz, a convenient trading site that allows us to buy multiple lowest price NFTs at once, known as ‘sweeping the floor’. Some traders do this to artificially raise the lowest price, so the NFTs that were just purchased can be relisted at the now higher price.

At this point, the fear of missing out may be setting in and giving the urge to enter this trade. We should consider a final bit of data to evaluate the market for these NFTs though. I will check this last chart on traitsniper.com.

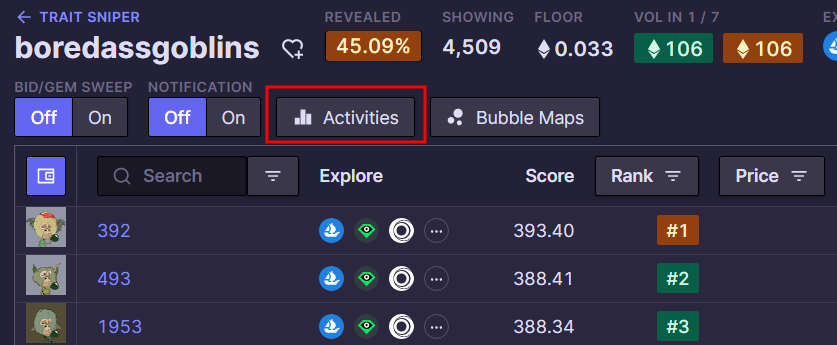

The button I want to click on is the activities one, which will give me the following Floor Chart after scrolling down slightly:

This chart shows trading started at 09:00 today, and both volume and floor are still growing. We have the kind of opportunity we’ve been looking for. Now we can head back to gem.xyz and use the floor-sweeping tool to begin a trade.

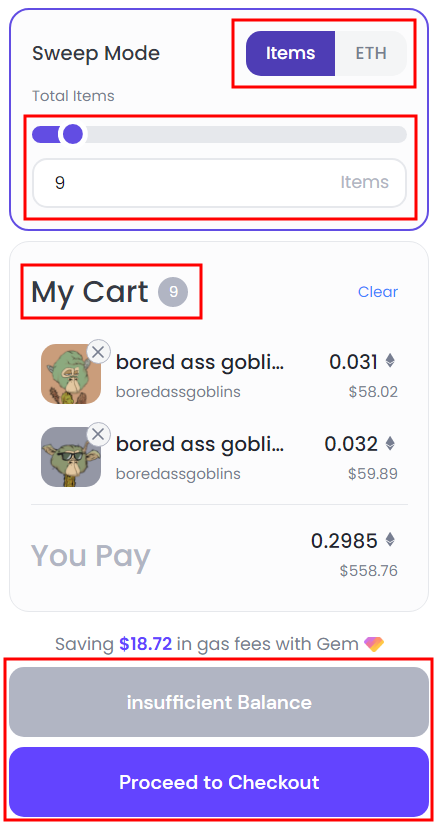

On gem.xyz, clicking the small brush symbol (see image below) opens a ‘sweep mode’ box. Here, select the number of NFTs to purchase or the amount of ETH to spend. As the relevant information is entered, gem.xyz automatically selects the necessary number of NFTs to fill the order.

The cart automatically fills with the nine cheapest boredassgoblins at a total cost of 0.295 ETH, which is about $540. To complete the transaction, I’ll need funds in my wallet and to either use the fast ‘buy now’ feature (greyed out in the above image as ‘insufficient balance’) or go the slower route by clicking proceed to checkout.

Going back to an earlier point about gas fees being low on Ethereum, trading in batches on gem.xyz is less expensive than it has been for a long time; check this example transaction for boredassgoblins. The purchase of 15 goblins cost just $4.96.

Lower gas costs make trading more manageable. If the value of a collection begins to fall, the cost of exiting the trade to control losses reduces, allowing more flexibility to make that decision.

On a batch purchase of ten NFTs, a small rise in the floor price of 0.01ETH is worth approximately $200, about a 40% return. This can be scaled up by purchasing more NFTs, sweeping the floor to raise the minimum price as I outlined above, or taking more risk by allowing the price to increase further.

To control the risks, take time to learn the market’s inner workings and research potential projects to trade as shown above. Keep sharpening your skills and evaluating what works. There is no hurry in this market because there will always be another opportunity.

In conclusion, trading NFTs is possible again on Ethereum and tools like gem.xyz, NFTGO, Trait Sniper, and Twitter Bots can be combined to significant effect to develop insight. While research and planning take some time, they will lower risk and increase the chances of success when done well.

I hope you enjoyed ₉uᵇlen uuᵖp Pₑrₒoᵥᵉᶦₜ.