The Crab.

In this market, I can’t help but remember the conversation I had with Mitchell Moos about what’s about to happen with the market. That was when I first thought about the possibility of a long-lasting “crab market.”

“Crab market” is a meme for price movement in a sideways channel. If the channel is narrow, it’s easy to comprehend and handle. Conversely, if the channel is wide, movements within it may be mistaken for bull or bear trends.

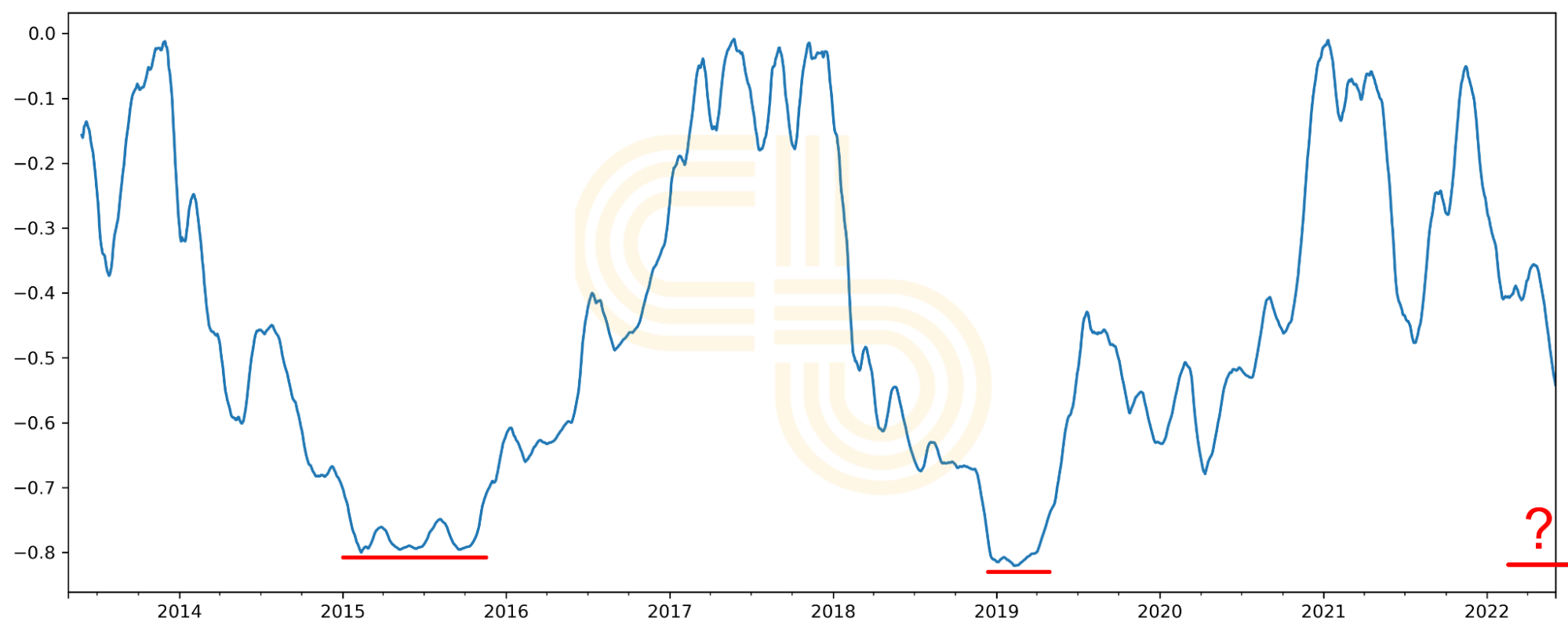

Historically, the bottom in crypto starts to form once $BTC has an 80-85% retracement. By that time, alts are flattened and barely show any signs of life. This is when it makes sense to double down on dollar-cost averaging strategies. It has been the golden period to feed the market.

We aren’t there yet. Take a look at the chart of $BTC drawdowns below. If this time isn’t different, we will have much more pain. However, it should be easy to call the bottom confidently once we get there.

$BTC drawdowns. Source: CoinGecko.

The question then is: “is this time different?” Although people often say that it never is, I’m a bit worried that this time might be slightly different.

I can’t say much about the 2014-2016 cycle because I wasn’t in the market. But, I remember that in 2018-2020 people were optimistic for a while after $BTC topped. The pain increased gradually. Currently, we’re seeing a similar picture: there’s still an appetite for speculation, and some influencers and teams are still active. This, however, wouldn’t stop $BTC from nuking to $20,000.

What could stop it is the increased participation of institutional capital, which is reflected in the increased correlation between crypto and stocks. That’s why crypto people talk about macro so often: if the macro is good, stocks will likely perform well, and so will crypto.

We live in quite an interesting time when many economic processes are not working as intended, and governments (the Fed in particular) are trying to handle it without causing much damage. This is uncharted territory.

Suppose the Fed will have a “soft landing” and recession doesn’t occur. This will likely bring optimism to the stock market and backstop crypto from falling further from the current levels. However, there might be other issues in the future which will send stocks down, and crypto will follow. Do you see the crab?

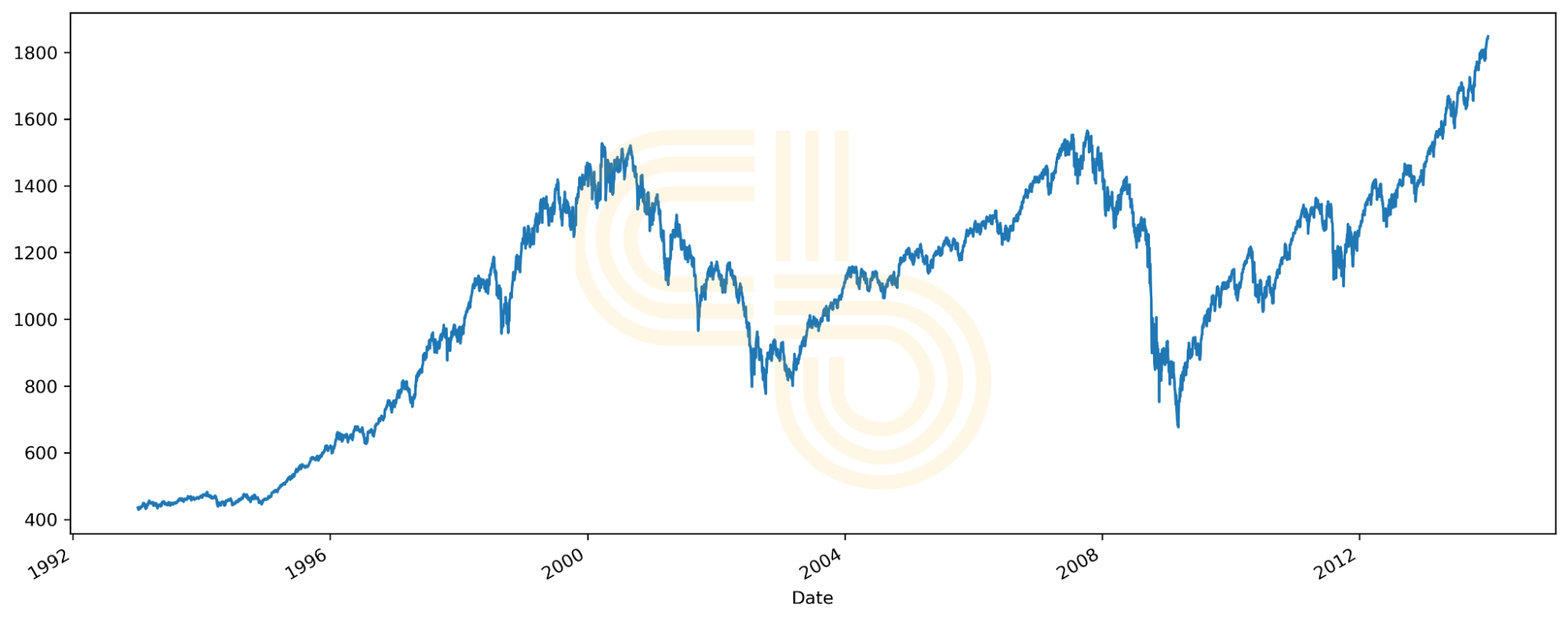

Take a look at the prices of the S&P 500 from 1997 to 2009. More than ten years of a wide-range crab market with an eventual exit to the up. I bet many people were unprepared for it and either got burned out while trading or ended up being underinvested when the bull market started.

$SPX. Source: Stooq.

Personally, I’d rather see a giga nuke and a prolonged flat line across crypto. It’s painful but, at the same time, easy to approach because the market sends you a clear bottom signal. However, a part of me is afraid that this time we might not get that signal.

But don’t fret. Dollar-cost averaging into the market’s core assets like $BTC and $ETH and fundamentally strong projects wins in any market: bear, bull, or crab.

SIMETRI Portfolio – The Crab

Since $BTC is largely hanging around the $30,000 level, alts stagnate. Hence, the portfolio’s ROI is hanging around 500%.