First Landing on StarkNet.

After the rise of Sybill attacks, where users create numerous fake accounts to farm potential airdrops, many teams have imposed stringent restrictions on airdrop eligibility to reward only sincere participants who contribute positively to the ecosystem.

For example, Optimism airdrop required participation at the very early stages of the network. The team rewarded users who bridged funds on Optimism mainnet before Jun. 23, 2021, but only hardcore Optimism fans did so because the network didn’t have many products with lucrative incentives.

We can expect similar limitations from future airdrops of the other three top Layer-2 networks: zkSync, Arbitrum, and StarkNet.

Recently, zkSync confirmed a token. People who bridged funds to the network and used applications early enough will likely get an airdrop. Comparing it with Optimism airdrop, the time for early user allocations has probably ended.

It leaves us with Arbitrum and StarkNet. Today, I will talk about StarkNet. There are signs that StarkNet will have a token as its founder Ben-Sasson recently noted, “In time, this community won’t just use StarkNet, but will also run the platform,” clearly pointing at governance tokens.

There’s very little to do on the StarkNet mainnet besides bridging the tokens. But it’d be good to start engaging with the ecosystem in the earliest stages. The idea is to spend little time and gas fees to participate in the StarkNet ecosystems early, likely making you eligible for the token airdrop.

If you have ever heard about dYdX and Immutable X, you’d know that they have low gas fees. That’s because they implement the StarkWare technology stack.

So far, their issue has been that StarkEx applications on StarkEx are isolated and permissioned. Starkware’s upcoming StarkNet will be the general-purpose permissionless blockchain, where applications can talk to each other. The potentially upcoming $STARK token would likely serve as a governance tool on StarkNet. Therefore, distributing it to early users makes the most sense.

Earlier this month, the team launched the official bridge to Ethereum, StarkGate. In the steps below, I will explain how to bridge tokens to StarkNet using StarkGate.

The prerequisite for using StarkGate bridge is a Metamask wallet with some ETH on it. You also need a StarkNet-supported wallet like Argent X. To download the Argent X browser extension, go to this link.

The steps to create a new account are similar to most wallets where you need to store 12-word backup seed phrases.

After setting up your wallet, go to the StarkGate bridge. Read and accept Terms of Service.

In the next step, connect your Metamask wallet with the bridge. Make sure you’re on the Ethereum Mainnet before making the connection.\

Then, connect your Argent X wallet to the bridge.

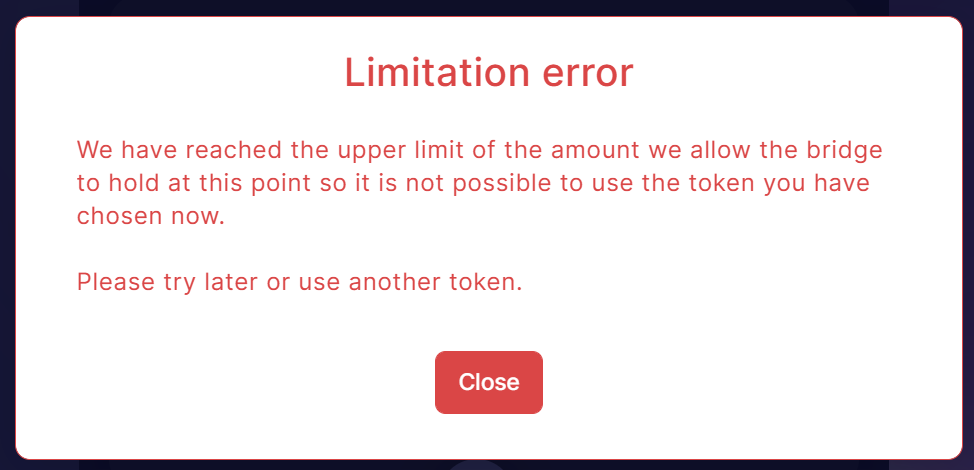

Currently, there’s an upper cap of 200 ETH on the bridge. Thus, you can receive a “Limitation error” message, when you try to bridge the tokens. However, the team increased the limit from 50 ETH to 200 ETH within two weeks. The plan to gradually raise this limit over the next few weeks.

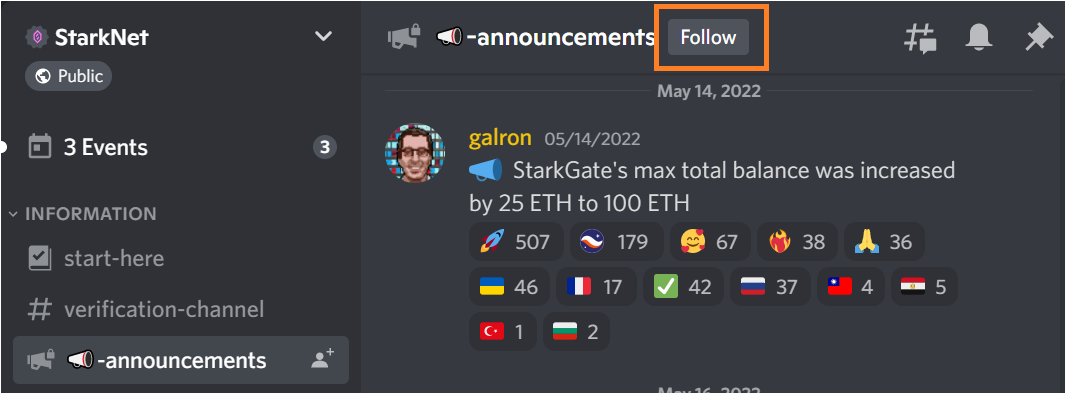

You can follow the project’s Discord server for updates on liquidity limit increases, or check the limit in their smart contracts.

The team posts the update about limit increases in the announcements channel. You can ‘follow’ the channel to receive instant updates to your personal server. If you don’t know how to set up a personal server, don’t worry, it’s easy. Just follow the instructions here.

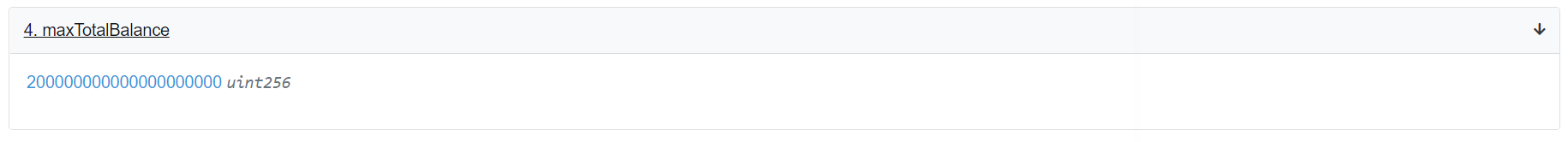

To verify the total liquidity limit on the contract: go to this link on Etherscan and select the “maxTotalBalance” options.

In the future, I’ll be trying out applications on StarkNet, such as decentralized exchanges: Starkswap, JediSwap, and ZKEX, NFT marketplaces: Play Oasis, and lending protocols: Curve Zero and Magnet Fi. You can find other ecosystem projects building on StarkNet here.

By bridging a small amount early, you can gain many advantages from new ecosystem projects. Since the gas fees on these protocols are negligible, it will only take a bit of your time, which shouldn’t be a problem in the relatively quiet bear market.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.