Drink Ethereum’s Milkshake (Part 2).

Last week’s Edge introduced you to Evmos, a new chain that connects the Cosmos ecosystem to Ethereum. I showed you how to connect to the network and bridge funds. This week we’re fightin’ it out for our gains, facing off against the competition in some high stakes trading.

We’re still on the hunt for oil and gold, but we’re going to be working on our quick-draw gunslinging, using a DEX screener to make off with some gains before the market catches up with us. Today is all about high-risk, high-reward opportunities.

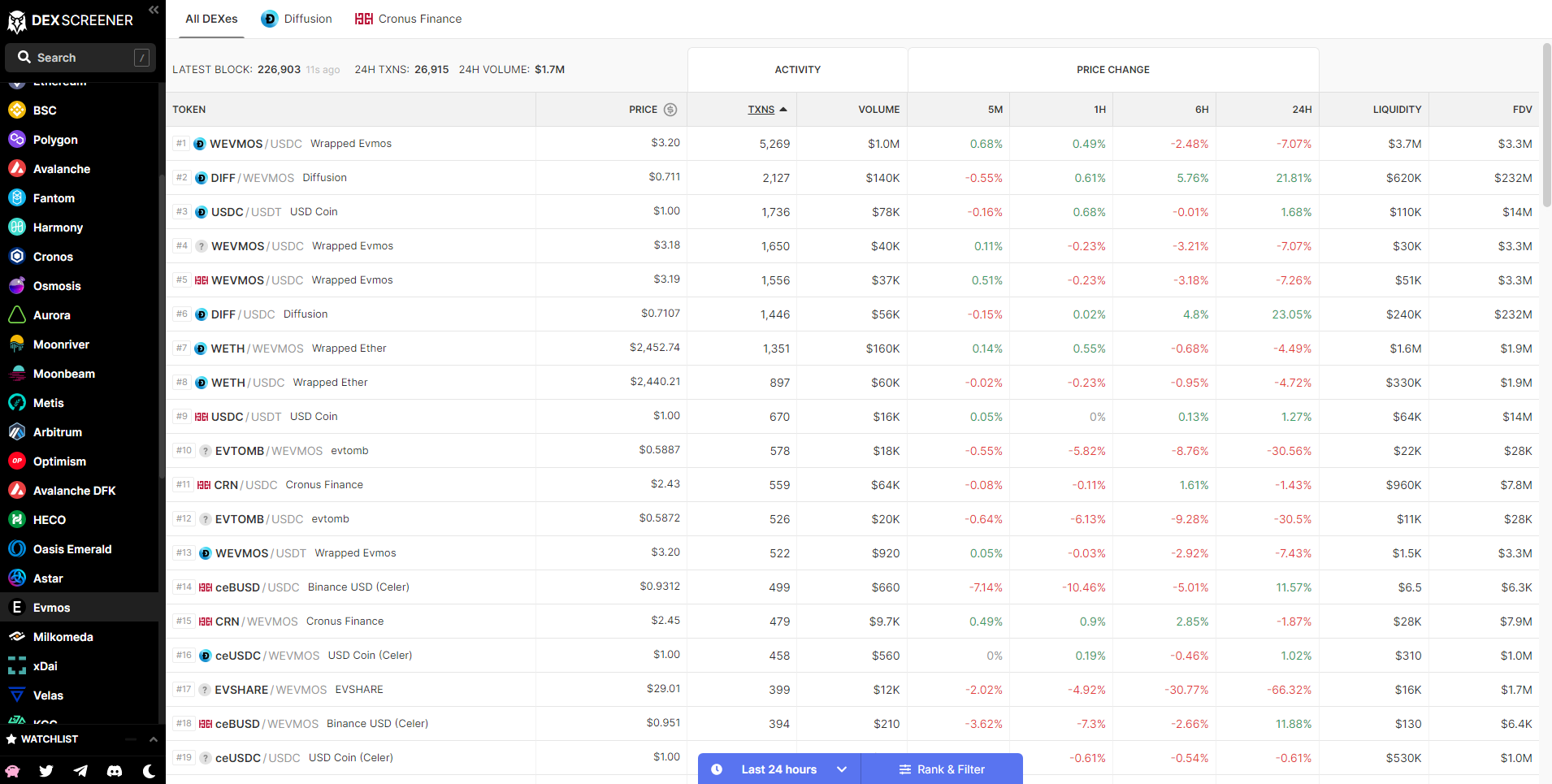

‘DEX screeners’ monitor the transactions passing through decentralized exchanges (DEXs) on various networks. They show the coins being exchanged and the quantities involved, letting us spot new tokens before everyone else.

The main screen above allows us to filter specific networks by selecting them in the panel on the left, changing the time frame, and choosing sort options in the blue box at the bottom. At the very top, we can also filter which DEXs we want to view information about.

The pairs of coins being traded are in the center of the screen, with the essential information needed to spot the newest coins. The data focuses on short time frames. This is why I think of it as quick-draw trading: reaction time and speed are of the essence.

I found the coin in the above image by selecting and sorting it with the 24hr time frame. The evSHIBA/wEVMOS was at the top, with an increase of 7,346%. These are the kind of gains we’re going to be targeting.

The less experienced reader at this point may think I’ve become some kind of delusional lunatic. But, under the right circumstances, there is money to be made here.

Let’s understand how.

On the graph above, the value of evSHIBA rises quickly from near zero. It’s relatively easy to send a low liquidity token up a few hundred percent.

This rise gets the trading pair noticed on DEX screeners and creates fear of missing out, drawing more investors to the idea of mind-blowing gains. Consequently, the price rises further. Some will believe that they’ve found the next moonshot, just in time. And sometimes it does happen.

If you got in and out at the right time, Floki Inu went 100x. Those that didn’t make a quick getaway paid for it.

I’m under no illusions here. Notice that as the blue price line in our evSHIBA graph moves exponentially upwards, the green and red volume bars at the bottom are getting smaller, showing fewer and fewer people are trading the coin.

This is a form of divergence suggesting the upwards price action will reverse. It’s time to take profit. You’ll get trapped with no one to sell to if you don’t. So: getting in close to the start and timing an exit is king.

Use the DEX screener at very short time frames to find new pairings that are just starting to trend upwards. The true degen will appreciate the one and six-hour settings especially.

This is very much a game. You’ll need to be careful and willing to take some unexpected hits. The DEX screener provides clear warnings that would usually help us understand that we shouldn’t get involved. But as we’ve got our degen heads on, these warnings are more like adverts to us today, except for ‘honeypot contracts’…

The honeypot contract allows anyone to buy a coin, but only specific addresses listed in the contract to sell the coin. Typically a honeypot contract will be characterized by significant percentage gains in price and a chart that shows no selling – as if all the buyers are diamond-handing the coin to death. Which they will.

Attracted by constantly increasing prices, degens in the honeypot have exchanged valuable tokens for something they can’t trade. Sadly for these lost souls, their purchase sent the price up further, attracting even more degens. The process can repeat ad-infinitum. This is a particularly dark version of ‘exit liquidity’.

We can see then that taking precautions is essential, so consider the following ideas that will let you control the risks of degen style trading:

- Set up a new wallet for each trade: don’t give a malicious smart contract permission to a wallet that has all your funds.

- Place micro bets: the largest buy order placed for evSHIBA from the screenshot was $22; most were half that or smaller. This type of trading is about getting in with pennies and coming out with any amount more, as soon as the warning signs emerge.

- Plan a high frequency of trades: you can put in a potentially decent day of earnings when you consider all the opportunities on all the networks. Low gas fees are therefore essential too.

- Keep time-frames short: evSHIBA went to zero during the writing of this article, less than twenty-four hours after it was released. This will happen to you if you wait too long.

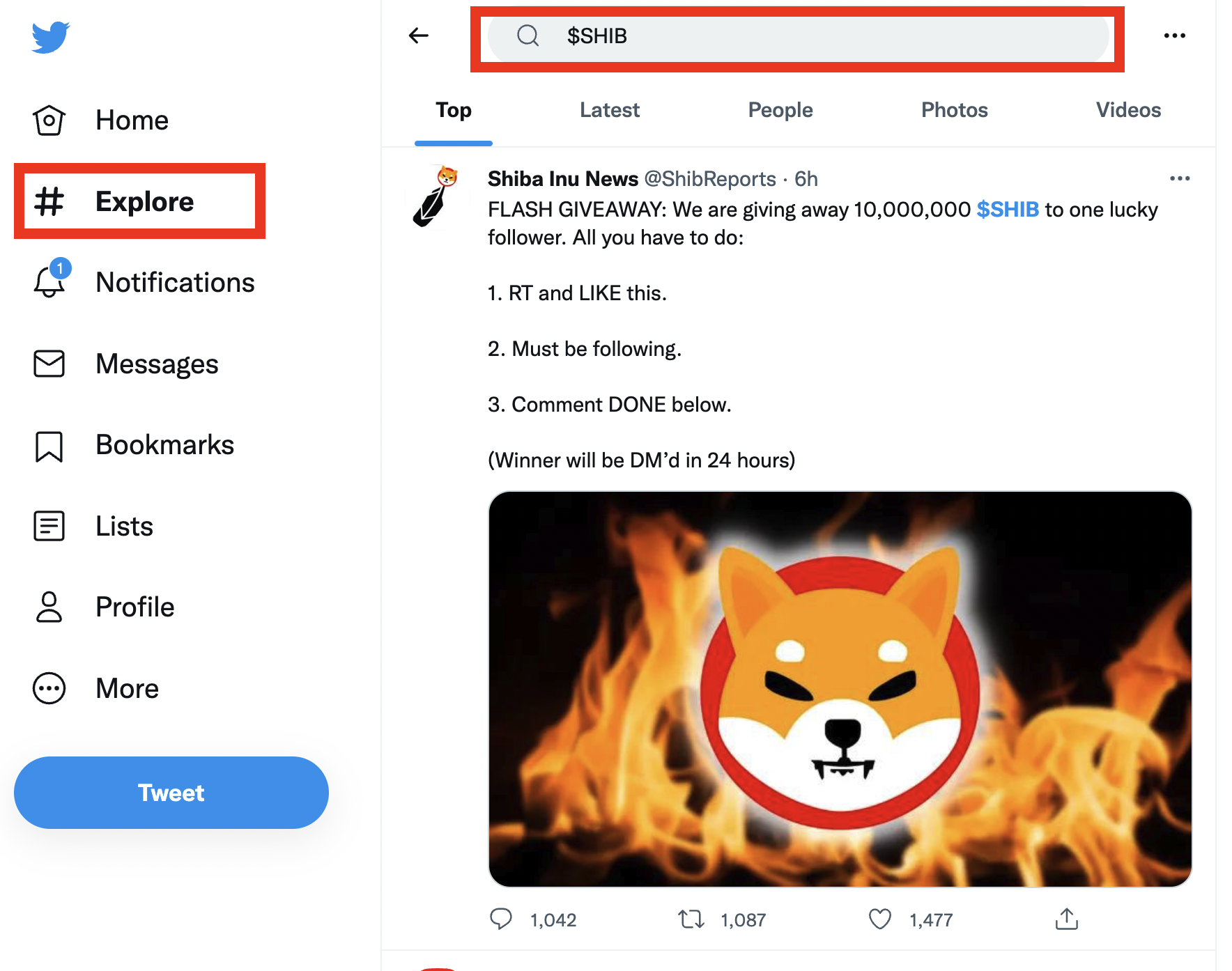

Once you’ve found a suitable trade on the DEX screener, you can also use social media to check out whether you’ve found a pump and dump, or… the real thing.

Search for a coin on Twitter by putting $[TOKEN NAME] in the search bar under the “Explore” tab. It should look like this. Your timeline will be filled with mentions of the ticker of the token you’re looking for.

There you will most likely find the project’s official page, where most likely are links to valuable information sources like a Discord server and a blog. If the account has been established for a good period of time, with interaction from trustworthy accounts, and a wide selection of quality resources, you may have stumbled across a project that may be worth holding for a little bit longer. If you can’t find any mentions, it’s a red flag, so be extremely careful.

A DEX screener is a tool that can assist with this type of trading. It is about speed, being willing to take higher than usual, but controlled, risks, and knowing that you’re dueling against those that have rigged the game in their favor.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Anthony, and my colleagues: Anton, Sergey, and Nivesh.