Where’s the top?—SIMETRI Portfolio Digest

How will the current crypto bull cycle end? We’ve touched on the topic in previous issues of the Digest, yet it still remains frequently discussed by our members and the industry in general.

Today, I will focus on how the ninth inning of this trend will look based on historical data, opinions, and human behavior. These insights will help you anticipate the market top and get out in time.

One of my favorite personas in the crypto space is Chris Burniske. His book, ‘Cryptoassets’, helped me get the right outlook on the market when I was just starting. In April, Chris posted this tweet in his feed:

The tweet got me thinking. Many of us still have PTSD from the 2017 top and the prolonged bear market that followed. However, OGs aren’t the entire market.

We review dozens of projects every day. We dig through GitHubs and interrogate people in Discord and Telegram. In contrast, newbies are diving into Dogecoin and Ethereum Classic, and they’re outperforming our portfolio. For now.

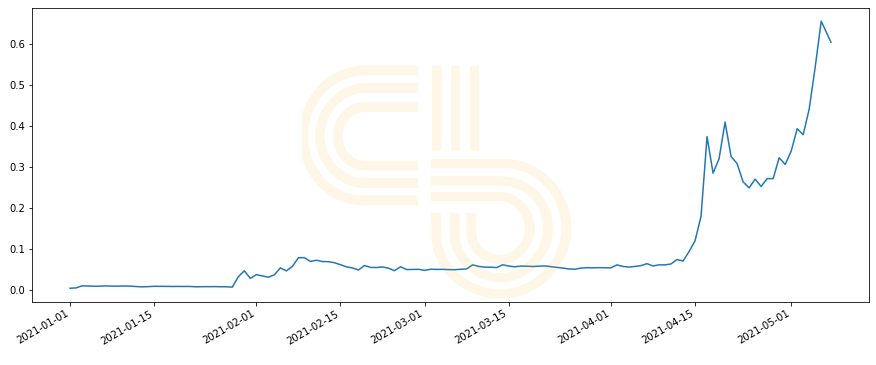

DOGE performance since the beginning of 2021. Source: CoinGecko.

The fresh blood in the market hasn’t lost any money yet. They have nothing to fear. When people feel invincible, they keep bidding the prices up.

We’ve seen this multiple times within and outside crypto. How else would companies get to astronomical valuations by just attaching ‘.com’ to their names back in the 1990s?

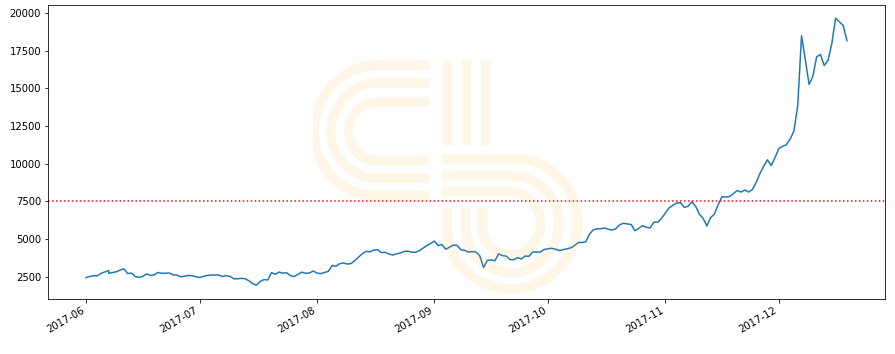

When the market will near the top, it will likely accelerate substantially. To give you some context, it took BTC only around two weeks to more than double in price in 2017.

BTC performance in the second half of 2017. Source: CoinGecko.

When the top approaches, irrational exuberance will be at its peak. It will be like ‘popcorn season,’ but on steroids.

I saw this phenomenon firsthand. On New Year’s eve of 2018 I bought a random coin on a tip I saw in a chat. It went 3x overnight. (The project was called “Status,” something I wouldn’t touch now.)

In the bigger picture, the printers will keep going ‘brrrr,’ which will only inflate asset prices further. As Arthur Hayes, founder of BitMEX, mentioned in his latest article: ‘crypto is the release valve’ for inflation. Hence, my bet is that near the top crypto valuations will be ridiculous.

To sum it all up, I don’t think we are anywhere near the top. When prices leave you in disbelief for several days straight, then it’s time to get cautious.

Until then…. Let it ride.

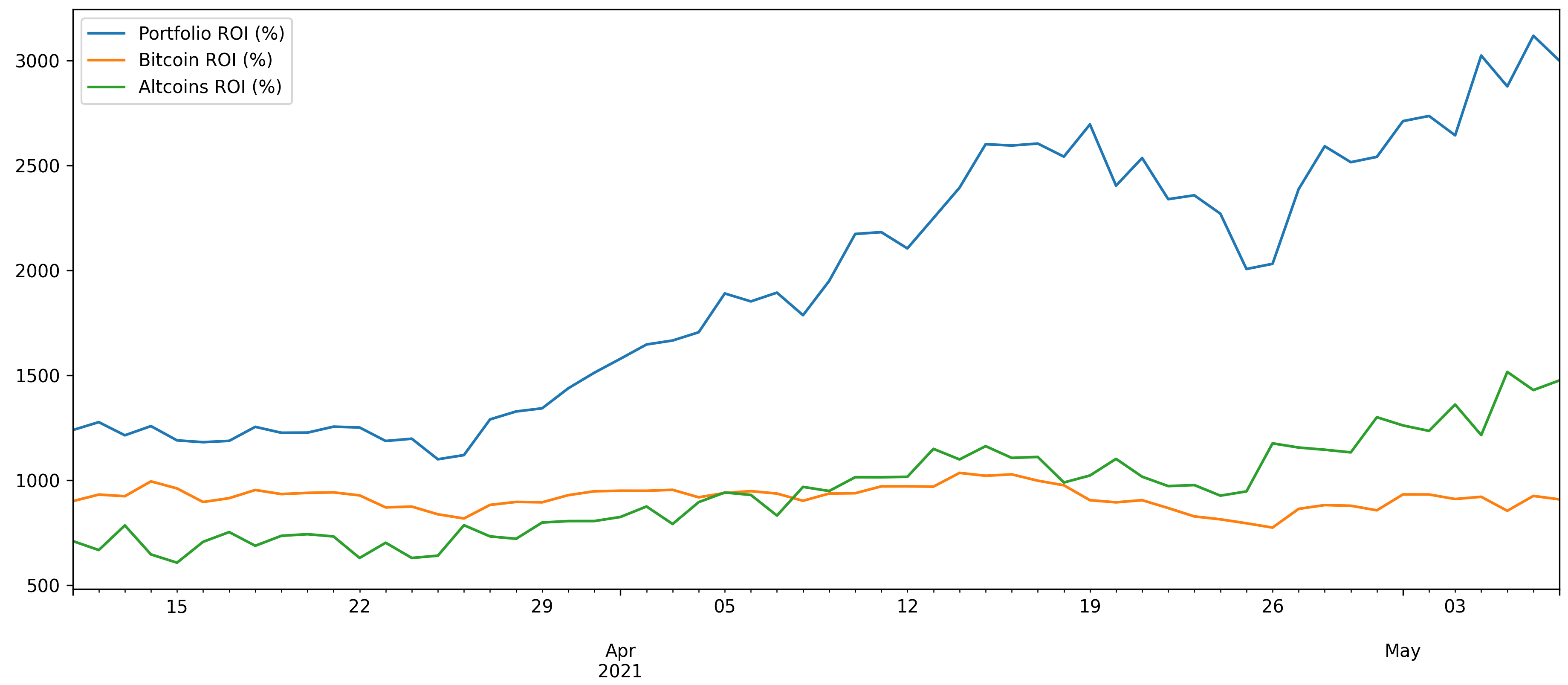

SIMETRI Portfolio – 70x

SIMETRI Portfolio just crossed another milestone of 7,000% ROI and currently shows 7,098% ROI, easily outperforming the market.

By popular demand, in one of the following issues of the Digest I will review our portfolio’s performance without THORChain.

I will also address how the portfolio would have performed if we moved the entry date to several days after each pick was published to better simulate the experience of SIMETRI subscribers

Subscribe to see all 16 active picks.

If you followed our buy recommendations with a bet of $1,000 for each of our Picks, investing a total of $22,000, your portfolio would be worth $1,799,598 today. Your unrealized gains would amount to $1,774,598 at current prices.

If you liked this newsletter and would like to learn how to make profitable altcoin investments, then check out our top-notch research.

Next Tuesday we are releasing May’s Pick of the Month. It’s the Picks that made over 7,000% and if you’ve been with us, you could’ve captured that too.

It’s the perfect time to get in. Besides, we only have 39 seats left, for this month to keep our subscribers profitable.

With SIMETRI you are getting trading signals, reports, and market commentary from our team in an easy-to-digest package. By becoming a member, you will become part of a community of like-minded people looking to make intelligent crypto investments with high upside potential.

I look forward to seeing you on board!

Disclosure: the author of this newsletter holds Bitcoin and Ethereum. Members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.