Fed Halts BTC Upside

Bitcoin incurred a bout of heightened price volatility last week. The price rocked between $38,500 and $43,000 levels as macroeconomic events took center stage.

At the start of last week, Bitcoin set a new multi-week price low around $38,500, and subsequently reversed towards the $43,000 resistance level by mid-week. However, it then staged a significant downside correction towards the $39,500 support area, following the hawkish comments from the U.S. Federal Reserve.

The Federal Reserve chair Jerome Powell said raising the benchmark U.S. interest rate by 50 basis points “is on the table” and he also warned about inflation. Tighter monetary policy has created a headwind for speculative assets such as stocks and cryptocurrencies since Q4 last year; it was no different this time.

Other major events from last week included:

- Sydney-based investment company, Cosmos Asset Management, received the all-clear for its Bitcoin ETF product in Australia, set for launch on April 27.

- Optimism grew around a spot Bitcoin exchange-traded (ETF) as Grayscale prepares for a legal fight against the U.S. Securities and Exchange Commission.

- A significant decline in Netflix’s price, which caused a significant downturn in the Nasdaq index.

- European Union (EU) officials discussed banning Bitcoin trading during a debate on a proposal to ban Proof of Work mining according to documents obtained through a freedom-of-information request.

- The start of Bitcoin’s mid-halving, (which has historically been a price negative).

At the beginning of this week, another fundamental negative catalyst emerged with the resurgence of COVID-19 cases in China. The Chinese government is presently weighing a Beijing lockdown; it will be the second major city after Shanghai to face lockdowns. The fresh wave of lockdowns present a severe risk as China is the world’s largest producer of manufactured goods.

The most widely-discussed issue amongst crypto social media is whether Bitcoin has started to bottom out or it’s yet to see crypto incur another leg lower.

This Week’s Economic Docket

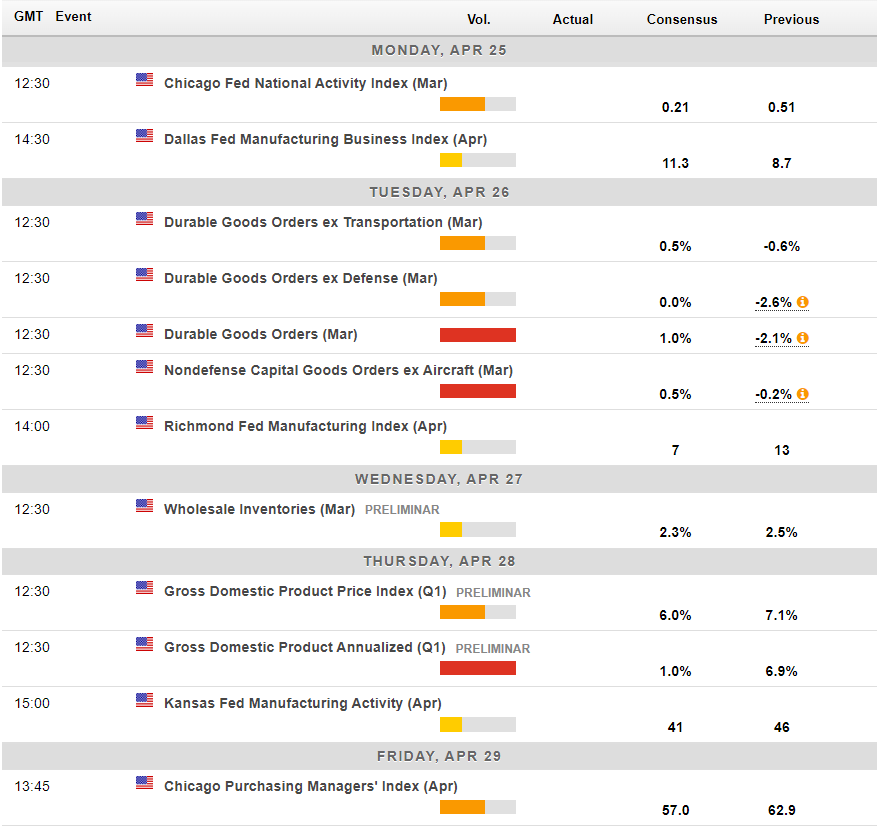

This week, the market’s focus will remain on the U.S. economic data, with the U.S. Gross Domestic Product (GPD) and Durable Goods Orders report amongst the highlights.

With a 50 basis point hike almost locked in for the Fed policy meeting on May 3-4, the GDP and demand for goods must be positive. Should the numbers come out lower than expectations, it will likely cause further decline in risk-on assets due to fears of an impending recession.

According to the International Monetary Fund (IMF), the 2022 projection for U.S.’s GDP is 3.7%.

The economic docket for this week. Source: Forexlive.com

The Australian ETF launch will also likely capture a fair amount of the market’s attention. Experts within the ETF industry speculate that $1 billion could find its way into the crypto product upon Australia’s ETF launch.

Bloomberg Intelligence has said Australia could act as the Asia-Pacific’s gateway to crypto ETFs, building a bullish case after its launch. The financial media mogul has a solid track record in predicting ETF markets; thus, I am inclined to believe that BTC will witness a buoyant demand after launch.

On-chain Trends and Trader Sentiments

Bitcoin’s supply inflation reduces by half every four years. This supply shock event called, Bitcoin halving, has historically caused positive price trends with a distinctive correlation with the event.

After the last two halvings, Bitcoin took exactly 518 days—from Jul. 11, 2016, and May 4, 2020—to reach new ATHs around $20,000 and $70,000, respectively.

Historically, the second half between consecutive halvings is marked by extreme negative action. It might be the season why some traders may be nervous about a bullish recovery.

This month, Bitcoin crossed the mid-halving point on Apr. 11, potentially kicking off nasty corrections based on previous cycles.

Bitcoin’s mid-halving analysis. Source: Santiment

Notably, in the previous cycle, BTC struggled with a critical resistance level of $10,000. Failure to break above this psychological benchmark led to a long-lasting bear market.

In this cycle, the $50,000 level serves a similar resistance point. If Bitcoin cannot break above $50,000 soon enough, sellers will continue to dominate the price action.

Another indicator I will talk about today is the Fee Ratio Multiple (FRM). The FRM indicator is calculated by dividing the total miner revenue (blocks rewards + transaction fees) by the transaction fees.

The transaction fee increases significantly during bull markets, leading to a decrease in FRM. The period around the peak of bull markets and the following corrective trends are marked by a high FRM ratio. This is because the cooldown causes the fee to reduce considerably.

If you follow the indicator, the best entry point is when the FRM subsidies and exit at the first sign of increased activity. The bull market started and ended with FRM near lows in prior runs. Currently, the FRM indicator has yet to reach optimum accumulation levels.

Bitcoin’s Fee Ratio Multiple indicator. Source: Glassnode

While these cyclic trends indicate more pain is due for Bitcoin in the future, the sentiment indicators suggest that the bottom is near. The Crypto Fear and Greed Index is trending around 23, and the Positive Sentiment indicator from Santiment has tanked after spiking last week.

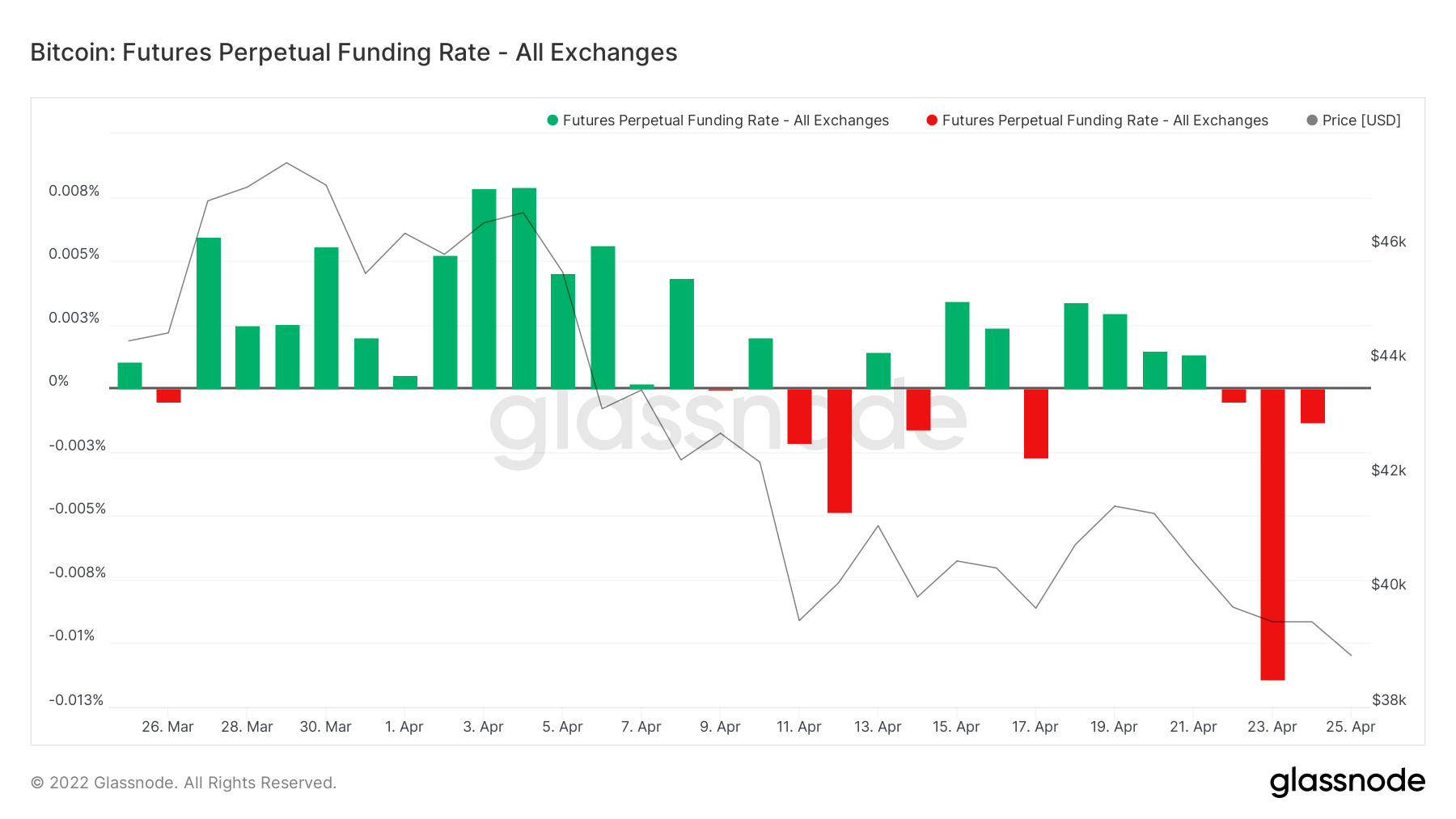

The funding rate for perpetual Bitcoin swaps also flipped negative after last week’s correction below $40,000, opening up the possibility of a short-squeeze to the upside.

The daily funding rate for perpetual BTC swaps. Source: Glassnode

Additionally, on-chain data provider, Glassnode, put out an excellent summary in their weekly report last week. I am excited to share two excerpts from the report as I am in total agreement with them. It read,

- “We have seen over the last 5-months is a 50%+ correction that appears to have significantly reshuffled the ownership structure of BTC. A great many Long-Term Holders with coins above $50k appear completely unfazed, whilst others have been totally shaken-out, at a historically significant rate”.

- “Many investors are awaiting a complete and total capitulation of the market, which may well be around the corner given the volume of coins held at a loss, and weak price structure. However under the surface, it appears as though a huge swathe of the market has already capitulated, in a statistically significant manner, and a resilient inflow of demand between $35k to $42k range has quietly absorbed this sell-side in its entirety”.

Overall, Bitcoin has entered a tense phase considering the global events and on-chain timelines. Nevertheless, the fear and uncertainty in the market are considerably larger; hence, the likelihood of a substantial decline is significantly less.

Awaiting Green Light

In terms of what BTC needs to do this week to get the green light to rally, it all comes down to the $42,000 and $43,000 price levels.

Bulls need to anchor the price above the $42,000 support level on a daily basis. This will provide a solid signal for technical traders that BTC is ready to do damage to the upside.

If bulls can get past the $43,000 level, then I believe that Bitcoin could start to move into a higher price range between the $44,000 and $47,000 resistance levels.

On the downside, if BTC fails to record multiple-daily closings above $42,000 until the May Fed meeting, which is scheduled for next week, further downside towards the worst levels of 2022 is on the table; sustained weakness under $38,400 would be a big concern.

Bulls and bears will get their fair share of warning over the coming weeks if they pay close attention to the triple bottom pattern on the higher time frame charts.

BTC/USD Daily price chart. Source: Trading View

Ethereum’s Pivotal Moment

Ethereum has arrived at a pivotal moment this week. As I said earlier this month, the recent rejection from the $3,600 level will either continue the bear market down towards $2,000 or a temporary pullback before ETH heads back to the best levels of 2021.

On the face of things, and bearing in mind the strong price correlation between the top two cryptocurrencies, Ethereum’s prospects look pretty poor until Bitcoin starts to muster strength above the technically important $42,000 price area.

For ETH/USD to shine on the charts, we need to see some constant strength above the $3,200 area, which puts the $3,300 to $3,400 well within reach of the bulls.

On the downside, a move under the $2,800 level would be pretty bearish for the ETH/USD pair. The chaos would only well and truly begin when ETH/USD pair cracks the $2,500 support zone.

ETH/USD Daily price chart. Source: Trading View

Canary In a Coal Mine: XRP

XRP has a lot to prove this week. For all intents and purposes, the technical moves in XRP could act as a proxy for the broader crypto market if it conquers meaningful price levels.

Something is evident on the charts, and simplistic as it seems, the $0.70 to $0.90 price range should define the trading action for the XRP/USD pair over the coming weeks and months.

Should the XRP/USD hold beneath the $0.70 level with some conviction, XRP will be in a precarious position and at the risk of slipping back towards the worst levels of the year.

In terms of upside potential, bulls need to make a run above the $0.90 level to kick off a new bullish trend. If it happens, I can confidently predict that XRP will likely attempt the $1.30 level later this year.

XRP/USD Daily price chart. Source: Trading View

The Bottom Line

It is evident in the price action and my interactions on social media that things are agitated at the moment. The fear of impending doom in crypto and stock markets is considerable.

One could make a case that when things look terrible, and blood is on the street, it might be the best time to bite the bullet and accumulate while others are fearful. My current issue with this theory is that there are many unknown risks in the market. Moreover, the technical confirmation needed to confirm a bullish reversal point has not arrived yet.

If we see multi-day price stabilization above the $42,000 level, I will be excited about a coming rally. Until that time comes, I remain concerned about a bullish recovery for this quarter.