In Stability We Trust.

If you’ve seen the film The Prestige, you’ll probably remember the following quote:

“Every great magic trick consists of three parts or acts.

The first part is called “The Pledge.” The magician shows you something ordinary: a deck of cards, a bird or a man. He shows you this object. Perhaps he asks you to inspect it to see if it is indeed real, unaltered, normal. But of course… it probably isn’t.

The second act is called “The Turn.” The magician takes the ordinary something and makes it do something extraordinary. Now you’re looking for the secret… but you won’t find it, because of course you’re not really looking. You don’t really want to know. You want to be fooled.

But you wouldn’t clap yet. Because making something disappear isn’t enough; you have to bring it back. That’s why every magic trick has a third act, the hardest part, the part we call “The Prestige.”

I want to explore how the ideas in this quote can help us understand the way we interact with crypto. More particularly, I’m interested in stablecoins, which appear to be one of the most ordinary things in crypto.

The Pledge

Let’s begin by asking ourselves: what makes stablecoins stable? Every stablecoin needs a stability mechanism. The mechanism is ‘The Pledge’ from our quote. It guarantees that the stablecoin is and will continue to be pegged to $1.

As users, we are invited to inspect how stability mechanisms maintain this ordinariness. Information is made available on websites, social media, and for the more technical connoisseurs in illustrious white papers with their promises of irrefutable math.

Like magicians, projects aim to establish trust among users. Some users investigate information deeply and evaluate the arguments and claims to assess the overall level of risk involved. But not everyone is free to do this. Therefore many are left to risk by blindly trusting that stability mechanisms are reliable and work under any circumstances.

When large numbers of people in crypto collectively place their trust in something, it is manifested in liquidity, and therefore: the deeper the liquidity is, the deeper the trust must be.

Some projects like Tether (USDT) develop trust by being the first to serve the market. Others like Terra (UST) try to build trust by growing liquidity from their reserves.

Stability mechanisms, in some cases, are highly complex and novel, which makes them rather risky. And if they are challenged, there may not be enough trust and liquidity to support pegs.

Beanstalk

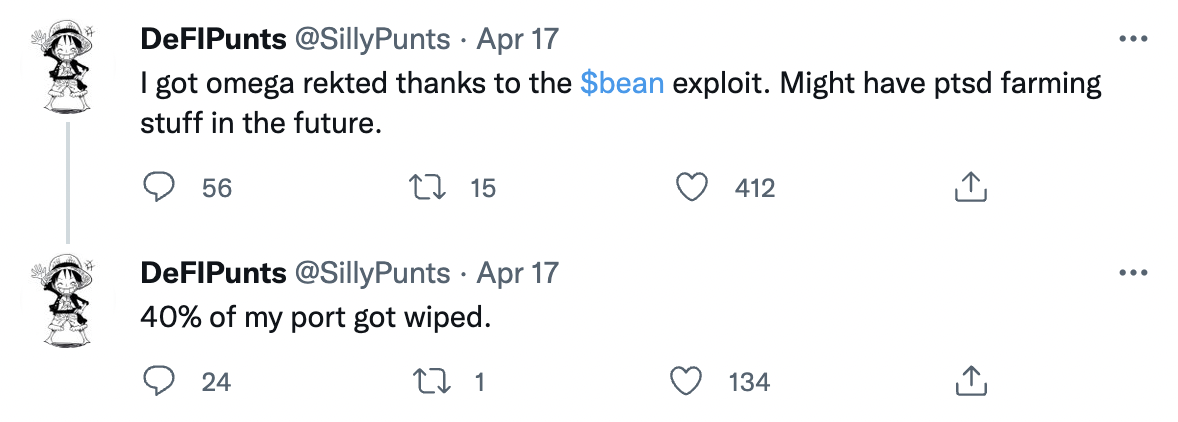

Getting “rekt” on $BEAN. Source.

Let’s turn our attention now to Beanstalk’s $BEAN: an algorithmic stablecoin based on unsecured debt. It’s a novel system, given that almost all debt in crypto is secured.

What does ‘secured’ mean? It means that in order to borrow something, something else of value has to be given first. Whatever you give becomes the ‘collateral’ to the loan. In the event of the loan not being repaid, the lender can take the collateral.

For example, to borrow 1,000 $DAI on MakerDAO, you need to lock up at least 1,500 worth of $ETH or equivalent. This pledge is required because MakerDAO doesn’t have your passport data or SSN and cannot hold you accountable for not returning debt and interest. Beanstalk tried to get around this pledge requirement.

Beanstalk’s debt is not secured by anything. The system promises to give you more $BEAN tokens at some point in the future in exchange for valuable assets like $ETH or something else now. In this case, you are lending money to Beanstalk, trusting that the price stability mechanism will hold the $BEAN price around $1 when the protocol pays you back.

If the price of $BEAN goes under $1, the protocol borrows money to buy $BEAN and pushes the price back up. If it has enough people to trust the mechanism and lend their money, everything should work fine, and deep liquidity should build up so that this operation can function. Conversely, if there’s not enough trust in Beanstalk, there will not be enough money to support the peg, and the project will end up like AMPL.

On the price chart of $BEAN above, there was about a one-month bootstrapping phase, where lenders took the highest risk and supported Beanstalk’s novel stability mechanism.

After $BEAN finally stabilized near $1 and the system somewhat proved its viability, there were a couple of depeg events where $BEAN went to around $0.8. With a 20% depeg, enough people still trusted Beanstalk and lent money to restore the peg. It was a risky but justified trade for some. However, had the price fallen to $0.5, there would likely have been fewer people ready to lend the protocol money.

Overall, Beanstalk’s undercollateralized crypto loans probably could have worked if its governance hadn’t been exploited. However, it would still be quite risky given that $BEAN stability would always rely on the readiness of lenders to fund the system. So the question is, why would they?

The Turn

This is the point at which the ordinary stablecoin promises to do something magical: make lenders 30x on their investments.

As we run through this example, keep in mind that with new, unproven concepts in crypto, it’s essential to limit risk by reducing exposure – the monetary extent to which you allow yourself to believe in the magic internet money.

In the context of Beanstalk, if you were willing to lend money for a very long term, you could buy $BEAN tokens for $0.03, giving you over thirty times more $BEAN for your money than if you purchased it on the open market. This means that, as long as Beanstalk’s stability mechanism kept $BEAN pegged to $1, you’d get over 30x on your initial investment.

30x is a pretty high return by any standard. Let’s work through an example of lending 0.5% of a $10,000 portfolio to Beanstalk for an extended period.

0.5% of $10,000 is a $50 investment, which would give you 1,666 $BEAN for a long-term loan. On maturity, assuming $BEAN remains pegged to $1, your $BEAN would be equal to $1,666—just over 33x from $50. Your portfolio would now be worth $11666. Had your investment not played out, you would still have $9950 remaining. The risk to reward ratio looks good enough, and risk management is vital.

A stability mechanism with the demonstrated upside potential is indeed wonderful to behold. Like in the second part of the magician’s act, it is not enough to make something disappear (your funds), but they must also reappear (and there will be more funds than before).

Many investors reached for their wallets because what they saw was good enough to stop them from trying to answer difficult questions about pegs and stability mechanisms. Trust seems simple. They waited for the third part of the act.

The Prestige

The Prestige of a stablecoin suggests that something which allegedly can be relied upon to never change in value can create large amounts of value for you. It is a paradox: an idea that is seemingly impossible yet seemingly true. If a stablecoin (or any investment for that matter) does deliver those returns, The Prestige is a wonderful experience, and Prestige is often earnt for all involved.

But, novel systems may fail. There may not be enough liquid trust to keep stablecoin pegs afloat, and some investors become so impressed that they blindly trust projects and throw all risk management out the window. In Beanstalk’s case, it appears some investors lent more than they were willing to lose.

It’s not a pretty picture, and anyone would sympathize with the person on the screenshot above. However, we shouldn’t overlook such examples as important reminders for us to manage risk appropriately.

Did you like the content of this Email?

Follow SIMETRI on Twitter. And for even more alpha, follow me: Stefan Stankovic, and my colleagues: Anton Tarasov, Sergey Yakovenko, and Nivesh Rustgi.

Disclosure: At the time of writing, the author held ETH, USDT and several other cryptocurrencies. Read our trading policy to see how SIMETRI protects its members against insider trading.