CONVEX PICK OF THE MONTH REPORT

CONVEX PICK OF THE MONTH REPORT: CVX Review and Evaluation

Safer Pick

TABLE OF CONTENTS

Quick Facts

Funding Information

3.3% Investors Vested over 1 year. Most of the tokens are released through Liquidity Mining.

External links

Summary

When the bull market is in full swing, the assets that grow the fastest are the ones that sell dreams. However during downturns, “cash cows” with real traction and utility are what shine. When you know that a project brings value that someone will pay for, then you can confidently hold your investment.

The “cash cows” of previous crypto cycles were centralized exchanges like Binance or Coinbase. Even during bear markets and crypto price bottoms, they make money because trading activity doesn’t stop. All that matters for these platforms is trading volumes.

In the current cycle, new “cash cows” have emerged such as Yearn. These new businesses can and should be viewed through the lens of traditional value investing. That’s because Warren Buffet’s criticism of BTC doesn’t apply to them.

Explaining how his firm chooses investments, Buffet said, “we’re buying something that at the end of the period we have not only what we bought in the first place, but we have something that the asset produced.” We think the same idea applies to our January Riskier Pick of the Month, Convex.

Convex’s business model is built on Curve, a DeFi blue chip that continues to be one of the market leaders. It repackages Curve’s governance into a liquidity bootstrapping product that is already being used by projects like Abracadabra and Alchemix, and there is potential for more projects using it down the line. Ergo, Convex is one of the few examples of business-to-business models in crypto.

By capturing Curve’s revenues and generating additional cash-flows from protocol bribes, Convex makes its native token, CVX, a productive asset. Bribes is a way for projects to drive CRV rewards to their liquidity pools by paying CVX holders so they vote on Curve as necessary.

You can buy Convex native tokens, CVX, on MEXC and Gate.io if you are based in the United States. Otherwise, you can also find it on Binance, Huobi Global, and more than one decentralized exchange (DEX) like Uniswap.

The instructions for doing so can be found at the end of this report.

Why Convex Exists

The advent of Convex resulted in the emergence of new slang in Decentralised Finance (DeFi), such as “Curve Wars” and “DeFi 2.0.” This new terminology mostly focuses on defining how protocols can efficiently manage liquidity for their tokens.

Liquidity is a crucial aspect for every project in DeFi, which users mostly overlook. That’s usually because it’s well maintained, and there are no issues in buying and selling large amounts of various cryptocurrencies on DEXes.

However, if liquidity wasn’t in place, the entire DeFi stack would collapse. Consider the following example.

You have an idea for a stablecoin, which you want to be used as collateral for loans or a safe haven for investors and traders. First, you build the product itself: a token, which has some sort of mechanism to maintain stability.

Generally, the stability of decentralized stablecoins is maintained by arbitrageurs and protocols themselves. If the price deviates from $1 to the up, your protocol mints more tokens and sells on the open market to bring the price down. Conversely, it buys tokens to burn them if the price goes under $1. Arbitrageurs help the process along the way by taking advantage of price discrepancies on various trading platforms.

For your protocol to be able to buy and sell tokens, you have to maintain liquidity. In simple terms, you either have to provide enough of your own assets like USDC and DAI so users can easily enter and exit your stablecoin, or you have to source liquidity from external sources.

If you don’t do a good job of bootstrapping liquidity, large players will not be interested in your product. That’s because if they wanted to buy or sell your stablecoin, their orders would significantly move the price above or below the $1 peg.

Remember that generally, there are no market makers on DEXes, which is in contrast to centralized exchanges. Protocols have no concept of “price,” they can’t know what the price is supposed to be and what it is on other venues like Coinbase or Binance.

Prices are calculated based on how many tokens are in pools; if there aren’t enough tokens in a pool, the pricing mechanism of a DEX breaks. That’s why all projects, especially new ones, actively source liquidity.

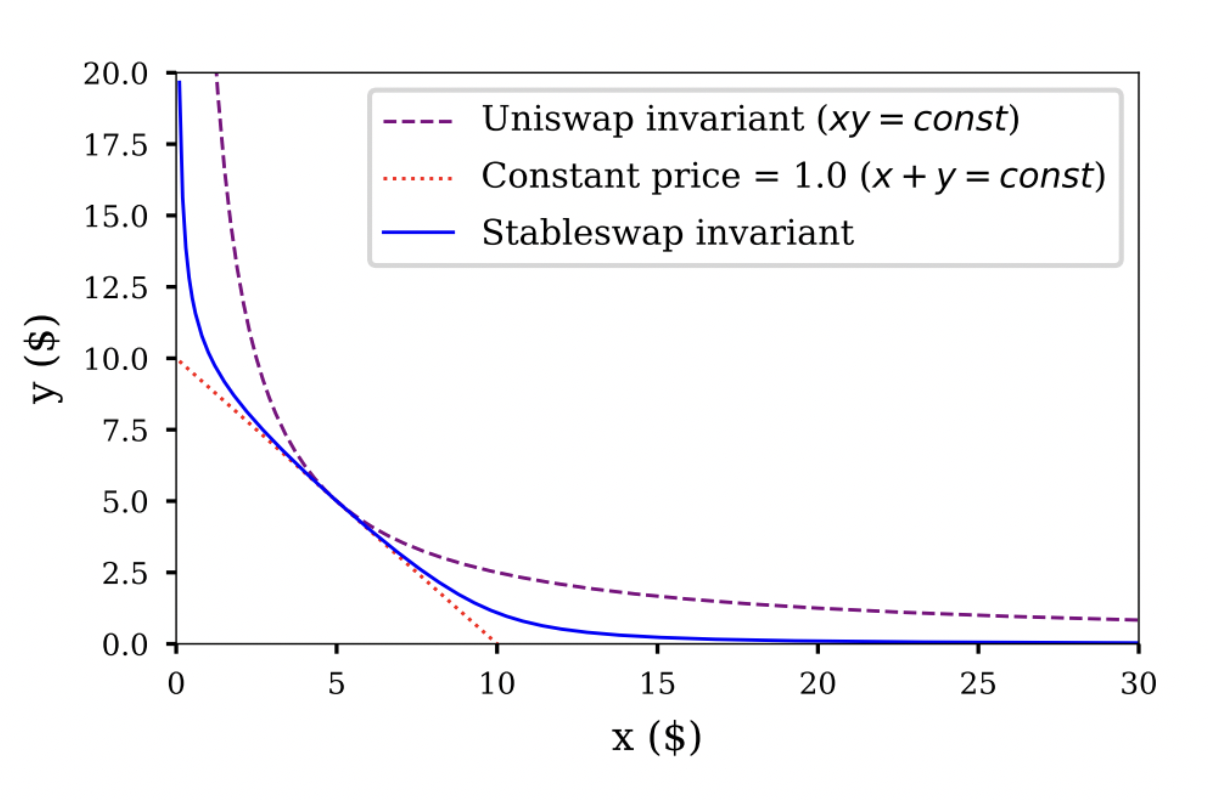

Curve and Uniswap pricing mechanisms. If an order is too large for a given pool, the price goes to the edges of the blue or the purple curve, resulting in an unfavorable price | Source: Smart Contract Programmer

Liquidity used to be sourced by offering an incentive in the form of governance tokens. The notion was pioneered by Compound in Summer 2020 and kickstarted a DeFi ecosystem as we know it.

However, the model Compound used isn’t ideal. It has a significant drawback that creates substantial selling pressure on DeFi protocols’ tokens.

DeFi Pulse Index, which includes many of the popular DeFi governance tokens. It hasn’t performed well, considering that the market was trending upwards in the second half of 2021 | Source: CoinGecko

The main reason for DeFi tokens’ poor performance is that to get enough liquidity for their tokens, they had to offer substantial incentives for external actors, also known as liquidity providers, to keep their money in specific pools.

The market quickly learned that liquidity is mercenary, and liquidity providers don’t care about the governance powers of a given token. Much like BTC or ETH miners, they only care about getting the best bang for their buck, and if incentives dry up, they move to more profitable protocols.

Such a dynamic creates a situation where protocols can’t escape the perpetual dilution and dumping of their governance tokens. At least that was the case until projects like Convex and Olympus DAO came up with more efficient solutions.

Where Convex Operates

When you think of DEXes, you think about projects like Uniswap and Sushiswap. And rightfully so, most of the time, you exchange different assets like BTC to ETH or ALCX to CRV.

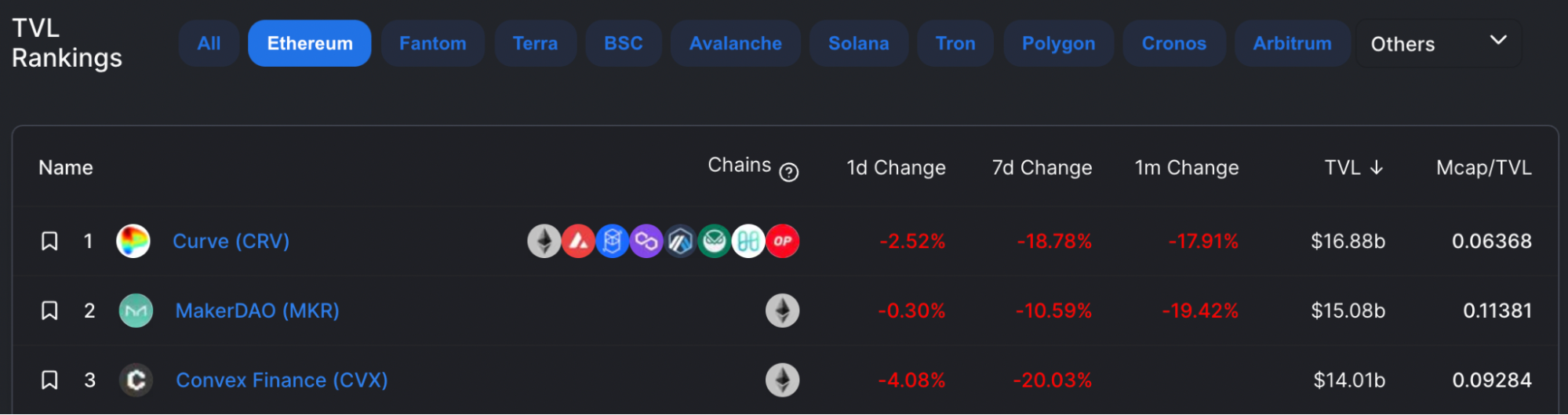

However, there’s a specific niche on the market for assets that are similar in value. It’s by and large served by Curve, our previous Safer Pick of the Month.

There’s a reason Curve remains the go-to exchange for swapping between stablecoins or similar assets like stETH/ETH or wBTC/renBTC. In short, it uses mathematical formulas to ensure that even large trades don’t move the price significantly, which is beneficial for traders and liquidity providers. The latter are at an advantage because their liquidity is actively utilized, and they receive fees in return.

Importantly, Curve’s team came up with a formula to enable cross-asset swaps. This means that the platform’s latest iteration enables the exchange of not similar assets, such as BTC to ETH. Ergo, Curve can be a competitor to Uniswap.

While we don’t believe that Curve will overtake Uniswap, the extended value proposition will inevitably drive more projects to use Curve as their liquidity bootstrapping tool. That will result in more offerings for liquidity providers and more trading volumes on the platform.

Total value locked and trading volume on Curve | Sources: DeFi Llama and CoinGecko

However, Curve doesn’t have built-in tools to organize liquidity incentives for multiple projects. In theory, that’s the responsibility of the DAO and governance. However, practice shows that on-chain governance is inefficient.

Individual liquidity providers don’t necessarily possess enough relevant knowledge and may not be interested in the platform’s efficiency. All they care about is maximizing gains on their holdings.

Protocols, on the other hand, only care about having enough liquidity and spending as little as possible on that. Hence, something should be there to find a middle ground for both groups. That’s where Convex comes into play.

What Convex Does

Since Convex is a tool that aligns the interests of liquidity miners and protocols, it makes sense to view it through the lens of each of them separately.

Liquidity Providers

Liquidity providers primarily focus on annual percentage yields (APYs). There’s a classic liquidity mining arrangement on Curve: a platform incentivizes liquidity providers to stick around by issuing governance tokens, CRV, as an added incentive on top of trading fees.

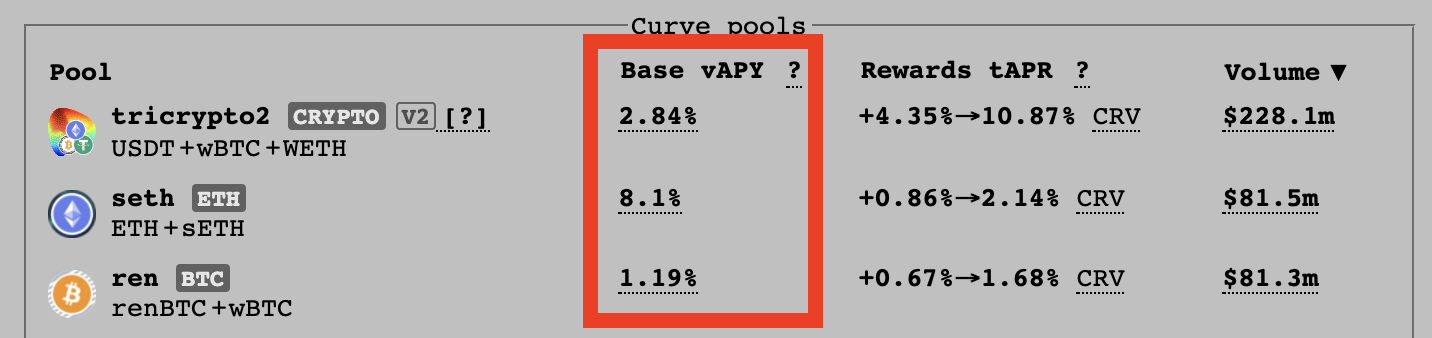

Curve’s base APYs, which every liquidity provider gets | Source: Curve

However, suppose a liquidity provider wants to fully take advantage of Curve’s emissions. In that case, they have to lock some CRV for an extended period (preferably four years to get max returns with the least amount of CRV locked). So, to maximize gains, liquidity providers on Curve have to give up on the liquidity of some of their CRV tokens.

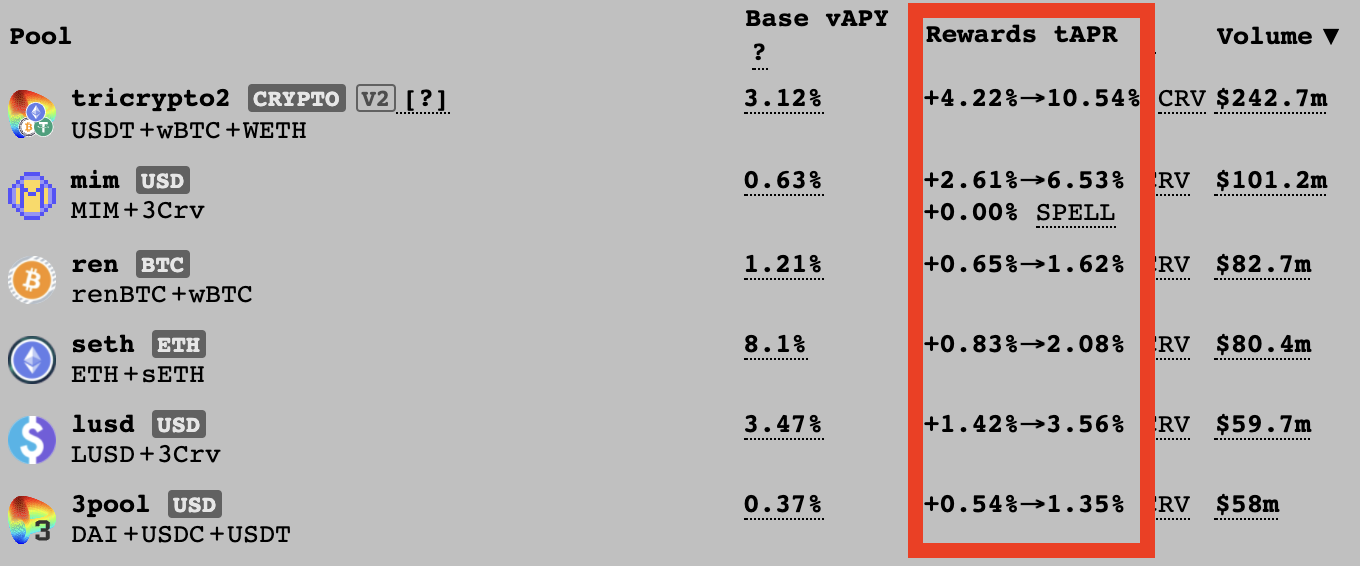

Curve’s boosted APYs, available only for those who lock their CRV | Source: Curve

The more liquidity a user provides to Curve, the more CRV tokens they will need to boost rewards. That may become an issue since giving up on liquidity for a large sum is not ideal.

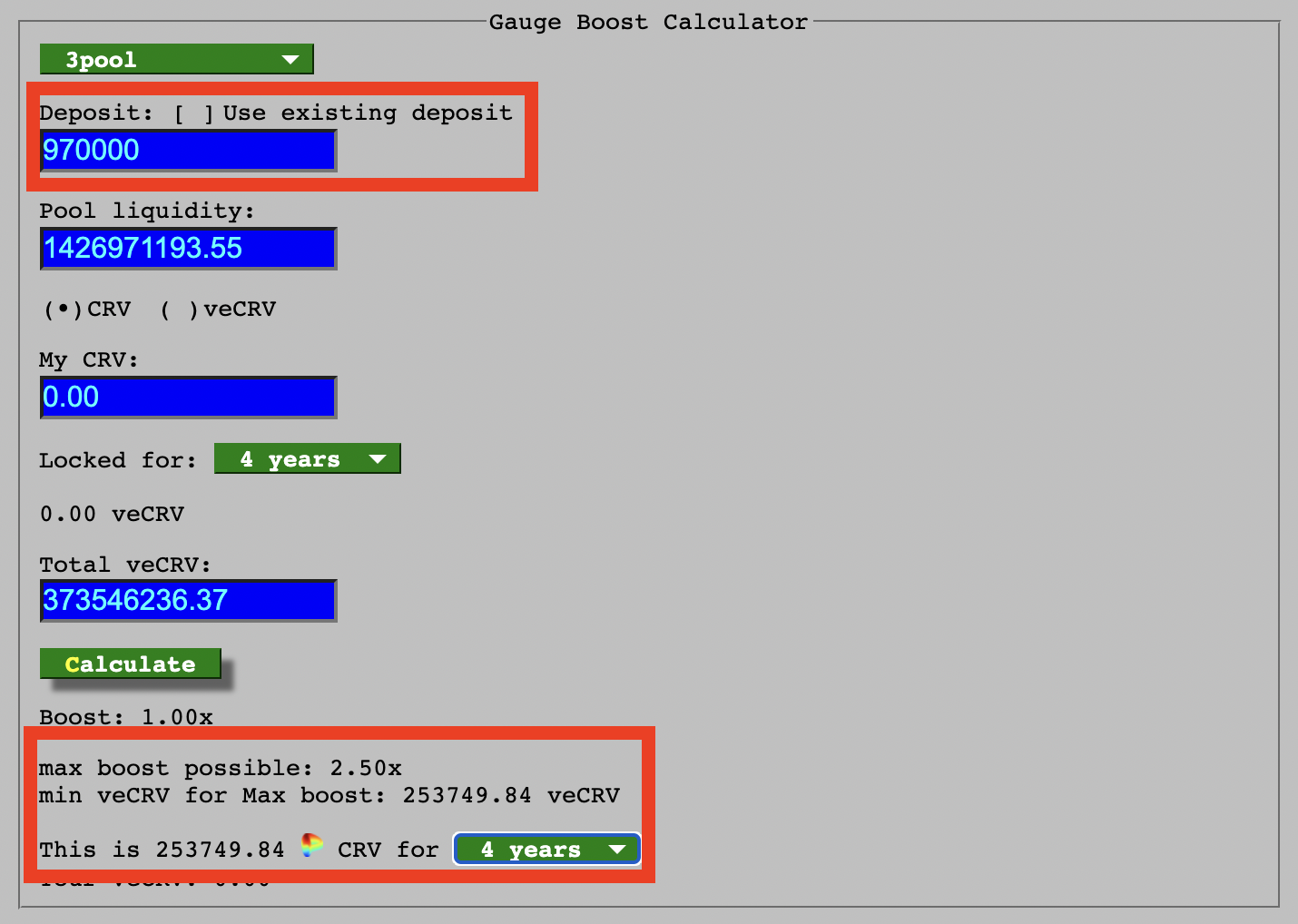

Consider the following example. You are a liquidity provider with 1 million DAI. You want to put it in Curve’s 3 pool, which has DAI, USDC, and USDT.

In exchange for 1 million DAI deposited, you get around 970 thousand LP tokens that represent your ownership in the pool. Now, if you want to boost your rewards 2.5x, you will need to lock slightly over 250 thousand CRV (~$677,000) for four years.

To boost rewards for $1 million worth of DAI deposit, you will need more than half of that in the form of CRV | Source: Curve

Now, if you want to reduce lock time, you will need to lock more CRV. If you are ready to give up on CRV liquidity for one year, you will need over 1 million CRV (~$2.67 million) for a max boost.

As you can see, locking CRV to boost is expensive and inefficient. Locking CRV means that by the time it fully unlocks, the token’s price may go down significantly, which until the advent of Convex discouraged potential liquidity providers from boosting and most likely from providing liquidity because base APYs aren’t competitive.

Convex solves this issue for liquidity providers by enabling them to have the boost but keep the liquidity of their CRV tokens simultaneously. For this, it uses a tokenized representation of locked CRV—cvxCRV.

A similar principle is used by Lido, which enables liquidity for staked ETH on Ethereum 2.0 beacon chain. Technically, locked CRV and staked ETH can’t be recovered once they are transferred to respective destinations. However, by creating mirroring tokens Convex and Lido solve this problem.

The process for liquidity providers on Convex is the following. First, they provide liquidity in USDC, wBTC, or stETH on Curve and get LP tokens in return. Then, they go to Convex and lock those LP tokens through Convex’s website.

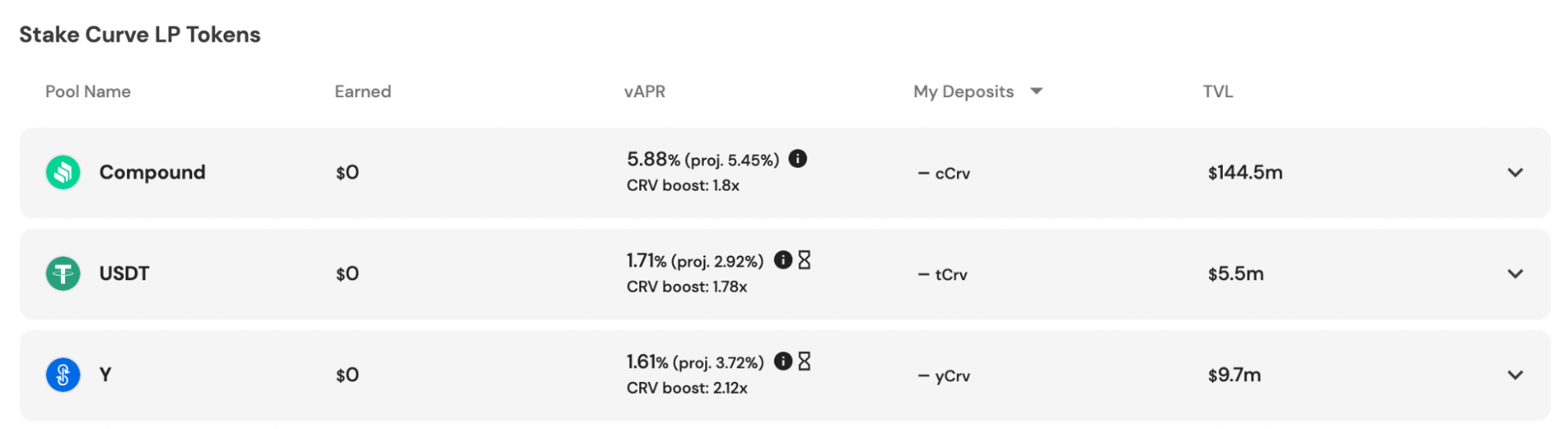

Boost liquidity provider rewards via Convex without the need to lock up CRV | Source: Convex

Importantly, liquidity providers don’t need to have CRV like they would need on Curve because boosting is already applied using CRV that were already locked on Convex. This makes earning yield through Convex more appealing than on Curve for some liquidity providers.

When Convex issues cvxCRV, it takes CRV and vote locks it. Then, it uses all the accumulated voting power to boost various pools.

Yield farmers receive rewards in CRV, which they can further convert into cvxCRV and receive additional rewards. A portion of these rewards comes from Curve, which offers admin fees for vote-locked CRV.

On top of that, by yield farming through Convex, liquidity providers gain additional yield in the form of CVX tokens, which come from Convex performance fees, which are subtracted from boosted rewards of liquidity providers.

However, unlike in earlier liquidity mining setups, liquidity providers may not want to dump their rewards tokens immediately. The reason? Bribes.

Protocols

By design, Convex focuses on accumulating as many CRV tokens as possible and then locking them up. This creates tremendous voting power in its hands. CVX token holders regulate that power.

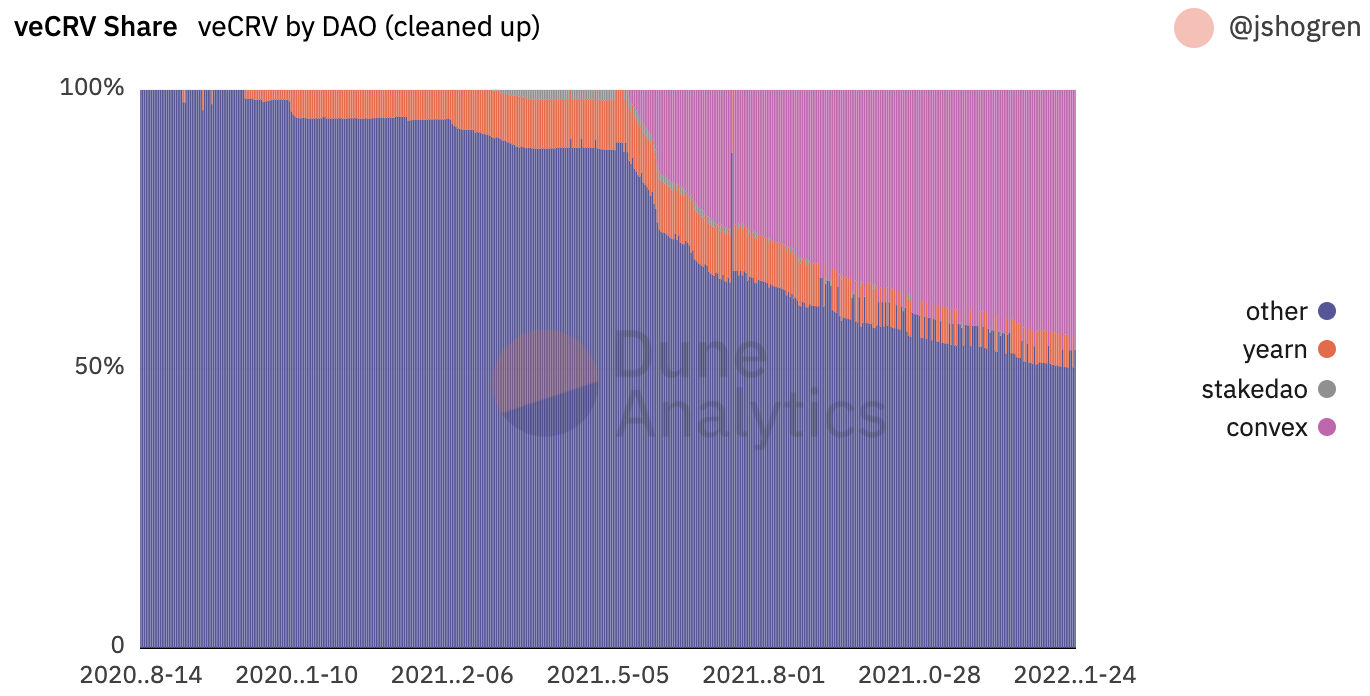

Convex controls almost half of all existing locked CRV | Source: Dune Analytics

However, we know that individuals don’t usually do a good job of managing DAOs. Hence, there needs to be a mechanism to direct voting power so that the result is a highly efficient reward distribution system.

Before we dive into how bribes work, here’s a refresher of how Curve’s vote-locked CRV works.

Curve emits (issues) a fixed amount of tokens as an added incentive for liquidity providers. These tokens are spread unevenly across liquidity pools.

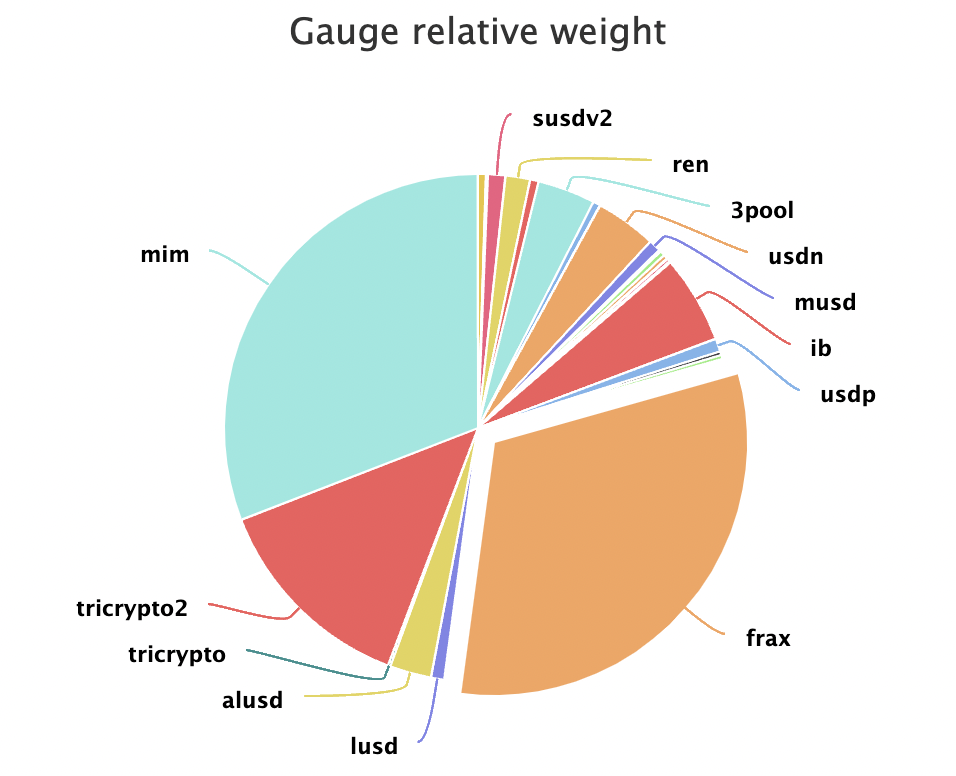

Distribution of CRV emissions among pools | Source: Curve

Every two weeks, there’s a voting period, after which percentages of CRV emissions to each of the pools on Curve are determined. The higher the incentive, the more liquidity providers flock to a given pool. That’s what protocols focus on.

By locking CVX tokens, liquidity providers and other actors get voting rights to determine which pools Convex as an entire platform will vote for. Since Convex holds almost 50% of all veCRV, it makes sense that protocols will want to incentivise CVX stakers to vote for their pools.

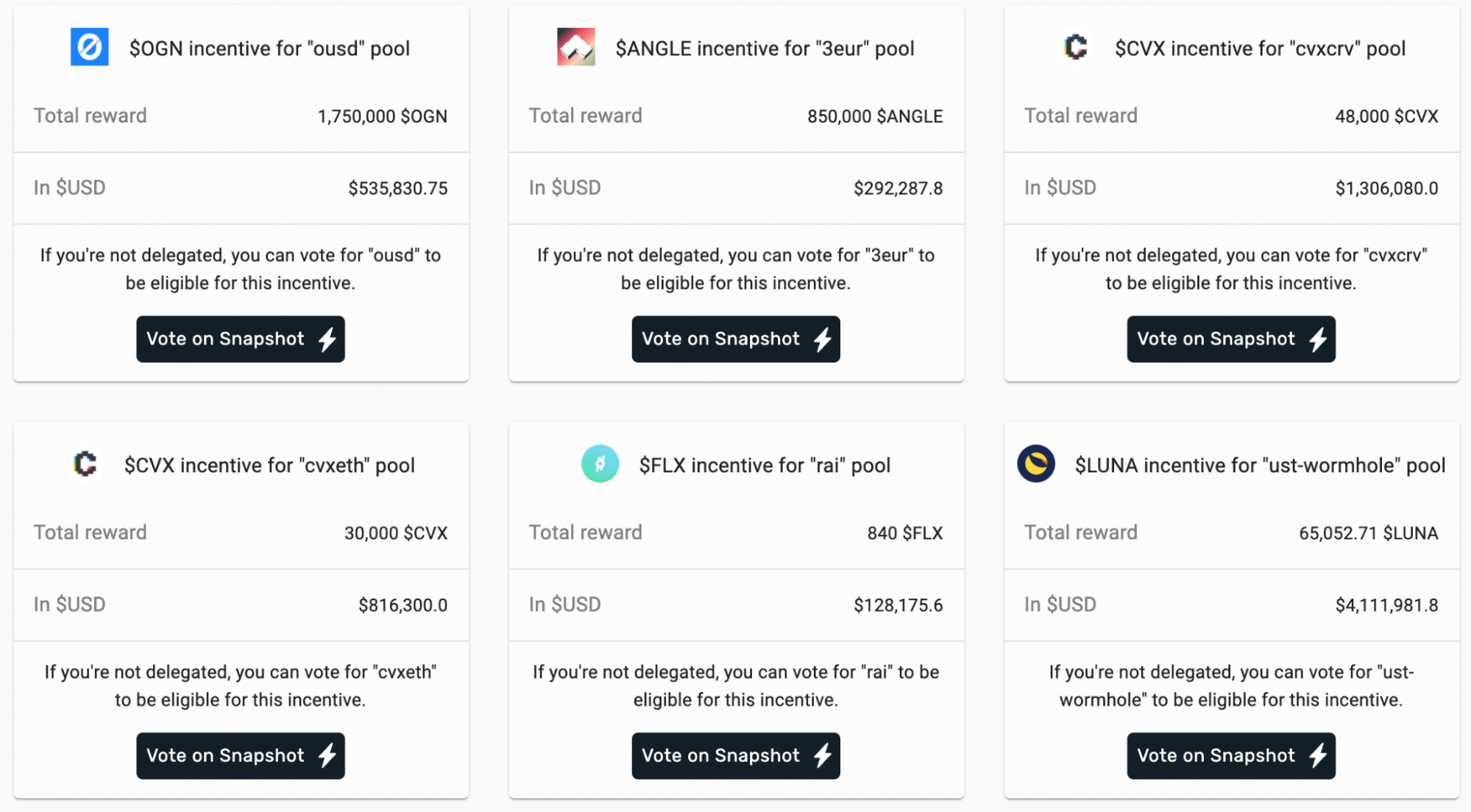

For this, protocols use their governance tokens as an added incentive for CVX stakers. If a staker votes for a particular protocol’s pool, they receive rewards in the form of that protocol’s tokens.

Bribes offered to CVX holders in exchange for votes | Source: Votium

This mechanism can be used to accumulate certain tokens without buying them or maximize yield by voting for pools with high enough yield, but not many voters among whom the rewards will be distributed.

But why do protocols opt-in for Curve if they still have to offer governance tokens in return for liquidity? The answer is simple—it’s cheaper and more predictable.

Even during a depressed market state, a $1 spend on bribes drives $1.84 worth of rewards to liquidity pools via Convex.

Convex bribes | Source: Llama Airforce

This is capital efficient and predictable because instead of adjusting emissions of governance tokens on the fly, protocols know in advance how much USD equivalent of their governance tokens they will need to incentivize the amount of liquidity they need.

The system is efficient to the point where certain projects like Alchemix stop liquidity mining altogether and rely only on incentives coming from Curve.

Importantly, liquidity providers can also be CVX stakers because they receive rewards in the form of CVX as well. So, they can further increase their yield, which is in line with their goals.

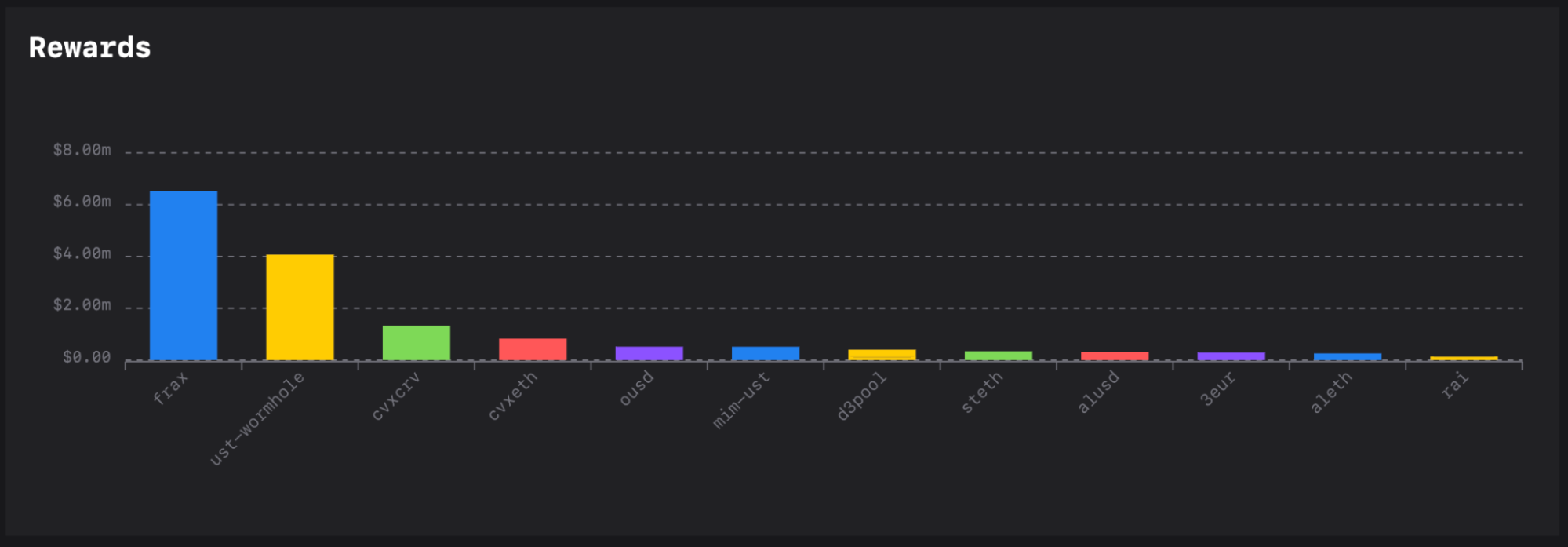

Moreover, protocols themselves can accumulate CVX to increase their influence over Convex. Such a strategy is implemented by stablecoin project Frax, which because of that, gets a major share of Convex rewards.

Convex rewards distribution | Source: Llama Airforce

To summarize, Convex aligns incentives for both liquidity providers and protocols. Plus, it increases the efficiency of CRV rewards management by placing it in the hands of DAOs instead of individuals. That alone makes Convex already worth attention. But, the main thing is cash flows.

Cash Flows

Curve is a real business that generates fess by offering currency exchange services. It’s not much different from centralized exchanges, which generate revenues regardless of whether the market is trending up or down.

The platform’s 30-day revenue exceeds $15 million, and CRV holders can capture these fees. Convex controls a large portion of CRV, making it a proxy to Curve’s revenues.

On top of that, Convex generates on average additional revenue of $65 million a month through bribes.

The trading activity on Curve is very unlikely to reduce significantly compared to the market’s average. Because of a downtrend, they may go down, but people will always need to trade.

Similarly, the bribing activity isn’t likely to slow down significantly. Protocols can’t afford poor liquidity and will always need to allocate budgets to keep it in place.

Consequently, CVX is a productive asset that takes advantage of Curve’s value proposition and adds value on top. Importantly, APYs in Convex aren’t coming from printing a meaningless governance token but from capturing cash flows that come from trading fees and bribes.

Token Economics

Liquidity providers that earn yield through Convex get additional APY in the form of CVX. New CVX tokens are printed when liquidity providers claim their CRV rewards on Convex.

The most interesting point about Convex token economics is that there will be increasingly more CRV locked on Convex compared to the total supply of CVX.

Ratio of minted CVX to claimed rewards on Convex in CRV | Source: Convex

As more CRV is claimed as a reward on Convex, the amount of minted CVX reduces. At this stage, over 120 million CRV has already been minted on the platform, which means that over 80% of CVX’s total supply has already entered circulation.

Once all CVX are minted, Convex won’t stop accumulating CRV, which will make CVX a levered bet on CRV. When all CVX is printed, the CRV in Convex should be over 650 million, which translates to at least a 6.5 CVX/CRV ratio. The ratio should only increase as more CRV will be claimed, and no CVX printed.

On top of that, CVX holders are largely incentivized to lock their tokens to vote and receive bribes. Locking has a fixed period of 16 weeks and two days, which is substantial by crypto standards. At this stage, almost 75% of CVX are locked.

Overall, Convex has attractive token economics. It doesn’t have overwhelming inflation of circulating supply and offers incentives to keep a large portion of the tokens out of circulation.

Who is in Control

Like many DeFi protocols, Convex is built by anonymous developers. However, admin rights to the protocol are controlled by several people from the Curve and Convex ecosystem.

Risks

The biggest risk for Convex value proposition is CRV price because liquidity provider rewards and incentives are accrued in CRV.

Profitability is the key factor that keeps liquidity providers around, and if they don’t get enough on their assets, they will abandon the platform. If that happens, protocols will be less incentivized to bribe because it may become more expensive.

For comparison, before the market took a dive on January 20, 2022, each $1 invested in bribes brought over $3 worth of incentives to liquidity pools. However, at the current price levels, the size of incentives fell to $1.84.

On top of that, Convex will always lose some of its market share to Yearn, which offers a similar yield aggregation.

While Yearn has higher performance and management fees, it auto compounds CRV rewards, which Convex doesn’t. That may be more preferable to some yield farmers than manually managing Convex rewards, although it may end up being less profitable.

Finally, there’s an ever-present smart-contract risk. Convex is the largest platform by total value locked among yield aggregators. Hence, it’s a honeypot for hackers and exploiters to attack. It’s encouraging that the platform was audited, but it doesn’t provide full guarantees that external protocols can’t be used to drain funds from the protocol somehow.

Conclusion

DeFi evolves, and projects will slowly move from inefficient business-to-customer models to business-to-business ones. And rightfully so, because individuals don’t necessarily have a strategic vision.

Convex adds value to an already proven business model of Curve. It captures Curve’s trading fees and adds a source of revenue by enabling protocols to incentivize liquidity predictably. Consequently, DeFi projects can conduct their business more efficiently while individuals still get what they come for—high APYs.

With more protocols realizing that they can take advantage of Curve to maintain their liquidity instead of printing overwhelming amounts of native tokens, Convex should become the go-to platform to deploy their liquidity maintenance budgets strategically.

As a result, the already strong influence of Convex is only likely to increase along with the generated cash flows. Therefore, it’s SIMETRI Riskier Pick of the Month for January.

How to Buy CVX

You can buy Convex native tokens, CVX, on MEXC and Gate.io if you are based in the United States. Otherwise, you can also find it on Binance, Huobi Global, and more than one decentralized exchange (DEX) like Uniswap.

The steps for Uniswap are shared at the end.

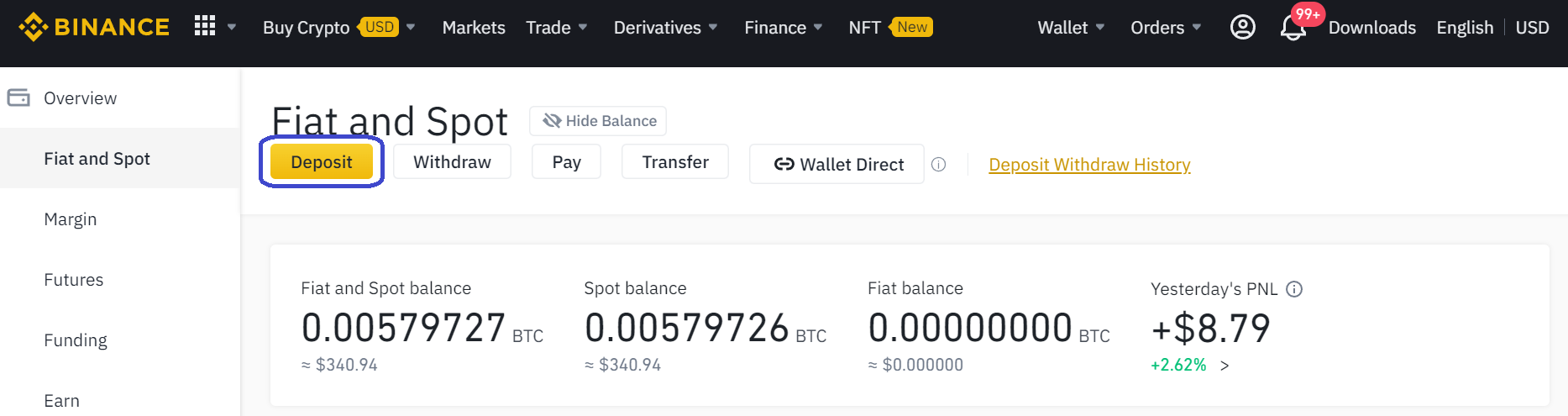

Step 1: Adding funds to a centralized exchange

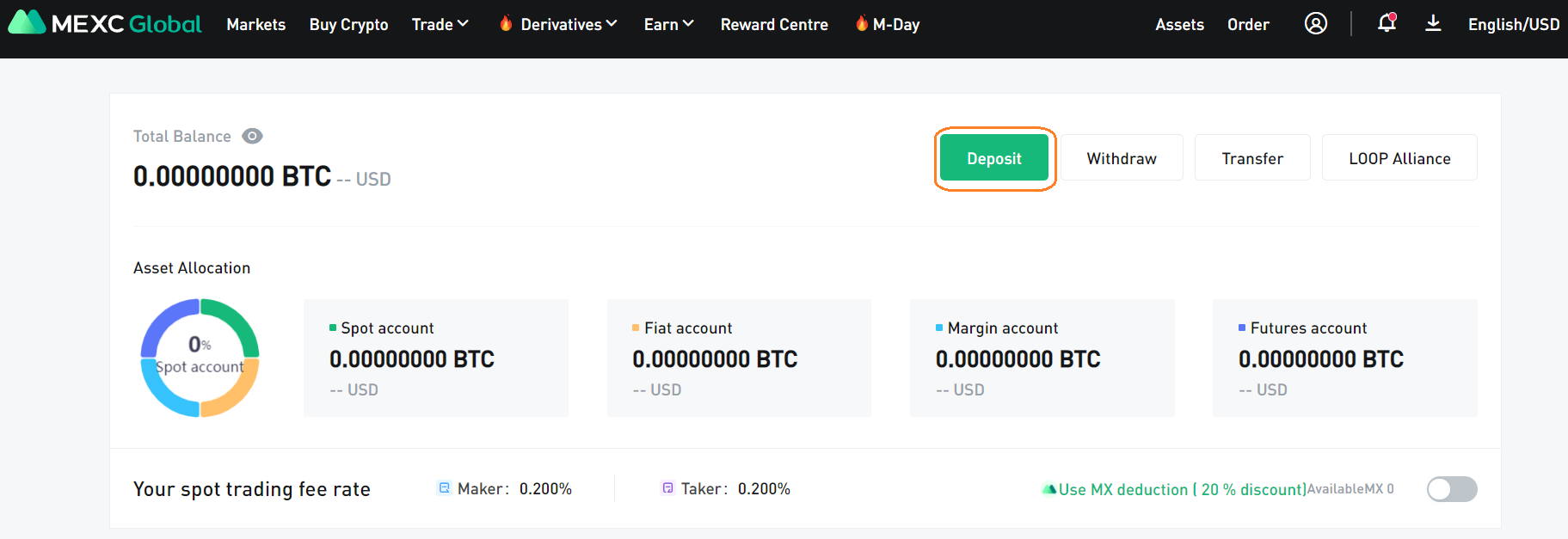

MEXC: First, hover over the Assets section and click on Account.

Then, click on the Deposit button.

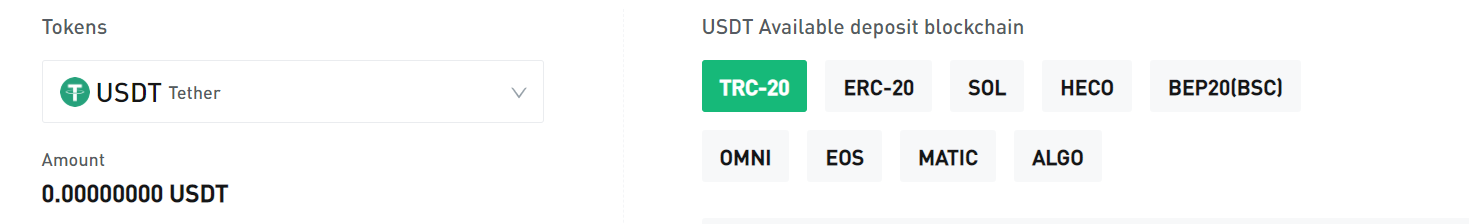

You need to have USDT on MEXC to trade CVX. MEXC enables USDT deposits via multiple blockchains. Copy the address and send funds to the exchange.

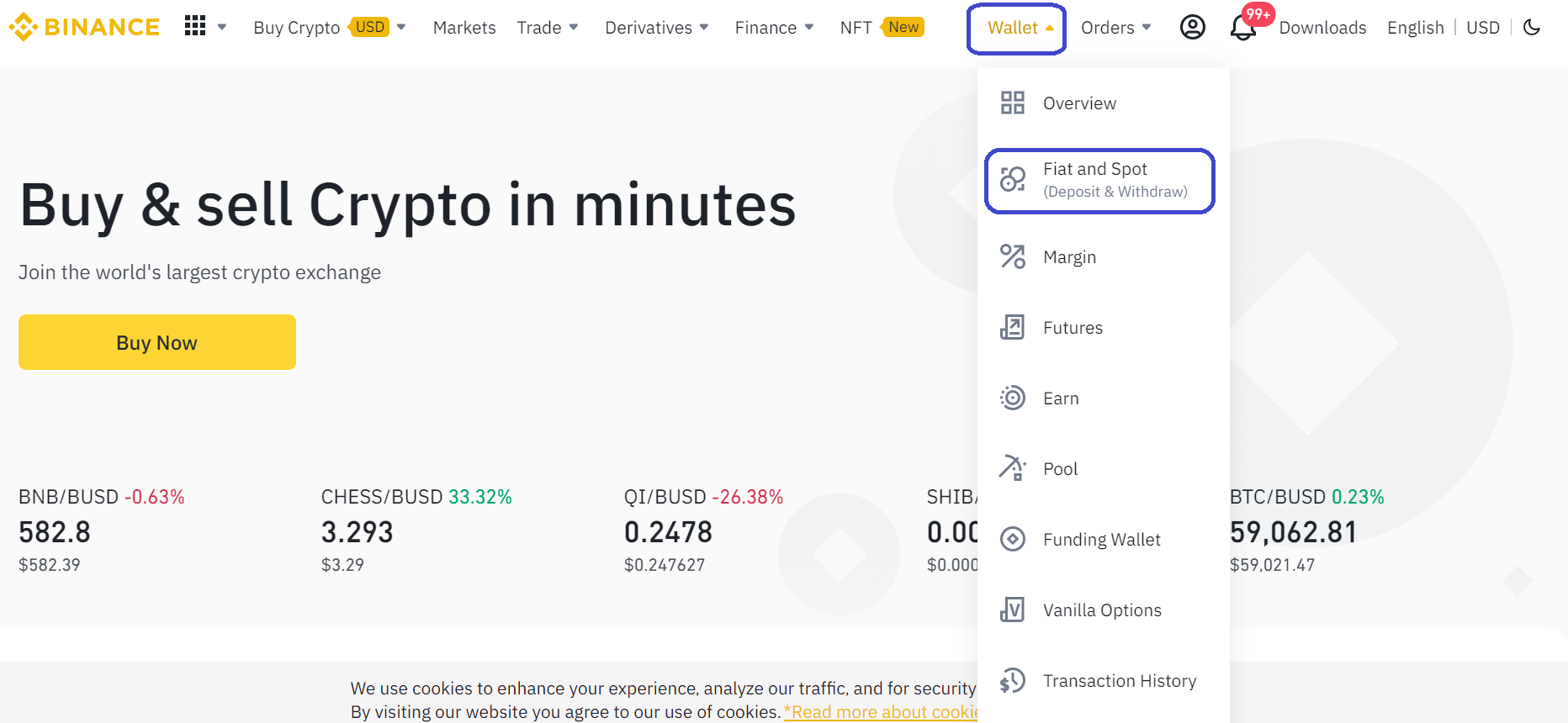

Binance: Hover over the Wallet tab in the top menu and choose the Fiat and Spot option.

Then, select the Deposit option.

Choose your deposit cryptocurrency from the drop-down list, select the blockchain you want to use in the Network section, and copy the deposit address. Currently, Binance allows buying CVX with USDT, BTC, and BUSD.

Step 2: Buying CVX

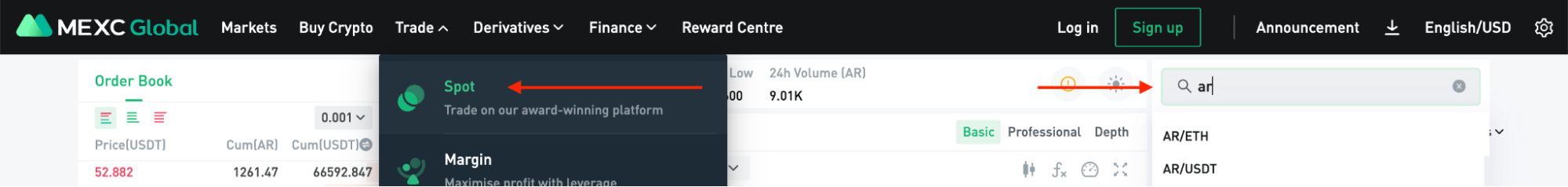

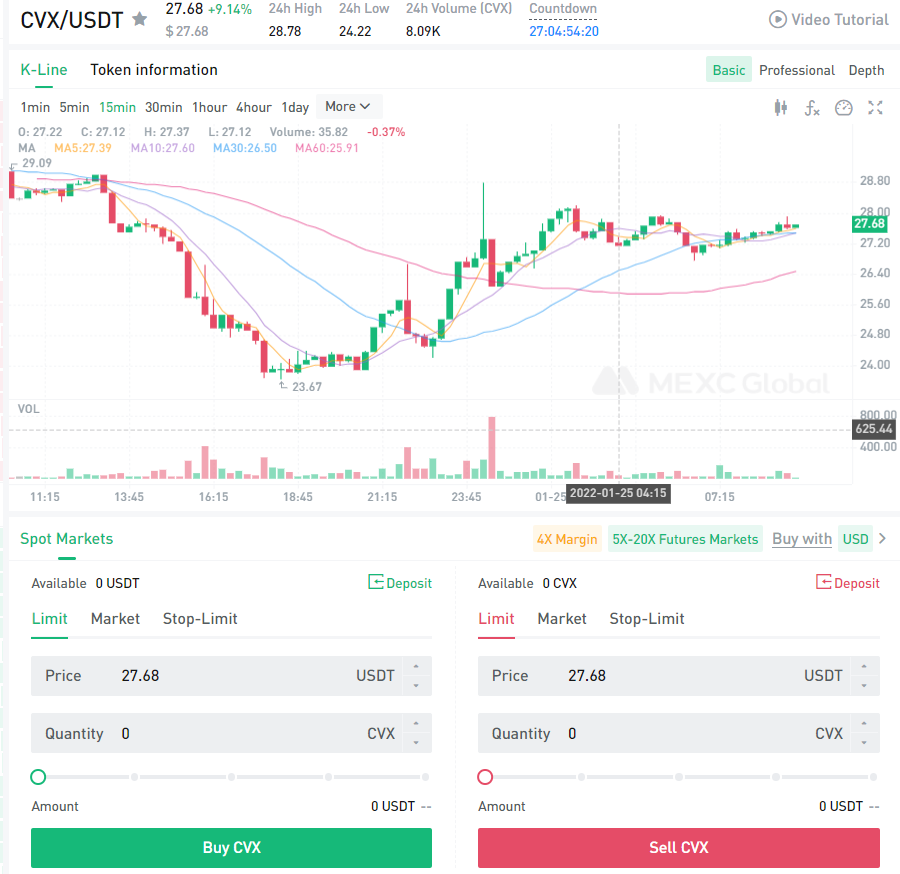

MEXC: After depositing USDT, choose the Spot Trading option from the Trade menu and look for the CVX/USDT.

Make sure you’re on the Spot tab, and after selecting an appropriate order size, click on Buy CVX option. You can either set a Limit or Market order for the purchase.

Limit order enables you to set a desirable price that can be lower than the current market price and place an order to be filled at a later time. Market order buys the crypto right away at the lowest ask price in the market.

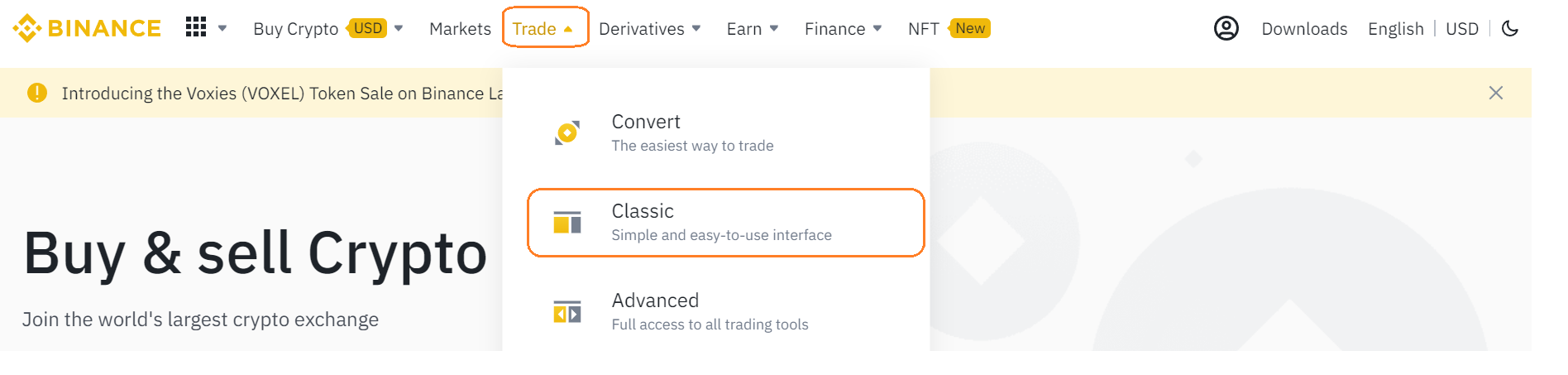

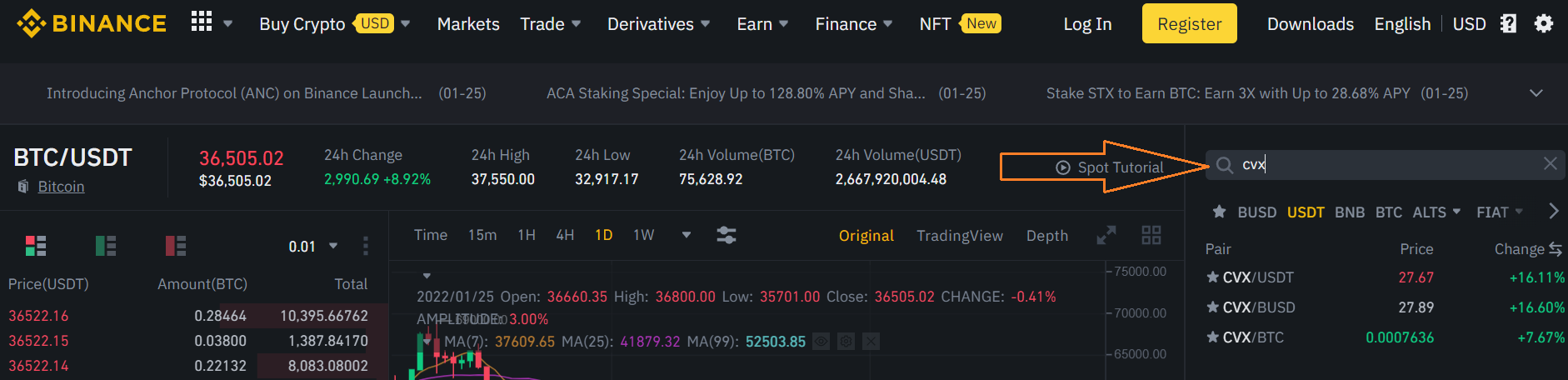

Binance: Hover over the Trade section and select Classic.

Search for CVX token in the search bar on the right side of the page.

Then buy from the spot market by placing a limit, or a market order.

Limit order enables you to set a desirable price that can be lower than the current market price and place an order to be filled at a later time. Market order buys the crypto right away at the lowest ask price in the market.

We do not recommend keeping your cryptocurrency on a centralized exchange. Withdraw CVX from the exchange to a decentralized wallet.

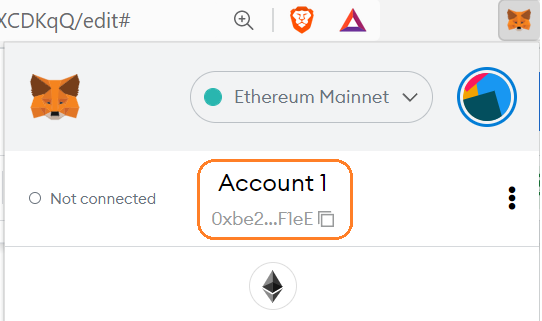

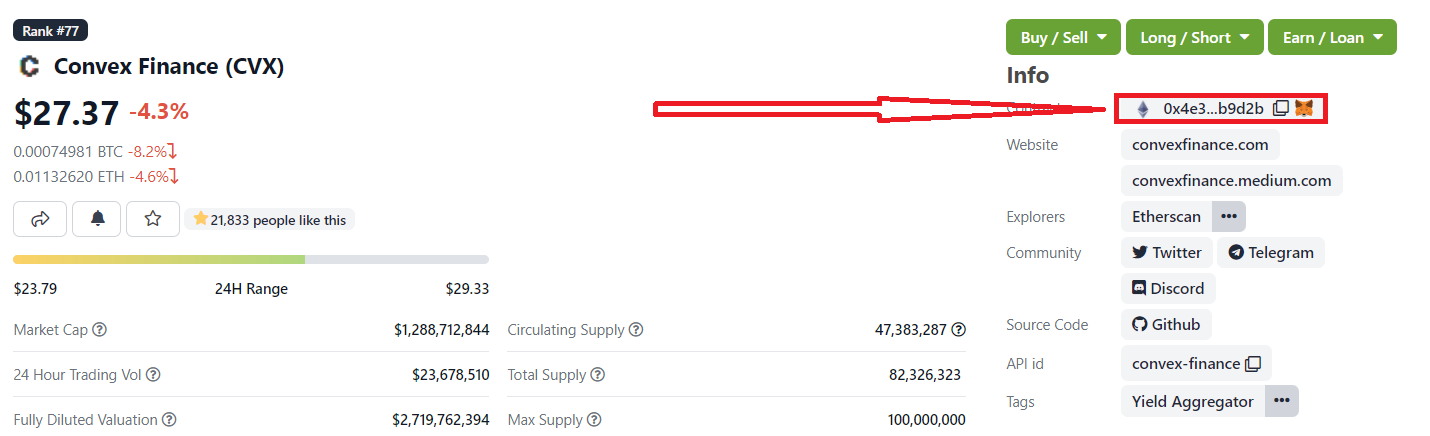

Step 3: Add CVX to your Metamask Wallet

Install Metamask browser extension for your browser here. You can follow the steps in our YouTube video for creating a wallet.

To add CVX to your Metamask wallet, go to the browser extension and make sure you’re on the Ethereum mainnet network. Hover over the Account section to copy your Metamask address.

Then, go to Coingecko’s Convex Finance page and select the Metamask fox icon to add CVX to your wallet. Click on Add Token from the Metamask extension pop-up to complete the process.

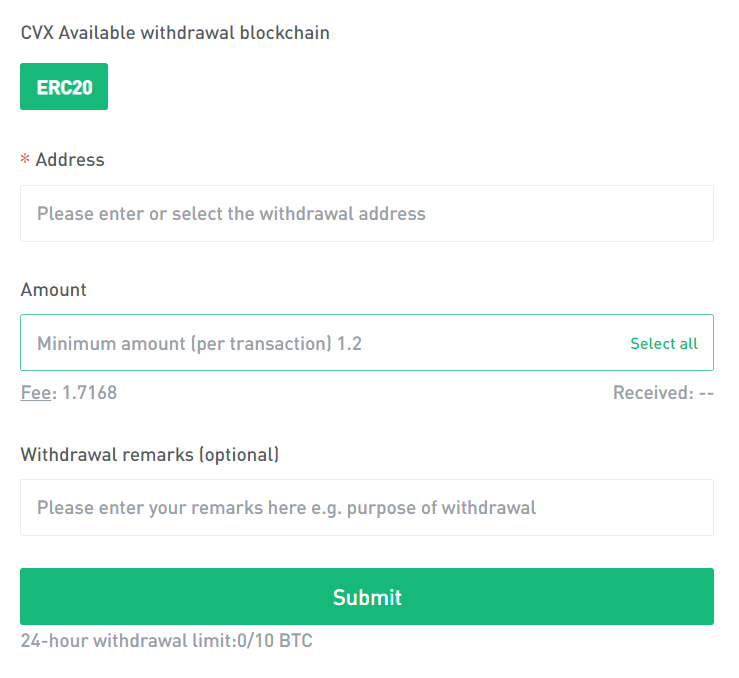

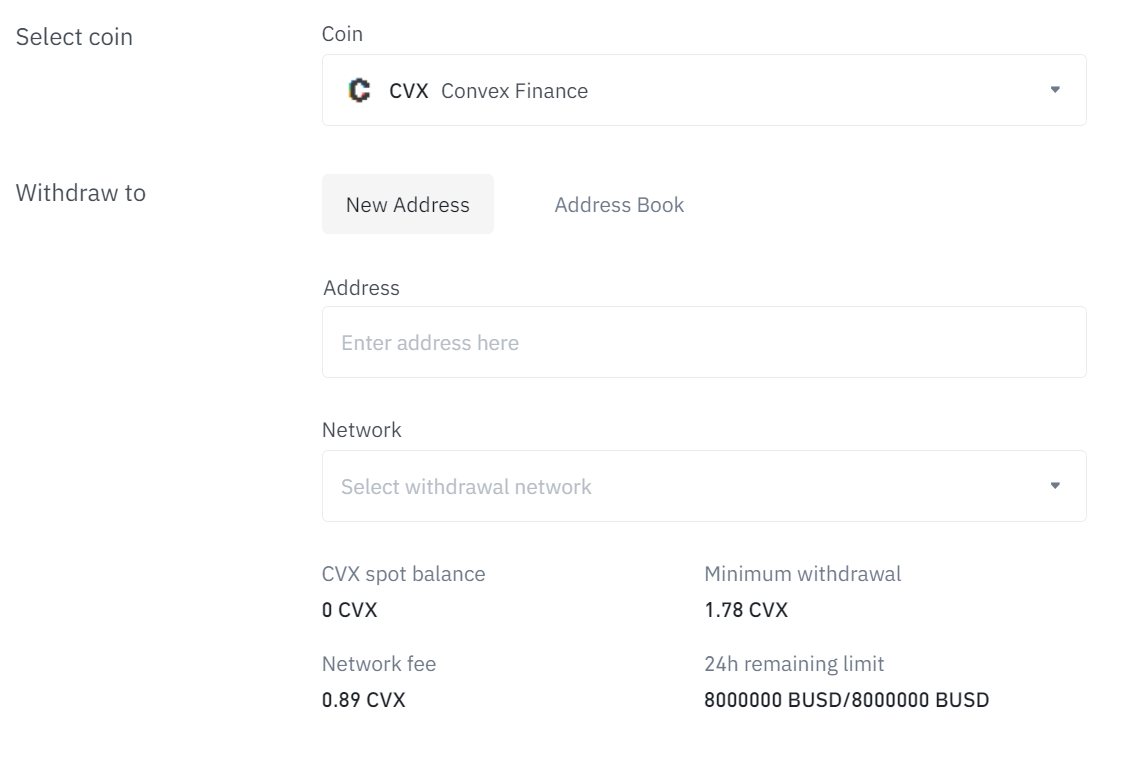

Step 4: Withdrawing CVX

MEXC: MEXC enables a maximum withdrawal of 0.3 BTC ($12,000) with two-factor authentication via Google or mobile number verification. After KYC, the withdrawal limit gets increased to 20 BTC.

The fees to withdraw CVX is 1.7168 CVX (worth ~$47.5)

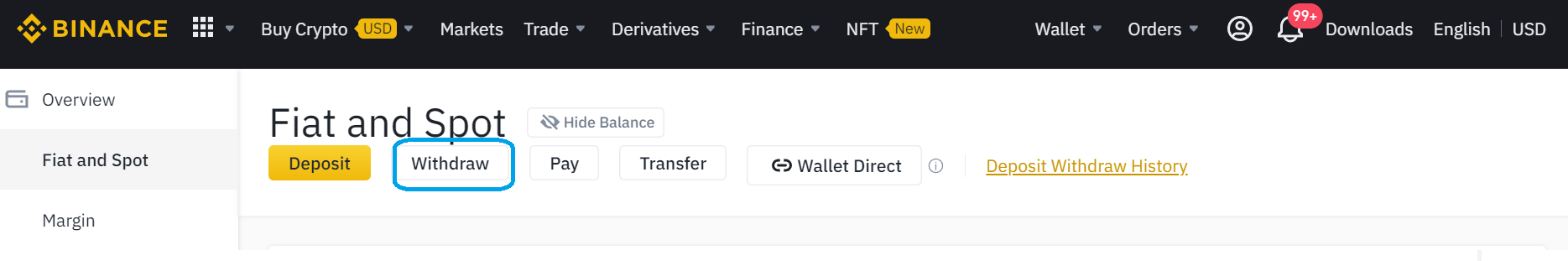

Binance: Head over to the Fiat and Spot option in the Wallet section and select the Withdraw option.

Paste your Metamask address, and select the Ethereum Network to make the withdrawal. The withdrawal fee on Binance is 1.78 CVX (worth ~$49.2).

Buying CVX on Uniswap

Step 1: Make sure you have ETH

If you’re using Uniswap, make sure you have ETH. You will need it to pay for gas, even if you use stablecoins or any other tokens to buy CVX.

Step 2: Go to the trading pair

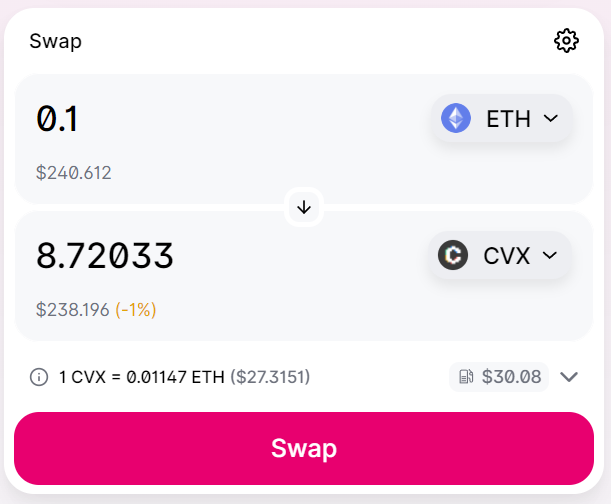

Use this link to go directly to the ETH/CVX trading pair on Uniswap.

Choose the amount you want to buy and click on ‘Swap.’ Metamask will show you an approximation of the gas fee for the transaction. If you deem it too expensive, you can reject the transaction and try again later when the network activity reduces . However, by that time the CVX price may change.

To view the CVX balance on your Metamask wallet, go to this link and press the Metamask icon. The addition process is automatic.